-

As the P&C market shifts, carriers are looking for growth from acquisitions.

-

Competition on price from traditional markets is weighing on bond market momentum.

-

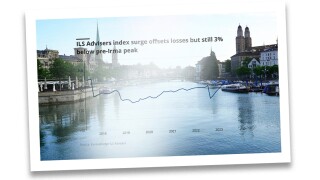

Investor interest is warming up following a colder spell over the past several years.

-

The market has learned lessons from earlier soft market phases that it will apply now.

-

The leadership’s commentary spotlighted to value of ILS to the group.

-

The reinsurer’s capacity is hugely important to ILS firms, with few alternative providers.

-

M&A and shifts in distribution arrangements bring risks and opportunities.

-

The ILS market has won market share at the top of programmes as buying expands.

-

The buzz in the air at ILS Connect told of a market entering its next growth phase.

-

Investor interest and capital flows point to potential for ILS proliferation.

-

Indirect exposure to cat risk through long-term investors gives Markel optionality.

-

Island appetite remains stable, but early 2025 loss activity has injected fresh uncertainty.

-

Several Florida start-ups are poised to begin writing business this year.

-

Wildfire is rarely singled out as an exposure that can shift portfolio outcomes.

-

Management track record has been a factor in capital raising for 2025.

-

Many in the ILS sector are bullish on Milton losses falling at the lower end of earnings impacts.

-

A $40bn Milton loss should barely dent many ILS returns but will trap some capital.

-

Floir approved nearly 650,000 policies for takeout from Citizens for October and November.

-

Winning higher-fee private ILS mandates will strengthen firms’ negotiating positions.

-

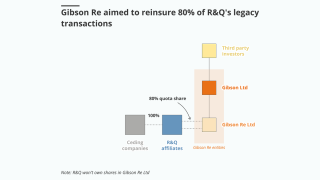

ILS investors’ stress over Gibson Re is unlikely to inhibit legacy ILS’s future.

-

Reinsurer-managers are building out asset management infrastructure as they expand.

-

Relentless focus on annual outcomes provides a packaging that doesn’t fit the purpose.

-

Reinsurers are much better placed to absorb cat losses; insurers are carrying more risk.

-

Top layer competition is an added pressure on ILS firms, but the impact can be overstated.

-

Various trends may work together to hold the cat markets up for longer than some had feared.

-

Pockets of new capital will not shift pricing at mid-year.

-

The depth of the retro market recovery will be an influential factor in the pace of the cat market slowdown from here.

-

Cat bonds and sidecars are well positioned for growth, while private ILS will benefit from further innovations to improve liquidity.

-

Competition for remote risk deals intensified as more capital has targeted the swathe of business that has historically been the heartland of ILS.

-

The cost of maintaining a team to service institutional investors does not always weigh favourably versus bringing in ILS capital.

-

Prior-year cat loss years that are finally shaking out drove fee benefits in Q3.

-

Fermat’s John Seo said the industry can “see the wall of money coming in, but it’s coming in slowly”.

-

A number of players suggested that the cost components of first-party claims were up between 30%-50% on that seen during Ransomware Wave One.

-

A challenge facing the industry in the years to come is the question of how can it move through a rotation of its investor base to capture the growth opportunities that have arisen.

-

The obvious question is where is the capital behind the letters of credit that were being pledged on its transactions.

-

With fundraising still difficult outside the liquid ILS segment, managers are looking for ways to shore up their economic proposition.

-

From seeing ILS as a fleeting competitor to a complement to traditional reinsurance, Denis Kessler’s descriptions of the alternative market were always colourful.

-

Removing any competitor is a positive for ILS peers in a competitive time for fundraising, but it is not clear how much of a boost this will give RenRe.

-

Capital has begun to flow again after a challenging time for ILS fundraising in 2022 – but there is a clear shift underway.

-

There are enough drivers supporting the trend for cat bond segment growth that ILS managers are likely to be plugging this business heavily in the short term, even if it is less attractive in fee yield.

-

The new higher-rate world brings the threat of some investors staying in a risk-off mentality.

-

ILS managers have pioneered externally managed rated carriers, but have done so with cost-consciousness in mind.

-

Reinsurers congregating in Bermuda flagged a lack of interest in helping under-capitalised Floridian insurers and under-priced diversifiers, with positive implications for ILS participation.

