-

The finance committee discussed shifting market dynamics as tort reform takes effect.

-

The fund held $10mn in AuM, with $3mn the minimum investment required.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

The company plans to launch in New York and New Jersey next year.

-

American Integrity grew GWP by 30% to $287mn and Slide GWP was up 25% to $435mn in Q2.

-

The Florida carrier said ceded premiums will rise slightly to $106mn in Q3.

-

At least 14 new companies have opened up shop in the state in recent years.

-

Category 4 and 5 storms could become more common and hit further north.

-

Despite predicting fewer hurricanes, the numbers are still above average.

-

The weather-modelling agency is predicting a below-normal season.

-

The programme’s total limit this year is down $594mn to $1.36bn.

-

The cost comes in at $530.6bn, roughly $20mn lower than budgeted.

-

Slide is putting faith in tort reforms and will lean into Florida, CEO Lucas said.

-

PCS's loss estimate for the March Missouri SCS pushed the bond beyond its exhaustion point.

-

Buyers have turned to retro markets for covers where ILW pricing is less attractive.

-

Investors eyeing private ILS include opportunistic allocators keeping watch on storm season.

-

The pension plan noted in June 2024 that it was exploring new options in ILS.

-

The latest update brings the agency’s combined estimate for Milton and Helene to $32.4bn.

-

HCI secured three towers with $3.5bn in XoL coverage.

-

The $2.59bn renewal is up 45% from last year.

-

The total cost excluding a 15% quota share was $201.85mn, with rates down 12.2% from last year.

-

The Floridian also secured $352mn of multi-year coverage extending to 2027.

-

Property cat XoL rates were off by around 10% on average on a blended risk-adjusted basis.

-

Florida’s top regulator says he’s eyeing eventual tweaks to the state’s cat fund, too.

-

The firm is pressing ahead with IPO plans just ahead of the start of the Atlantic storm season.

-

The ILS market has won market share at the top of programmes as buying expands.

-

The bond will provide protection for Allstate’s Florida subsidiary, Castle Key.

-

The agency forecasts up to five major hurricanes and 19 named storms.

-

As with 2024, pricing pressure has been most acute on top layers.

-

Berkshire Hathaway lost market share but remained the largest traditional reinsurer, our study shows.

-

Proceeds will expand the company’s reinsurance protection in Florida and South Carolina.

-

The revision is significantly lower than the $4.5bn October estimate.

-

Some $200mn of fresh limit entered the ILS market as $3.4bn of deals priced.

-

The bond provides coverage on personal-lines property in Florida.

-

With plenty of reinsurance capacity, CEO Patel said it’s been a “boring year” for treaty negotiations.

-

The total cost for the program increased 1.8% from last year’s.

-

The carrier’s estimated first event limit could increase 16%, to $1.35bn.

-

California homeowners are also expected to move admitted business to E&S.

-

The bond will provide storm protection in Florida and South Carolina.

-

The deal will provide named Florida storm protection on an indemnity, per occurrence basis.

-

The state insurer of last resort is set to purchase $2.89bn of reinsurance this year.

-

The initial offering will include 6,875,000 shares of common stock.

-

Renewal rates were favorable compared to what could have happened after several hurricanes.

-

An allocation to insurance could “feel like a nice, calm port in the storm” amid wider market volatility.

-

The industry loss data provider also increased its estimate for Hurricane Helene to $15.3bn.

-

The Floridian company applied to be traded on the NYSE.

-

Portfolio rebalancing was not triggered last week, but investors are now distracted and nervous.

-

US Coastal Property and Utica Mutual Insurance have brought out their first cat bond deals.

-

The issuance is split across three tranches with varying degrees of risk.

-

Market participants expect pricing will be flat to down through Q2.

-

The insurer has lined up Piper Sandler and KBW to run the process.

-

The ILS segment is not ready to gloss over loss-heavy years in renewal discussions.

-

The mega cat bond season in Q2 last year recorded issuance of $8.2bn.

-

This year’s coverage will involve $2.94bn of new risk transfer.

-

There are signs that Florida’s insurance industry is coming under increasing legislative scrutiny.

