AuM data

-

The investor is targeting a new insurance allocation.

-

The fund will offer additional spread versus other similarly rated corporate debt.

-

The ILS AuM in its flagship cat funds rose 13% over the half year to $6bn as of 31 October.

-

The fund limits positions in aggregate structures exposed to secondary perils.

-

The Italian asset manager also plans to relaunch its multi-strategy ILS fund.

-

Growth included a $240mn increase in partner capital in DaVinci equity plus debt.

-

The reinsurer-linked manager now offers three ILS funds encompassing private ILS and cat bonds.

-

Third-party investors made a net income of $415mn in the quarter.

-

The award of the mandates marks the California public pension plan’s entry into ILS.

-

Returns from cat risk investments stood at 20.1% for the year to 30 June 2025.

-

The allocation is around 3% of the fund’s total assets.

-

The manager’s largest ILS holding is in the cat-bond-heavy High Yield fund.

-

Victory Pioneer Cat Bond Fund also added assets in the past month.

-

Reinsurers are confident on cat rates and ready to deploy ILS capital.

-

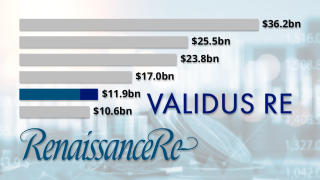

The merged business of Twelve Securis ranked third among ILS managers for AuM, behind Fermat and RenRe.

-

The fund was renamed from the Pioneer Cat Bond Fund.

-

The recommended “AIF lite” structure could be suited to cat bond lites.

-

The Diversified Alternative Fund’s allocation to cat bonds was up by 31% from $386mn at 31 January.

-

Twelve Securis is now a challenger for the top spot on the Insurance Insider ILS leaderboard.

-

The pensions scheme’s existing ILS holdings to Aeolus and HSCM are in run-off.

-

The fund lists Twelve, Swiss Re and Cambridge Associates as managers.

-

AuM in GAIA Cat Bond Fund had grown to $3.9bn as of 31 May.

-

The firm said it was the first time a UCITS cat bond fund passed the $4.0bn mark.

-

The fund was set up 18 months ago by cat bond investor Florian Steiger.

-

This followed a $650mn fall in April, after management change of the fund.

-

The Swiss pension fund has not disclosed an ILS allocation before.

-

Some assets in the Medici Fund were transferred to a new UCITS strategy.

-

The ILS manager’s total AuM increased to $2.2bn in 2024 from $1.7bn the year prior.

-

Fermat and GAM announced that the former will take sole control of the GAM FCM Cat Bond Fund.

-

January’s California wildfires meant third-party investors suffered a loss of $195.3mn.

-

The Swiss rail pension scheme has been cutting its ILS allocation since 2018.

-

The Swiss pension fund’s ILS allocation stood at 4.9% of the total fund as of 25 March.

-

Fees on the GAM Star cat bond funds will drop in May in a recognition of fee competition in the market.

-

Most of the ILS investments were made via the cat bond heavy High Yield Fund.

-

Many UK pension funds are over-funded and lack appetite for higher-risk, higher-yield products.

-

ILS as a percentage of the pension fund’s total assets grew to 1.5%.

-

The UK listed investment manager has almost doubled its ILS allocation since April last year.

-

The scope of QRT’s new ILS strategy will include cat bonds and private ILS.

-

There was a slight increase in DaVinci and Fontana from 31 December 2024 to 1 January 2025.

-

The firm will match segregated accounts of portfolios to investor mandates.

-

Liquid alternative strategies accounted for around $1.4bn of the total.

-

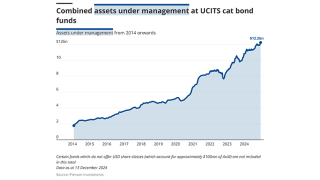

AuM remains generally flat at UCITS funds over the weeks since LA fires started.

-

FY24 disclosures show shifting fortunes at reinsurer ILS platforms.

-

The value of its investment in RenRe stood at $330.4mn as of 30 June 2024.

-

PFZW’s insurance allocation stood at $8.7bn as of year-end.

-

Fermat stayed in the top spot surpassing $10.0bn for the first time.

-

This comes after the firm’s distribution partner GAM has had a challenging few years.

-

The manager’s Interval Fund returned 28.25% over the financial year.

-

The Bermuda based entity is expected to continue on its “responsible growth trajectory”.

-

The UCITS cat bond segment has added 54% in AuM since Hurricane Ian.

-

The reinsurer said investors were interested in expanding after benefiting from good results.

-

Former ILS investors who left the space have looked again and re-allocated.

-

The scheme’s ILS allocation has held steady at 0.7% of the total fund.

-

The ILS manager’s existing Medici cat bond strategy stood at $1.68bn in assets under management (AuM) as of 30 September.

-

CEO Jonathan Zaffino said he saw opportunities for expansion in casualty.

-

The UCITS fund was launched in 2021 and invests in cat bonds and the money markets.

-

The headline figure of $7.72bn includes $3.11bn of DaVinci equity plus debt.

-

Strong growth in fee income builds on the favourable rating environment.

-

Daniel Ineichen, former co-head of ILS, had been with the company for nearly two decades.

-

Fee income fell by 42% to $25.1mn in Q3 over the prior-year quarter.

-

The pension scheme has been winding down its ILS portfolio in recent years.

