-

The bond will provide protection against US wind with a PCS trigger.

-

ILS has been a driver of innovation in reinsurance, Convergence 2025 attendees heard Wednesday.

-

The Bermuda reinsurer has been active in ILS since launching in 2007.

-

The sidecar will support five programs providing specialty frequency coverages.

-

ILS executives talked pricing, capacity and opportunities in casualty at an ILS roundtable in Monte Carlo.

-

The tech firm is building a joint stock company with insurers and investors.

-

Fleming’s attempt follows those of other legacy carriers that have had recent successes raising capital.

-

It is understood that CyberCube has been considering a sale of the business.

-

The global specialty player is also exploring ILS offerings across specialty and cat bonds.

-

The ILS play will make the business more capital efficient under new owner Sixth Street.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

The Bermuda SPI will write a quota share of SageSure’s captive Anchor Re.

-

The fund’s ILS portfolio is split between 70% property cat and 30% cyber risk.

-

The Cayman Islands-domiciled SPI now has four institutional backers.

-

Michael Hamer recognised for his work with investors and on reporting frameworks.

-

M&A and shifts in distribution arrangements bring risks and opportunities.

-

Slide is putting faith in tort reforms and will lean into Florida, CEO Lucas said.

-

ILS offers efficient capital for underwriters, but casualty ILS transactions are complex.

-

The $2.59bn renewal is up 45% from last year.

-

The cat bond limit total is an uplift of around 60% on the carrier’s 2024 bonds.

-

Fox highlighted the increasing role of alternative capital and creative financial vehicles.

-

Proceeds will expand the company’s reinsurance protection in Florida and South Carolina.

-

The buzz in the air at ILS Connect told of a market entering its next growth phase.

-

The initial offering will include 6,875,000 shares of common stock.

-

The carrier is offering shares priced at $29-$31.

-

The casualty ILS business now has $175mn in capital.

-

An allocation to insurance could “feel like a nice, calm port in the storm” amid wider market volatility.

-

Portfolio rebalancing was not triggered last week, but investors are now distracted and nervous.

-

The Swiss pension fund’s ILS allocation stood at 4.9% of the total fund as of 25 March.

-

Fees on the GAM Star cat bond funds will drop in May in a recognition of fee competition in the market.

-

The vehicle will take a quota share of all of the risks underwritten by Ryan Specialty’s MGA arm.

-

The bond upsized by around 20% as pricing settled 2% below initial guidance at 7%.

-

Indirect exposure to cat risk through long-term investors gives Markel optionality.

-

DaVinci equity plus debt stood at $3.25bn as of 31 December.

-

The investors are led by PE firm NMS Capital Group.

-

Two ILS funds featured in the top five asset-raisers within the index.

-

The departures include North American Arcas head Alex Orloff.

-

The start-up has achieved an A- credit rating from AM Best.

-

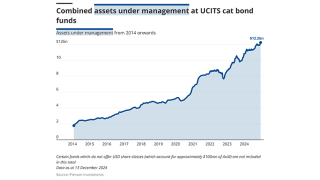

Capital inflows, notably into UCITS funds, and accumulated returns supported issuance of $17.2bn in 2024.

-

The offering is a collaboration with Generali and parametric carrier Descartes.

-

Barthelemy Thomas joins from PartnerRe Capital Management in Zurich

-

The reinsurer added two new tranches to its 2025 issuance.

-

The capital partners unit was launched via London Bridge 2 in Lloyd’s last year.

-

-

Graeme Bell (pictured) will continue in his role as group legal officer.

-

-

Amin Touahri spent five years in a variety of roles at Munich Re.

-

Compressed cat bond spreads could drive some rebalancing, as M&A remains a prospect.

-

The vehicle is smaller by 8% as White Mountains’ participation grew.

-

The sponsor has expanded its target deal size compared with a year ago.

-

The first cat bond deal from the carrier achieved its target size of C$150mn.

-

The reinsurer is seeking index-based cover for a wide scope of perils and territories.

-

The broker anticipates strengthening investor demand for collateralised re.

-

The firm has commenced writing collateralised retro and reinsurance but its rated launch is still pending.

