AuM data

-

The fund will offer additional spread versus other similarly rated corporate debt.

-

The ILS AuM in its flagship cat funds rose 13% over the half year to $6bn as of 31 October.

-

The fund limits positions in aggregate structures exposed to secondary perils.

-

The Italian asset manager also plans to relaunch its multi-strategy ILS fund.

-

Growth included a $240mn increase in partner capital in DaVinci equity plus debt.

-

The reinsurer-linked manager now offers three ILS funds encompassing private ILS and cat bonds.

-

Third-party investors made a net income of $415mn in the quarter.

-

The award of the mandates marks the California public pension plan’s entry into ILS.

-

Returns from cat risk investments stood at 20.1% for the year to 30 June 2025.

-

The allocation is around 3% of the fund’s total assets.

-

The manager’s largest ILS holding is in the cat-bond-heavy High Yield fund.

-

Victory Pioneer Cat Bond Fund also added assets in the past month.

-

Reinsurers are confident on cat rates and ready to deploy ILS capital.

-

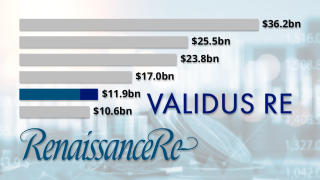

The merged business of Twelve Securis ranked third among ILS managers for AuM, behind Fermat and RenRe.

-

The fund was renamed from the Pioneer Cat Bond Fund.

-

The recommended “AIF lite” structure could be suited to cat bond lites.

-

The Diversified Alternative Fund’s allocation to cat bonds was up by 31% from $386mn at 31 January.

-

Twelve Securis is now a challenger for the top spot on the Insurance Insider ILS leaderboard.

-

The pensions scheme’s existing ILS holdings to Aeolus and HSCM are in run-off.

-

The fund lists Twelve, Swiss Re and Cambridge Associates as managers.

-

AuM in GAIA Cat Bond Fund had grown to $3.9bn as of 31 May.

-

The firm said it was the first time a UCITS cat bond fund passed the $4.0bn mark.

-

The fund was set up 18 months ago by cat bond investor Florian Steiger.

-

This followed a $650mn fall in April, after management change of the fund.

-

The Swiss pension fund has not disclosed an ILS allocation before.

-

Some assets in the Medici Fund were transferred to a new UCITS strategy.

-

The ILS manager’s total AuM increased to $2.2bn in 2024 from $1.7bn the year prior.

-

Fermat and GAM announced that the former will take sole control of the GAM FCM Cat Bond Fund.

-

January’s California wildfires meant third-party investors suffered a loss of $195.3mn.

-

The Swiss rail pension scheme has been cutting its ILS allocation since 2018.

-

The Swiss pension fund’s ILS allocation stood at 4.9% of the total fund as of 25 March.

-

Fees on the GAM Star cat bond funds will drop in May in a recognition of fee competition in the market.

-

Most of the ILS investments were made via the cat bond heavy High Yield Fund.

-

Many UK pension funds are over-funded and lack appetite for higher-risk, higher-yield products.

-

ILS as a percentage of the pension fund’s total assets grew to 1.5%.

-

The UK listed investment manager has almost doubled its ILS allocation since April last year.

-

The scope of QRT’s new ILS strategy will include cat bonds and private ILS.

-

There was a slight increase in DaVinci and Fontana from 31 December 2024 to 1 January 2025.

-

The firm will match segregated accounts of portfolios to investor mandates.

-

Liquid alternative strategies accounted for around $1.4bn of the total.

-

AuM remains generally flat at UCITS funds over the weeks since LA fires started.

-

FY24 disclosures show shifting fortunes at reinsurer ILS platforms.

-

The value of its investment in RenRe stood at $330.4mn as of 30 June 2024.

-

PFZW’s insurance allocation stood at $8.7bn as of year-end.

-

Fermat stayed in the top spot surpassing $10.0bn for the first time.

-

This comes after the firm’s distribution partner GAM has had a challenging few years.

-

The manager’s Interval Fund returned 28.25% over the financial year.

-

The Bermuda based entity is expected to continue on its “responsible growth trajectory”.