-

There is the potential for cat bond H1 issuance to be a record breaking six months.

-

The bond will cover named storms in the state of Florida.

-

The Class A section of the bond has doubled in size, at lower pricing.

-

The CEO expects to see a larger shift between condos and apartments in 2026 and 2027.

-

HCI will now consist of two operating units – the other being its four underwriting entities.

-

Comments came as universal reported a 4.2 CoR jump to 107.9% in Q4.

-

UCITS fund diversification targets limit their capacity for US wind bonds.

-

Several Florida start-ups are poised to begin writing business this year.

-

Total combined losses for the agency’s Helene and Milton estimates stand at $31.8bn.

-

Citizens approved an average 8.6% rate hike and decreases for one-fifth of policyholders.

-

The state has seen 11 new entrants into the insurance market, reflecting renewed confidence.

-

Tower Hill secured $400mn of Winston Re limit in 2024.

-

Peril- and geography-specific deals are being well received by investors.

-

The industry loss number has increased threefold from an initial $5bn pick.

-

Price guidance for the bond is 7.00%-7.75%.

-

CEO Cerio highlighted changes that allowed the insurer of last resort to combine commercial, coastal and personal lines.

-

The new agreement provides $40mn of aggregate limit excess of zero.

-

Casualty ILS made inroads, while hurricane hedging strategies came into focus.

-

The bond offers a higher multiple than a similar Fuchsia Re deal placed last year.

-

Mapfre Re CEO Miguel Rosa was “very satisfied” with the debut cat bond deal.

-

The bond will provide multi-peril coverage in the US and District of Columbia.

-

The pricing multiple on the deal is 12.1x the sensitivity case expected loss.

-

The state reinsurer of last resort discussed options for 2025 reinsurance buying strategy.

-

The bond will provide coverage for named storm across five US states.

-

The 2025 target would be ~25% larger than the $3.56bn it placed for 2024.

-

Losses from Hurricane Milton are expected to affect only select junior structures.

-

Euler ILS Partners and Tropical Storm Risk teamed up to produce an updated version of an earlier study.

-

The loss figure has increased 200% from the initial number provided in October.

-

Moderate impacts to ILS returns are anticipated from Hurricane Milton.

-

The deal is offering a multiple of 13.6x on the sensitivity case expected loss.

-

Helene losses were spread wider than initially suggested, in contrast to Milton claims.

-

Fema's traditional reinsurance programme will attach at losses of $7bn and above.

-

A total of $2.1bn in Fema money has been approved for the state.

-

Latest pricing suggests secondary market traders are baking in further loss development.

-

The firm will provide an update on 22 November to avoid holiday season.

-

The low PCS number is presenting a challenge for ILW buyers and sellers.

-

The estimate implies a roughly $15bn homeowners’ industry loss from the hurricane.

-

The figures imply first-layer reinsurance recoveries for Helene.

-

The scheme is researching options for allocating to Lloyd’s.

-

The loss tally is considerably lower than estimates issued by model vendors.

-

The firm still expects to deliver positive net income for Q3 2024.

-

Many in the ILS sector are bullish on Milton losses falling at the lower end of earnings impacts.

-

The company said $13bn-$22bn will come from wind damage.

-

Florida domestics, aggregate retro and flood deals were all marked down.

-

HCI is estimated to incur a net expense of $125mn for Milton in Q4 2024.

-

Most of the insured loss was attributable to wind.

-

Icosa said certain cat bonds could see more than 0.2 points of price movement.

-

The bulls expect around $20bn-$30bn in Milton losses, with the bears anticipating $40bn-$50bn.

-

RMS will issue its final loss estimates for Milton later this week.

-

Plenum said wind damage from Milton could lead to “moderate” losses for its cat-bond funds.

-

The company is monitoring the NFIP’s flood-exposed bonds.

-

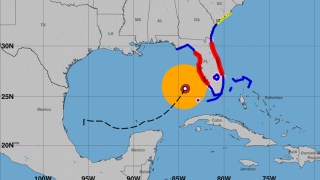

Milton made landfall near Siesta Key yesterday, leaving 2.7 million homes without power.

