-

Total yield is down from 11.18% in the last week of October 2024.

-

Covea’s Hexagon IV Re deal priced 13% below the initial target on a weighted average basis.

-

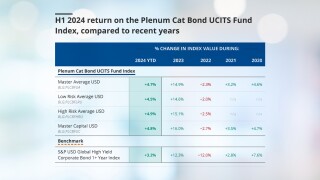

Total gains for the year reached 7.71%.

-

Some experienced investors are pivoting out of cat bonds and into the top layers of private ILS deals.

-

Operating revenues were also up on the $29.1mn reported over Q2.

-

O’Donnell believes RenRe is well positioned to produce longer-tail risk to third-party investors.

-

Third-party investors made a net income of $415mn in the quarter.

-

Central pressure of 900mb or below would trigger a full loss of the $150mn deal.

-

The legacy cover will backstop policies written by its North American insurance business.

-

Pricing on Friday implied a potential $45mn loss to the bond, before the storm outlook deteriorated.

-

So far this year, there have been 11 first-time sponsors to place a deal.

-

The insurer of last resort’s exposure was $696bn as of last September.

-

The bond will provide protection against US wind with a PCS trigger.

-

Spreads on USAA’s latest deal priced below comparative issuances in 2023-2024.

-

Investor interest is warming up following a colder spell over the past several years.

-

The award of the mandates marks the California public pension plan’s entry into ILS.

-

ILS has been a driver of innovation in reinsurance, Convergence 2025 attendees heard Wednesday.

-

The hire is the hedge fund manager’s third ILS appointment in the past year.

-

Key topics include private ILS growth prospects and the longevity of longtail interest.

-

Returns from cat risk investments stood at 20.1% for the year to 30 June 2025.

-

A cat-focused vehicle is “the missing piece” of Hannover Re’s ILS offerings, said Silke Sehm.

-

The allocation is around 3% of the fund’s total assets.

-

The alternative asset manager was founded in 2021 with offices in London, New York and Abu Dhabi.

-

The facility will initially focus on US, Bermudian and European business.

-

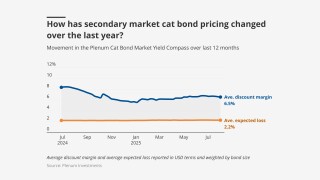

Pricing has hit historically soft market lows, based on secondary market pricing.

-

The manager’s largest ILS holding is in the cat-bond-heavy High Yield fund.

-

Cat bonds have outpaced the returns on private strategies in the year to date.

-

The new Verisk SCS model is increasing expected losses on aggregate bonds.

-

The Bermuda firm said HS Sawmill reflected its continued focus on life insurance.

-

The resource was developed by leading ILS managers and investors.

-

Deals would need to be sized at $50mn plus for transfer to capital markets.

-

Samild held multiple roles including head of alternatives at the Future Fund.

-

The ILS manager has $6.8bn in assets and will be led by MariaGiovanna Guatteri.

-

Axa IM’s acquisition by BNP Paribas was confirmed in July this year.

-

ILS executives talked pricing, capacity and opportunities in casualty at an ILS roundtable in Monte Carlo.

-

The market has learned lessons from earlier soft market phases that it will apply now.

-

Victory Pioneer Cat Bond Fund also added assets in the past month.

-

Arch set up Bermuda investment manager Arch Fund Management in February.

-

The figure comprises 6.07% of insurance discount margin and 4.15% of risk-free rate.

-

The leadership’s commentary spotlighted to value of ILS to the group.

-

The agency noted inflows to cat bond funds and investor interest in private ILS.

-

Competition from cat bonds in the top layers of programmes applied downward pressure on reinsurance pricing in 2025.

-

Dedicated reinsurance capital is on track to increase by 8% in 2025, the broker said.

-

Funds encompassing private ILS outperformed cat bond strategies in July.

-

Aspen Capital Markets earned $169mn in fee income in 2024 alone.

-

Hagood will stay on as sole CEO of Nephila Holdings, with Taylor continuing as president.

-

Benjamin Baltesar spent more than six years at Euler ILS.

-

The reinsurer’s capacity is hugely important to ILS firms, with few alternative providers.

-

This is the latest in a string of appointments made by the firm’s ILS unit.

-

Aaron Garcia will hold a senior role at the operation, sources have confirmed.

-

Reinsurers are confident on cat rates and ready to deploy ILS capital.

-

The firm’s ILS vehicles posted low single-digit growth in assets under management in Q2.

-

The ILS manager revised down slightly its forecast for the syndicate’s 2023 YOA.

-

ILS investors have fought shy of multi-peril aggs due to low confidence in SCS modelling.