-

The ILS allocation increased in dollar terms and held steady in euros.

-

The class of 2023-24 cat bond funds will grow existing investors and add new ones.

-

The firm’s new name is inspired by 18th Century Swiss mathematician Leonard Euler.

-

The deal freed up capital held against deals written in 2019 and 2020.

-

The ILS industry offered 11 points of merit that justify cat bonds being eligible for UCITS funds.

-

The deal takes year-to-date cat bond lite issuance to $367.6mn

-

Schroders moves into fifth place in the Insurance Insider ILS leaderboard.

-

The combined Twelve-Securis entity would be a top-five ILS firm currently.

-

More than 30% of the fund's AuM is allocated to US windstorm-linked bonds.

-

Sources said that Gallagher Re had ‘first mover’ advantage as the exclusive broker.

-

Sub-1% management fee and performance fee-only structures have evolved in ILS.

-

The Icosa Cat Bond Strategy now stands at $130mn in AuM.

-

Tanja Wrosch joins Twelve after more than a decade at Credit Suisse ILS.

-

The regulation now allows pension funds a more flexible benchmark for measuring alternatives.

-

Rich had spent 13 years at the firm where he began his career and oversaw a cat bond and ILS portfolio.

-

-

The capital will be deployed by Bermuda-based special purpose insurer Arachne.

-

Combined AuM of UCITS funds stood at $11.3bn as of 26 April 2024.

-

Over Q1, the loss ratio improved by 34.6 points year on year to 43.7%.

-

ILS returned 3.2% for the scheme in the first quarter.

-

The platform’s ILS holdings comprise cat bonds and UCITs funds, and were up 8% over January and February.

-

Fee income was up by 30% year-over-year to $136mn in 2023.

-

The fund will follow an existing Twelve strategy and add short-term corporate bonds.

-

Chris Parry said the denominator effect remains a suppressant on ILS inflows after a strong phase of returns.

-

Daniel Ineichen and Flavio Matter have been promoted to co-heads of ILS.

-

It is only the second year in the last eight that the allocation grew.

-

CEO Hussain said third-party capital in 2023 remained flat.

-

The firm’s assets under management dropped to $1.6bn, as a capital return more than offset new inflows.

-

Head of alternatives Gareth Abley believes the asset class remains attractive following a 16% return in 2023.

-

The outlook for M&A activity is brighter after 2023 returns.

-

The parent also expects the ILS platform’s AuM to grow.

-

The acquiring reinsurer will now run off the business.

-

-

The reinsurer’s assets under management rose 14% to $3.3bn.

-

Aside from the one-year view, 2023 remixes the track record.

-

The firm told investors yields in the cat bond market are 'still very attractive'.

-

The sidecars segment has been attracting inflows after returns hit a high note in 2023.

-

In its semi-annual report for the six months to 31 July 2023, the manager said the fund had returned 2.74% over the half-year.

-

The independent manager’s post-Ian growth has helped it more than double from prior estimated assets under management.

-

The Swiss Re Total Return Index climbed month-over-month throughout the year, to more than regain ground lost after Hurricane Ian in September 2022.

-

Nearly 90% of the fund’s allocation is in cat bonds, with a small allocation to other ILS securities and US Treasury Bills.

-

Broker-dealers' year-ahead forecasts have undershot total final issuance in three of the last five years.

-

Schwartz will set the firm’s investment process on its ILS, equity and debt strategies.

-

The asset manager’s flagship ILS funds posted stellar returns for its 2023 fiscal year.

-

The firm’s flagship reinsurance strategy delivered its best performance in its 10-year history.

-

The year brought a degree of closure on the loss-hit years of 2017-2021, while the outlook remains changeable for ILS managers.

-

Swiss Re Alternative Capital Partners assets under management hit $3.3bn as of 30 September.

-

The Australian sovereign wealth fund first allocated to the ILS manager in 2016.

-

Research by Kepler Absolute Hedge showed that seven out of the 10 best-performing alt credit funds were cat bond strategies.

-

AuM stood at $1.5bn as of 30 September, up from $1.2bn as of January 2023.

-

The Zurich-based ILS manager has grown the fund by around 167% from $150mn as of mid-2021.

-

A new pooling structure allowed the firm to free up historic side pockets and provides a template for future exit options.

-

Steiger is said to be moving to an “entrepreneurial” role after more than six years with the Zurich-based firm.

-

The ILS sector grew in the context of 0% interest rates historically.

-

Hiscox said outflows from the ILS unit were offset by "record returns" in Q3.

-

The ILS firm reported $6.8bn of assets under management at the third-quarter mark.

-

The ILS executive is departing the ILS platform following RenRe’s move to buy Validus Re for ~$3bn.

-

The fund had taken major losses on cat-related investments, including through Southeast primary carriers Weston and Southern Fidelity.

-

The recent ILS start-up was the only new mandate for 2022 after the Dutch firm had added two new mandates in 2021.

-

Cat bond investors are sufficiently capitalised to fulfil demand from an anticipated strong pipeline of new issuance in Q4.

-

Gallagher Re has stated that the alternative capital market has increased by 4%.

-

The private equity firm is targeting $1trn in assets under management for the combined segment.

-

The broker’s half-year 2023 report said reinsurers’ RoE has surpassed the cost of capital for second year running.