-

A $40bn Milton loss should barely dent many ILS returns but will trap some capital.

-

On Wednesday, the model had suggested a mean figure at $25.3bn.

-

The event has spared (re)insurers the more extreme scenarios that were under discussion earlier this week.

-

Milton made landfall south of Tampa Bay at Category 3 on Wednesday night.

-

This is based on insured loss estimates of between $20bn and $60bn.

-

The hurricane has destroyed hundreds of homes and left more than 2.7 million homes without power in Florida.

-

The NHC storm track predicts landfall below Sarasota, south of Tampa Bay.

-

Hurricane Milton’s overall impact, based on the current pre-landfall scenario, could lead to “moderate losses” for Plenum’s funds.

-

Collateralised reinsurance and retro are in the firing line.

-

The NHC is predicting storm surge, exacerbated by the tide, as high as 15 ft for Tampa Bay.

-

A hurricane warning has been issued for the east coast of Florida.

-

Most sources noted expectations of a $50bn+ event, but the range of outcomes is huge.

-

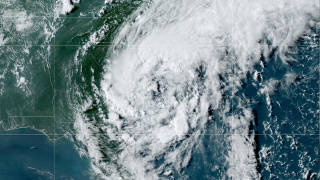

Hurricane Milton strengthened from a tropical storm on Sunday to a Category 5 storm yesterday.

-

Milton is expected to move north of the Yucatan Peninsula today and cross the eastern Gulf of Mexico by Wednesday.

-

Eight Floridians will take on personal residential multi-peril and wind-only policies.

-

Citizens’ auto-renewal controls were down from February 2023 to August 2023.

-

The storm brought a lot of rain, but the Floridian doesn’t provide flood insurance.

-

The ‘life threatening’ hurricane has potential for “historic heavy rainfall” in the southeastern United States.

-

Sources said that while a late June-early July IPO is still on the table, a Q4 or early 2025 listing is expected.

-

Concerning hurricane forecasts are among the factors driving tighter reinsurer capacity.

-

Top layer competition is an added pressure on ILS firms, but the impact can be overstated.

-

The program includes all perils coverage and third-event protection.

-

The company plans to reduce its quota share to 20% from 40%.

-

The carrier has completed its 2024-25 reinsurance renewal.

-

The coverage will be indemnity, annual aggregate for Florida named storm.

-

Eleven hurricanes are predicted, with five expected to reach Category 3 or higher.

-

FHCF rates are also projected to decrease by a statewide average of 7.38%.

-

The bond offers named storm coverage in Florida.

-

The body’s budget committee is again pressing Citizens over solvency concerns.

-

The carrier is seeking named storm coverage in the state of Texas.

-

The closing of the Interboro sell-off was postponed to nearer the end of the year.

-

The increase in limit reflects the carrier’s growing exposure.

-

The state-backed fund had been advised to increase its allocation of ILS to 1%.

-

The carrier is now offering up to $250mn of Class A notes and $150mn of Class B.

-

The bond will provide protection from named storms in Florida for three years.

-

The Florida Building Code was introduced following the impacts of Hurricane Andrew.

-

The limit on the reinsurance Citizens will look to buy from the private markets will stretch to $14.35bn, up 2% on prior-year coverage.

-

The Floridian was approved for 75,000 policies, made 72,958 offers and assumed 53,750 policies – a 74% acceptance rate.

-

A non-binding term sheet was signed on October 6, whereby the buyer will acquire 100% of Interboro’s issued and outstanding securities in exchange for cash.

-

The most important factors driving insured losses over the years include hurricanes, other weather-related events, inflation, and excess litigation.

-

The insurance company had set out plans last summer to expand its market share in Florida.

-

Out of the roughly 88 claims received so far, some were storm surge claims that are not covered by the carrier, according to the executive.

-

Idalia might add further aggregate erosion to several cat bonds covering various perils over an annual risk period, it stated.

-

With Hurricane Idalia’s landfall underway loss estimates are uncertain, but sources noted that the storm’s trajectory shows it taking the best path to impact minimal insured values in Florida.

