Casualty/GL

-

The influx of capital, combined with a quiet wind season, led to favorable conditions for cedants during 1.1 renewals.

-

Mory Katz joined the broker earlier this year.

-

It is understood around $1bn of premiums could be ceded to the proposed vehicle.

-

Scor's CEO said the P&C market had experienced a “competitive” first half.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

The legacy player is working to secure its first deal, and could look to expand to US E&S.

-

The carrier reported preliminary profits of EUR2.1bn, driven by “very low” major-loss expenditure in P&C re.

-

ILS offers efficient capital for underwriters, but casualty ILS transactions are complex.

-

The casualty ILS business now has $175mn in capital.

-

The program will provide excess casualty coverage across a broad range of industries.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

The reinsurance broker said total reinsurance market capacity was up 5.3% year over year.

-

The vehicle will take a quota share of all of the risks underwritten by Ryan Specialty’s MGA arm.

-

Indirect exposure to cat risk through long-term investors gives Markel optionality.

-

The carrier increased premium by 7% at the January renewals.

-

More than 33,000 claims had been filed as of 5 February.

-

FY24 disclosures show shifting fortunes at reinsurer ILS platforms.

-

EGPI growth at the carrier’s Alternative Solutions unit jumped 29.6%.

-

CEO Jim Williamson said social inflation was a “growing barrier” to a vibrant economy.

-

The (re)insurer recorded a reserve charge of nearly $1.3bn within its casualty insurance book.

-

He was appointed acting CEO earlier this month, after Andrade’s departure.

-

Amin Touahri spent five years in a variety of roles at Munich Re.

-

Andrade is taking up a CEO role at another “prominent financial services firm”, Everest said.

-

Investment in the space comes mainly from the cat bond market, Gallagher Re said.

-

Increased reinsurance capacity was more than sufficient to meet continued growth in global demand.

-

Casualty ILS made inroads, while hurricane hedging strategies came into focus.

-

Strong growth in fee income builds on the favourable rating environment.

-

The reinsurer took $743mn of nat-cat losses in the quarter.

-

Nat cat pricing is expected to be more or less flat, with rises on loss-affected programmes.

-

Reserve risk specialist Enstar has struck its first deals in the ILS space this year.

-

Risk remote strategies, including private ILS, have outperformed higher risk strategies over the last decade.

-

Praedicat CEO Bob Reville outlined the firm’s approach to "casualty cat" as liability risk modeling continues to mature.

-

The facility will provide reinsurance coverage over three underwriting years.

-

-

The carrier said European cat business needs further price improvement.

-

The number of sponsors has risen from 46 about a year ago to 66 over the last 12 months.

-

-

The transaction complements its previous acquisition of RMS in 2021.

-

Growth was driven by strong returns and new investors entering the market.

-

Winning higher-fee private ILS mandates will strengthen firms’ negotiating positions.

-

Sidecar vehicles are being tailored to match investors’ objectives.

-

The executive explored ILS options as MD of hedge fund Horton Point post financial crisis.

-

The moves mark a major step in realising “trillion dollar” casualty ILS potential, according to Ledger Investing CEO Samir Shah.

-

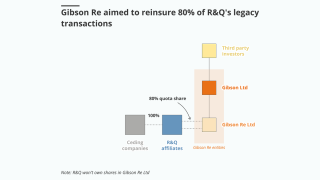

ILS investors’ stress over Gibson Re is unlikely to inhibit legacy ILS’s future.

-

The firm also posted a 56% increase in fee income.

-

The property market remains “one of the most favorable ... I've seen in my career,” the executive said.

-

The executive joined in January after a decade at Liberty Mutual.

-

The broker said it did not anticipate a slew of new entrants, with the possible exception of casualty start-ups.

-

Amy Stern started her career as vice president of group reinsurance at Zurich Re.

-

Aspen said reduced reinsurance appetite made it a good time to seek alternative capacity.

-

The former Ledger director was joined by fellow ex-Ledger employees to “hit the ground running”.

-

The firm said it was poised to build on ‘significant growth’ in 2023.