-

The UCITS cat bond segment has added 54% in AuM since Hurricane Ian.

-

Casualty ILS made inroads, while hurricane hedging strategies came into focus.

-

The bond offers a higher multiple than a similar Fuchsia Re deal placed last year.

-

The company no longer has any exposure to reinsurance contracts.

-

Everest is in the process of transforming its ILS offering.

-

The reinsurer said investors were interested in expanding after benefiting from good results.

-

Magnani has served for more than 14 years in ILS broking roles.

-

The ILS manager will “pragmatically accept” a degree of credit risk in deals.

-

Former ILS investors who left the space have looked again and re-allocated.

-

CEO Jonathan Zaffino said he saw opportunities for expansion in casualty.

-

Management track record has been a factor in capital raising for 2025.

-

The start-up has secured BMA approval as it looks to a 1 January kick-off.

-

Shareholders are voting to approve being wound up on 18 December.

-

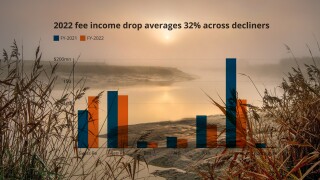

Strong growth in fee income builds on the favourable rating environment.

-

The fund will be denominated in US dollars and digital currencies.

-

The sidecar was established to enhance RGA’s access to capital for its US asset intensive business.

-

The capital being returned to shareholders is part of a compulsory partial redemption.

-

The firm’s AuM in four key vehicles rose $526mn in Q3.

-

The company’s reinsurance premiums ceded fell by 58% to $149mn.

-

The deal would represent a diversifying auto risk deal.

-

Many in the ILS sector are bullish on Milton losses falling at the lower end of earnings impacts.

-

Post-Milton investor interest in ILS has yet to translate into dollars allocated.

-

The Dutch scheme is the largest ILS allocator with a long list of mandates within the sector.

-

Hurricane Milton will show the ILS product behaving as investors expect it to.

-

The company is monitoring the NFIP’s flood-exposed bonds.

-

The Canadian pension plan put its Lloyd’s portfolio under review earlier this year.

-

The raise includes minority investments from Nationwide, Enstar and others.

-

The manager is hopeful of closing all contracts by the end of 2024.

-

Maya Henry will be tasked with raising capital and managing clients in North America.

-

Floir approved nearly 650,000 policies for takeout from Citizens for October and November.

-

The new commingled fund will target investors with $5mn or higher potential investments.

-

ILS brokers are pitching for Sanders Re and ResRe transactions.

-

Cat bond funds continue to draw interest as private ILS more challenged.

-

The Brian Duperreault-led reinsurer start-up has secured a cornerstone investor and aims to have an ILS fund running from day one.

-

-

Sidecar vehicles are being tailored to match investors’ objectives.

-

The executive explored ILS options as MD of hedge fund Horton Point post financial crisis.

-

The board of directors has voted for a 10% rate hike.

-

The moves mark a major step in realising “trillion dollar” casualty ILS potential, according to Ledger Investing CEO Samir Shah.

-

The reinsurer raised $84.5mn of third-party capital in the quarter.

-

The firm has observed a “more widespread investor base” in cat bonds.

-

-

Availability of ILS has so far fulfilled investor demand.

-

Benefits of ILS smart contracts include transparency and tradeability.

-

The broker said high ILS maturities would boost cat bond issuance though the hurricane season would impact capital availability.

-

The broker said it did not anticipate a slew of new entrants, with the possible exception of casualty start-ups.

-

Sébastien Bamsey joins from JP Morgan, where he has worked for 18 years.

-

Schmidt will lead Markel's Global Strategy team and work with Nephila.

-

Park assumed the role earlier this month.

-

Evercore is leading the capital raise process and Aon is assisting with the Lloyd’s application process.

-

State National has been lined up to front for the vehicle, which would be a rare example of third-party capital in this space.

-

The Florida portion of the program provides $1bn in protection.

-

Concerning hurricane forecasts are among the factors driving tighter reinsurer capacity.

-

The program includes all perils coverage and third-event protection.

-

The former Everest executive will look to roll out a range of new product lines at the MGA.

-

The firm’s AuM was down 17% on $1.8bn as of 31 December.