-

Outside the cat bond segment, Aon said it was observing rising sidecar interest, putting volumes at $7.1bn from $6.4bn the prior year.

-

The move comes as investors are on track to reject a bid from Liontrust.

-

The ILS business ‘continues to be an important differentiator’, says Aspen CEO Mark Cloutier

-

The industry’s ability to draw new capital will hinge on the outcome of the Atlantic hurricane season.

-

The AuM total hits $12.1bn when including Top Layer Re and RenRe’s own participation.

-

The reinsurance and ILS unit posted strong net premium growth supported by additional capital from Hiscox Group.

-

The reinsurer opened its cat bond portfolio to third-party investors last summer.

-

-

The firm has moved to defend its plans against a rival strategy supported by a small group of investors.

-

Some sources have called for more transparency on secondary trades, though others note the buy-and-hold nature of the market limits trading appetite.

-

The ILS fund now comes in at the 26th spot on Trading Risk’s ILS fund manager directory.

-

The cat bond fund posted returns of around 10.75% for the first six months of Stone Ridge’s financial year.

-

The distribution arrangement will cover Securis's full range of ILS offerings.

-

The fund ranks 19th in Trading Risk’s ILS fund manager directory following this disclosure.

-

The new fund will be led by Daniel Ineichen and be open to US investors.

-

The former chairman and CEO of New York Life will support the asset manager in developing strategies that harness longevity pooling.

-

The UK asset manager’s ILS strategy is operating across six of its multi-asset funds.

-

The current year performance marks an uplift compared to a tough 2022, in which Elementum delivered a loss to White Mountains of 4.6%.

-

The takeover will push it up two places to rank as the fifth-largest writer of P&C reinsurance by gross premium.

-

AIG will invest a significant amount into Fontana and DaVinci.

-

The company has eroded about half its international catastrophe deductible following New Zealand losses.

-

The acquisition gives UK asset manager Liontrust a broader European footprint and cat bond products.

-

The reinsurer lifted net reinsurance premiums by 38%, although, on a gross basis, growth was lower at 5%.

-

Markel’s ILS platform maintained assets under management at $7.2bn, down by $200mn from a January figure of $7.4bn.

-

UBS previously explored setting up an ILS offering, but instead opted to offer other firms’ products.

-

The New York-based executive had been one of the firm’s co-heads of ILS, leading on investor relations and sales.

-

-

The uplift was helped by the Atropos Catbond fund surpassing $1bn.

-

The real test for cat capacity will come at the mid-year point, according to Gallagher Re.

-

The new higher-rate world brings the threat of some investors staying in a risk-off mentality.

-

The rival Swiss bank did not have an ILS operation.

-

The division is deploying its own capital to make up for the lack of wider reinsurance and ILS capacity.

-

The ILS expert had joined as a portfolio manager in 2018 from Ontario Teachers’ Pension Plan.

-

The ILS manager said the cat bond sector could double to become a $70bn market in the next three to five years.

-

The manager’s life & alternative credit segment invested in the reverse mortgage specialist.

-

The insurance conglomerate initially committed $50mn to Elementum funds.

-

The ILS unit earned $5mn of fee income, down by $1mn year on year.

-

The capital commitments to the vehicle have expired.

-

The CFO of parent company Markel has said it aims to lean into property cat through Nephila.

-

Nephila achieved significant rate increases at 1 January and expected the strong rate environment to continue this year.

-

The former Aspen Capital Markets COO hopes to set up fronting partnerships for reinsurers wanting to build out in ILS.

-

The world’s largest investment company has assets under management of more than $10tn.

-

The move follows Sal Tucci’s departure from the firm to set up Jireh Risk Advisors.

-

The new firm has registered Jireh Re (SAC), an unrestricted special purpose insurer, with the Bermuda Monetary Authority.

-

The asset manager’s reinsurance funds shrank 17% in its fiscal year to end October to reach $2.6bn.

-

Baltesar worked for Hiscox Re and ILS before joining Credit Suisse ILS in 2019.

-

It is understood that Ascot will continue to write worldwide retro business.

-

The manager received a mandate from a new investor who had taken the call to come in ahead of Hurricane Ian.

-

The insurer also emphasized that it realised more than $300mn from selling two MGA operations.

-

AIG’s Q3 net cat losses of $600mn included $450mn from Hurricane Ian.

-

The ILS platform has dipped to $7.8bn in assets under management, as ILS revenues were down 44% after the sale of Velocity.

-

The reinsurer’s CFO and COO Michael Dennis has been named CEO, subject to immigration approval.

-

The fund’s allocations to general and life insurance investments have grown year over year.

-

Evanston Insurance Company, a subsidiary of Markel, backed the move.

-

The group-level cat impact to the combined ratio improved 0.3 points to 1.8.

-

Inflows allowed the unit to step up to the distressed Florida market.

-

The ILS firm reported $8.5bn of assets under management at mid-year.

-

The investor will manage a portion of the Bermudian’s assets.

-

Jacquet previously served for five years at Credit Suisse ILS.

-

The hardening rate environment in Florida provided a mid-year opportunity for some, but overall there was little growth.

-

The vehicle was supported by a group of institutional investors.

-

Elliott Management, the other key suitor for the business, is understood to have dropped out of the auction.

-

Partial owner White Mountains said conditions for ILS investing are “attractive”.