-

The sidecar took $19mn of cat losses relating to the California wildfires.

-

The yield figure comprises 6.53% of insurance discount margin and 4.28% risk-free.

-

Around 95% of the Hiscox Re & ILS portfolio is rated rate “adequate” or better.

-

The unit said capital in the ILS market remains more than adequate to meet rising demand.

-

The ILS Advisers Fund Index reported a profit of 1.11% in June.

-

Markel announced the sale of its global reinsurance renewal rights to Nationwide.

-

Amid $17bn of new deals, cat bond activity included aggregate and cascading structures.

-

The bond will provide protection on an industry-loss basis, as reported by PCS.

-

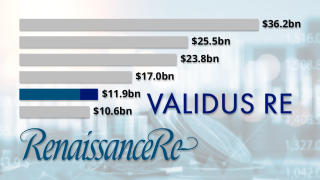

The merged business of Twelve Securis ranked third among ILS managers for AuM, behind Fermat and RenRe.

-

Brian Hickey joins the firm from PE specialist AE Industrial Partners.

-

The reinsurer returned $216.7mn to investors in Q2.

-

The firm reported a net pre-tax cat loss of $414mn from January’s LA wildfires.

-

Managers believed end-investors value diversification and non-correlation of cat bonds over liquidity.

-

Cat bonds remain attractive for investors seeking risk-adjusted return and diversification.

-

He had spent 10 years at Securis, with seven of them as COO.

-

The fund was renamed from the Pioneer Cat Bond Fund.

-

The recommended “AIF lite” structure could be suited to cat bond lites.

-

The Diversified Alternative Fund’s allocation to cat bonds was up by 31% from $386mn at 31 January.

-

The Bermudian ILS manager has recently changed its name from Mereo Advisors.

-

The fund’s ILS portfolio is split between 70% property cat and 30% cyber risk.

-

This comes in at the lower end of the initial spread guidance of 725-775 bps.

-

Property cat-focused sidecar capital was up by approximately 10% in H1.

-

The sidecars will provide capacity for reinsurers and large insurance carriers.

-

Initial responses to ESMA’s report welcomed the long timeframes for any changes.

-

The third-party capital manager is a new entrant to the retro space.

-

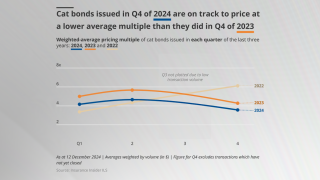

Weighted average multiples were down as sponsors capitalised on demand to push spreads lower.

-

The total return for the Swiss Re Global Cat Bond Index stood at 0.61% for the month.

-

The body said cat bonds are closer to an insurance product than a security.

-

The awards celebration took place at the Hilton Bankside on 25 June.

-

Twelve Securis is now a challenger for the top spot on the Insurance Insider ILS leaderboard.

-

The bond is split across a Series 1 and Series 2 structure, with eight notes in total.

-

Everest Re increased the targeted size of Kilimanjaro Re across all four classes of notes.

-

The pensions scheme’s existing ILS holdings to Aeolus and HSCM are in run-off.

-

M&A and shifts in distribution arrangements bring risks and opportunities.

-

The fund lists Twelve, Swiss Re and Cambridge Associates as managers.

-

Pricing on all classes of notes are being offered at the bottom of the guided range.

-

AuM in GAIA Cat Bond Fund had grown to $3.9bn as of 31 May.

-

PCS's loss estimate for the March Missouri SCS pushed the bond beyond its exhaustion point.

-

The California Earthquake Authority upsized its Ursa Re deal by 60% to $400mn.

-

Buyers have turned to retro markets for covers where ILW pricing is less attractive.

-

The Californian insurer had a private deal, Randolph Re, that provided pure wildfire protection.

-

The firm said it was the first time a UCITS cat bond fund passed the $4.0bn mark.

-

Investors eyeing private ILS include opportunistic allocators keeping watch on storm season.

-

Everest Re has structured its deal into two sections targeting aggregate and per occurrence cover.

-

The sidecar renewed at $230mn for 2025.

-

The pension plan noted in June 2024 that it was exploring new options in ILS.

-

The fund was set up 18 months ago by cat bond investor Florian Steiger.

-

Total yield was 10.93% as of 30 May, including 4.34% of risk-free rate.

-

She was previously head of investor relations and business development for North America and Australia at Securis.

-

This followed a $650mn fall in April, after management change of the fund.

-

ILS offers efficient capital for underwriters, but casualty ILS transactions are complex.

-

The index provider revised up its return for March by 0.39 percentage points to 1.21%.