-

Performance fees soared by 605% to $27.5mn from $3.9mn in Q1 2023.

-

Aspen said reduced reinsurance appetite made it a good time to seek alternative capacity.

-

The announcement confirms earlier reports from this publication.

-

Sources said the deal was roughly three times over-subscribed as cat becomes hot.

-

The platform distributed ~$50mn to investors for 2023.

-

The carrier closed its Sussex Diversified Fund in October last year.

-

Managers are hoping strong returns in 2023 will aid capital raising efforts.

-

Pockets of new capital will not shift pricing at mid-year.

-

ILS platform London Bridge II has had a good year as volumes reached $750mn, the CFO said.

-

-

The vehicle’s loss ratio improved 66 percentage points YoY.

-

The firm was founded in 2015 to help clients raise capital.

-

The carrier booked a reserve charge of $392mn for casualty insurance.

-

The ILS platform ceded around 40% of its total managed premiums of $1.8bn.

-

Fourth quarter inflows also included $111mn for its retro platform Upsilon

-

The Medici cat bond fund experienced the largest growth in AuM.

-

Of the 18 top-tier ILS managers, 10 recorded growth, while eight were flat or down.

-

Phoenix Re renewal ‘shows commitment to doing Asia ILS, for Asia in Asia’, according to MS Amlin Asia Pacific CEO Will Ho.

-

The allocation last autumn amounted to around 1.4% of the investment manager’s total funds under management.

-

Leadenhall Capital Partners (LCP) has named Yuko Hoshino as senior managing director for Japan and Asia within its business development team.

-

Projected 2024 ILS returns remain historically high, but signs of increased appetite for top-layer cat risk and top-end retro raise questions over how long this will last.

-

The “convenience claims” route to payout will be limited to claims up to $200,000.

-

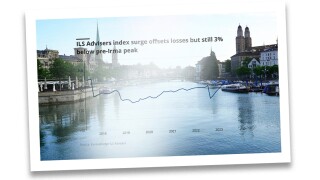

The year brought a degree of closure on the loss-hit years of 2017-2021, while the outlook remains changeable for ILS managers.

-

The executives will look to bring the company’s full suite of products to clients.

-

This latest funding round brings total committed capital for the collateralized reinsurer to $75mn.

-

ILS managers are still waiting for hard market growth.

-

CatX said it is already working with institutional investors, including pension funds.

-

The second iteration of the Bermuda sidecar has brought in additional investors.

-

The Trustee had sought to accelerate the liquidation process while avoiding significant admin costs.

-

The sidecar’s loss ratio improved by 139 points to 35% in the latest quarter.

-

Prior-year cat loss years that are finally shaking out drove fee benefits in Q3.

-

The carrier returned $369mn of capital to third-party investors in Q3 from investors in the Upsilon and Vermeer vehicles.

-

Layr claims its platform can help brokers serve up to 6x more small business clients.

-

With plans to support three different types of Lloyd’s syndicates, the vehicle intends to trade under the new name London Innovation Underwriters by 15 November.

-

A market-wide loss of $700mn would amount to around 15% of the total amount of life ILS assets under management .

-

The company’s on-risk Kilimanjaro Re cat bond volumes have been gradually shrinking in the past year.

-

Doing so would save “at least $8.5mn in cash” based on the firm’s monthly operational expenditures, according to a recent motion.

-

A strong outlook for sidecar profits in 2023 is rebuilding investor confidence but one to three years of good performance will be needed to sustain it more fully.

-

The Bermuda-based collateralised reinsurance platform Sussex Capital was set up in December 2017 and had more than $400mn of assets at its peak.

-

Bohm joins from Swiss Re Capital Markets, where he was head of structuring for the Americas.

-

Fermat’s John Seo said the industry can “see the wall of money coming in, but it’s coming in slowly”.

-

Bernard Opoku will replace Jeff Sangster as CFO effective 1 October.

-

Hiscox and Aeolus are looking to capitalise on strong investor appetite for cat bonds this year with their respective fund launches.

-

The rating follows a $25mn debt financing for the company in June last year.

-

A challenge facing the industry in the years to come is the question of how can it move through a rotation of its investor base to capture the growth opportunities that have arisen.