-

CEO Luca Albertini has no immediate plans to step down but the firm said the promotion provided clarity on succession plans.

-

The allocation increased in dollar terms by just under 2% during the past year.

-

The ILS fund said the funding would support the company’s growth prospects.

-

The firm reserved $40mn for Ukraine, citing ‘small net losses’ in Re & ILS.

-

Third-party assets under management were up $100mn in Q1 at $3.6bn.

-

The carrier posted 6% growth in reinsurance, with primary insurance premiums rising 15%.

-

Company's Nephila ILS operations will focus on “significant” cat opportunities.

-

Acrisure entered into a definitive agreement with Markel in March to acquire the MGA.

-

The ILS platform delivered stable revenues as Markel spent $102mn on its Catco buyout.

-

The reinsurer said the third-party platform, which reached $2.2bn at the start of this year, provided capital relief and supported nat-cat capacity.

-

The carrier recorded $224mn of natural catastrophe losses.

-

Lancashire posted heavy losses in its Q4 result and said its ILS capital is down materially.

-

The exit of key Florida insurers could spur rate increases.

-

He spent seven years at Arch Capital and will be working on HSCM’s reinsurance strategies.

-

Lauer and Bean work in operations and Denny on the investment side.

-

The carrier cut exposure to both earnings level and highly volatile cat events as it shed risk.

-

The flagship Atropos fund reached $1.4bn while its cat bond strategy is sized at $831mn.

-

The hire comes as the ILS firm grows its asset base during a surge in cat bond popularity.

-

The group will look to build on synergies between its insurance platforms.

-

The deal expanded scope of Aspen’s delegated underwriting operations across both US and European operations run by Ryan Specialty.

-

The firm will look to grow its offerings on climate change and natural catastrophe risk.

-

-

The pair have helped to lead the life and alternative credit team since January 2020.

-

He will replace Jonathan Malawer, who held the position for fourteen years and has left to join a new firm focussed on climate risk investments.

-

The firm said he would oversee transactions and assist in growing AuM.

-

The business has reported sustained strong growth in its programs segment.

-

The London-based manager said the open-ended fund structure was no longer “optimal” for mingling life and non-life exposures.

-

The topic of quota-share support is becoming all the more crucial because supply is shrinking at the same time as demand is rising.

-

The Dutch firm had given the AIG-owned platform a mandate that could range from EUR500mn to EUR1bn, covering US cat reinsurance.

-

The Bermudian carrier took $188mn losses from Hurricane Ida and $60mn from the European floods.

-

Despite the drop-off in AuM, Markel boosted ILS operating revenues significantly in the quarter.

-

The ILS manager’s cat bond investments generated inflows for GAM’s fixed income pot.

-

The larger fund PK SBB revealed it made a loss of 7.0% in its ILS portfolio for 2020.

-

The carrier posted a small loss in the first half of 2021, the agency noted.

-

The investor has significantly cut back its allocation over the past few years.

-

One market participant said the strategy was $250mn in size, but it is not known how much business it has so far written.

-

Brooks had been in his post for almost two years and joined AlphaCat in 2011.

-

The deal covers the reinsurer’s worldwide cat XL book, as Scor plans to ramp up P&C growth.

-

Kevin O’Donnell also said he saw social inflation as more of a concern for the industry than climate change.

-

The Credit Suisse-backed firm produced a small profit in the first quarter of 2021, the ratings agency said.

-

Matt Berdoff, Jason Braunstein and Wendy Wong-Tsang have joined the firm’s partnership.

-

Despite the Q2 increase, the Everest Re sidecar’s written premium for the first half was down 2% to $155.3mn.

-

The 2017 start-up has previously focussed on quota share investing.

-

The reinsurer had previously signalled it would grow its net reinsurance portfolio after deploying less third-party capital.

-

Fee income – an area of patchy disclosure by reinsurers – was generally stable amongst early reporters.

-

The broker said ILS capital had reached $96bn at the end of Q1.

-

Cat bond fund managers continue to reap growth as the industry has rebounded from its Covid dip.

-

The insurance investment expert joins Jefferies with a brief to develop activity in EMEA’s primary and secondary insurance credit markets.

-

Richard Anson previously served as head of ceded reinsurance at Antares and reinsurance manager for Aviva.

-

The underwriter had worked with the ILS firm since 2018.

-

Executives including AIG CEO Peter Zaffino, Aon CEO Greg Case and Munich Re CEO Joachim Wenning have joined the task force, chaired by Lloyd’s.

-

The asset manager has previously invested in ILS via external specialists.

-

The fund will limit capacity to $400mn or 1.5% market share, and minimise exposure to secondary risks.

-

The investment house made a blended 0.7% underwriting return via its holdings in Elementum funds and 7% cash yield from its ownership stake in the firm.

-

British Virgin Islands-based investor Eugenia II Investment Holdings had alleged fraud and misrepresentation after losing $7.5mn with the retro fund manager.

-

The firm announced a gross performance of more than 10% on the fund since it was established in late May 2020.

-

The executive was one of the Swiss bank’s most senior ILS executives and established their life fund.

-

The vehicle will launch with $200mn of equity contributed by all the manager's ILS funds.

-

Parent AIG’s cat losses remained elevated in line with the prior-year Covid-19-impacted quarter.

-

Markel’s overall ILS revenues dropped by 27% year on year as it lifted fronted premium written for the Bermudian firm.