-

The technology specialist is joining the firm from Reinsurance Group of America.

-

More than 800,000 houses could be affected by the hurricane’s storm surge.

-

If the storm steers clear of Tampa, reinsurers will be well placed for minimal losses, but a retention loss is a further blow for weak Floridians.

-

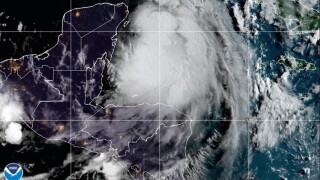

Idalia is forecast to become a hurricane later today and a dangerous major hurricane over the northeastern Gulf of Mexico by early Wednesday.

-

A major hurricane in any section of Florida that extends into the Southeast states is likely a “multi-billion-dollar” insurance industry event, according to the broker.

-

The storm is now forecast to become a major hurricane by Tuesday night. This morning’s advisory update had estimated that Idalia would reach major hurricane status by early Wednesday.

-

The domestic carrier will write homeowners’ multi-peril business, according to filings which also detailed that $300,000 of the initial capital will be used to complete the statutory deposit requirement.

-

The carrier’s Florida reinsurance tower’s top layers comprise a total of $450mn in Class A Sanders Re cat bond coverage.

-

The executive said that the company reduced its consolidated retention and ceded premium ratio for its 2023 and 2024 treaty program.

-

Following media reports last week that AAA had plans to pull out of the Florida insurance market entirely, the home and auto carrier "set the record straight” on Monday.

-

The decision applies only to policies issued through the company’s exclusive agency distribution channel.

-

Considering recent reforms, Citizens’ rates, on average, are still 58.6% below actuarially sound levels, but the inadequacy would have been 88.3% without them.

-

ACIC’s program offers sufficient coverage for approximately a one-in-167-year event and a one-in-100-year event followed by a one-in-50-year event in the same season, the company said.

-

The bills place additional requirements on insurers in the state and expand consumer protections.

-

Tower Hill Insurance Exchange has completed its 2023 Florida reinsurance program, which offers nearly $2bn for catastrophe cover, including all perils.

-

This compares to the subsidiaries’ 2022-2023 reinsurance tower, in which they secured coverage for losses up to $3.16bn.

-

Shifts in reinsurance appetite across the risk spectrum has squeezed out ILS providers in some cases.

-

First event reinsurance tower exhaustion points are $1.3bn for the Northeast, $1.1bn in the Southeast and $870mn in Hawaii.

-

The board also approved a PLA 2023 line of credit, which provides up to $1.25bn in liquidity.

-

Five counterparties account for almost half of all premiums ceded by a sample of major Floridian carriers, analysis shows.

-

Citizens’ board is slated to meet on May 16 at 13:30 ET to discuss the reinsurance and risk transfer program.

-

The pace of rate hikes will ease back from the 1 January reset as buyers seek to lock up capacity early after last year’s dislocated renewal.

-

The northeast deal had previously priced at the low end of the regional insurer’s targets.

-

The impact of recent tort reforms is already being felt in the Sunshine State, the CEO said.

-

The recommendations await approval from the Florida Office of Insurance Regulation.

-

The state carrier completed phase one of its program with the $500mn Lightning Re cat bond placement.

-

Most of the 708,255 claims relate to residential properties and arose from Lee County, Florida.

-

On Thursday, the bill passed 23-15 in Florida's Senate, after passing the House last week.

-

The Floridian has lowered pricing to 900-950bps in a second reduction.

-

The Florida insurance carrier has grown its book rapidly through acquisition.

-

Yaworsky has served as interim insurance commissioner since being nominated by Governor Ron DeSantis last month.

-

CEO Locke Burt said Florida reforms would be “transformational” and that investors had become more receptive to cat risk owing to higher rates.

-

The state-backed carrier’s policy count is projected to hit a record high of 1.6 million by year-end.

-

The insurer reported an underwriting profit for Q4.

-

The issuance is replacing $400mn of cat bond coverage placed in early 2020.

-

The bond is seeking industry-loss-based annual aggregate named storm coverage.