-

The Swiss pension fund has not disclosed an ILS allocation before.

-

The deals covered Euro wind and Italy quake, Florida hurricane and a retro bond.

-

The ILS market has won market share at the top of programmes as buying expands.

-

The bond will provide protection for Allstate’s Florida subsidiary, Castle Key.

-

The Italian sponsor has $237mn of limit maturing this July.

-

Some assets in the Medici Fund were transferred to a new UCITS strategy.

-

The bond will provide named storm and quake coverage in the US.

-

The bond is offering a spread range of 850-925bps.

-

The ILS manager’s total AuM increased to $2.2bn in 2024 from $1.7bn the year prior.

-

The fund was set up in 2015 to capitalise on higher post-event yields.

-

Debut sponsor SV SparkassenVersicherung also secured its target size of $100mn.

-

Fales will focus on creating investment opportunities for the carrier’s specialty reinsurance portfolios.

-

Some $200mn of fresh limit entered the ILS market as $3.4bn of deals priced.

-

Sources believe the market will grow gradually over years after its initial cluster of dealmaking.

-

The bond provides coverage on personal-lines property in Florida.

-

The series one notes will provide protection to the benefit of Twia.

-

The total yield, inclusive of the risk-free rate, was down on the same period last year.

-

The bond will provide multi-peril coverage on an industry loss basis.

-

The bond will provide storm protection in Florida and South Carolina.

-

Fermat and GAM announced that the former will take sole control of the GAM FCM Cat Bond Fund.

-

The deal will provide named Florida storm protection on an indemnity, per occurrence basis.

-

Florida Citizens upsized its latest Everglades Re deal by 50%.

-

The buzz in the air at ILS Connect told of a market entering its next growth phase.

-

Commutations need to be optimal for the sponsor and the investor to avoid sponsors taking back chunky risks.

-

The CEO said private ILS funds can generate additional returns of 10%-20%.

-

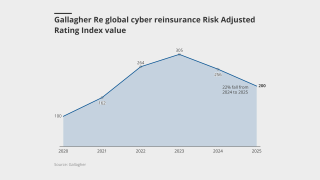

Richard Pennay also addressed the dip in cyber ILS activity.

-

Private ILS would benefit from extension spreads to manage investor concerns, the CEO argued.

-

The unit’s premium reduced by 4% for the first quarter.

-

The ILS manager also swung to an operating profit after posting a loss in Q1 2024.

-

All 29 funds tracked by the index returned a positive performance.

-

The bond will provide protection against named storm and thunderstorm.

-

The casualty ILS business now has $175mn in capital.

-

Cat bond sponsors continue to secure higher limits and lower rates versus their targets.

-

Investor interest and capital flows point to potential for ILS proliferation.

-

The bond will cover China, India and Japan quake and Japan typhoon.

-

The bond will provide protection against German and Japan quake.

-

Secondary market traders are baking in further loss potential after PCS increased its wildfire and Helene loss estimates.

-

This year’s ceremony will include the inaugural Women in ILS Award presentation.

-

January’s California wildfires meant third-party investors suffered a loss of $195.3mn.

-

Franklin Templeton’s allocations to ILS are managed by fund of funds manager K2 Advisors.

-

An allocation to insurance could “feel like a nice, calm port in the storm” amid wider market volatility.

-

He joined what was then Credit Suisse ILS in 2019, moving from Hiscox Re & ILS.

-

The executive formerly served in senior leadership roles at Nomura, Credit Suisse and Goldman Sachs.

-

The deal of the size was unchanged at $100mn.

-

He joined Nephila in 2023 from Lancashire as a senior underwriter.

-

Portfolio rebalancing was not triggered last week, but investors are now distracted and nervous.

-

Gokul Sudarsana has been with the company since 2020, having joined from Deloitte.

-

The Swiss rail pension scheme has been cutting its ILS allocation since 2018.

-

The Swiss pension fund’s ILS allocation stood at 4.9% of the total fund as of 25 March.

-

The bond will provide protection against China, India and Japan quake, and Japan typhoon.

-

The subject business covers a portfolio of residential insurance.

-

The sponsor is estimating a loss of ~$300mn in relation to one of last month’s US tornado events.

-

Sutton National and Bamboo Ide8 secured $170mn of sidecar and cat bond protection.

-

The bond will provide coverage against named storm or severe thunderstorm over three years.

-

The issuance is split across three tranches with varying degrees of risk.

-

The deal is split across four tranches, with the riskiest note Class D targeting $150mn.

-

Market participants expect pricing will be flat to down through Q2.

-

The bond will provide protection against Louisiana named storm.