-

The firm reallocated from short-tail lines amid social inflation concerns.

-

The ILS allocator has invested in the asset class over 17 years.

-

The hire has 20 years’ experience in asset management and corporate finance.

-

The broker’s report also hailed the best risk-adjusted margins for ILS investors in a decade.

-

The broker said global cat rates rose 3% in the 1 January reinsurance renewals.

-

Reinsurers are making some adjustments to secure target signings but appetite to grow is finely balanced.

-

Fish Bond Re will provide coverage for any named storm in Texas on an indemnity, per-occurrence basis.

-

The carrier reported a Q3 combined ratio of 138.8% for casualty within the P&C re unit.

-

The Bermudian firm said it expects the acquisition could drive more growth than the prior forecast of $2.7bn incremental premium.

-

The carrier continued to experience a significant level of catastrophe losses this year, which resulted in lower year-to-date earnings than expected, according to CFO Frey.

-

The reinsurer said hardening of property reinsurance conditions must continue.

-

Mallen previously spent over 10 years at Chaucer, most recently as a US casualty reinsurance underwriter.

-

The sidecar has been launched alongside partner Stone Point Credit Adviser.

-

CEO Jean-Jacques Henchoz said it was “difficult to find a positive trend” in the global risk outlook.

-

The transaction covered a portfolio of $250mn in casualty risk premiums.

-

The AuM total hits $12.1bn when including Top Layer Re and RenRe’s own participation.

-

The company has already seen submissions from MGAs that are potentially looking for a new fronting partner.

-

CFO John Dacey said the carrier remains underweight in Florida due to concerns around underlying economics.

-

The scandal over letters of credit at Vesttoo has put a spotlight on the casualty ILS segment, where Ledger Investing is growing market share.

-

Kattan’s role will include establishing the strategy and structure of SiriusPoint’s global ceded reinsurance function, managing the ceded team based in Stockholm and overseeing all reinsurance placements.

-

The obvious question is where is the capital behind the letters of credit that were being pledged on its transactions.

-

The company’s targeted Vescor cat bond would have provided collateral to meet auto and other obligations, but there were multiple structural points of risk for investors.

-

The firm’s statement followed allegations in Israeli tech media of missing collateral linked to deals it was concerned in.

-

The bulk of risks linked to a new investment grade cat bond it is working on relate to US private motor risks, with a fifth from commercial motor.

-

O’Donnell will focus on strategic and tactical operations within global reinsurance alongside his continuing responsibility for Chubb Tempest Re USA.

-

Chuck Scherer will report to Jonathan Reiss, chairman of SRS Bermuda.

-

The ILS manager said returns on casualty ILS were "much higher than on the diversifying nat cat perils such as Italian quake or German flood".

-

Howden Tiger worked on the structure of the deal with the unnamed syndicate.

-

RenRe will be taking control of ILS manager AlphaCat as part of its purchase of Validus Re.

-

The non-catastrophe ILS platform hit a valuation of $1bn after a Series C funding round.

-

The marketing executive previously worked at iCapital and Fitch.

-

-

The company said the result was "encouraging given the challenges of ILS capital raising".

-

The aim is to launch a casualty ILS product that would enable Saudi investors to access US casualty risk.

-

The casualty ILS fund has been on a hiring spree since its $75mn Series B fundraise in June last year.

-

A canvass of Lloyd’s market executives generated an expected combined ratio of 92%-93% for 2022.

-

The carrier is confident the positive cycle will continue as it prepares for April, June and July renewals.

-

The executive was previously head of casualty underwriting for EMEA.

-

Key themes of the renewal that resonated across the ILS investor base include the elevation of attachment points, though lack of take-up of named perils coverage may disappoint some.

-

The former analyst at Aeolus joins the growing number of ILS experts to join the firm.

-

RenRe, Fontana’s owner, said earlier this year that it was considering getting a rating for the casualty and specialty sidecar.

-

She succeeds William Mills, who left his role as group head of ceded re and third-party capital for Allianz.