-

Prabis does not envisage market softening at this stage, for reasons including wider macroeconomic impacts.

-

The sidecar has been launched alongside partner Stone Point Credit Adviser.

-

Interest income also boosted the results, with net assets of $9mn rising to $10.8mn by the half-year point.

-

The firm joins other challenger brokers in tackling the stronghold of the cat-bond broking space.

-

The group structure would constitute a Bermuda-based rated carrier, and an associated fund structure.

-

The SPAC has undergone a dramatic shift in strategy since it first listed on the London Stock Exchange.

-

Since 2020, Vesttoo has quoted 96 and closed 65 transactions with collateral totaling roughly $3.9bn, according to a court filing.

-

Radford joins after spending two years at Aon’s Capital Advisory business.

-

Reinsurance underwriting discipline will not subside even as reinsurers’ willingness to deploy capital increases, the broker said.

-

The ratings agency has said ILS firms could encounter “pent-up demand” from cedants during the January 2024 renewal.

-

The Florida hurricane season still has three months to run in a predicted above-average year.

-

The ratings agency said there had been no capital inflows through new company formations.

-

The (re)insurer also appointed Thomas Deane as head of investment banking.

-

The broking firm’s (re)insurance market update said growth in alternative capital is a now a permanent feature of the market.

-

The broker said that capital levels should stabilise at previous levels, given a normal second half.

-

Swiss Re Capital Markets said there was a ‘strong chance’ of a record-breaking year in size and number of new bonds.

-

The US pension fund heard pitches from four ILS manager finalists at its board meeting in May in a selection process following a request for proposals issued last October.

-

Greg McBride joins the firm after nearly 18 months at Mt Logan Re.

-

The scandal over letters of credit at Vesttoo has put a spotlight on the casualty ILS segment, where Ledger Investing is growing market share.

-

Risers and fallers emerge within peer group of larger ILS firms, with Twelve Capital and Pillar the fastest growing in H1.

-

The reinsurer’s ILS vehicles delivered returns of $174.9mn to investors during the quarter, with improved returns from PGGM joint venture Vermeer and the Medici cat bond fund.

-

The vehicle will focus on middle-market transactions in the US and Europe across the insurance value chain.

-

The firm said it had identified two specific transactions in which “collateral inconsistencies” were in question.

-

The firm’s statement followed allegations in Israeli tech media of missing collateral linked to deals it was concerned in.

-

With fundraising still difficult outside the liquid ILS segment, managers are looking for ways to shore up their economic proposition.

-

Loss-free accounts were generally up 20%-50% at renewal, the reinsurance broker said.

-

The new SPA will write cyber reinsurance initially and could progress to writing insurance.

-

The InsurTech uses AI to calculate the severity of extreme weather events.

-

The executive first joined Vantage in 2021 after stints at Hamilton and Allied World.

-

The ILS manager said returns on casualty ILS were "much higher than on the diversifying nat cat perils such as Italian quake or German flood".

-

The life segment has shifted from its genesis in mortality and morbidity risk transfer as lapsed risk deals have proliferated.

-

Removing any competitor is a positive for ILS peers in a competitive time for fundraising, but it is not clear how much of a boost this will give RenRe.

-

Early private deals have provided far more stability in this year’s renewal than last.

-

RenRe will be taking control of ILS manager AlphaCat as part of its purchase of Validus Re.

-

The deal includes AIG's AlphaCat platform.

-

Softening cat bond rates are among the bearish signals for cat rates, but latent new demand and still-cautious supply should prolong reinsurer gains.

-

This comes as the reinsurer is preparing a major equity raise to attack the harder reinsurance market.

-

Net proceeds will be used for general corporate purposes, which may include expanding its existing business lines and operations.

-

Details of the placement are being closely guarded, but one source suggested the raise could be in the region of $1bn.

-

The ILS investments specialist has assumed a role within the broker's corporate advisory and solutions unit.

-

The manager has gained increments from existing investors and inflows from new ones.

-

After more than a decade at ILS platforms, Brooks has returned to a broking role.

-

Welcome to the 2023 Trading Risk Awards, where the best and brightest in the ILS market are recognised for their achievements from the past year – and what a year it was.