-

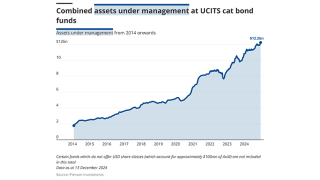

The UCITS cat bond segment has added 54% in AuM since Hurricane Ian.

-

The reinsurer said investors were interested in expanding after benefiting from good results.

-

Former ILS investors who left the space have looked again and re-allocated.

-

The scheme’s ILS allocation has held steady at 0.7% of the total fund.

-

The ILS manager’s existing Medici cat bond strategy stood at $1.68bn in assets under management (AuM) as of 30 September.

-

CEO Jonathan Zaffino said he saw opportunities for expansion in casualty.

-

The UCITS fund was launched in 2021 and invests in cat bonds and the money markets.

-

The headline figure of $7.72bn includes $3.11bn of DaVinci equity plus debt.

-

Strong growth in fee income builds on the favourable rating environment.

-

Daniel Ineichen, former co-head of ILS, had been with the company for nearly two decades.

-

Fee income fell by 42% to $25.1mn in Q3 over the prior-year quarter.

-

The pension scheme has been winding down its ILS portfolio in recent years.

-

The ILS allocation increased in dollar terms and held steady in euros.

-

The class of 2023-24 cat bond funds will grow existing investors and add new ones.

-

The firm’s new name is inspired by 18th Century Swiss mathematician Leonard Euler.

-

The deal freed up capital held against deals written in 2019 and 2020.

-

The ILS industry offered 11 points of merit that justify cat bonds being eligible for UCITS funds.

-

The deal takes year-to-date cat bond lite issuance to $367.6mn

-

Schroders moves into fifth place in the Insurance Insider ILS leaderboard.

-

The combined Twelve-Securis entity would be a top-five ILS firm currently.

-

More than 30% of the fund's AuM is allocated to US windstorm-linked bonds.

-

Sources said that Gallagher Re had ‘first mover’ advantage as the exclusive broker.

-

Sub-1% management fee and performance fee-only structures have evolved in ILS.

-

The Icosa Cat Bond Strategy now stands at $130mn in AuM.

-

Tanja Wrosch joins Twelve after more than a decade at Credit Suisse ILS.

-

The regulation now allows pension funds a more flexible benchmark for measuring alternatives.

-

Rich had spent 13 years at the firm where he began his career and oversaw a cat bond and ILS portfolio.

-

-

The capital will be deployed by Bermuda-based special purpose insurer Arachne.

-

Combined AuM of UCITS funds stood at $11.3bn as of 26 April 2024.

-

Over Q1, the loss ratio improved by 34.6 points year on year to 43.7%.

-

ILS returned 3.2% for the scheme in the first quarter.

-

The platform’s ILS holdings comprise cat bonds and UCITs funds, and were up 8% over January and February.

-

Fee income was up by 30% year-over-year to $136mn in 2023.

-

The fund will follow an existing Twelve strategy and add short-term corporate bonds.

-

Chris Parry said the denominator effect remains a suppressant on ILS inflows after a strong phase of returns.

-

Daniel Ineichen and Flavio Matter have been promoted to co-heads of ILS.

-

It is only the second year in the last eight that the allocation grew.

-

CEO Hussain said third-party capital in 2023 remained flat.

-

The firm’s assets under management dropped to $1.6bn, as a capital return more than offset new inflows.

-

Head of alternatives Gareth Abley believes the asset class remains attractive following a 16% return in 2023.

-

The outlook for M&A activity is brighter after 2023 returns.

-

The parent also expects the ILS platform’s AuM to grow.

-

The acquiring reinsurer will now run off the business.

-

-

The reinsurer’s assets under management rose 14% to $3.3bn.

-

Aside from the one-year view, 2023 remixes the track record.

-

The firm told investors yields in the cat bond market are 'still very attractive'.

-

The sidecars segment has been attracting inflows after returns hit a high note in 2023.

-

In its semi-annual report for the six months to 31 July 2023, the manager said the fund had returned 2.74% over the half-year.

-

The independent manager’s post-Ian growth has helped it more than double from prior estimated assets under management.

-

The Swiss Re Total Return Index climbed month-over-month throughout the year, to more than regain ground lost after Hurricane Ian in September 2022.