-

Fermat’s John Seo divided the potential incoming capital broadly into “fast” and “slow” capital.

-

Should reinsurers retain the option of playing in ILS, or take a ‘go hard or go home’ approach?

-

The outcome over the debate on narrowing cat reinsurance coverage will not be an all-or-nothing bet, with all perils deals with exclusions not a polar opposite of named perils coverage.

-

Several structural factors, including the pricing cycle, make insurers more insulated from US activist states.

-

High-yielding alternatives are taking away attention from this sector, with its complex narrative around recent losses, and diversification only goes so far in selling its story.

-

Announcements and interviews at the UN conference have shed light on the tools emerging to help carriers decarbonise their underwriting portfolios.

-

Major questions confront the industry after Hurricane Ian, but no matter the answers, certain outcomes are inevitable.

-

Buyers are more open than ever to different sources of capacity, but the timing of entry will not be on the industry’s terms.

-

Some are suggesting a rotation of the investor base may be underway, with a move back towards more opportunistic funds.

-

Ratings agencies suggest that carriers must do better on controlling volatility – but diverging risk appetites give the lie to the idea that the industry is walking away from risk.

-

As the ILS market heads back to the office after summer breaks to get stuck into a busy conference season, we recap our top summer features and news coverage that you won’t want to miss.

-

In the absence of a major tactical shift from Demotech, will the reinsurers become the de facto selection party determining which domestics survive?

-

Market orthodoxy suggests cross-class reinsurers secure more leverage – but are there too many implicit offsets in this game?

-

Collaboration should help protect against greenwashing fears but the industry should start with leaving behind the issue of the sector’s “inherent ESG” appeal.

-

With reinsurance availability scarce and costs rising, several carriers have called an interim halt to new homeowners’ business.

-

The carrier has shared insurance and reinsurance risk with ILS partners in the past, but the ILS team reports to Axis Re CEO Steve Arora.

-

In certain areas more collaboration is needed but in others the market will continue to get more diverse as investors respond to post-Irma challenges in differing ways.

-

Even though underlying ILS market conditions are improving, getting a hearing from investors could become harder.

-

Catastrophe reinsurers are already off to a messy start for the year and may have eroded a significant part of their year-to-date Q1 cat budgets as floods are still unfolding in Australia following recent European/UK windstorms.

-

Absent more significant reform, any changes this year look set to simply shift the timing of burdens falling on the public purse.

-

Many investors are in a “hold and assess” pattern on ILS, but some changes in the broader landscape could be more positive for the industry.

-

Greater participation of cat bond investors in the retro market has some advantages alongside the risks.

-

The “squeezed middle” of the reinsurance sector is under pressure, but attritional risk aversion could drive ongoing changes.

-

Cat risk-takers are benefitting from some money leaving the sector, but is this disruption creating inefficiencies as well?

-

This year, instead of talk about running late, people were highlighting how the starting gun has barely been fired.

-

The retro renewals are barely underway, as a challenging fundraising environment and queries over loss experience has delayed the typical pace of progress.

-

Re-allocation of capital rather than true growth seems to be a more likely outcome for the sector in the near term.

-

S&P suggested that an “abrupt rethinking” was a more likely outcome than gradual pricing increases – but a third way is possible if ratings agencies set a glidepath to change.

-

The lower-than-expected losses so far from Ida do not stack up against what is thought to be a $30bn+ cat event.

-

Recently one of my colleagues argued that it was time for a “bonfire of PMLs”, as the past five years have shown that the industry has seriously underpriced the kind of $10bn-$20bn loss events that have been happening since Harvey, Irma and Maria landed in 2017.

-

It is not so much the size of the hit, as the regularity of moderate cat events that is worrying risk-takers.

-

There is no such thing as an average loss year, but investors will still be looking for benchmarks.

-

It’s been a year of high turnover in general, but the ILS low-cost operating model can become a disadvantage in managing through such disruption.

-

Across a wide range of different ILS strategies, there are a number of managers that have failed to gain critical mass in the past 5 years.

-

CPI surged to 4.2% in April, levels not seen since before the Global Financial Crisis.

-

Initially, negotiations are likely to be led by risk takers but there could be a case to model a future role for service providers.

-

The Florida reinsurance renewals ran more smoothly, with lower overall rate increases than initially expected.

-

The latest generation of ILS-backed rated fronting platforms is looking more “ILS-y” due to their ownership structures.