-

Scor Investment Partners has announced that the assimilation of Coriolis Capital into its wider ILS business has now been completed, following an acquisition of the London firm in September 2019.

-

Average reinsurer return on equity (RoE) was just 4.8% over the past four years.

-

The news follows the reinsurer’s announcement that the executive would step down from his role at the end of April.

-

The firm reported a $100mn drop in ILS AuM to $1.4bn, although previously had said deployable capital was lower.

-

The fund’s worst ILS return to date is understood to be driven by investments hit by Covid-19.

-

Recent investor inflows to its cat bond UCITS have brought it to over $1bn assets under management.

-

The Insurance Capital Fund combines US wind cat bonds with subordinated debt issued by European insurers.

-

The company also lowered the attachment points on its per-occurrence and aggregate property catastrophe treaties after shrinking its portfolio.

-

Parent company AIG posted an underwriting loss for the period.

-

The deal gives life insurer and asset manager Eldridge the opportunity to take an equity stake in the future, with further capital commitments likely.

-

Assets under management at the sidecar rose 12.5% year-on-year to $900mn by the start of 2021

-

This came as Everest Re fell to a $44mn underwriting loss on a pre-reported prior-year reserve charge.

-

Markel’s ILS revenues were impacted by the Markel Catco run-off and Lodgepine start-up costs.

-

Returns have disappointed some institutional investors, but prospective rates may attract fresh investment, sources said.

-

The additional raise takes the carrier’s committed capital to $3.2bn.

-

Ben Somers, former head of investor relations, has left after more than 11 years at the company.

-

The ILS market expanded by $1bn in Q3 but still shrank by 4% over the first nine months of 2020 to $92bn.

-

The emerging markets specialist aims to raise around $860mn of additional funds by 2025.

-

Leadenhall more than tripled its deal volume and Schroders has increased its assets under management in 2020.

-

The new Bermuda venture launched at the beginning of the year as part of the business’s scale-up.

-

The new vehicle gives third-party investors access to Premia’s run-off investments.

-

Target investments could include cat bonds and other reinsurance, though the allocation size is unknown.

-

The ILS manager is in cost-cutting mode as assets shrink, but the run-off may lead other ILS managers to reconsider their tactics with rated platforms.

-

The Credit Suisse-managed firms will stop underwriting new business as of 1 January.

-

The companies said they will pursue a “controlled exit” as the affiliated ILS manager continues to draw back following a reduction in assets.

-

The Q4 figures represent an increase of 24% since July 2020.

-

The company has expanded its sidecar in recent years but this will allow it to tap into a different investor base.

-

Pessimism around trapped capital is growing, but low reported losses may mitigate the issue.

-

The Zurich-based manager holds the industry's fourth spot after a steeper year-end 2019 drop.

-

The Atropos fund has delivered 6.29% yield and recorded gross inflows of over $140mn since the beginning of 2020.

-

The firm said it planned to focus on new vehicles that would increase permanency of third-party capital.

-

More ILS funds are allocating to retro than in past years, while a third of investors are expecting to increase their allocations slightly.

-

The new paired entity will allow the company to grow its reinsurance business, starting with a deal covering $10bn of annuities.

-

The pullback from incumbent backer Credit Suisse is influenced by concerns over returns against a long-term capital lock-in, as the manager’s AuM has shrunk.

-

The reconstruction of funds backing Syndicate 1856 comes as the vehicle is expected to shift towards being a follow-only writer.

-

Fee income stayed flat but AIG's share of AlphaCat investment results dropped.

-

The risk modeller has been fending off Senator Investment and Cannae Holdings since their initial $5.2bn takeover proposal in June.

-

The commitment from the Canadian investor, which also backs Integral partner AmWins, is its first in the ILS sector.

-

The carrier's ILS assets under management remain in line with prior estimates, at $1bn deployable capacity.

-

The Australian bank is willing to lend against a broader range of instruments than cat bonds.

-

Firms will not cover their cost of capital this year, though capital positions remain robust.

-

It made a 4.4% gain over the past year from its insurance holdings, and has made 7.9% per annum since inception.

-

The carrier said it had added new ILS structures, as it took $187mn in Covid losses.

-

The sidecar's asset base has fallen by around $140mn in the past year.

-

Everest Re said it has written more retro and has enough firepower for market opportunities.

-

The reinsurer wants to take more net risk after raising £400mn new equity earlier this year, but is facing a steep drop in ILS support.

-

The departures follow a review of the Credit Suisse-backed firm’s underwriting strategy which will see it focus on bigger lines across a smaller client set.

-

AIG turned a $2mn investment loss from its small stake in the ILS manager's funds.

-

The firm's ILS AuM remains at $1.5bn nominally, but reserves pulled deployable capital to $1bn.

-

The (re)insurer also said most of LCM’s investors have appetite to go forward and remain active in the ILS market.

-

The manager’s MGA operations boosted ILS revenue despite lower AuM.

-

Parent Lancashire fell to an underwriting loss for the first half after lifting its Covid-19 loss estimate to $42mn.

-

The growth follows the reinsurer expanding its relationship with PGGM.

-

Cat programmes have been completed this year, but a heavy hurricane season could shake up the market, the broker said.

-

The ILS manager is discussing public solutions and expects demand to emerge.

-

KKR described the $4.4bn deal as a “transformative event” and a “highly strategic” investment for the company.