-

The reinsurer is ready to “walk away from business” where it feels pricing and terms and conditions are not good enough.

-

The Bermudian reinsurer said both appointments are effective January 1, 2023.

-

Transparency and alignment of interests are the keys to expanding casualty ILS.

-

The casualty ILS platform said it now expects to do more secondary transactions.

-

The Bermudian’s operating loss per share, however, grew nearly four times from the prior-year quarter to $5.28 per share.

-

The company will use the funds to expand its global presence, enhance its marketplace platform and widen its offering.

-

The reinsurer said it will look to double rates and retentions and halve the amount of override on casualty quota shares.

-

The casualty ILS platform is building out its team following a Series B fundraise.

-

The expansive broker has also hired Mario Binetti from Everest Re as head of casualty treaty and actuarial.

-

ABIR reported that Bermudians posted a total loss ratio of 69.9% and a combined ratio of 100.1% last year.

-

Former Natixis banker Alexandre Delacroix will focus on a range of capital market activities.

-

Neyme was previously vice president, US casualty treaty.

-

The firm hopes to offer investors legacy and live risk in the future.

-

Ledger is on a hiring spree after a $75mn Series B round.

-

Based in Morristown, New Jersey, the executive will report directly to Victor CEO Brian Hanuschak.

-

HSCM has had a majority stake in the company since 2020.

-

The CEO said reduced ILS appetite was a “net positive” for the carrier.

-

The executive will rejoin as EVP, reinsurance purchasing and risk capital optimization.

-

Australia and Florida buyers faced capacity problems as inflation drives up pricing.

-

The property reinsurance market may be fast approaching a true ‘hard’ market, the broker said.

-

Pricing has settled at the top end of the reinsurer’s original guidance.

-

In this newly created role, Joe Stuhl will lead the reinsurance organization’s global distribution strategy and address emerging needs.

-

The executive will report to Everest Group COO and head of reinsurance Jim Williamson.

-

The agency said casualty risk was attractive to investors for its low-to-moderate correlation.

-

It is the reinsurance company’s first entry to the cat bond market.

-

The reorganisation is one of the first major changes to the reinsurance arm since Nancy Bewlay became CEO of the division.

-

The firm reserved $40mn for Ukraine, citing ‘small net losses’ in Re & ILS.

-

Higher interest rates drove investment write-downs that offset a turnaround in underwriting performance after last year’s first quarter was hit by Uri losses.

-

Mango was a respected industry leader and played a key role in elevating the company’s culture of rigorous risk management.

-

Fontana investors will face a short lock-up period in the sidecar’s ramp-up phase, but thereafter there will be some “embedded liquidity.”

-

The new platform extends RenRe’s suite of ILS and reinsurance strategies.

-

The executive will oversee management liability, healthcare and casualty/specialty reinsurance.

-

The carrier has introduced a number of ESG-focused roles, which sees Cathal Carr, SVP, underwriting, appointed as global head of climate and sustainability strategy.

-

Having set up its London Bridge ILS platform, Lloyd’s believes it can leverage its reinsurance-to-close (RITC) mechanism to develop an ILS market for casualty, CFO Burkhard Keese said on a results call yesterday.

-

The casualty ILS platform said it had handled more money in the past three weeks than in its first three years.

-

A tsunami advisory is in place in the Fukushima area.

-

The new chief joined XL Catlin in 2017 and previously worked for Swiss Re and CV Starr.

-

Some programs had to be restructured as rates hardened and capacity flowed away from cat risk in some cases.

-

The firm says it has condensed the securitisation process into weeks rather than months

-

The “squeezed middle” of the reinsurance sector is under pressure, but attritional risk aversion could drive ongoing changes.

-

The recruit was formerly a portfolio manager at Nephila Capital.

-

SiriusPoint has hired Andreas Kull as its new chief risk officer, the Bermudian carrier announced.

-

After raising around $150mn to open its Nanorock fund, Ledger Investing believes casualty business is set to capture more investor interest.

-

Tim Ronda was president of Aon’s US reinsurance business and was recently given a new global leadership role.