-

The reinsurer’s core management fee income was up by 50% year on year to $40.9mn.

-

Capital has begun to flow again after a challenging time for ILS fundraising in 2022 – but there is a clear shift underway.

-

At Trading Risk’s annual ILS conference, Lloyd’s CFO Burkhard Keese explained how the Corporation is working with the market to attract investors to participate in risk transfer across the Lloyd’s market.

-

Hard-market conditions have been beneficial but more improvements are needed, the panel said.

-

The fundraise represents the fourth issuance of the Torrey Pines Re cat bond.

-

The company said the result was "encouraging given the challenges of ILS capital raising".

-

Bart Zanelli will work within Gallagher Securities, specialising in capital raising and M&A.

-

Cat bond pricing has fallen by about 12% since year-end but margins are still strong enough that the market could be set for meaningful growth, the broker forecast.

-

The role will involve managing alternative capital strategies for the specialist lines insurer.

-

The securitised reinsurance tokens require a minimum investment of $20,000 in the US and $2,500 outside of the US.

-

It is understood that the company has mandated Nomura to raise the risk capital.

-

City of London grandee Martin Gilbert is attached to the project in a non-executive capacity, sources said.

-

The casualty ILS fund has been on a hiring spree since its $75mn Series B fundraise in June last year.

-

Beazley executives spoke of further growth prospects in the class, after its results revealed a 79% combined ratio for its cyber division in 2022.

-

The carrier becomes the first syndicate to use the new London Bridge structure.

-

The asset manager said this year’s conditions were the most attractive in ILS history.

-

Reinsurer-owned ILS platforms were challenged to grow fee income in a tough year for nat cat losses and as cat market economics shifted.

-

Should reinsurers retain the option of playing in ILS, or take a ‘go hard or go home’ approach?

-

A difficult fundraising environment had not eased during 2022.

-

-

The executive will build out Vesttoo’s capital markets team in the region.

-

The capital management platform remains active but January renewals were fronted by the balance sheet.

-

Cat activity and financial market volatility had impacted investor’s allocations to ILS and redemptions, Markel said.

-

All four of the firm’s key third-party vehicles were profitable in the quarter.

-

The headline market drop in AuM belies a more lively growth story for funds operating outside of the ILS major league.

-

The Zurich-based ILS manager has entered a partnership with the new life ILS firm set up by former Securis CUO Paul Whiting.

-

The former reinsurance CEO had previously parted ways with Bob Cooney after working together on a reinsurer start-up last year.

-

The firm’s flood solution will be available to layer on top of existing parametric hurricane wind policies.

-

The former Lancashire treaty underwriter had worked at the ILS platform since October 2021.

-

The sidecar has stepped down in size over the past three years.

-

The cat bond will pay out to Beazley if total claims arising from a cyber attack on its clients surpass $300mn.

-

The executive said many reinsurers have secured the pricing and terms necessary to cover their cost of capital.

-

The broker said the renewal had been “gruelling” for cedants.

-

Reinsurers have successfully pushed hard on T&Cs but, as capacity begins to fall into place, there are still many unanswered questions for this renewal.

-

FGF is a reinsurance and asset management holding company focused on collateralised and loss capped reinsurance and merchant banking.

-

TigerRisk Capital Markets & Advisory acted as exclusive structuring and placement agent for the reinsurance sidecar.

-

The move comes amid a general cutback from reinsurers’ in their cat risk appetite.

-

Scott Stephenson, former chairman, president and CEO of Verisk, will join CyberCube’s board after participating in the funding round.

-

The state’s lawmakers will meet on December 12-16 to address the challenges facing its troubled property insurance market.

-

The broker said clients can move fast in a harder market but need time to review quotes.

-

Some firms have fared better than others in the competition to raise funds during the year.

-

Outrigger Re will write a quota share of Ark’s Bermuda property treaty book.

-

The London-listed carrier said that market dislocation could last for years and had created a strategic opportunity for the carrier.

-

Most ILS firms are marking the Ian loss as a $50bn+ event, although there are exceptions.

-

FloodSmart Re bonds recovered by a few points in October after initial steep write-downs following Ian.