-

Nearly 90% of the fund’s allocation is in cat bonds, with a small allocation to other ILS securities and US Treasury Bills.

-

Broker-dealers' year-ahead forecasts have undershot total final issuance in three of the last five years.

-

Schwartz will set the firm’s investment process on its ILS, equity and debt strategies.

-

The asset manager’s flagship ILS funds posted stellar returns for its 2023 fiscal year.

-

The firm’s flagship reinsurance strategy delivered its best performance in its 10-year history.

-

The year brought a degree of closure on the loss-hit years of 2017-2021, while the outlook remains changeable for ILS managers.

-

Swiss Re Alternative Capital Partners assets under management hit $3.3bn as of 30 September.

-

The Australian sovereign wealth fund first allocated to the ILS manager in 2016.

-

Research by Kepler Absolute Hedge showed that seven out of the 10 best-performing alt credit funds were cat bond strategies.

-

AuM stood at $1.5bn as of 30 September, up from $1.2bn as of January 2023.

-

The Zurich-based ILS manager has grown the fund by around 167% from $150mn as of mid-2021.

-

A new pooling structure allowed the firm to free up historic side pockets and provides a template for future exit options.

-

Steiger is said to be moving to an “entrepreneurial” role after more than six years with the Zurich-based firm.

-

The ILS sector grew in the context of 0% interest rates historically.

-

Hiscox said outflows from the ILS unit were offset by "record returns" in Q3.

-

The ILS firm reported $6.8bn of assets under management at the third-quarter mark.

-

The ILS executive is departing the ILS platform following RenRe’s move to buy Validus Re for ~$3bn.

-

The fund had taken major losses on cat-related investments, including through Southeast primary carriers Weston and Southern Fidelity.

-

The recent ILS start-up was the only new mandate for 2022 after the Dutch firm had added two new mandates in 2021.

-

Cat bond investors are sufficiently capitalised to fulfil demand from an anticipated strong pipeline of new issuance in Q4.

-

Gallagher Re has stated that the alternative capital market has increased by 4%.

-

The private equity firm is targeting $1trn in assets under management for the combined segment.

-

The broker’s half-year 2023 report said reinsurers’ RoE has surpassed the cost of capital for second year running.

-

Outside the cat bond segment, Aon said it was observing rising sidecar interest, putting volumes at $7.1bn from $6.4bn the prior year.

-

The move comes as investors are on track to reject a bid from Liontrust.

-

The ILS business ‘continues to be an important differentiator’, says Aspen CEO Mark Cloutier

-

The industry’s ability to draw new capital will hinge on the outcome of the Atlantic hurricane season.

-

The AuM total hits $12.1bn when including Top Layer Re and RenRe’s own participation.

-

The reinsurance and ILS unit posted strong net premium growth supported by additional capital from Hiscox Group.

-

The reinsurer opened its cat bond portfolio to third-party investors last summer.

-

-

The firm has moved to defend its plans against a rival strategy supported by a small group of investors.

-

Some sources have called for more transparency on secondary trades, though others note the buy-and-hold nature of the market limits trading appetite.

-

The ILS fund now comes in at the 26th spot on Trading Risk’s ILS fund manager directory.

-

The cat bond fund posted returns of around 10.75% for the first six months of Stone Ridge’s financial year.

-

The distribution arrangement will cover Securis's full range of ILS offerings.

-

The fund ranks 19th in Trading Risk’s ILS fund manager directory following this disclosure.

-

The new fund will be led by Daniel Ineichen and be open to US investors.

-

The former chairman and CEO of New York Life will support the asset manager in developing strategies that harness longevity pooling.

-

The UK asset manager’s ILS strategy is operating across six of its multi-asset funds.

-

The current year performance marks an uplift compared to a tough 2022, in which Elementum delivered a loss to White Mountains of 4.6%.

-

The takeover will push it up two places to rank as the fifth-largest writer of P&C reinsurance by gross premium.

-

AIG will invest a significant amount into Fontana and DaVinci.

-

The company has eroded about half its international catastrophe deductible following New Zealand losses.

-

The acquisition gives UK asset manager Liontrust a broader European footprint and cat bond products.

-

The reinsurer lifted net reinsurance premiums by 38%, although, on a gross basis, growth was lower at 5%.