-

The carrier reported a Q4 combined ratio of 101.4%, an improvement of 30 points year-on-year, driven by a 27-point reduction in its loss ratio.

-

Ron DeSantis has also announced proposals to modernize Florida’s "bad faith" law, in the latest set of reforms he described as the most “comprehensive in decades”.

-

The transaction provides relief for policyholders and agents, but especially for those policyholders whose policies expire past UPC’s June 1 deadline.

-

The firm’s flood solution will be available to layer on top of existing parametric hurricane wind policies.

-

KBRA believes First Protective’s and Frontline’s strong underwriting and claims handling compares favourably with that of their Florida peers.

-

The carrier had earlier signalled that uncertainty over reinsurance would affect its ability to write new business.

-

Senate Bill 2A addresses key concerns in the Florida property market, including one-way attorney fees and assignment of benefits, the ratings agency said.

-

The announcement comes on the helm of both houses of the Florida legislature passing the proposed overhaul of the state's property insurance market.

-

The legislature met for a special session this week, discussing key concerns in the state's property insurance market.

-

Affected areas in the state include Tangipahoa, St. Bernard and Terrebonne parishes, the town of Gretna, and the New Iberia area.

-

The bill under discussion tackles key concerns like eliminating one-way attorney fees and getting rid of the state’s controversial assignment of benefits right.

-

Citizens will be ineligible for the coverage, which will attract premiums ranging from rates-on-line of 50-65%.

-

The broker has pegged the global reinsurance supply demand imbalance at $20bn-$30bn.

-

The upcoming special session, which will take place from December 12 to 16, will need to consider how to make Florida attractive to national insurers and reinsurers.

-

A FLOIR arrangement will help Floridians secure homeowners cover during hurricane season.

-

The special session comes as the Florida market braces itself for the effects of the anticipated reinsurance market hardening, potential regional insolvencies and the dearth of private capital.

-

The state’s lawmakers will meet on December 12-16 to address the challenges facing its troubled property insurance market.

-

2022 was a near-average season in terms of the number of storms, but featured an unusually quiet start in August, followed by two Florida hurricanes, including one of the US’s most expensive.

-

The NAIC argued that crass use of industry data would not accurately reflect climate change impacts on affordability.

-

The CEO emphasized that the estimate is a modeled estimate and does not include litigation or inflationary pressures.

-

Most ILS firms are marking the Ian loss as a $50bn+ event, although there are exceptions.

-

Expanded state reinsurance support and legal reforms will be top priorities as Florida insurers face another retention loss.

-

According to the latest reports, around 110,000 customers have been left without power in Florida as Nicole makes its way across the state.

-

The Florida carrier has cut total insured values in the state by 10.3% compared to Q3 2021.

-

The company is confident it has sufficient additional reinsurance capacity should claims begin to develop outside of initial expectations.

-

The Floridian's net loss ratio jumped nearly 18 points to 97.6%, driven by a $40mn retention from Ian and slightly lower net earned premium than the prior-year quarter.

-

FloodSmart Re bonds recovered by a few points in October after initial steep write-downs following Ian.

-

The executive added that while the Florida market has seen benefits from recent legislation, the major issue remaining is one-way attorney fees.

-

The carrier said it was “insulated from open market pricing dynamics” for its 2023-24 reinsurance.

-

The Floridian's loss ratio increased 42.8 points, reflecting $111mn of retained Hurricane Ian losses and a higher attritional initial accident year loss pick.

-

The projected Ian loss is $2.2bn higher than the state reinsurer took from Hurricane Irma in 2017.

-

A special session in December and prohibition of assignments of benefits have been cited on the Florida campaign trail.

-

The firm’s capital and risk solutions segment has been growing its reinsurance business this year.

-

UPC’s closing price hit the bottom of $0.99 per share on Sept 6 and has remained below the $1.00-threshold ever since.

-

The analysts said market pricing indicators suggested a hard market was going to set in, requiring increases of 20%-30%.

-

The federal flood insurance program’s claims count has stepped up from 25,000 a fortnight ago.

-

Major questions confront the industry after Hurricane Ian, but no matter the answers, certain outcomes are inevitable.