-

The manager said last year it wanted to deploy $100mn to $200mn in casualty ILS.

-

From ESG to social inflation, systemic risk to cat risk, we highlight some of the top discussions from this year’s four-day virtual conference.

-

Kevin O’Donnell also said he saw social inflation as more of a concern for the industry than climate change.

-

A reinsurance panel at Reconnect also called for reform of risk models

-

The speciality residential and commercial house has a focus on earthquake, hurricane and flood risk.

-

The carriers with the largest Louisiana market shares also ceded more than $100mn to Lloyd’s syndicates during 2020.

-

Across London, the US and Bermuda, Ascot Re will provide P&C, PI and specialty lines cover via its new aligned division.

-

Reinsurers are talking about a new era of elevated risks, but their behaviour may signal a more relaxed view heading into 2022.

-

Jasmine DeSilva will work on strategic initiatives and business development for the ILS services provider.

-

This came as the insurer said its reinsurance programme was oversubscribed and it expected rate increases to be in a mid single digit range.

-

The firm reported a $100mn drop in ILS AuM to $1.4bn, although previously had said deployable capital was lower.

-

The reinsurer adds $300mn to the unit’s pandemic reserving in Q4 and slashes premium volumes by 11% at the renewals.

-

The Floridian has also incurred $23mn of net catastrophe losses in Q4 before tax.

-

The $296mn of reported cat losses were down 31% year on year.

-

The analyst predicts the insurance sector could experience its best performance in nearly a decade.

-

The Convex CEO reiterates his prediction of a potential $200bn casualty-reserving deficit and anticipates a similar amount of Covid claims.

-

The start-up adds Angus Hampton as head of international casualty and reports a quota-share focus during the renewals.

-

The new classification will allow the carrier to increase GWP and third-party risk.

-

Former president Widdicombe has taken the role of chairman, as planned, but won’t serve on any board committee.

-

Former Canopius marine treaty head Andrew Gladwin becomes CEO of the British entity.

-

-

Nearly 80% of respondents said underwriting capacity decreased in the quarter.

-

The reinsurers point to falling interest rates and loss experience as the basis for further hardening.

-

The reinsurance CEO says Swiss Re will cut back its US casualty share.

-

The executive will work alongside outgoing chief Richard Pryce for the next few months.

-

-

The Samir Shah-led firm has transferred risks for more than 15 MGAs.

-

July rains and typhoons Maysak and Haishen severely damaged Kyushu region, the body said.

-

Alternative capital reduced by around $3bn in H1 2020 due to trapping.

-

Joe Jackson becomes the latest in a line of retro or reinsurance brokers to transfer to the smaller intermediary.

-

The former Everest Re CEO will join the firm after a major US hiring spree.

-

Mallon and Foxall will join a 120-person international reinsurance team later this year.

-

The Aon Reinsurance Aggregate (ARA) stock index fell by 46 percent in the five weeks to 23 March due to Covid-19.

-

P&C (re)insurers are in a stronger position than peers in the life insurance market, according to S&P.

-

The Bermudian platform sources casualty reinsurance deals for hedge funds.

-

Howard left JLT in 2019 following Marsh & McLennan’s takeover.

-

But the carrier’s CEO stressed the importance of moderation in the price hikes.

-

Large cat and man-made losses for the year amounted to $2.3bn.

-

The Everest Re sidecar began 2020 with $819mn of assets under management.

-

Social inflation is not just a Florida issue – it's also top of mind in the casualty market.

-

We've been talking about the reinsurance market being the “squeezed middle” caught in between accelerating primary and retro markets for some time, but could Neon be the first casualty of collateral damage from this phenomenon?

-

Terry Ledbetter will be replaced by president Matthew Freeman from 1 January 2020.

-

Amid the information overload of results season, “man-made catastrophes” appear to be the main emerging theme – albeit manifesting in two very different ways.

-

All the reinsurers want to grow and some leaders continue to pursue growth very aggressively, according to the Scor boss.