-

Fees on the GAM Star cat bond funds will drop in May in a recognition of fee competition in the market.

-

The asset manager has hired Rom Aviv as head of ILS.

-

The sponsor secured $240mn of limit as the bond upsized by 20% on its initial target.

-

The insurance discount margin is now at a similar level to where it was in the final week of March 2022.

-

Most of the ILS investments were made via the cat bond heavy High Yield Fund.

-

Martin Bisping has moved to CRO and Bernard Bachmann was named CEO of SRILIM.

-

Rachel Barnes Binnie joins as portfolio manager.

-

Multiples in March were below historic averages from 2001 through 2024.

-

LA wildfire-exposed ILS positions experienced further declines.

-

Scor is targeting limit of $200mn with its latest Atlas DAC retro cat bond.

-

Many UK pension funds are over-funded and lack appetite for higher-risk, higher-yield products.

-

The vehicle will take a quota share of all of the risks underwritten by Ryan Specialty’s MGA arm.

-

The notes replace a 2021 issuance that matured in January this year.

-

The ILS segment is not ready to gloss over loss-heavy years in renewal discussions.

-

Industry sources estimate the market to be around $3bn.

-

Founding partners DeCaro and Rettino will continue to provide oversight and investment advice.

-

The cat bond manager warned of excess downside risk owing to an accumulation of losses.

-

Flood Re’s bond Vision 2039 bucked the trend by pricing up 7% as its secured £140mn ($174mn) of limit.

-

Indirect exposure to cat risk through long-term investors gives Markel optionality.

-

ILS as a percentage of the pension fund’s total assets grew to 1.5%.

-

GP Affluent Markets will look to serve high-net-worth individuals.

-

The UK listed investment manager has almost doubled its ILS allocation since April last year.

-

Tom Fealey has assumed lead portfolio manager responsibilities.

-

Some $625mn of new issuance entered the market in the first week of March.

-

There is the potential for cat bond H1 issuance to be a record breaking six months.

-

The scope of QRT’s new ILS strategy will include cat bonds and private ILS.

-

The fund is open to European and other global investors.

-

Dispersion of returns was high, with the range 0.87% to -3.71%.

-

The third-party capital platform is looking to enhance its tailored strategy offerings.

-

Deal sizes increased by 84% on average across the six tranches that saw an increase.

-

Climate change and other loss impacts were not adequately incorporated, sources said.

-

The firm has rotated capital in sidecar Voussoir toward direct investor relationships.

-

The NCIUA had initially sought $350mn of limit.

-

DaVinci equity plus debt stood at $3.25bn as of 31 December.

-

There was a slight increase in DaVinci and Fontana from 31 December 2024 to 1 January 2025.

-

The firm reported record fee income of $128.2mn in 2024, up 26%.

-

UCITS fund diversification targets limit their capacity for US wind bonds.

-

Pricing fell by 13.5% on a weighted average basis across deals that updated last week.

-

Total combined losses for the agency’s Helene and Milton estimates stand at $31.8bn.

-

Scrocca will be based in Bermuda on focus on underwriting and risk sourcing, among other things.

-

The aim is to capitalise on cat bond market’s robust growth and US peril concentration.

-

New limit of $474mn entered the market across two deals.

-

Two ILS funds featured in the top five asset-raisers within the index.

-

The firm will match segregated accounts of portfolios to investor mandates.

-

The combined entity ranks third in the Insurance Insider ILS leaderboard.

-

Liquid alternative strategies accounted for around $1.4bn of the total.

-

The firm said the appointment would support its ambitious growth strategy.

-

Neuberger Berman’s AuM stood at $3.2bn as of 1 January 2025.

-

AuM remains generally flat at UCITS funds over the weeks since LA fires started.

-

American Integrity is seeking expanded limit on more favourable terms.

-

FY24 disclosures show shifting fortunes at reinsurer ILS platforms.

-

Tower Hill secured $400mn of Winston Re limit in 2024.

-

The group ceded 55% more premium to Nephila over the year at $1.3bn.

-

The sponsor secured $100mn limit last year, paying a multiple of 8.3x.

-

The value of its investment in RenRe stood at $330.4mn as of 30 June 2024.

-

The offering is a collaboration with Generali and parametric carrier Descartes.

-

Barthelemy Thomas joins from PartnerRe Capital Management in Zurich

-

The index delivered a total return of 1.29% for the month of December.

-

The latest issuance will add extra cat bond limit, with a $100mn note still on risk.

-

-

PFZW’s insurance allocation stood at $8.7bn as of year-end.

-

He joins from Pillar Capital and will be based in Bermuda and New York.