-

The state-backed insurer's claims tally was just over 47,000 this morning.

-

The carrier is the latest in a string of primary insurers to provide loss estimates.

-

So far, the company has received nearly 12,000 claims associated with the storm.

-

The company estimates its overall gross loss to be approximately $1bn, below its $3bn overall reinsurance tower.

-

Buyers are more open than ever to different sources of capacity, but the timing of entry will not be on the industry’s terms.

-

The state insurance body received reports of 375,293 claims as of 6 October.

-

The loss estimate does not include litigation or claims below the deductible.

-

The cat bond market has a high level of exposure to Florida wind risk.

-

The Swiss ILS specialist pointed to potential impacts on Floodsmart, Florida indemnity and index-linked bonds.

-

The storm, currently 285 miles south of Charleston, is expected to make landfall as a hurricane on Friday.

-

Georgia, Virginia and the Carolinas have declared a state of emergency as the storm moves north.

-

Research by sister title Inside P&C shows the top three homeowners carrier exposures by county for forecast highest impact areas.

-

A landfall at Category 3 or 4 along the west coast of Florida later this week would be one of the more damaging scenarios for Ian.

-

The industry net loss and LAE ratios decreased 7.3 points year-over-year, while expense ratios improved by 5.9 points.

-

Florida specialists have continued to cede more premium to reinsurers, topping $7bn in 2021.

-

Some sources argue that now is the time for new management teams to tap into the market with fresh platforms.

-

As the ILS market heads back to the office after summer breaks to get stuck into a busy conference season, we recap our top summer features and news coverage that you won’t want to miss.

-

The carrier said its commercial business gave the company a platform to build on.

-

It is understood that the company is being advised by boutique investment bank/broking firm Stonybrook and TigerRisk Capital Markets.

-

The guaranty association’s board voted on Friday to extend an existing 0.7% assessment into 2023.

-

UPC policyholders could be force-placed by their mortgage lender.

-

Sources have suggested that Weston's policy count is about 20,000 policies, of which most are wind-only.

-

At the time of publication, only a small number of carriers remain to be affirmed, including People's Trust and Cypress P&C.

-

The Florida firm lost its rating from Demotech last week.

-

Nicole Fried cited her department’s duty to act in consumers’ best interests.

-

The former executive is looking for $40mn to $80mn of new capital, sources suggested.

-

The carrier had improved its combined ratio by 6 points to 99.4%.

-

It is unclear if policies transferred by UPC to other entities through quota shares and renewal rights deals are covered by federal mortgage institutions.

-

HSCM has had a majority stake in the company since 2020.

-

The firm said it was well prepared for hurricane season with no gaps in reinsurance coverage.

-

The purpose of the agreement is to allow insurers to meet the guidelines set forth by Fannie Mae and Freddie Mac.

-

With many local insurers essentially “zombie companies”, state legislators need to end one-way fees and assignment of benefits.

-

The insurer also completed the reorganization plan to consolidate its four Florida domiciled insurance carriers into two.

-

Floir stated that they "formally referred those insurers to the stability unit" after the legislation from the special session was passed.

-

The insurance agents’ trade body also raised concerns over brokers’ E&O cover.

-

Floir Commissioner Altmaier and Florida CFO Patronis sent out letters questioning Petrelli's decision to put 17 insurers on notice of a downgrade.

-

The ratings agency has given the carriers until next week to respond.

-

Since January, claims lawsuits have hovered around the low to mid 4,000s each month.

-

The $2.5bn includes $1.45bn of newly placed limit and $1.06bn of existing coverage.

-

The latest forecast from the insurer of last resort envisages 1.55 million policies by the end of 2023.

-

The portfolio covers distressed Florida, Louisiana and US nationwide deals.

-

The ratings agency continues to review other Florida carriers’ positions following the 1.6 renewal.

-

The vehicle was supported by a group of institutional investors.

-

At the end of 2021, Centauri Specialty had 26,000 policies in force and $79mn of total written premiums.

-

The insurer reclassified some Hurricane Ida claims as storm Nicholas losses, producing an overweight loss for the second event.