-

The reinsurer’s balance sheet strength and parental support were among the factors cited by the ratings agency in its decision.

-

The Bermudian alternative asset manager has named Validus' Jeff Sangster as partner, CFO and head of strategy.

-

The ILS platform’s chief operating officer had helped drive growth to $1.5bn assets under management.

-

The start-up is the first Insurtech to be listed as a member of the new block chain initiative.

-

RenaissanceRe’s funds platform has taken significant losses.

-

Merion Square will invest in property and casualty insurance, annuities and mortality-related ILS products.

-

The insurer is understood to be exploring the possibility of claiming the Camp Fire as two separate events as it looks to maximise reinsurance recoveries.

-

The carrier’s $1.2bn gross loss from the two wildfires would trigger the carrier’s nationwide programme, which attaches above $500mn.

-

Oxbridge Re licensed its Oxbridge Re NS sidecar in the Cayman Islands in June.

-

The reinsurer said the fronting operations were “a very different business” than its own ventures division.

-

The 2017 hurricanes have deteriorated less steeply than events in previous years, JLT Re said.

-

Human behaviour now has a smaller role in determining pricing, according to the broker's president and global head of casualty.

-

The reinsurer has created a new P&C partners unit encompassing its retro and third-party capital strategies as well as insurtech ventures, underwriting management and product development.

-

The Everest Re sidecar’s Q2 claims burden was up by more than 400 percent year on year.

-

Reinsurance chief underwriting officer Emil Issavi has been named as the new CEO of the unit.

-

A court of appeal in Florida has said assignment of benefit rights can be split between multiple parties.

-

Alberto, the first named storm of 2018, made landfall near Panama City, Florida on Sunday.

-

Travelers has returned to the ILS market to renew cover.

-

Axis Re has announced that it has hired Megan Thomas as its chief underwriting officer (CUO).

-

AIR Worldwide and RenaissanceRe said they are collaborating to develop a probabilistic model for extreme liability events.

-

Hiscox Re and ILS reported a profit of £25.5mn ($35.8mn) in 2017, a drop of 83.6 percent on a year earlier, the company said on Monday.

-

MultiStrat has announced that it has completed a $28mn casualty linked securities (CLS) deal covering high-frequency and low-severity casualty business for a $14bn alternative asset manager.

-

XL Group shares jumped 12.5 percent yesterday after a Bloomberg report said the Bermuda-based (re)insurer was drawing takeover interest from Allianz and possibly others.

-

Los Angeles-based modelling company Praedicat has announced it has raised $6mn to develop latency catastrophe models for emerging casualty risk..

-

Renaissance Re has made a minority investment in run-off specialist Catalina, it confirmed in a press release yesterday.

-

A group of sidecars tracked by Trading Risk took losses of 13.0 percent on average between July and October as the fallout from hurricanes Harvey, Irma and Maria took its toll

-

Nephila has provided seed capital for Volante Global, the super managing general agency (MGA) set up by ex-Dual CEO Talbir Bains, which will start writing next year, sister publication The Insurance Insider reported.

-

Guy Carpenter chairman and reinsurance industry heavyweight Britt Newhouse is set to retire at the end of the year, sister publication The Insurance Insider revealed.

-

Markel will be seeking to recruit a new a chief reinsurance officer to oversee its ceded reinsurance after managing director of reinsurance Robert Blazer leaves the specialty carrier, sister publication The Insurance Insider reported.

-

Axis Capital has named Steve Arora as the new CEO of Axis Re, replacing Jay Nichols who resigned earlier this year.

-

JLT Re North America CEO Ed Hochberg has said the scale of insured losses from Hurricane Maria could result in ILS investors changing their view of risk and return.

-

Swiss Re said that its P&C treaty premium volume up for renewal in the mid-year season dropped by 10 percent, as it reported a weaker half-year underwriting result in its P&C reinsurance and specialty insurance corporate solutions unit.

