-

The finance committee discussed shifting market dynamics as tort reform takes effect.

-

The fund held $10mn in AuM, with $3mn the minimum investment required.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

The company plans to launch in New York and New Jersey next year.

-

American Integrity grew GWP by 30% to $287mn and Slide GWP was up 25% to $435mn in Q2.

-

The Florida carrier said ceded premiums will rise slightly to $106mn in Q3.

-

At least 14 new companies have opened up shop in the state in recent years.

-

Category 4 and 5 storms could become more common and hit further north.

-

Despite predicting fewer hurricanes, the numbers are still above average.

-

The weather-modelling agency is predicting a below-normal season.

-

The programme’s total limit this year is down $594mn to $1.36bn.

-

The cost comes in at $530.6bn, roughly $20mn lower than budgeted.

-

Slide is putting faith in tort reforms and will lean into Florida, CEO Lucas said.

-

PCS's loss estimate for the March Missouri SCS pushed the bond beyond its exhaustion point.

-

Buyers have turned to retro markets for covers where ILW pricing is less attractive.

-

Investors eyeing private ILS include opportunistic allocators keeping watch on storm season.

-

The pension plan noted in June 2024 that it was exploring new options in ILS.

-

The latest update brings the agency’s combined estimate for Milton and Helene to $32.4bn.

-

HCI secured three towers with $3.5bn in XoL coverage.

-

The $2.59bn renewal is up 45% from last year.

-

The total cost excluding a 15% quota share was $201.85mn, with rates down 12.2% from last year.

-

The Floridian also secured $352mn of multi-year coverage extending to 2027.

-

Property cat XoL rates were off by around 10% on average on a blended risk-adjusted basis.

-

Florida’s top regulator says he’s eyeing eventual tweaks to the state’s cat fund, too.

-

The firm is pressing ahead with IPO plans just ahead of the start of the Atlantic storm season.

-

The ILS market has won market share at the top of programmes as buying expands.

-

The bond will provide protection for Allstate’s Florida subsidiary, Castle Key.

-

The agency forecasts up to five major hurricanes and 19 named storms.

-

As with 2024, pricing pressure has been most acute on top layers.

-

Berkshire Hathaway lost market share but remained the largest traditional reinsurer, our study shows.

-

Proceeds will expand the company’s reinsurance protection in Florida and South Carolina.

-

The revision is significantly lower than the $4.5bn October estimate.

-

Some $200mn of fresh limit entered the ILS market as $3.4bn of deals priced.

-

The bond provides coverage on personal-lines property in Florida.

-

With plenty of reinsurance capacity, CEO Patel said it’s been a “boring year” for treaty negotiations.

-

The total cost for the program increased 1.8% from last year’s.

-

The carrier’s estimated first event limit could increase 16%, to $1.35bn.

-

California homeowners are also expected to move admitted business to E&S.

-

The bond will provide storm protection in Florida and South Carolina.

-

The deal will provide named Florida storm protection on an indemnity, per occurrence basis.

-

The state insurer of last resort is set to purchase $2.89bn of reinsurance this year.

-

The initial offering will include 6,875,000 shares of common stock.

-

Renewal rates were favorable compared to what could have happened after several hurricanes.

-

An allocation to insurance could “feel like a nice, calm port in the storm” amid wider market volatility.

-

The industry loss data provider also increased its estimate for Hurricane Helene to $15.3bn.

-

The Floridian company applied to be traded on the NYSE.

-

Portfolio rebalancing was not triggered last week, but investors are now distracted and nervous.

-

US Coastal Property and Utica Mutual Insurance have brought out their first cat bond deals.

-

The issuance is split across three tranches with varying degrees of risk.

-

Market participants expect pricing will be flat to down through Q2.

-

The insurer has lined up Piper Sandler and KBW to run the process.

-

The ILS segment is not ready to gloss over loss-heavy years in renewal discussions.

-

The mega cat bond season in Q2 last year recorded issuance of $8.2bn.

-

This year’s coverage will involve $2.94bn of new risk transfer.

-

There are signs that Florida’s insurance industry is coming under increasing legislative scrutiny.

-

There is the potential for cat bond H1 issuance to be a record breaking six months.