-

Collaboration could address many of the issues vexing the ILS market and help to even out the pace of its recovery.

-

Syndicates and managing agents who want third-party capital support need to deliver on profit and transparency.

-

Could investors – and ILS managers – be ready for another attempt at developing the retail ILS market?

-

Cat bond market exuberance seems to be mismatched against overall ILS sentiment.

-

One swallow doesn't make a summer, but what do two retro "cashback" transactions portend for hurricane season?

-

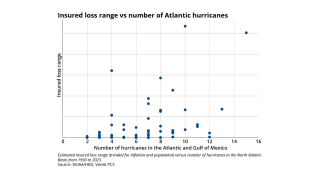

Last year cat losses were highly dispersed across a large number of events with no single loss above $10bn.

-

A cluster of new launches demonstrate continued interest in an "independent aligned" model.

-

By setting up an asset manager, the reinsurer is competing with ILS firms on their turf.

-

The transaction is a bearish signal for the post-Covid cat reinsurance market.

-

Could a back-to-basics approach see ILS firms shun Lloyd's advantages for lower-cost alternatives?

-

The sting could be in the tail for reinsurers dropping agg risk.

-

Investors from the ILS boom era are also those who've had the least luck, so fundraising remains a slog.

-

Storm Delta may feel like a reprieve, but escaping storms gives no upside for investors.

-

Our ILS Week sessions were packed with thoughtful comments from panellists and fireside chat speakers.

-

Earlier this month, we recapped some of the issues causing rising tensions in the retro market, where providers are pushing for release of capital trapped in connection to Covid-19 claims.

-

Like with Hurricane Irma, the pandemic loss is the kind of disaster that does not highlight the strengths of the collateralised reinsurance and retro model.

-

To what extent does the business opportunity for new start-ups rely on BI losses that the industry is vigorously rebutting?

-

If Covid-19 is a slow-growing loss, fundraising may not come in through fast-access ILS routes.

-

The event could drive greater interest in buying cover for pandemic and contingency risks.

-

The infrastructure of the ILS market is undergoing extensive renovation at the moment.

-

"Access" is one of those magic words or mantras that get horribly over-used in the (re)insurance markets.

-

The January 2020 sidecar renewal season could emerge as a turning point in the evolution of reinsurer ILS tactics and strategies.

-

The topsy-turvy nature of the past few years for the ILS market is apparent when you look at our half-yearly surveys of assets under management.

-

The (re)insurance and ILS industry has headed into a new decade in a spirit of change – as can be seen across multiple lines of business.

-

Every New Year the (re)insurance industry looks back at how much natural disasters cost it in the last 12 months – but the 2019 statistics undercut the value of this exercise.

-

The reinsurance market has scrambled its way through the January renewal season in typical festively messy fashion – but in the sober light of New Year it will be mulling over several key issues that will set the trend for the rest of 2020, with change far from complete.

-

The reinsurance market has scrambled its way through the January renewal season in typical festively messy fashion – but in the sober light of New Year it will be mulling over several key issues that will set the trend for the rest of 2020, with change far from complete.

-

The 2010s are about to end and over the past decade the ILS market has gone through an adolescent growth spurt – heading into 2020 as a far bigger and more complex entity than it was.

-

Most people describing the ILS manager world might break the peer group into three broad categories: reinsurer-affiliated platforms, independent owner-operated firms and asset manager-backed vehicles. Does the market need another category?

-

We have written a bit about how certain (re)insurance business lines, such as retro, are struggling for capacity right now, but another noteworthy development is that some types of structures are also requiring major efforts to shore them up.

-

It used to be called “diworsification” – a phrase coined by Dowling analysts that took hold and became the industry's standard jargon for low-priced international catastrophe risk back around 2011.

-

We've been talking about the reinsurance market being the “squeezed middle” caught in between accelerating primary and retro markets for some time, but could Neon be the first casualty of collateral damage from this phenomenon?

-

The retro renewals are still in the calm-before-the storm phase but it seems that capacity limitations are set to open up more of a role for opportunistic players.

-

Currently, most people trying to describe the ILS manager world might break the peer group into three broad categories: reinsurer-affiliated platforms, independent owner-operated firms and asset manager-backed vehicles.

-

Amid the information overload of results season, “man-made catastrophes” appear to be the main emerging theme – albeit manifesting in two very different ways.