-

Markel’s ILS platform maintained assets under management at $7.2bn, down by $200mn from a January figure of $7.4bn.

-

UBS previously explored setting up an ILS offering, but instead opted to offer other firms’ products.

-

The New York-based executive had been one of the firm’s co-heads of ILS, leading on investor relations and sales.

-

-

The uplift was helped by the Atropos Catbond fund surpassing $1bn.

-

The real test for cat capacity will come at the mid-year point, according to Gallagher Re.

-

The new higher-rate world brings the threat of some investors staying in a risk-off mentality.

-

The rival Swiss bank did not have an ILS operation.

-

The division is deploying its own capital to make up for the lack of wider reinsurance and ILS capacity.

-

The ILS expert had joined as a portfolio manager in 2018 from Ontario Teachers’ Pension Plan.

-

The ILS manager said the cat bond sector could double to become a $70bn market in the next three to five years.

-

The manager’s life & alternative credit segment invested in the reverse mortgage specialist.

-

The insurance conglomerate initially committed $50mn to Elementum funds.

-

The ILS unit earned $5mn of fee income, down by $1mn year on year.

-

The capital commitments to the vehicle have expired.

-

The CFO of parent company Markel has said it aims to lean into property cat through Nephila.

-

Nephila achieved significant rate increases at 1 January and expected the strong rate environment to continue this year.

-

The former Aspen Capital Markets COO hopes to set up fronting partnerships for reinsurers wanting to build out in ILS.

-

The world’s largest investment company has assets under management of more than $10tn.

-

The move follows Sal Tucci’s departure from the firm to set up Jireh Risk Advisors.

-

The new firm has registered Jireh Re (SAC), an unrestricted special purpose insurer, with the Bermuda Monetary Authority.

-

The asset manager’s reinsurance funds shrank 17% in its fiscal year to end October to reach $2.6bn.

-

Baltesar worked for Hiscox Re and ILS before joining Credit Suisse ILS in 2019.

-

It is understood that Ascot will continue to write worldwide retro business.

-

The manager received a mandate from a new investor who had taken the call to come in ahead of Hurricane Ian.

-

The insurer also emphasized that it realised more than $300mn from selling two MGA operations.

-

AIG’s Q3 net cat losses of $600mn included $450mn from Hurricane Ian.

-

The ILS platform has dipped to $7.8bn in assets under management, as ILS revenues were down 44% after the sale of Velocity.

-

The reinsurer’s CFO and COO Michael Dennis has been named CEO, subject to immigration approval.

-

The fund’s allocations to general and life insurance investments have grown year over year.

-

Evanston Insurance Company, a subsidiary of Markel, backed the move.

-

The group-level cat impact to the combined ratio improved 0.3 points to 1.8.

-

Inflows allowed the unit to step up to the distressed Florida market.

-

The ILS firm reported $8.5bn of assets under management at mid-year.

-

The investor will manage a portion of the Bermudian’s assets.

-

Jacquet previously served for five years at Credit Suisse ILS.

-

The hardening rate environment in Florida provided a mid-year opportunity for some, but overall there was little growth.

-

The vehicle was supported by a group of institutional investors.

-

Elliott Management, the other key suitor for the business, is understood to have dropped out of the auction.

-

Partial owner White Mountains said conditions for ILS investing are “attractive”.

-

CEO Luca Albertini has no immediate plans to step down but the firm said the promotion provided clarity on succession plans.

-

The allocation increased in dollar terms by just under 2% during the past year.

-

The ILS fund said the funding would support the company’s growth prospects.

-

The firm reserved $40mn for Ukraine, citing ‘small net losses’ in Re & ILS.

-

Third-party assets under management were up $100mn in Q1 at $3.6bn.

-

The carrier posted 6% growth in reinsurance, with primary insurance premiums rising 15%.

-

Company's Nephila ILS operations will focus on “significant” cat opportunities.

-

Acrisure entered into a definitive agreement with Markel in March to acquire the MGA.

-

The ILS platform delivered stable revenues as Markel spent $102mn on its Catco buyout.

-

The reinsurer said the third-party platform, which reached $2.2bn at the start of this year, provided capital relief and supported nat-cat capacity.

-

The carrier recorded $224mn of natural catastrophe losses.