-

Partnerships with the reinsurer and wholesale broker will grant the start-up access to insurance and reinsurance business.

-

The restructure of finances also brings CDPQ in as debt provider and lines up a £300mn+ M&A war chest.

-

Investors collectively tried to redeem more than a third of the $3bn fund.

-

The sidecar’s loss ratio improved by 30 points year on year.

-

It becomes the eighth ILS specialist firm to join the standards association, and the third this year.

-

Seo and Millette both expressed optimism about inflows into ILS over the coming months.

-

Some argue that what appears to be a stepping back by Japanese investors may just be a pause as investors switch managers.

-

The statements come after an outline agreement, signed by Covea 10 weeks ago, collapsed this week.

-

The firm's new minority investor reaped half-year returns of 2-4 percent.

-

Two large ILS managers bucked the trend for alternative retractions, but traditional carriers recorded the fastest expansion.

-

The sidecar’s AuM has held steady and remains an important hedging mechanism to the reinsurer, it said.

-

-

This came as the carrier sank to a $1.4bn Q1 loss on huge investment losses.

-

The top ILS manager expects assets under management to decline by 7% in H1.

-

The major buyback was completed before the Covid-19 pandemic sparked a market crisis.

-

-

The finance company is led by ex-Leadenhall deputy CIO Dan Knipe.

-

The consultancy with more than A$410bn in AuM said Joseph Clark's insurance background would benefit clients.

-

This is the first time premium income has outpaced claims in three years.

-

The board has six specialist ILS members, in addition to pension funds and other institutional investors.

-

The investor bought a minority stake in Elementum last year.

-

Hiscox expects its ILS AuM to drop in 2020 as one of its investors indicated it will reduce its ILS commitments.

-

First-event cover and the level of per-event deductibles in aggregate typhoon deals are being re-examined.

-

The fund also lifted the size of a new mandate to Hudson Structured Capital Management as it withdraws from Nephila’s loss-making Palmetto fund.

-

The $1.28bn fund allocates assets across multiple alternative strategies.

-

The infrastructure of the ILS market is undergoing extensive renovation at the moment.

-

The Bermudian ILS platform returned to profit after a loss-making 2018.

-

The (re)insurer should benefit from profit commission later in the year, chief executive officer Darren Redhead said.

-

Third-party investors recorded a $2.6mn underwriting profit for the year.

-

The carrier posted $1mn investment income from its investment in AlphaCat funds for the period, compared to a $12mn loss in Q4 2018.

-

The platform delivered $5.9mn in profit to Lancashire from its 10 percent stake in the funds.

-

The Everest Re sidecar began 2020 with $819mn of assets under management.

-

The investment comes as the Indiana Public Retirement System exited Nephila’s Palmetto fund in pursuit of a more diversified ILS strategy.

-

The topsy-turvy nature of the past few years for the ILS market is apparent when you look at our half-yearly surveys of assets under management.

-

People moves in the ILS marketplace

-

Further retro price increases at 1 January may not have yet produced much impact on the underlying reinsurance markets, but the true test will come at 1 June.

-

Deputy CIO Dan Knipe is setting up a new credit platform.

-

Brit has confirmed further details of the structure of its new Lloyd’s specialty fund, which will take a whole account slice of risk from its Syndicate 2988, using a corporate member investment structure.

-

The vehicle was set up as a Bermuda fund funnelling capital through a Lloyd's corporate member.

-

-

He will have a similar mandate at New York-based One William Street as he had at recently-sold hedge fund BlueMountain.

-

-

The Everest Re sidecar assumed $79.5mn of losses after Dorian and Faxai hits, up from $29mn in the same quarter last year.

-

Lodgepine departs from the pillared structure of Markel Catco, Markel co-CEO Richie Whitt said.

-

Gross written premiums (GWP) for the reinsurance and ILS division increased by 6.1 percent for the first nine months of the year to reach $823.6mn.

-

AIG's reinsurance subsidiary has just $155mn of losses to retain before triggering retro recoveries.

-

The carrier’s ILS revenues tripled year on year after its Nephila acquisition.

-

The Everest Re sidecar shrank by $6mn, as the carrier fell to an underwriting loss for the quarter.

-

Broader risks could entice new investors to the ILS space, Dan Brookman head of alternative capital at Axa XL said at Trading Risk’s conference in New York earlier this month.

-

The present CEO of the AIG-owned ILS manager Lixin Zeng will hand over the reins in mid-2020, it is understood.

-

The firm is “far from a start-up” according to head of ILS business Rick Pagnani.

-

The acquisition will not impact the ILS fund manager, managing partner and president Richard Pennay has said.

-

Assured Guaranty paid $160mn in cash for the alternative asset management firm which has $18.9bn in assets under management.

-

Martin McCarty’s new responsibilities will include servicing Axis’ strategic capital partners.

-

The combined $2.1bn offering will now look to develop common products and funds, according to the Coriolis CEO.

-

The deal announced in May takes the reinsurer’s ILS assets to $2.1bn.

-

CEO Greg Hendrick said the third-party capital platform could eventually be used within the entire Axa group.

-

Jeff Fraser was assistant vice president of cat pricing at the insurer before joining the ILS start-up.

-

The handful of reinsurers to disclose third-party fee income lifted this source of earnings by almost a third year on year in the second quarter.