-

Large loss estimate ranges are arguably just masking risk modelling limitations – not improving themBenjamin Franklin apparently once said that ‘nothing in life is certain except death and taxes’ – and it seems like the adage resonated with the risk modellers of the (re)insurance industry.

-

Lloyd's syndicates are hugely reliant on reinsurance and retrocession to manage their catastrophe exposures – so the Corporation's plans to help make it easier for players to source ILS capacity couldn't come soon enough.

-

In the midst of reinsurance conference season you might expect there to be a tendency towards group-think.

-

Cracking into a crème brûlée will always make me think, in passing, of (re)insurance.

-

At Munich Re's ILS roundtable in Monte Carlo, one of the speakers raised the concept of whether a "flight to quality" amongst ILS investors might be better labelled a "flight to alignment".

-

Every year, returning from the Monte Carlo Rendez-Vous is like emerging from a chrysalis – a draining process of freeing oneself from a tiny hive of frantic activity.

-

Rewind a few years and “hot money” was one of the pejorative labels thrown at a burgeoning ILS sector.

-

There’s no doubt that the stress of a serious hit from Hurricane Dorian to Florida reinsurers will add age lines to the ILS market.

-

The reinsurance and ILS markets have spent two years talking about losses, but perhaps more focus on the good years would help reduce some of the noise in the bad years.

-

Do we need new labels for the different types of ILS managers that exist?

-

As ILS reinsurers recover from the 2017-2018 loss years, the consensus view now is that the market will see a “flight to quality” by investors, bolstering the position of some platforms while eroding the asset base of poorer performers.

-

Reinsurers are taking modest rate increases largely by “riding on the backs of primary writers”, Chubb CEO Evan Greenberg said recently.

-

On sweltering weeks like this, you can see why climate change has become a talking point that every ILS manager has to cover in their pitch for new investor mandates.

-

If 2018 is to be a horrible but ultimately beneficial tonic for the overall market, then it is crucial that all players now decide to go above and beyond recommended standards on transparency.

-

Retro brokers are itching to get back to the driver’s wheel – but they may have to wait a bit longerThe retro market has been hard hit in the past couple of years by trapped capital and losses.

-

In a pleasantly warm Zurich this week, I was discussing one of the city’s traditions – burning the giant figure of a snowman to herald the end of winter and coming spring.

-

There has been a fair bit of congratulatory talk about the “discipline” of the (re)insurance market in the past month or so.

-

As the FCA updates the market on its view of the Woodford funds saga, some of the material it is publishing has echoes that may resonate within the ILS market.

-

Timing is everything and, for the reinsurance market, this is especially true when it comes to losses.

-

A move towards more bilateral trades is counter to what you’d expect from a commoditised market.

-

One of my colleagues with an affection for Denis Kessler’s turn of phrase once labelled him the Beyonce of the reinsurance world.

-

Markel has not actually come out and said what it plans to do with former top 10 ILS manager Markel Catco, but the likely money has to be on a gradual closure now that an overwhelming 91 percent of assets under management are due to be returned to investors, as claims development permits.

-

After two years of volatility it’s not surprising to see reports that are urging the ILS market to find more harmonisation and standardisation.

-

Is ILS a sufficient part of Lloyd’s vision for a future of increased efficiency and profitability? There were certainly overtures to alternative capital in the Lloyd’s prospectus launch this week.

-

Perhaps it is not the perfect analogy for an event in Florida, but the famous failure of Devon Loch in the Grand National springs to mind.

-

Earlier this month, Lane Financial speculated that higher Treasury yields would encourage investors to return to the cat bond fold.

-

The relationship between Florida insurers and their reinsurers is obviously going through a rough patch. It makes you wonder whether the role of brokers this year might be akin to that of marriage counsellors.

-

Is this both the best and worst of times for the ILS market?

-

Why has ‘payback’ become a dirty word in the reinsurance markets?

-

What does it say about the insurance market that for every new fund or facility that is launched as a passive or index tracker-style initiative, it seems that another existing one is unwound?

-

Warm winter sun might have helped Miami’s case for bringing ILS folks to the city for one of its annual conferences a couple of weeks ago.

-

The reinsurance industry spends a lot of time obsessing about risk modelling, but arguably its efforts to pin down ever more precise estimates of expected losses are let down by a 20th century approach to data handling.