-

Fermat stayed in the top spot surpassing $10.0bn for the first time.

-

Secondary market pricing indicated anticipated California wildfire losses.

-

Two 2021 worldwide aggregate ILW notes are also among the markdowns.

-

The former Credit Suisse ILS head Niklaus Hilti said working on life buyout hedges could rejuvenate the life ILS market.

-

The bond is likely replacing the 2021-1 Class F bond, which matured in December.

-

The fund returned 15.69% in calendar year 2024.

-

This comes after the firm’s distribution partner GAM has had a challenging few years.

-

ILS managers expect the losses to have some impact on future cat bond spreads.

-

The strategy launched on 1 January, winning mandates from several investors

-

Compressed cat bond spreads could drive some rebalancing, as M&A remains a prospect.

-

The ILS manager analysed 16 UCITS fund portfolios to compare risk levels.

-

The vehicle is smaller by 8% as White Mountains’ participation grew.

-

The manager’s Interval Fund returned 28.25% over the financial year.

-

Nicole Chase was central to the build-out of Mt Logan while at Everest.

-

The Bermuda based entity is expected to continue on its “responsible growth trajectory”.

-

The firm has commenced writing collateralised retro and reinsurance but its rated launch is still pending.

-

First-time sponsor QBE secured $250mn of quake and storm coverage.

-

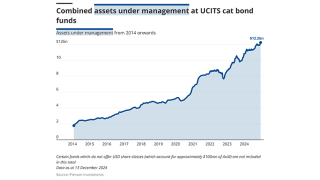

The UCITS cat bond segment has added 54% in AuM since Hurricane Ian.

-

Some $1.2bn of limit was placed in the cat bond market this week.

-

Casualty ILS made inroads, while hurricane hedging strategies came into focus.

-

The firm will also act as sub-adviser to the Brookmont ETF cat bond fund.

-

The company no longer has any exposure to reinsurance contracts.

-

Everest is in the process of transforming its ILS offering.

-

Full year 2023 set the record to beat of $15.8bn in new issuance volume.

-

The reinsurer said investors were interested in expanding after benefiting from good results.

-

The top quartile, which includes Nephila 2357, were set to shrink overall.

-

The bond will provide multi-peril coverage in the US and District of Columbia.

-

The pricing multiple on the deal is 12.1x the sensitivity case expected loss.

-

Beazley returned with its second Fuchsia cat bond issuance.

-

Former ILS investors who left the space have looked again and re-allocated.

-

The scheme’s ILS allocation has held steady at 0.7% of the total fund.

-

The ILS manager’s existing Medici cat bond strategy stood at $1.68bn in assets under management (AuM) as of 30 September.

-

CEO Jonathan Zaffino said he saw opportunities for expansion in casualty.

-

Management track record has been a factor in capital raising for 2025.

-

The firm is understood to be reviewing contracts to bind coverage for 1 January.

-

Losses from Hurricane Milton are expected to affect only select junior structures.

-

The ruling indicated it was unlikely all claims would be dismissed, as defendants had requested.

-

The fund will invest in listed and private transactions.

-

The ILS manager has hit back at an attempt by the defendants to have the case dismissed.

-

Euler ILS Partners and Tropical Storm Risk teamed up to produce an updated version of an earlier study.

-

Moderate impacts to ILS returns are anticipated from Hurricane Milton.

-

The UCITS fund was launched in 2021 and invests in cat bonds and the money markets.

-

The headline figure of $7.72bn includes $3.11bn of DaVinci equity plus debt.

-

Shareholders are voting to approve being wound up on 18 December.

-

Strong growth in fee income builds on the favourable rating environment.

-

The ILS unit’s AuM was higher by $100mn compared to $1.9bn as of 30 June.

-

The fund will be denominated in US dollars and digital currencies.

-

The new funds will target the US wealth market through financial professionals.

-

The reinsurer confirmed its intention to reduce the K-Cession sidecar for 2025.

-

Cheaper traditional reinsurance as of mid-year may have dampened deal pipeline.

-

The failure of a Jamaica bond to pay out following Hurricane Beryl damage has brought focus onto the deals.

-

Daniel Ineichen, former co-head of ILS, had been with the company for nearly two decades.

-

The firm’s AuM in four key vehicles rose $526mn in Q3.

-

Michael Rich left the portfolio management role in May.

-

Latest pricing suggests secondary market traders are baking in further loss development.

-

Some $409mn of volume entered the market in the week to 4 November.

-

The low PCS number is presenting a challenge for ILW buyers and sellers.

-

Nephila revenues would likely have been higher, but for an ‘elevated climate signal’ this year.