-

M&A activity has made analysing structural conflicts in ILS platforms harder but winners may be those that offer a range of means of access to risk, consultants say.

-

Graham joins from Lancashire Insurance Company where he was operations and claims manager.

-

Improvements to models and peril exclusions are expected to encourage growth once losses have been settled, the ratings agency said.

-

As ILS reinsurers recover from the 2017-2018 loss years, the consensus view now is that the market will see a “flight to quality” by investors, bolstering the position of some platforms while eroding the asset base of poorer performers.

-

The ILS platform lifted fee income by a third year on year, offsetting its investment loss.

-

Alleghany recorded $3.3mn investment income from its ILS holdings, up nearly three-quarters year on year.

-

The business bought 30 percent of the ILS manager for $55mn in May.

-

The insurer reported $17.7mn of income from sidecar investors and MGAs.

-

The growth contrasted with a 2 percent slide in collective assets among the top tier of ILS players.

-

Its new acquisition offset lower revenues from the Markel Catco business, which will take about three years to run off.

-

“We're not trying to grow for the sake of growing,” Everest Re’s reinsurance chief executive John Doucette told analysts yesterday.

-

The ILS fund, which contains insurance and reinsurance risk, continues to attract investors.

-

BlueOrchard manages the InsuResilience Investment Fund which provides access to insurance in the developing world.

-

The ILS unit has reached $1.6bn assets, as Hiscox’s reinsurance group was hit by 2018 loss creep.

-

The Reinsurance Opportunities fund holds $40.2mn in cash across its two share classes, with the remainder invested or in side pockets.

-

On sweltering weeks like this, you can see why climate change has become a talking point that every ILS manager has to cover in their pitch for new investor mandates.

-

The increase suggests the Lancashire-owned firm has grown to $750mn of assets under management.

-

The retro-focussed Upsilon fund saw limited growth, while the Medici cat bond fund attracted $107mn in new capital.

-

The institutional asset manager ownership model could help the ILS asset class shed its niche feel, Secquaero founder Dirk Lohmann suggested to Trading Risk.

-

The funds were raised over 18 months, portfolio manager Florian Steiger said.

-

PGGM senior investment director recognised for her exceptional contribution to the sector.

-

The ILS platform’s chief operating officer had helped drive growth to $1.5bn assets under management.

-

There will be no change to the running of the ILS fund Merion Square or its strategy, managing partner Richard Pennay told Trading Risk.

-

The manager gained approval from a majority of investors in its Guernsey-listed Securis I fund to implement side pocket shares.

-

Research by the broker shows the ILS industry contracted by $4bn in the first quarter to $93bn, with $15bn of capital still trapped.

-

Fosun said Tenax Capital will become one of its most important European asset management platforms.

-

Investors sought to redeem about $200mn in 2019 from the shrinking Securis I fund, but the London manager has grown its lower-risk non-life fund.

-

Winners were recognised at the 11th Trading Risk Awards ceremony, held in London last night.

-

The Zurich-based fund manager will no longer manage two Falcon cat bond funds.

-

Zurich-based Solidum Partners will oversee the two funds, estimated to be worth $400mn, from 1 August.

-

Firming market an opportunity for the growing ILS fund, according to the analysts.

-

Ultimately, with advantages and challenges in any ownership situation, the parentage of an ILS platform is not going to be the determining factor in its success.

-

The industry’s market heavyweights remain split amongst different types of ownership models.

-

The firm will invest $50mn in Elementum’s ILS funds.

-

The reinsurance fund has ramped up in recent years to $700mn-$800mn.

-

The combination would have around $2.1bn of assets under management.

-

M&A deals have resulted in reinsurer affiliated businesses overtaking the market share of independent ILS firms, but asset managers have also grown their share via new launches since 2014.

-

One of my colleagues with an affection for Denis Kessler’s turn of phrase once labelled him the Beyonce of the reinsurance world.

-

Coriolis execs Diego Wauters and Martin Jones will stay for at least two years to continue to run the business.

-

Scor chairman and CEO Denis Kessler said the acquisition would help its ILS platform move into the top tier of the market.

-

New disclosure on the ILS manager shows AIG made a Q1 profit on its allocation to AlphaCat funds after a Q4 loss.

-

The broad portfolio, including ILS holdings, made a loss in the year to 31 March but the organisation did not mention any shift in its reinsurance strategy.

-

The fair value of AP3's ILS portfolio rose by 10.7 percent to $560mn at year end in 2018.

-

Carriers that wrote more premium include Swiss Re, Munich Re, RenaissanceRe and Everest Re, while Hiscox Re and Axis posted reductions in top line income.

-

AlphaCat’s $4.16bn net AuM was detailed in a recent Securities and Exchange Commission filing.

-

Markel has not actually come out and said what it plans to do with former top 10 ILS manager Markel Catco, but the likely money has to be on a gradual closure now that an overwhelming 91 percent of assets under management are due to be returned to investors, as claims development permits.

-

Among other promotions, chief risk officer Tim Aman will take responsibility for outwards reinsurance.

-

Mt Logan Re joins AlphaCat to manage the Australian asset manager’s $560mn ILS investments.

-

Excluding the impact of its ILS operations, premiums in the reinsurance segment grew by 3 percent.

-

Lancashire group CEO Alex Maloney said capital providers are pushing on return and risk disclosures.