-

The deadline for Lighthouse Excalibur policy cancellations has been extended to 30 June.

-

The cover changed from cascading aggregate to an occurrence-based structure.

-

The US P&C carrier is putting more premium through its captive.

-

Despite capital infusions into the firm, the Florida insurer was unable to stave off receivership.

-

The carrier’s below-FHCF layer is 29% unplaced.

-

Benefits of legislative reform will take ‘several quarters’ to emerge: CaseGlide.

-

Rates have climbed 20%-35% since 1 January, and 40%-50% year on year, sources estimated.

-

The counties include Palm Beach, Polk, Orange, Broward, St Lucie, Escambia, Seminole, Osceola, Lake and Miami-Dade.

-

The company also proactively suspended writing new personal residential policies in various counties in Florida, effective June 3.

-

Reinsurers secured concessions on terms and hiked rates as most insurers managed to patch together cover to enter hurricane season.

-

The state-backed carrier hopes to fill out more of the gaps in the coming days.

-

The ratings agency says a quarter of the Floridians it rates have still not secured multi-event cover, although first-event towers have come together.

-

The cover offers protection for a one-in-160-year first event.

-

The Florida homeowners writer had suspended new business and renewals as it scrambled to procure reinsurance coverage.

-

DE Shaw has been offering a form of “capacity wrap” to insurers in which its limit could be used to plug gaps throughout programmes, sources said.

-

The firm recently invested $15mn in FedNat’s Monarch National.

-

The forecast range of hurricanes is slightly wider than in 2021, but in line with 2020.

-

The chunky deal comes as many reinsurers are heavily cutting their Florida cat books.

-

The contractors’ association argued the law would prevent contractors who hold AoBs from recovering their attorneys’ fees if they prevail in a lawsuit against an insurance company.

-

Insurers are still fighting to survive as reinsurance costs rise and availability dries up.

-

Cat bond spreads settled 11% above sponsor targets as many deals were scaled back or parked.

-

One Floridian had “zero” reinsurance in place before weekend.

-

With reinsurance availability scarce and costs rising, several carriers have called an interim halt to new homeowners’ business.

-

The national carrier follows Southern Fidelity’s suspensions earlier today.

-

Southern Fidelity said until it could be sure of reinsurance capacity it could not bind cover, as renewals have been delayed.

-

Some cedants remain far behind in a stressed renewal, but others are on the path to completion in a reshaped Florida market.

-

The proposed Florida special session Senate bills 2-D and 4-D have overwhelmingly passed the house floor and will now move to Florida Governor Ron DeSantis for signing.

-

State representatives will vote on the bill on the House floor tomorrow.

-

Proposed RAP coverage layer adds protection and exposures for insurers.

-

State senators will vote on the bill on the Senate floor tomorrow.

-

Industry association FAIR said a full reinsurance backstop should be provided.

-

The multiple is significantly up on the 4.8x achieved last time on a higher expected loss.

-

Major ILS providers active in Florida including Nephila and Aeolus lifted assumed premiums.

-

A key plank will be a Reinsurance to Assist Policyholders (RAP) program providing a $2bn reinsurance layer below the FHCF.

-

The special legislative session to be held the week of May 23 is the last chance Florida insurers and reinsurers have this year for some desperately needed reform to the stricken homeowners’ market.

-

Sources close to the industry are calling for litigation reform as a priority, while Florida Hurricane Catastrophe Fund expansion is also on the cards.

-

The bill that will be discussed in the special session is expected to be available for senator perusal later this week or early next week to allow ample time to read and discuss.

-

Several firm-orders have been released, but there are widespread expectations of a much-delayed renewal as low-layer capacity remains elusive.

-

Notices of intent to file lawsuits fell 12%, the first time such notices have fallen since July.

-

The company previously had its Demotech rating downgraded from 'A' to 'S'.

-

The bond will provide cover against named storms in the US.

-

The US nationwide has placed $550mn of nat cat risk into the cat bond market already this year.

-

The issuance is seeking named storm cover in Florida, Georgia and South Carolina.