-

Fee income fell by 42% to $25.1mn in Q3 over the prior-year quarter.

-

The pension scheme has been winding down its ILS portfolio in recent years.

-

The deal would represent a diversifying auto risk deal.

-

The ILS allocation increased in dollar terms and held steady in euros.

-

Managers expect Hurricane Milton losses to shore up pricing.

-

Risk remote strategies, including private ILS, have outperformed higher risk strategies over the last decade.

-

Florida domestics, aggregate retro and flood deals were all marked down.

-

The ILS industry alumnus is understood to have two ILS investors lined up.

-

Hurricane Milton will show the ILS product behaving as investors expect it to.

-

This is a far narrower drop than post Ian, when the index was lost 10%.

-

A $40bn Milton loss should barely dent many ILS returns but will trap some capital.

-

Integrity Re 2024-D and Lightning Re 2023-1A are two bonds that were marked down, although no trading has occurred.

-

Hurricane Milton’s overall impact, based on the current pre-landfall scenario, could lead to “moderate losses” for Plenum’s funds.

-

Collateralised reinsurance and retro are in the firing line.

-

The class of 2023-24 cat bond funds will grow existing investors and add new ones.

-

The firm’s new name is inspired by 18th Century Swiss mathematician Leonard Euler.

-

Maya Henry will be tasked with raising capital and managing clients in North America.

-

The deal freed up capital held against deals written in 2019 and 2020.

-

The ILS industry offered 11 points of merit that justify cat bonds being eligible for UCITS funds.

-

The deal takes year-to-date cat bond lite issuance to $367.6mn

-

The CEO cited ‘no change’ in appetite from a shift in the capital mix.

-

The manager is looking to buy positions on the secondary market.

-

Schroders moves into fifth place in the Insurance Insider ILS leaderboard.

-

The ILS manager leaderboard demonstrates the ongoing popularity of cat bonds.

-

The combined Twelve-Securis entity would be a top-five ILS firm currently.

-

More than 30% of the fund's AuM is allocated to US windstorm-linked bonds.

-

-

Secondary market activity and hedging would be likely if a Beryl-sized storm tracked toward the US.

-

This is lower compared to 8.2% recorded by the index in H1 2023.

-

DeCaro is one of the cohort of pioneering ILS managers.

-

The Swedish fund AP2 invests in Fermat GAM, Elementum and Credit Suisse.

-

Sources said that Gallagher Re had ‘first mover’ advantage as the exclusive broker.

-

Sub-1% management fee and performance fee-only structures have evolved in ILS.

-

The Icosa Cat Bond Strategy now stands at $130mn in AuM.

-

Tanja Wrosch joins Twelve after more than a decade at Credit Suisse ILS.

-

The regulation now allows pension funds a more flexible benchmark for measuring alternatives.

-

Rich had spent 13 years at the firm where he began his career and oversaw a cat bond and ILS portfolio.

-

-

The Sussex Capital ILS platform managed $440mn at its 2019 peak.

-

Citizens also secured $1.1bn of limit for its Everglades Re cat bond.

-

The capital will be allocated to a pure cat bond strategy, sources have confirmed.

-

The capital will be deployed by Bermuda-based special purpose insurer Arachne.

-

Combined AuM of UCITS funds stood at $11.3bn as of 26 April 2024.

-

The pension fund’s ILS allocation as of the end of 2023 was CHF300.3mn ($356.8mn).

-

Over Q1, the loss ratio improved by 34.6 points year on year to 43.7%.

-

ILS returned 3.2% for the scheme in the first quarter.

-

The platform’s ILS holdings comprise cat bonds and UCITs funds, and were up 8% over January and February.

-

The syndicate snatched the number one spot from Chaucer’s Syndicate 1176.

-

Fee income was up by 30% year-over-year to $136mn in 2023.

-

The fund will follow an existing Twelve strategy and add short-term corporate bonds.

-

Chris Parry said the denominator effect remains a suppressant on ILS inflows after a strong phase of returns.

-

The Guernsey legacy carrier is working with an independent valuer.

-

Daniel Ineichen and Flavio Matter have been promoted to co-heads of ILS.

-

It is only the second year in the last eight that the allocation grew.

-

CEO Hussain said third-party capital in 2023 remained flat.

-

The firm’s assets under management dropped to $1.6bn, as a capital return more than offset new inflows.

-

Head of alternatives Gareth Abley believes the asset class remains attractive following a 16% return in 2023.

-

The outlook for M&A activity is brighter after 2023 returns.

-

The parent also expects the ILS platform’s AuM to grow.

-

The acquiring reinsurer will now run off the business.