-

There are some players in our industry who truly believe that any insurance risk can be securitised.

-

Anyone scanning the news stories we have covered in the past week might get a sense of déjà vu.

-

Shipping out risks to ILS partners might lift some weight off insurance balance sheets, but there are other counterweights that are worth bearing in mind.

-

Arguably the single biggest challenge to face reinsurers attempting to attract third-party ILS capital is nothing to do with engaging in fundraising, estimating monthly valuations, or any of the operational facets of asset management.

-

If the ILS market is all about convergence, is it still a worthwhile task to try to create dividing lines within the market, or is a movable border a better representation of messy reality?

-

Regulatory investigations can move at a snail’s pace.

-

The crucial thing for the industry now is that the nuances of the lessons from 2017-2018 are heard.

-

Winners and losers may well emerge but many questions remain to be answered.

-

Reinsurers are still figuring out just how costly 2018 was in terms of disaster losses – after all, 2018 has only just wrapped up and events such as the Sydney hailstorms lumped on further costs late in the year.

-

Looking ahead to the rest of the year and 2020, how likely is it that the industry will hold to its resolutions?

-

Last year’s feast has repeated on the market as Irma losses deteriorated, while fresh wildfires have caught out those who loaded up on liability exposure.

-

Have reinsurers become so reliant on cheap retro that the task of writing their inwards portfolios is skewed by this support?

-

Trading Risk view: investor fatigue

-

How do ILS investors know whether they’re being paid enough for shouldering catastrophe risks?

-

Apparently, some broking firms have recently been rolling out training to their younger staff on how to broke in a hard market – which is quite striking in itself, given that hard markets were meant to be a relic of the past.

-

The ILS market is often presented as the player in the (re)insurance industry with the deepest pockets, with access to trillions of pension fund wealth in worldwide bank vaults.

-

Last year’s catastrophe losses were exactly the kind of disaster event that made it easy for ILS managers and reinsurers to pitch to investors for fresh capital and to succeed in delivering the “great ILS reload” at the year-end of 2017.

-

The world of so-called collateralised reinsurance has always been a bit of a misnomer as significant volume is transacted behind several rated fronts.

-

I don’t know how widely known Kellogg’s “Just Right” cereal may be outside the antipodean market, but it has a marketing slogan that came to mind when I was thinking about reinsurance reserves this week, believe it or not.

-

Hurricane Michael’s losses will contribute to a scrappy year for reinsurers and ILS firms.

-

M&A is once again at the forefront of industry minds, as Scor and RenaissanceRe have been fending off bidders and activist investors in recent weeks.

-

A gloomy pub in Lime Street, EC3 – the kind where light barely penetrates stained glass windows, hiding any grubby floors – is an apt metaphor for the opacity of the reinsurance markets.

-

Broker distribution facilities have made a comeback in recent years as intermediaries seek new ways to streamline operations and boost fee income.

-

Standard philosophy is that the boundaries between the traditional and “alternative” reinsurance markets have now entirely dissolved as each have intertwined.

-

Several themes discussed at this year’s Rendez-Vous threaten to bust reinsurers' navel-gazing habitsEmerging from the glare of the Monte Carlo Rendez-Vous – the reinsurance market’s annual gathering in Monaco – is always something of a bubble-popping moment.

-

One of the broad industry trends at the moment is reinsurers and MGAs seeking ILS or third-party capital to replace other funding sources or underwriting paper, respectively.

-

If you rewind to Monte Carlo a decade ago, Nephila and other ILS managers were merely an exotic corner of the reinsurance markets – independent, small teams slugging away at building up franchises. Ten years on and the industry’s largest manager has just sold up to Markel in a landmark M&A deal, and the ILS top 10 have boomed from under $10bn to $68bn in size.

-

Markel Catco investors must be prepared to take a critical look at some of the statements in the company’s half-year report.

-

A new research paper suggests there could be more cause for gloom if cover becomes more unaffordable.

-

ILS managers' income is going to be dented by lost performance fees.

-

Even if you’re not currently in London, you’ve probably heard about the heatwave we’re experiencing here – we are not ones to shut up about the weather.

-

ILS investors have shown that they’re not going to run from disaster losses.

-

Last year the hot topic was how the ILS market would respond to the challenge of reloading after the string of hurricanes. But this year, the tables have turned.

-

As Florida’s first hurricane in a decade, Irma was always going to throw a few curveballs to the insurance industry even if it wasn’t “the big one”.