-

Lancashire posted heavy losses in its Q4 result and said its ILS capital is down materially.

-

The exit of key Florida insurers could spur rate increases.

-

He spent seven years at Arch Capital and will be working on HSCM’s reinsurance strategies.

-

Lauer and Bean work in operations and Denny on the investment side.

-

The carrier cut exposure to both earnings level and highly volatile cat events as it shed risk.

-

The flagship Atropos fund reached $1.4bn while its cat bond strategy is sized at $831mn.

-

The hire comes as the ILS firm grows its asset base during a surge in cat bond popularity.

-

The group will look to build on synergies between its insurance platforms.

-

The deal expanded scope of Aspen’s delegated underwriting operations across both US and European operations run by Ryan Specialty.

-

The firm will look to grow its offerings on climate change and natural catastrophe risk.

-

-

The pair have helped to lead the life and alternative credit team since January 2020.

-

He will replace Jonathan Malawer, who held the position for fourteen years and has left to join a new firm focussed on climate risk investments.

-

The firm said he would oversee transactions and assist in growing AuM.

-

The business has reported sustained strong growth in its programs segment.

-

The London-based manager said the open-ended fund structure was no longer “optimal” for mingling life and non-life exposures.

-

The topic of quota-share support is becoming all the more crucial because supply is shrinking at the same time as demand is rising.

-

The Dutch firm had given the AIG-owned platform a mandate that could range from EUR500mn to EUR1bn, covering US cat reinsurance.

-

The Bermudian carrier took $188mn losses from Hurricane Ida and $60mn from the European floods.

-

Despite the drop-off in AuM, Markel boosted ILS operating revenues significantly in the quarter.

-

The ILS manager’s cat bond investments generated inflows for GAM’s fixed income pot.

-

The larger fund PK SBB revealed it made a loss of 7.0% in its ILS portfolio for 2020.

-

The carrier posted a small loss in the first half of 2021, the agency noted.

-

The investor has significantly cut back its allocation over the past few years.

-

One market participant said the strategy was $250mn in size, but it is not known how much business it has so far written.

-

Brooks had been in his post for almost two years and joined AlphaCat in 2011.

-

The deal covers the reinsurer’s worldwide cat XL book, as Scor plans to ramp up P&C growth.

-

Kevin O’Donnell also said he saw social inflation as more of a concern for the industry than climate change.

-

The Credit Suisse-backed firm produced a small profit in the first quarter of 2021, the ratings agency said.

-

Matt Berdoff, Jason Braunstein and Wendy Wong-Tsang have joined the firm’s partnership.

-

Despite the Q2 increase, the Everest Re sidecar’s written premium for the first half was down 2% to $155.3mn.

-

The 2017 start-up has previously focussed on quota share investing.

-

The reinsurer had previously signalled it would grow its net reinsurance portfolio after deploying less third-party capital.

-

Fee income – an area of patchy disclosure by reinsurers – was generally stable amongst early reporters.

-

The broker said ILS capital had reached $96bn at the end of Q1.

-

Cat bond fund managers continue to reap growth as the industry has rebounded from its Covid dip.

-

The insurance investment expert joins Jefferies with a brief to develop activity in EMEA’s primary and secondary insurance credit markets.

-

Richard Anson previously served as head of ceded reinsurance at Antares and reinsurance manager for Aviva.

-

The underwriter had worked with the ILS firm since 2018.

-

Executives including AIG CEO Peter Zaffino, Aon CEO Greg Case and Munich Re CEO Joachim Wenning have joined the task force, chaired by Lloyd’s.

-

The asset manager has previously invested in ILS via external specialists.

-

The fund will limit capacity to $400mn or 1.5% market share, and minimise exposure to secondary risks.

-

The investment house made a blended 0.7% underwriting return via its holdings in Elementum funds and 7% cash yield from its ownership stake in the firm.

-

British Virgin Islands-based investor Eugenia II Investment Holdings had alleged fraud and misrepresentation after losing $7.5mn with the retro fund manager.

-

The firm announced a gross performance of more than 10% on the fund since it was established in late May 2020.

-

The executive was one of the Swiss bank’s most senior ILS executives and established their life fund.

-

The vehicle will launch with $200mn of equity contributed by all the manager's ILS funds.