-

-

The reinsurer’s assets under management rose 14% to $3.3bn.

-

Aside from the one-year view, 2023 remixes the track record.

-

-

The firm told investors yields in the cat bond market are 'still very attractive'.

-

Of the 18 top-tier ILS managers, 10 recorded growth, while eight were flat or down.

-

The sidecars segment has been attracting inflows after returns hit a high note in 2023.

-

Cat bonds and sidecars are well positioned for growth, while private ILS will benefit from further innovations to improve liquidity.

-

In its semi-annual report for the six months to 31 July 2023, the manager said the fund had returned 2.74% over the half-year.

-

The bond will provide protection from named storms in Florida for three years.

-

The independent manager’s post-Ian growth has helped it more than double from prior estimated assets under management.

-

The Swiss Re Total Return Index climbed month-over-month throughout the year, to more than regain ground lost after Hurricane Ian in September 2022.

-

Nearly 90% of the fund’s allocation is in cat bonds, with a small allocation to other ILS securities and US Treasury Bills.

-

The firm will deploy newly developed, proprietary cat bond analysis platform Hubble.

-

Broker-dealers' year-ahead forecasts have undershot total final issuance in three of the last five years.

-

The new fund generated 11.2% in profits for the period from 27 January to 31 October last year.

-

Schwartz will set the firm’s investment process on its ILS, equity and debt strategies.

-

The asset manager’s flagship ILS funds posted stellar returns for its 2023 fiscal year.

-

The firm’s flagship reinsurance strategy delivered its best performance in its 10-year history.

-

Projected 2024 ILS returns remain historically high, but signs of increased appetite for top-layer cat risk and top-end retro raise questions over how long this will last.

-

The year brought a degree of closure on the loss-hit years of 2017-2021, while the outlook remains changeable for ILS managers.

-

The Eurekahedge ILS Advisers Index has posted the strongest performance for October since it started in 2008.

-

Swiss Re Alternative Capital Partners assets under management hit $3.3bn as of 30 September.

-

The Australian sovereign wealth fund first allocated to the ILS manager in 2016.

-

ILS managers are still waiting for hard market growth.

-

Research by Kepler Absolute Hedge showed that seven out of the 10 best-performing alt credit funds were cat bond strategies.

-

AuM stood at $1.5bn as of 30 September, up from $1.2bn as of January 2023.

-

The Zurich-based ILS manager has grown the fund by around 167% from $150mn as of mid-2021.

-

Artex hopes the rebrand will bring greater efficiency and a higher level of service to clients

-

A new pooling structure allowed the firm to free up historic side pockets and provides a template for future exit options.

-

Steiger is said to be moving to an “entrepreneurial” role after more than six years with the Zurich-based firm.

-

With more ILS managers chasing the popular bond space, how will new operators differentiate themselves?

-

The ILS sector grew in the context of 0% interest rates historically.

-

Hiscox said outflows from the ILS unit were offset by "record returns" in Q3.

-

De Klerk spent a decade at Artex Risk Solutions, where he created special purpose insurers and closed cat bonds.

-

The investment manager held its outlook at strongly overweight for cat bonds, retro and private ILS in Q4.

-

Prior-year cat loss years that are finally shaking out drove fee benefits in Q3.

-

The Bermudian firm said it expects the acquisition could drive more growth than the prior forecast of $2.7bn incremental premium.

-

The ILS firm reported $6.8bn of assets under management at the third-quarter mark.

-

A market-wide loss of $700mn would amount to around 15% of the total amount of life ILS assets under management .

-

Mortgage ILS issuance has totalled $787.2mn so far this year.

-

The ILS executive is departing the ILS platform following RenRe’s move to buy Validus Re for ~$3bn.

-

The manager has made four appointments including two internal promotions.

-

The fund has been adapting its investment strategy in light of inflation and rising interest rates.

-

The Bermuda-based collateralised reinsurance platform Sussex Capital was set up in December 2017 and had more than $400mn of assets at its peak.

-

The fund had taken major losses on cat-related investments, including through Southeast primary carriers Weston and Southern Fidelity.

-

The recent ILS start-up was the only new mandate for 2022 after the Dutch firm had added two new mandates in 2021.

-

The fund is on course for its strongest year of returns since inception in 2014.

-

Hiscox and Aeolus are looking to capitalise on strong investor appetite for cat bonds this year with their respective fund launches.

-

Private ILS outperformed cat bonds in August, as hurricane season earnings began to kick up a gear.

-

The Elementum executive told Trading Risk New York that “appropriate returns” over time were the key to a sustainable ILS market.