-

The bond will cover named storms in the state of Florida.

-

The Class A section of the bond has doubled in size, at lower pricing.

-

The CEO expects to see a larger shift between condos and apartments in 2026 and 2027.

-

HCI will now consist of two operating units – the other being its four underwriting entities.

-

Comments came as universal reported a 4.2 CoR jump to 107.9% in Q4.

-

UCITS fund diversification targets limit their capacity for US wind bonds.

-

Several Florida start-ups are poised to begin writing business this year.

-

Total combined losses for the agency’s Helene and Milton estimates stand at $31.8bn.

-

Citizens approved an average 8.6% rate hike and decreases for one-fifth of policyholders.

-

The state has seen 11 new entrants into the insurance market, reflecting renewed confidence.

-

Tower Hill secured $400mn of Winston Re limit in 2024.

-

Peril- and geography-specific deals are being well received by investors.

-

The industry loss number has increased threefold from an initial $5bn pick.

-

Price guidance for the bond is 7.00%-7.75%.

-

CEO Cerio highlighted changes that allowed the insurer of last resort to combine commercial, coastal and personal lines.

-

The new agreement provides $40mn of aggregate limit excess of zero.

-

Casualty ILS made inroads, while hurricane hedging strategies came into focus.

-

The bond offers a higher multiple than a similar Fuchsia Re deal placed last year.

-

Mapfre Re CEO Miguel Rosa was “very satisfied” with the debut cat bond deal.

-

The bond will provide multi-peril coverage in the US and District of Columbia.

-

The pricing multiple on the deal is 12.1x the sensitivity case expected loss.

-

The state reinsurer of last resort discussed options for 2025 reinsurance buying strategy.

-

The bond will provide coverage for named storm across five US states.

-

The 2025 target would be ~25% larger than the $3.56bn it placed for 2024.

-

Losses from Hurricane Milton are expected to affect only select junior structures.

-

Euler ILS Partners and Tropical Storm Risk teamed up to produce an updated version of an earlier study.

-

The loss figure has increased 200% from the initial number provided in October.

-

Moderate impacts to ILS returns are anticipated from Hurricane Milton.

-

The deal is offering a multiple of 13.6x on the sensitivity case expected loss.

-

Helene losses were spread wider than initially suggested, in contrast to Milton claims.

-

Fema's traditional reinsurance programme will attach at losses of $7bn and above.

-

A total of $2.1bn in Fema money has been approved for the state.

-

Latest pricing suggests secondary market traders are baking in further loss development.

-

The firm will provide an update on 22 November to avoid holiday season.

-

The low PCS number is presenting a challenge for ILW buyers and sellers.

-

The estimate implies a roughly $15bn homeowners’ industry loss from the hurricane.

-

The figures imply first-layer reinsurance recoveries for Helene.

-

The scheme is researching options for allocating to Lloyd’s.

-

The loss tally is considerably lower than estimates issued by model vendors.

-

The firm still expects to deliver positive net income for Q3 2024.

-

Many in the ILS sector are bullish on Milton losses falling at the lower end of earnings impacts.

-

The company said $13bn-$22bn will come from wind damage.

-

Florida domestics, aggregate retro and flood deals were all marked down.

-

HCI is estimated to incur a net expense of $125mn for Milton in Q4 2024.

-

Most of the insured loss was attributable to wind.

-

Icosa said certain cat bonds could see more than 0.2 points of price movement.

-

The bulls expect around $20bn-$30bn in Milton losses, with the bears anticipating $40bn-$50bn.

-

RMS will issue its final loss estimates for Milton later this week.

-

Plenum said wind damage from Milton could lead to “moderate” losses for its cat-bond funds.

-

The company is monitoring the NFIP’s flood-exposed bonds.

-

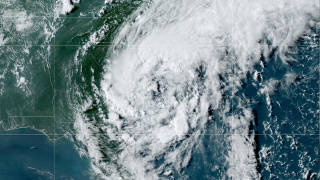

Milton made landfall near Siesta Key yesterday, leaving 2.7 million homes without power.

-

A $40bn Milton loss should barely dent many ILS returns but will trap some capital.

-

On Wednesday, the model had suggested a mean figure at $25.3bn.