-

The gains were partially offset by the costs associated with Markel Catco.

-

-

People moves in the industry in the past month.

-

Experts at Trading Risk’s London ILS Conference gave a mixed report on investor appetite and opportunities in the sector.

-

The executive predicts more differentiation between cedants at the upcoming Florida renewals.

-

The reinsurer’s ILS team has reshuffled responsibilities as Vincent Prabis moves on from the fund manager.

-

The New Mexico Educational Retirement Board pension fund invested in ILS via ILS Capital Management.

-

Reinsurer-owned ILS managers reported mixed outcomes in terms of assets under management (AuM) in their Q4 results.

-

Juan Prado was previously a senior vice president at RenaissanceRe Ventures.

-

The sidecar’s cat claims came in just under the $323.7mn level recorded in 2017.

-

Catastrophes and large claims dragged Bermuda-based Hiscox Re and ILS to a $23.2mn loss for 2018.

-

The insurer’s Q4 cat losses take yearly total to EUR1.29bn.

-

It took a steeper 2018 loss from the ILS platform than in 2017.

-

The business is achieving a 10 percent uplift in pricing.

-

Basic fee income was up year on year, although 2017 losses meant it made no profit commission.

-

John Doucette, president and CEO of reinsurance at parent company Everest Re, said the company had shrunk its January catastrophe portfolio.

-

At $1.05bn, the Everest Re sidecar has remained stable throughout 2018.

-

Most investors in Markel Catco are expected to take up an offer to redeem their shares, as the platform further increased its loss reserves for 2017 events and had its value written down to zero by parent company Markel.

-

Mitsui Sumitomo Insurance (MSI) now owns 80 percent of Leadenhall Capital Partners after taking over the holding from its international subsidiary MS Amlin.

-

Allianz will participate in Pimco’s new ILS business both as an underwriter and an investor in its ILS funds, a spokesperson said.

-

The restructure also includes CEO Dirk Lohmann becoming Schroder’s head of ILS.

-

A Markel executive said he expects most investors will seek to cash out by March 31.

-

The insurer took a $179mn hit to its Q4 results from loss of goodwill.

-

The Luca Albertini-led ILS manager will become a direct subsidiary of the Japanese insurance group, rather than being held by MS Amlin.

-

The Bermuda-based ILS manager withdrew from the insurer’s reinsurance treaty following losses in 2018.

-

Allianz said it would assist Pimco’s new ILS business through originating collateralised reinsurance and other investments.

-

People moves in the industry in the past month.

-

Assets under management fell by around $5bn.

-

Rick Pagnani was most recently CEO of Everest Re’s Mt Logan vehicle.

-

The Pennsylvania start-up will manage the portfolio of a new liquid ILS fund offered by Rational Funds.

-

Total assets have grown from $45.6mn at the end of July.

-

PGGM is initially backing the rated reinsurer with $600mn to target remote US cat risk.

-

The Latin American investment bank has backed the ILS start-up to launch a new low volatility fund in 2019.

-

ILS funds with life strategies reported substantially higher transaction volumes in 2018, helping to drive growth in assets under management (AuM).

-

The exit comes ahead of Lloyd’s closure of SPA 6129.

-

Trapped capital will add to losses from Michael, Jebi and the wildfires.

-

The manager is aiming to sell its products to investors in the UK and French-speaking Europe.

-

Two M&A deals in the ILS sector in the past month provide a contrasting view on what kind of acquirers may step forward in the future.

-

The firm warned that it expected continuing industry adverse development into 2019.

-

The $1bn ILW specialist will be remained NB Insurance-Linked Strategies after the sale.

-

The asset manager’s CFO praised the ILS fund’s excellent management.

-

Catastrophe losses added 9.0 points to the (re)insurer’s combined ratio as Hurricane Florence and Typhoon Jebi pushed up losses, mainly impacting its reinsurance division.

-

The firm’s Fermat-managed ILS portfolios lifted assets under management to $3.3bn in Q3.

-

UK bank Lloyds has set up a JV with the investment manager, which owns a share in $3bn ILS manager Secquaero.

-

The asset manager and Oppenheimer’s former owner MassMutual have entered into an agreement which will bring Invesco’s total assets under management to $1.2 trillion.

-

The fund is one of a number of new mutuals to launch in the sector.

-

The company is moving away from market-facing collateralised reinsurance funds, head of alternative capital Dan Brookman told this publication.

-

Combined net assets for the High Yield and Interval Funds remained stable at $6.99bn at the end of July, Stone Ridge said.

-

Mt Logan Re investors took $133.8mn of losses in Q2 as its parent Everest Re suffered from adverse development on 2017 claims, undoing the benefit of reserve releases booked in the fourth quarter last year.

-

-

Reporting to director of underwriting in London Megan McConnell, Ross Nottingham will lead Hiscox Re's North American underwriting team and strategy.

-

Aspen CEO Chris O’Kane said the acquisition by Apollo would help the group have additional scale and “take Aspen to the next level”.

-

ILS managers' income is going to be dented by lost performance fees.

-

The retro manager’s assets under management reached $6.5bn at the end of June, including trapped capital.

-

Premiums written by AlphaCat’s low-risk ILS funds overtook its high-risk premiums, as overall assets fell to $3.5bn.

-

The reinsurer's ILS assets under management have now reached $1.6bn.