-

Cat bond investors are sufficiently capitalised to fulfil demand from an anticipated strong pipeline of new issuance in Q4.

-

ILS capacity in the form of retained earnings and new inflows is shaping up to meet growing demand for reinsurance and retro coverage.

-

Gallagher Re has stated that the alternative capital market has increased by 4%.

-

The private equity firm is targeting $1trn in assets under management for the combined segment.

-

The broker’s half-year 2023 report said reinsurers’ RoE has surpassed the cost of capital for second year running.

-

Outside the cat bond segment, Aon said it was observing rising sidecar interest, putting volumes at $7.1bn from $6.4bn the prior year.

-

The move comes as investors are on track to reject a bid from Liontrust.

-

The ILS business ‘continues to be an important differentiator’, says Aspen CEO Mark Cloutier

-

The industry’s ability to draw new capital will hinge on the outcome of the Atlantic hurricane season.

-

The AuM total hits $12.1bn when including Top Layer Re and RenRe’s own participation.

-

The reinsurance and ILS unit posted strong net premium growth supported by additional capital from Hiscox Group.

-

The scandal over letters of credit at Vesttoo has put a spotlight on the casualty ILS segment, where Ledger Investing is growing market share.

-

The reinsurer opened its cat bond portfolio to third-party investors last summer.

-

-

Risers and fallers emerge within peer group of larger ILS firms, with Twelve Capital and Pillar the fastest growing in H1.

-

The reinsurer recorded net income of $1.9mn, helped by a reduction in losses and loss adjustment expenses.

-

The obvious question is where is the capital behind the letters of credit that were being pledged on its transactions.

-

The firm has moved to defend its plans against a rival strategy supported by a small group of investors.

-

Some sources have called for more transparency on secondary trades, though others note the buy-and-hold nature of the market limits trading appetite.

-

The ILS fund now comes in at the 26th spot on Trading Risk’s ILS fund manager directory.

-

The cat bond fund posted returns of around 10.75% for the first six months of Stone Ridge’s financial year.

-

The distribution arrangement will cover Securis's full range of ILS offerings.

-

The fund ranks 19th in Trading Risk’s ILS fund manager directory following this disclosure.

-

The new fund will be led by Daniel Ineichen and be open to US investors.

-

The former chairman and CEO of New York Life will support the asset manager in developing strategies that harness longevity pooling.

-

The UK asset manager’s ILS strategy is operating across six of its multi-asset funds.

-

The current year performance marks an uplift compared to a tough 2022, in which Elementum delivered a loss to White Mountains of 4.6%.

-

The ILS manager said returns on casualty ILS were "much higher than on the diversifying nat cat perils such as Italian quake or German flood".

-

Howden Tiger worked on the structure of the deal with the unnamed syndicate.

-

The life segment has shifted from its genesis in mortality and morbidity risk transfer as lapsed risk deals have proliferated.

-

The takeover will push it up two places to rank as the fifth-largest writer of P&C reinsurance by gross premium.

-

AIG will invest a significant amount into Fontana and DaVinci.

-

The firm has posted a combined ratio of 75.4% for 2022.

-

Nephila Syndicate CEO Adam Beatty said that the firm hopes to grow its new specialty syndicate to $500mn of premium within the next few years.

-

The company has eroded about half its international catastrophe deductible following New Zealand losses.

-

The acquisition gives UK asset manager Liontrust a broader European footprint and cat bond products.

-

The reinsurer lifted net reinsurance premiums by 38%, although, on a gross basis, growth was lower at 5%.

-

Capital has begun to flow again after a challenging time for ILS fundraising in 2022 – but there is a clear shift underway.

-

Markel’s ILS platform maintained assets under management at $7.2bn, down by $200mn from a January figure of $7.4bn.

-

In a discussion at Trading Risk’s London ILS 2023 conference, panellists compared the current cyber ILS market to the cat market in the 1990s.

-

The firm noted that investor pushback at the January renewal had resulted in "the cleanest risk" being transferred to the capital markets.

-

UBS previously explored setting up an ILS offering, but instead opted to offer other firms’ products.

-

The New York-based executive had been one of the firm’s co-heads of ILS, leading on investor relations and sales.

-

-

There are enough drivers supporting the trend for cat bond segment growth that ILS managers are likely to be plugging this business heavily in the short term, even if it is less attractive in fee yield.

-

The uplift was helped by the Atropos Catbond fund surpassing $1bn.

-

The real test for cat capacity will come at the mid-year point, according to Gallagher Re.

-

The new higher-rate world brings the threat of some investors staying in a risk-off mentality.

-

The syndicate’s combined ratio was down for the fifth year in a row.