-

Simon Burton, the new CEO of Greenlight Re, said the reinsurer is now looking to enter the subscription market, having focused traditionally on a small number of closed client relationships

-

Guy Carpenter has appointed Tom Hettinger to lead its capital, structured risk, growth and rating agency operations in the US and Canada.

-

Hudson Structured Capital Management and Twelve Capital were the lead investors in a $45.5mn debt issuance from legacy carrier Catalina General Insurance.

-

Hudson Structured Capital Management acted as a lead investor on a $45.5mn private debt arrangement for Catalina General Insurance, the investment manager announced.

-

Markel reported $9.4mn of fee income from third-party investors in Markel Catco funds during the first quarter, up from $7.2mn in the same period a year earlier, reflecting growth in underlying assets.

-

Insured losses from storms and flooding that hit the US over the past week are expected to reach into the hundreds of millions of dollars, according to a report from Impact Forecasting.

-

Casualty reinsurers operating in the US started to push back against historically broad soft-market terms at the January renewals, with most placements renewing flat, sister publication The Insurance Insider reported.

-

Long-tail lines of reinsurance business such as casualty and legacy risk can be adapted to the ILS market, a panel of speakers suggested at the 2016 Bermuda Reinsurance Conference hosted by Standard & Poor's and PWC this week (8 November).

-

Casualty risk offers an opportunity for the ILS industry to expand beyond catastrophe business, according to Willis Capital Markets & Advisory's head of ILS Bill Dubinsky

-

Axis reported $8.1mn of fee income from "strategic capital providers" in the third quarter, up fourfold from $2.1mn a year earlier after it established casualty underwriting vehicle Harrington Re with Blackstone.

-

AIG has recruited former Chubb reinsurance buyer Mark James in a senior ceded risk role, sister publication The Insurance Insider reported

-

A $6mn investment in the Bellemeade Re mortgage insurance securitisation was the only ILS instrument held by the Blackstone Alternative Investment Funds as at 31 March 2016, according to annual report filings

-

Swiss Re has announced that its current CEO of reinsurance for Asia, Moses Ojeisekhoba, will become reinsurance CEO later this year

-

American International Group (AIG) has followed through on plans to make greater use of reinsurance after agreeing a two-year quota share deal with Swiss Re covering its US casualty book.

-

Swiss Re reported 2015 results that were boosted by low catastrophes and a $183mn one-off tax gain in the fourth quarter.

-

AIG picked out expanded use of reinsurance as one of six ways that will help it return at least $25bn to shareholders over the next two years.

-

The non-life reinsurance market will likely fall into an underwriting loss in 2016 if natural catastrophe losses return to historical averages, with the deficit deepening in 2017, according to predictions by Swiss Re chief economist Kurt Karl.

-

TigerRisk has been marketing a derivative product that triggers off a Lloyd's index, which could offer ILS funds exposure to a range of specialty business written within the London market, Trading Risk understands.

-

Aspen Re has recruited Deutsche Bank executive James Lee to work in its $185mn capital markets unit, Trading Risk can reveal

-

Liquidity has improved in the ILS market across all tradeable instruments, according to Tullett Prebon's head of cat bond trading Steve Emmerson

-

Aspen is believed to have chosen an asset management partner for a hedge fund reinsurer vehicle, sister publication The Insurance Insider has reported

-

Swiss Re said it wrote 7 percent more P&C reinsurance premiums in the April renewals than in 2014, expanding in high growth markets to add $1.5bn of premium to its books.

-

Casualty reinsurance may never see significant involvement from the ILS market, Credit Suisse Asset Management's (CSAM) head of ILS Niklaus Hilti said in a speech delivered to Insurance Institute of London members at Lloyd's today.

-

Further broking facilities targeting alternative market partners are expected to emerge following the recently announced Nephila-Amwins arrangement.

-

XL and Catlin have agreed on the reinsurance leadership structure following their merger, which will establish five regional CEOs all reporting to group reinsurance head Greg Hendrick

-

Moody's has estimated that catastrophe reinsurance rates will fall by 10 percent in 2015, less than the 15+ percent reduction in 2014, according to its 2015 Global Reinsurance Outlook report.