-

So who might buy in next? That will be the question Nephila’s peers will be wondering as it emerged that the Bermudian is looking for new investors to buy into its management company.

-

Credit Suisse’s launch of Bermudian reinsurer Bernina Re shows a continued trend of major ILS managers developing in-house platforms that free up their reliance on fronting partners.

-

The ILS market is often said to have destroyed the potential for there to ever be another "class of x" reinsurers, as there was in 1993 or 2001 or 2005, when a rush of start-ups followed major loss events. But ?maybe we could see the ILS market as a whole as the "class of 2008".

-

The ILS market is often said to have destroyed the potential for there to ever be another "class of x" reinsurers.

-

Hurricane season is now open, but I’d argue that the persistent headwinds facing the reinsurance industry are far more challenging than anything the Atlantic may send its way this summer.

-

Reinsurers are taking different approaches to their third-party capital management strategies.

-

The concept of reinsurance market “payback” – higher premiums that follow major losses – might well be dead.

-

Ever heard the underwriting joke about how to spot the actuary driving a car?

-

These days almost all reinsurers are officially aboard the ILS bandwagon. But is all ILS capacity created equal?

-

As a journalist, you quickly learn the Q&A sessions that follow industry presentations are often among the most illuminating exchanges of an event and can give you a better headline than the official takeaway points.

-

London may be a huge city, but there are a few things that can make it feel like a village, when all inhabitants are in sync and turning out to enjoy their home town together.

-

Earlier this year, while reinsurance risk-takers were being buffeted by winter storm losses and rising wildfire and hurricane claims, another niche corner of the financial markets was experiencing its own "vol-mageddon".

-

In the past week, several signs of distress have been emerging in the (re)insurance industry, which had seemed to rebound so quickly from last year's catastrophes.

-

Is catastrophe risk as exotic as the reinsurance industry thinks it is?

-

One of the major post-HIM talking points in reinsurance circles was the question of whether there was a gap in loss estimates recognised by individual carriers and the overall anticipated industry burden.

-

I took a three-week holiday in the sun in December - not the sort of thing you want to go bragging about in the reinsurance market when many people are working late nights in the run-up to the 1.1 renewals

-

Smart beta products seem to be the flavour of the month

-

At this point there are a lot of questions being asked in the reinsurance markets and few definitive answers available. As it is a journalist's privilege to ask questions, let's go through some on the list

-

There will be significant volumes of ILS capital trapped at year-end, particularly in the retro segment, but out of this challenge the reinsurance market is looking for opportunities to spin out new products

-

The first week back at the desk after the reinsurance industry's annual Monte Carlo gathering can be a long and difficult slog for executives, having powered through dozens of half-hour meetings and evening receptions in sunny Monaco

-

What a difference a week makes.

-

This is certainly not going to be a year where the reinsurance industry is twiddling its thumbs at the annual Monte Carlo Rendez-Vous.

-

The ILS market has well and truly put its foot on the accelerator this year - with cat bond volumes setting new records and ILS managers competing hard in Florida

-

Access to people with money to spend is closely guarded in the insurance and reinsurance markets. Premium dollars are shepherded carefully from insurance agents to carriers and then brokers before eventually reaching reinsurers and ILS managers.

-

Back in 2013-2014 when the cat bond market was last booming the way it is right now, the boisterous volumes of issuance prompted a bit of philosophising over whether ILS rates had "decoupled" from the traditional market.

-

ILS capacity has acted as the equaliser of Florida hurricane rates. It chased after the extra margin that reinsurers built into their calculations in taking on their peak hurricane risk, with the logical result of helping to erode the margin

-

Reinsurers live and die by their claims-paying ability, and the ILS market is no different.

-

Convergence may be a preferred term for the ILS markets, but arguably it is becoming just as much of a misnomer for today's industry as the now outmoded "alternative reinsurance"

-

As a New Zealander, I grew up accustomed to watching rugby players crash around the field armed with little more than a bit of strapping on their ears.

-

What kind of presents might be waiting for the reinsurance market under this year's Christmas tree?

-

When you've been writing editorials for a few years, the ghosts of columns past inevitably come back to haunt you.

-

The reinsurance industry is dominated by talk of disruptive threats, cutting out loops in the supply chains and getting "closer to the risk".