-

Around $100mn of the facility was funded at close, with the remaining funds available in two tranches as the company reaches certain agreed-upon milestones.

-

The two Lloyd’s players are the first to bring sidecars to market as they seek to capitalise on surging projected returns.

-

-

The major ILS investor described 2023 opportunities as attractive but said they were set to get more selective in the industry.

-

The broker is looking to solve the severe capacity crunch for its clients as rising demand meets falling supply.

-

The two ILS firms were among those participating in a $20mn fundraise for Elpha Secure Technology.

-

With an industry loss of less than $30bn, the cat bond segment can “shrug it off”, but a $50bn-plus loss would have major impacts, speakers suggested.

-

Amid a wide range of industry loss estimates, it is clear that ILS trapped capital will be a major issue for 2023 with back-of-the-envelope calculations suggesting at least double-digit billions held.

-

The storm’s likely quantum is still highly contested, but all scenarios are challenging for Florida homeowners and cat treaty writers.

-

Reinsurers are better positioned to face this storm from a financial point of view – to Florida state’s detriment – but how capital providers will react to a loss is the wildcard.

-

Some are suggesting a rotation of the investor base may be underway, with a move back towards more opportunistic funds.

-

HSCM Ventures partner Vikas Singhal will join the Inclined board.

-

AlphaCat will lose a mandate worth a few hundred million dollars as part of a broader pivot on alternatives from the pension fund.

-

The casualty ILS platform is building out its team following a Series B fundraise.

-

Randall & Quilter’s ambition is to launch additional vehicles once Gibson Re’s $300mn is deployed.

-

Some sources argue that now is the time for new management teams to tap into the market with fresh platforms.

-

The appointment to the ILS unit follows news of Howden’s move to buy TigerRisk.

-

The ratings agency placed the carrier’s ratings on negative review earlier this year, prompting broker and cedant scrutiny.

-

-

Some reinsurers emerged as increasingly positive on the cat space, despite generally subdued risk appetites.

-

The firm’s Medici and Fontana vehicles were hit by foreign exchange losses.

-

The executive will rejoin as EVP, reinsurance purchasing and risk capital optimization.

-

As ILS players such as Vesttoo seek to grow beyond cat risk, Trading Risk looks at some of the questions surrounding how casualty ILS deals will operate and the amount of risk transfer undertaken to date.

-

Kalachian moves from Allianz where he was a managing director.

-

The hardening rate environment in Florida provided a mid-year opportunity for some, but overall there was little growth.

-

There is no guarantee that the process will yield a particular transaction.

-

The offering will be rolled out to Arizona, Georgia, Tennessee and Texas later this year.

-

Envelop anticipates that cyber ILS could hit $100mn of GWP within four years

-

The ILS manager’s half-year report showed significantly lower holdings with Everest Re, as much of its portfolio has gone private.

-

The segment’s lustre has been dulled by losses and capital trapping.

-

Ledger has placed more than $400mn in premium into the capital markets.

-

He will lead capital raising for its insurance linked programme.

-

Rates have climbed 20%-35% since 1 January, and 40%-50% year on year, sources estimated.

-

Branch reported 1300% growth YoY in annualized written premium and a 400% increase in employee growth in the last year.

-

One Floridian had “zero” reinsurance in place before weekend.

-

The firm has developed a capability to hedge commodity price risk and was originally backed by Ascot Underwriting.

-

The firm aims to build on the origination capability of Fleming Re and Accelerant.

-

Higher interest rates drove investment write-downs that offset a turnaround in underwriting performance after last year’s first quarter was hit by Uri losses.

-

The firm will evolve its strategy but continue its focus on the aggregate product.

-

Fontana investors will face a short lock-up period in the sidecar’s ramp-up phase, but thereafter there will be some “embedded liquidity.”

-

The firm has refreshed its management line-up and said it would develop new low-correlation products.

-

ILS funds were showing pockets of positivity as market dynamics shift.

-

The insurance investment fund’s Brandon Baron will join Layr’s board of directors.

-

Even though underlying ILS market conditions are improving, getting a hearing from investors could become harder.

-

Reciprocal carriers could become more popular, but while this could better serve capital providers it does nothing to address underlying problems.