-

Parent AIG’s cat losses remained elevated in line with the prior-year Covid-19-impacted quarter.

-

Markel’s overall ILS revenues dropped by 27% year on year as it lifted fronted premium written for the Bermudian firm.

-

Scor Investment Partners has announced that the assimilation of Coriolis Capital into its wider ILS business has now been completed, following an acquisition of the London firm in September 2019.

-

Average reinsurer return on equity (RoE) was just 4.8% over the past four years.

-

The news follows the reinsurer’s announcement that the executive would step down from his role at the end of April.

-

The firm reported a $100mn drop in ILS AuM to $1.4bn, although previously had said deployable capital was lower.

-

The fund’s worst ILS return to date is understood to be driven by investments hit by Covid-19.

-

Recent investor inflows to its cat bond UCITS have brought it to over $1bn assets under management.

-

The Insurance Capital Fund combines US wind cat bonds with subordinated debt issued by European insurers.

-

The company also lowered the attachment points on its per-occurrence and aggregate property catastrophe treaties after shrinking its portfolio.

-

Parent company AIG posted an underwriting loss for the period.

-

The deal gives life insurer and asset manager Eldridge the opportunity to take an equity stake in the future, with further capital commitments likely.

-

Assets under management at the sidecar rose 12.5% year-on-year to $900mn by the start of 2021

-

This came as Everest Re fell to a $44mn underwriting loss on a pre-reported prior-year reserve charge.

-

Markel’s ILS revenues were impacted by the Markel Catco run-off and Lodgepine start-up costs.

-

Returns have disappointed some institutional investors, but prospective rates may attract fresh investment, sources said.

-

The additional raise takes the carrier’s committed capital to $3.2bn.

-

Ben Somers, former head of investor relations, has left after more than 11 years at the company.

-

The ILS market expanded by $1bn in Q3 but still shrank by 4% over the first nine months of 2020 to $92bn.

-

The emerging markets specialist aims to raise around $860mn of additional funds by 2025.

-

Leadenhall more than tripled its deal volume and Schroders has increased its assets under management in 2020.

-

The new Bermuda venture launched at the beginning of the year as part of the business’s scale-up.

-

The new vehicle gives third-party investors access to Premia’s run-off investments.

-

Target investments could include cat bonds and other reinsurance, though the allocation size is unknown.

-

The ILS manager is in cost-cutting mode as assets shrink, but the run-off may lead other ILS managers to reconsider their tactics with rated platforms.

-

The Credit Suisse-managed firms will stop underwriting new business as of 1 January.

-

The companies said they will pursue a “controlled exit” as the affiliated ILS manager continues to draw back following a reduction in assets.

-

The Q4 figures represent an increase of 24% since July 2020.

-

The company has expanded its sidecar in recent years but this will allow it to tap into a different investor base.

-

Pessimism around trapped capital is growing, but low reported losses may mitigate the issue.

-

The Zurich-based manager holds the industry's fourth spot after a steeper year-end 2019 drop.

-

The Atropos fund has delivered 6.29% yield and recorded gross inflows of over $140mn since the beginning of 2020.

-

The firm said it planned to focus on new vehicles that would increase permanency of third-party capital.

-

More ILS funds are allocating to retro than in past years, while a third of investors are expecting to increase their allocations slightly.

-

The new paired entity will allow the company to grow its reinsurance business, starting with a deal covering $10bn of annuities.

-

The pullback from incumbent backer Credit Suisse is influenced by concerns over returns against a long-term capital lock-in, as the manager’s AuM has shrunk.

-

The reconstruction of funds backing Syndicate 1856 comes as the vehicle is expected to shift towards being a follow-only writer.

-

Fee income stayed flat but AIG's share of AlphaCat investment results dropped.

-

The risk modeller has been fending off Senator Investment and Cannae Holdings since their initial $5.2bn takeover proposal in June.

-

The commitment from the Canadian investor, which also backs Integral partner AmWins, is its first in the ILS sector.

-

The carrier's ILS assets under management remain in line with prior estimates, at $1bn deployable capacity.

-

The Australian bank is willing to lend against a broader range of instruments than cat bonds.

-

Firms will not cover their cost of capital this year, though capital positions remain robust.