-

The grand Monte Carlo casino is one of a number of entertainment options open to the horde of reinsurance executives about to descend upon Monaco for the annual Rendez-Vous.

-

Is the ILS market feeling old before its time?

-

Getting "closer to risk" is one of the talking points in the reinsurance market at the moment

-

One of the eternal unanswered questions in the reinsurance market is "what will happen next?"

-

An organised city planner might well look at a road map of the reinsurance sector and weep

-

A few years ago when the pace of the ILS market's expansion really began picking up, the concept of the sector having "decoupled" from the reinsurance market engine was first mooted

-

This week the sharing economy arrived in the insurance sector, with the news that Berkshire Hathaway was among the reinsurance partners backing the imminent launch of peer-to-peer (P2P) carrier Lemonade.

-

Reinsurance cycles may come and go but the seasonal swing from the period of Christmas indulgence to January detox resolution is one that will return every year without fail.

-

Some might argue that sartorial traces of the 1970s or 80s cling to the reinsurance industry: the slipcases overflowing with papers, the Monte Carlo polo tops, the lunch-bedaubed shirt on a Friday afternoon.

-

In the process of watching New Zealand's All Blacks powering through the Rugby World Cup over the past month, I've heard a few explanations of why they're the strongest team on the field these days.

-

Ostensibly the reinsurance industry gathers in Monte Carlo every September to talk about rates for the upcoming January renewals.

-

2015 might be the alternative reinsurance market's chance for a break from the spotlight during the industry's annual Monte Carlo Rendez-Vous.

-

Are ILS managers on a bit of a summer diet?

-

The orthodox history of the convergence market revolution is that the catastrophe reinsurance establishment has been well and truly overturned by the growth of the broader ILS markets

-

No doubt many of you have read recent articles in the financial press advertising the launch of a new book, Making a Market for Acts of God, which has been billed as an anthropological study on "reinsurance tribes at work

-

It's no surprise that participants in the reinsurance industry fight for the power to narrate what is going on in the market.

-

Flexibility is a bit of a double-edged adjective to apply to underwriters in a softening market.

-

ILS fund managers have often critiqued the reinsurance industry's cost base, so it's not surprising to hear them borrowing comparisons from the aviation market to illustrate their value proposition.

-

This month's edition of Trading Risk has involved a fair bit of bean counting to try to sum up the year ahead for the ILS market.

-

Earlier this week, after breaking the news that Montpelier Re was making overtures to potential bidders, The Insurance Insider editor Mark Geoghegan tweeted that one of our bird-watching colleagues should keep his binoculars handy as it seemed it was "mating season" in Bermuda.

-

Do other industries talk about pie as much as the reinsurance sector?

-

The alternative reinsurance market now looks like it has come full circle as one of the industry's longest-standing fund managers looks to set up a rated equity-funded vehicle

-

One of the questions the reinsurance market has been grappling with over the past year is how to make a "strategic sidecar" work

-

While most people in the northern hemisphere are on alert for barbecue weather this summer, reinsurance executives will be on a different type of weather watch - closely tracking tropical storm updates for potential threats to their portfolios

-

The reinsurance market has been asking itself the dreaded "are we there yet" question for quite some time now as it waits to see when rates will stabilise.

-

Reinsurance underwriters place a high value on building up strong relationships with brokers and counterparties, so it's no surprise that talk about the direction of the current market tends to sound like someone reeling from a painful break-up.

-

Earlier this year we covered a speech from Scor CEO Denis Kessler, in which he suggested that the ILS market had been fuelled by ultra-low interest rates - and that the end of quantitative easing in the US would lessen the sector's appeal.

-

It's maybe a bit ironic for the editor of a convergence magazine to be sceptical of the impact that new capital vehicles will have on the market.

-

One of the perks of working for Insider Publishing is that the events we put on make for some great copy.

-

All the kerfuffle at last year's Monte Carlo Rendez-Vous about allegedly naive capital and declining cat bond premiums seems quite ironic now that the January renewals are behind us.

-

This is my last deadline of the year, so sympathies to those who will still be plugging away on renewals until the New Year.

-

After Monte Carlo, Baden-Baden, Trading Risk New York and this month's ILS gathering in Bermuda, the autumn 2013 conference season will be almost at an end, but have all the talk-fests got the sector any closer to knowing what will happen at the 1 January renewals and the mid-year 2014 renewals?

