-

The breadth of strategies targeted by ILS start-ups signals where the industry is heading.

-

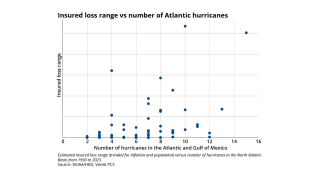

Demand for top layer coverage may also need to be supported by underlying market growth.

-

As the P&C market shifts, carriers are looking for growth from acquisitions.

-

Competition on price from traditional markets is weighing on bond market momentum.

-

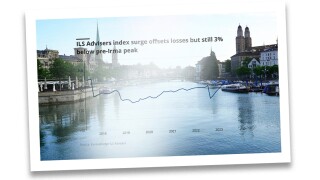

Investor interest is warming up following a colder spell over the past several years.

-

The market has learned lessons from earlier soft market phases that it will apply now.

-

The leadership’s commentary spotlighted to value of ILS to the group.

-

The reinsurer’s capacity is hugely important to ILS firms, with few alternative providers.

-

M&A and shifts in distribution arrangements bring risks and opportunities.

-

The ILS market has won market share at the top of programmes as buying expands.

-

The buzz in the air at ILS Connect told of a market entering its next growth phase.

-

Investor interest and capital flows point to potential for ILS proliferation.

-

Indirect exposure to cat risk through long-term investors gives Markel optionality.

-

Island appetite remains stable, but early 2025 loss activity has injected fresh uncertainty.

-

Several Florida start-ups are poised to begin writing business this year.

-

Wildfire is rarely singled out as an exposure that can shift portfolio outcomes.

-

Management track record has been a factor in capital raising for 2025.

-

Many in the ILS sector are bullish on Milton losses falling at the lower end of earnings impacts.

-

A $40bn Milton loss should barely dent many ILS returns but will trap some capital.

-

Floir approved nearly 650,000 policies for takeout from Citizens for October and November.

-

Winning higher-fee private ILS mandates will strengthen firms’ negotiating positions.

-

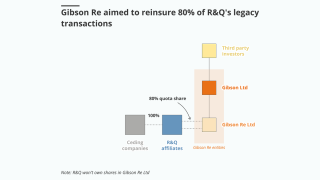

ILS investors’ stress over Gibson Re is unlikely to inhibit legacy ILS’s future.

-

Reinsurer-managers are building out asset management infrastructure as they expand.

-

Relentless focus on annual outcomes provides a packaging that doesn’t fit the purpose.

-

Reinsurers are much better placed to absorb cat losses; insurers are carrying more risk.

-

Top layer competition is an added pressure on ILS firms, but the impact can be overstated.

-

Various trends may work together to hold the cat markets up for longer than some had feared.

-

Pockets of new capital will not shift pricing at mid-year.

-

The depth of the retro market recovery will be an influential factor in the pace of the cat market slowdown from here.

-

Cat bonds and sidecars are well positioned for growth, while private ILS will benefit from further innovations to improve liquidity.

-

Competition for remote risk deals intensified as more capital has targeted the swathe of business that has historically been the heartland of ILS.

-

The cost of maintaining a team to service institutional investors does not always weigh favourably versus bringing in ILS capital.

-

Prior-year cat loss years that are finally shaking out drove fee benefits in Q3.

-

Fermat’s John Seo said the industry can “see the wall of money coming in, but it’s coming in slowly”.

-

A number of players suggested that the cost components of first-party claims were up between 30%-50% on that seen during Ransomware Wave One.

-

A challenge facing the industry in the years to come is the question of how can it move through a rotation of its investor base to capture the growth opportunities that have arisen.

-

The obvious question is where is the capital behind the letters of credit that were being pledged on its transactions.

-

With fundraising still difficult outside the liquid ILS segment, managers are looking for ways to shore up their economic proposition.

-

From seeing ILS as a fleeting competitor to a complement to traditional reinsurance, Denis Kessler’s descriptions of the alternative market were always colourful.

-

Removing any competitor is a positive for ILS peers in a competitive time for fundraising, but it is not clear how much of a boost this will give RenRe.

-

Capital has begun to flow again after a challenging time for ILS fundraising in 2022 – but there is a clear shift underway.

-

There are enough drivers supporting the trend for cat bond segment growth that ILS managers are likely to be plugging this business heavily in the short term, even if it is less attractive in fee yield.

-

The new higher-rate world brings the threat of some investors staying in a risk-off mentality.

-

ILS managers have pioneered externally managed rated carriers, but have done so with cost-consciousness in mind.

-

Reinsurers congregating in Bermuda flagged a lack of interest in helping under-capitalised Floridian insurers and under-priced diversifiers, with positive implications for ILS participation.

-

Fermat’s John Seo divided the potential incoming capital broadly into “fast” and “slow” capital.

-

Should reinsurers retain the option of playing in ILS, or take a ‘go hard or go home’ approach?

-

The outcome over the debate on narrowing cat reinsurance coverage will not be an all-or-nothing bet, with all perils deals with exclusions not a polar opposite of named perils coverage.

-

Several structural factors, including the pricing cycle, make insurers more insulated from US activist states.

-

High-yielding alternatives are taking away attention from this sector, with its complex narrative around recent losses, and diversification only goes so far in selling its story.

-

Announcements and interviews at the UN conference have shed light on the tools emerging to help carriers decarbonise their underwriting portfolios.

-

Major questions confront the industry after Hurricane Ian, but no matter the answers, certain outcomes are inevitable.

-

Buyers are more open than ever to different sources of capacity, but the timing of entry will not be on the industry’s terms.

-

Some are suggesting a rotation of the investor base may be underway, with a move back towards more opportunistic funds.

-

Ratings agencies suggest that carriers must do better on controlling volatility – but diverging risk appetites give the lie to the idea that the industry is walking away from risk.

-

As the ILS market heads back to the office after summer breaks to get stuck into a busy conference season, we recap our top summer features and news coverage that you won’t want to miss.

-

In the absence of a major tactical shift from Demotech, will the reinsurers become the de facto selection party determining which domestics survive?

-

Market orthodoxy suggests cross-class reinsurers secure more leverage – but are there too many implicit offsets in this game?

-

Collaboration should help protect against greenwashing fears but the industry should start with leaving behind the issue of the sector’s “inherent ESG” appeal.

-

With reinsurance availability scarce and costs rising, several carriers have called an interim halt to new homeowners’ business.