-

It made a 4.4% gain over the past year from its insurance holdings, and has made 7.9% per annum since inception.

-

The carrier said it had added new ILS structures, as it took $187mn in Covid losses.

-

The sidecar's asset base has fallen by around $140mn in the past year.

-

Everest Re said it has written more retro and has enough firepower for market opportunities.

-

The reinsurer wants to take more net risk after raising £400mn new equity earlier this year, but is facing a steep drop in ILS support.

-

The departures follow a review of the Credit Suisse-backed firm’s underwriting strategy which will see it focus on bigger lines across a smaller client set.

-

AIG turned a $2mn investment loss from its small stake in the ILS manager's funds.

-

The firm's ILS AuM remains at $1.5bn nominally, but reserves pulled deployable capital to $1bn.

-

The (re)insurer also said most of LCM’s investors have appetite to go forward and remain active in the ILS market.

-

The manager’s MGA operations boosted ILS revenue despite lower AuM.

-

Parent Lancashire fell to an underwriting loss for the first half after lifting its Covid-19 loss estimate to $42mn.

-

The growth follows the reinsurer expanding its relationship with PGGM.

-

Cat programmes have been completed this year, but a heavy hurricane season could shake up the market, the broker said.

-

The ILS manager is discussing public solutions and expects demand to emerge.

-

KKR described the $4.4bn deal as a “transformative event” and a “highly strategic” investment for the company.

-

Partnerships with the reinsurer and wholesale broker will grant the start-up access to insurance and reinsurance business.

-

The restructure of finances also brings CDPQ in as debt provider and lines up a £300mn+ M&A war chest.

-

Investors collectively tried to redeem more than a third of the $3bn fund.

-

The sidecar’s loss ratio improved by 30 points year on year.

-

It becomes the eighth ILS specialist firm to join the standards association, and the third this year.

-

Seo and Millette both expressed optimism about inflows into ILS over the coming months.

-

Some argue that what appears to be a stepping back by Japanese investors may just be a pause as investors switch managers.

-

The statements come after an outline agreement, signed by Covea 10 weeks ago, collapsed this week.

-

The firm's new minority investor reaped half-year returns of 2-4 percent.

-

Two large ILS managers bucked the trend for alternative retractions, but traditional carriers recorded the fastest expansion.

-

The sidecar’s AuM has held steady and remains an important hedging mechanism to the reinsurer, it said.

-

-

This came as the carrier sank to a $1.4bn Q1 loss on huge investment losses.

-

The top ILS manager expects assets under management to decline by 7% in H1.

-

The major buyback was completed before the Covid-19 pandemic sparked a market crisis.

-

-

The finance company is led by ex-Leadenhall deputy CIO Dan Knipe.

-

The consultancy with more than A$410bn in AuM said Joseph Clark's insurance background would benefit clients.

-

This is the first time premium income has outpaced claims in three years.

-

The board has six specialist ILS members, in addition to pension funds and other institutional investors.

-

The investor bought a minority stake in Elementum last year.

-

Hiscox expects its ILS AuM to drop in 2020 as one of its investors indicated it will reduce its ILS commitments.

-

First-event cover and the level of per-event deductibles in aggregate typhoon deals are being re-examined.

-

The fund also lifted the size of a new mandate to Hudson Structured Capital Management as it withdraws from Nephila’s loss-making Palmetto fund.

-

The $1.28bn fund allocates assets across multiple alternative strategies.

-

The infrastructure of the ILS market is undergoing extensive renovation at the moment.

-

The Bermudian ILS platform returned to profit after a loss-making 2018.

-

The (re)insurer should benefit from profit commission later in the year, chief executive officer Darren Redhead said.

-

Third-party investors recorded a $2.6mn underwriting profit for the year.

-

The carrier posted $1mn investment income from its investment in AlphaCat funds for the period, compared to a $12mn loss in Q4 2018.

-

The platform delivered $5.9mn in profit to Lancashire from its 10 percent stake in the funds.

-

The Everest Re sidecar began 2020 with $819mn of assets under management.

-

The investment comes as the Indiana Public Retirement System exited Nephila’s Palmetto fund in pursuit of a more diversified ILS strategy.

-

The topsy-turvy nature of the past few years for the ILS market is apparent when you look at our half-yearly surveys of assets under management.