-

The event has spared (re)insurers the more extreme scenarios that were under discussion earlier this week.

-

Milton made landfall south of Tampa Bay at Category 3 on Wednesday night.

-

This is based on insured loss estimates of between $20bn and $60bn.

-

The hurricane has destroyed hundreds of homes and left more than 2.7 million homes without power in Florida.

-

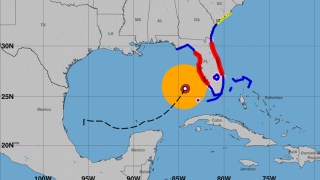

The NHC storm track predicts landfall below Sarasota, south of Tampa Bay.

-

Hurricane Milton’s overall impact, based on the current pre-landfall scenario, could lead to “moderate losses” for Plenum’s funds.

-

Collateralised reinsurance and retro are in the firing line.

-

The NHC is predicting storm surge, exacerbated by the tide, as high as 15 ft for Tampa Bay.

-

A hurricane warning has been issued for the east coast of Florida.

-

Most sources noted expectations of a $50bn+ event, but the range of outcomes is huge.

-

Hurricane Milton strengthened from a tropical storm on Sunday to a Category 5 storm yesterday.

-

Milton is expected to move north of the Yucatan Peninsula today and cross the eastern Gulf of Mexico by Wednesday.

-

Eight Floridians will take on personal residential multi-peril and wind-only policies.

-

Citizens’ auto-renewal controls were down from February 2023 to August 2023.

-

The storm brought a lot of rain, but the Floridian doesn’t provide flood insurance.

-

The ‘life threatening’ hurricane has potential for “historic heavy rainfall” in the southeastern United States.

-

Sources said that while a late June-early July IPO is still on the table, a Q4 or early 2025 listing is expected.

-

Concerning hurricane forecasts are among the factors driving tighter reinsurer capacity.

-

Top layer competition is an added pressure on ILS firms, but the impact can be overstated.

-

The program includes all perils coverage and third-event protection.

-

The company plans to reduce its quota share to 20% from 40%.

-

The carrier has completed its 2024-25 reinsurance renewal.

-

The coverage will be indemnity, annual aggregate for Florida named storm.

-

Eleven hurricanes are predicted, with five expected to reach Category 3 or higher.

-

FHCF rates are also projected to decrease by a statewide average of 7.38%.

-

The bond offers named storm coverage in Florida.

-

The body’s budget committee is again pressing Citizens over solvency concerns.

-

The carrier is seeking named storm coverage in the state of Texas.

-

The closing of the Interboro sell-off was postponed to nearer the end of the year.

-

The increase in limit reflects the carrier’s growing exposure.

-

The state-backed fund had been advised to increase its allocation of ILS to 1%.

-

The carrier is now offering up to $250mn of Class A notes and $150mn of Class B.

-

The bond will provide protection from named storms in Florida for three years.

-

The Florida Building Code was introduced following the impacts of Hurricane Andrew.

-

The limit on the reinsurance Citizens will look to buy from the private markets will stretch to $14.35bn, up 2% on prior-year coverage.

-

The Floridian was approved for 75,000 policies, made 72,958 offers and assumed 53,750 policies – a 74% acceptance rate.

-

A non-binding term sheet was signed on October 6, whereby the buyer will acquire 100% of Interboro’s issued and outstanding securities in exchange for cash.

-

The most important factors driving insured losses over the years include hurricanes, other weather-related events, inflation, and excess litigation.

-

The insurance company had set out plans last summer to expand its market share in Florida.

-

Out of the roughly 88 claims received so far, some were storm surge claims that are not covered by the carrier, according to the executive.

-

Idalia might add further aggregate erosion to several cat bonds covering various perils over an annual risk period, it stated.

-

With Hurricane Idalia’s landfall underway loss estimates are uncertain, but sources noted that the storm’s trajectory shows it taking the best path to impact minimal insured values in Florida.

-

The technology specialist is joining the firm from Reinsurance Group of America.

-

More than 800,000 houses could be affected by the hurricane’s storm surge.

-

If the storm steers clear of Tampa, reinsurers will be well placed for minimal losses, but a retention loss is a further blow for weak Floridians.