-

The (re)insurance industry is normally vigilant about reminding regulators that they're not banks - dodging the AIG elephant in the room to point out that they got through the crisis fine, thank you very much, and hands off our balance sheets please.

-

Summer is supposed to be a time when the reinsurance market can kick back after settling the mid-year renewals before gearing up again for the madness that is the annual Monte Carlo Rendez-Vous

-

After a runaway first half for cat bonds, talk about "decoupling" from the reinsurance markets is one of the themes of 2013 as capital market participants take the lead in setting their own pricing.

-

Some ILS fund managers might make raking in new mandates look easy, but appearances can be deceptive - going into the sector is not a license to raise money.

-

I learned a new word of jargon this week reading about the RMS(one) platform - apparently ecosystems can be technological these days and not just environmental.

-

I wonder who first used the term "hot capital" to describe the current investor enthusiasm for the alternative reinsurance market?

-

When you think about some of the deals that Berkshire Hathaway has struck in Australasia over the past couple of years it makes you wonder why so much attention is paid to the impact of alternative market capacity on the pricing cycle

-

The convergence market has always insisted that it is not in competition with traditional reinsurers

-

Club deal seems to be exactly the right term for a private cat bond, with all the cliquey-ness that the term implies

-

If I was to pick out the most persistent talking points for the Trading Risk market in 2012, it would be the idea that the convergence market has not only arrived at the party, but is mingling so successfully that barriers between traditional and alternative capacity have broken down.

-

This is just my third hurricane season in the industry, so perhaps you'll understand why I'd started writing 2012 off as another non-event for catastrophe losses in mid-October.

-

The old saying "no news is good news" occurred to me when I was talking to one of the panellists who'll be speaking at our New York Rendez-Vous this month, as he confessed that he wasn't quite sure what he was going to find to talk about.

-

I've only been to the Monte Carlo Rendez-Vous twice, but already the words Monte Carlo and madness have been firmly linked in my mind when it comes to this time in the reinsurance season.

-

It was lovely to catch up with so many of our readers at the Trading Risk awards just a few weeks ago - I hope you all enjoyed yourselves as much as I did

-

Where did the past six months go? Hurricane season is already upon us, it's the Trading Risk awards next week and Monte Carlo bookings are starting to go in the diary.

-

So many cat bond deals upsize these days that you start to wonder if cat bond distributors are pursuing some kind of McDonald's marketing strategy to make the deal look successful in print.

-

There was a fun little video introduction at the recent Securities Industry and Financial Markets Association ILS conference that involved asking passersby on Wall Street what they thought of the world of cat modelling and cat bonds

-

I have spent far more time tussling with spreadsheets and charts in the run-up to this issue than was good for the longevity of my keyboard (it's taken a bit of a bashing).

-

You'll notice that this issue of Trading Risk has a new look, thanks to the great work of our designer Paul.

-

Each month as we send Trading Risk out into the convergence world, I'll spend a few moments wondering what all our readers will make of the new edition - and then the post-deadline surge of relief will take over

-

Are we in danger of creating an exclusive club for the cat bond fraternity, where $100mn is the new threshold for entry to the room?

-

It is with some trepidation that I write this letter in early October, with the US wind season still in train.

-

As the core of the convergence market prepares to descend on the wealthy principality of Monaco this month, I thought I'd give you some tips on how to arrive in style this year.

-

I'll start this summer holiday-inspired comment with a phrase borrowed from the 2011 Trading Risk Awards outstanding contributor of the year, Tony Rettino.

-

In recent years, as we approached the US wind season, the ILS market would be in the throes of a feeding frenzy, with investors gorging on offering circulars until they had to roll away and digest the contents of their stomach.

-

I'm too young to remember the infamous London smogs of the 1950s, or pea-soupers, as the impregnable clouds of coal, industrial emissions and Thames-borne fog were nicknamed.

-

The fact that capital markets investors in the (re)insurance arena are facing natural catastrophe-related claims should not be viewed in a negative light.

-

Mother Nature once again reminded us of her power at the dawn of 2011, with tornadoes and hailstorms across the US Midwest states almost attempting to batter the new year back from whence it came.

-

Who would have thought we would be here today, watching the ILS issuance ticker push above the $5bn mark for the year?

-

As we enter the European wind season with gusto, investor pricing thresholds seem to have swept peril diversification and the energy sector off the top of the market's agenda.