-

Idalia is forecast to become a hurricane later today and a dangerous major hurricane over the northeastern Gulf of Mexico by early Wednesday.

-

A major hurricane in any section of Florida that extends into the Southeast states is likely a “multi-billion-dollar” insurance industry event, according to the broker.

-

The storm is now forecast to become a major hurricane by Tuesday night. This morning’s advisory update had estimated that Idalia would reach major hurricane status by early Wednesday.

-

The domestic carrier will write homeowners’ multi-peril business, according to filings which also detailed that $300,000 of the initial capital will be used to complete the statutory deposit requirement.

-

The carrier’s Florida reinsurance tower’s top layers comprise a total of $450mn in Class A Sanders Re cat bond coverage.

-

The executive said that the company reduced its consolidated retention and ceded premium ratio for its 2023 and 2024 treaty program.

-

Following media reports last week that AAA had plans to pull out of the Florida insurance market entirely, the home and auto carrier "set the record straight” on Monday.

-

The decision applies only to policies issued through the company’s exclusive agency distribution channel.

-

Considering recent reforms, Citizens’ rates, on average, are still 58.6% below actuarially sound levels, but the inadequacy would have been 88.3% without them.

-

ACIC’s program offers sufficient coverage for approximately a one-in-167-year event and a one-in-100-year event followed by a one-in-50-year event in the same season, the company said.

-

The bills place additional requirements on insurers in the state and expand consumer protections.

-

Tower Hill Insurance Exchange has completed its 2023 Florida reinsurance program, which offers nearly $2bn for catastrophe cover, including all perils.

-

This compares to the subsidiaries’ 2022-2023 reinsurance tower, in which they secured coverage for losses up to $3.16bn.

-

Shifts in reinsurance appetite across the risk spectrum has squeezed out ILS providers in some cases.

-

First event reinsurance tower exhaustion points are $1.3bn for the Northeast, $1.1bn in the Southeast and $870mn in Hawaii.

-

The board also approved a PLA 2023 line of credit, which provides up to $1.25bn in liquidity.

-

Five counterparties account for almost half of all premiums ceded by a sample of major Floridian carriers, analysis shows.

-

Citizens’ board is slated to meet on May 16 at 13:30 ET to discuss the reinsurance and risk transfer program.

-

The pace of rate hikes will ease back from the 1 January reset as buyers seek to lock up capacity early after last year’s dislocated renewal.

-

The northeast deal had previously priced at the low end of the regional insurer’s targets.

-

The impact of recent tort reforms is already being felt in the Sunshine State, the CEO said.

-

The recommendations await approval from the Florida Office of Insurance Regulation.

-

The state carrier completed phase one of its program with the $500mn Lightning Re cat bond placement.

-

Most of the 708,255 claims relate to residential properties and arose from Lee County, Florida.

-

On Thursday, the bill passed 23-15 in Florida's Senate, after passing the House last week.

-

The Floridian has lowered pricing to 900-950bps in a second reduction.

-

The Florida insurance carrier has grown its book rapidly through acquisition.

-

Yaworsky has served as interim insurance commissioner since being nominated by Governor Ron DeSantis last month.

-

CEO Locke Burt said Florida reforms would be “transformational” and that investors had become more receptive to cat risk owing to higher rates.

-

The state-backed carrier’s policy count is projected to hit a record high of 1.6 million by year-end.

-

The insurer reported an underwriting profit for Q4.

-

The issuance is replacing $400mn of cat bond coverage placed in early 2020.

-

The bond is seeking industry-loss-based annual aggregate named storm coverage.

-

The carrier reported a Q4 combined ratio of 101.4%, an improvement of 30 points year-on-year, driven by a 27-point reduction in its loss ratio.

-

Ron DeSantis has also announced proposals to modernize Florida’s "bad faith" law, in the latest set of reforms he described as the most “comprehensive in decades”.

-

The transaction provides relief for policyholders and agents, but especially for those policyholders whose policies expire past UPC’s June 1 deadline.

-

The firm’s flood solution will be available to layer on top of existing parametric hurricane wind policies.

-

KBRA believes First Protective’s and Frontline’s strong underwriting and claims handling compares favourably with that of their Florida peers.