-

The bond will provide protection against US wind with a PCS trigger.

-

The carrier will continue to write assumed retro in Bermuda.

-

The sidecar will support five programs providing specialty frequency coverages.

-

The market has learned lessons from earlier soft market phases that it will apply now.

-

Nick Fallon is the latest in a string of retro-broker moves in the market.

-

Syndicate 1440 was approved to assume business incepting January 2026.

-

The ratings agency warned negative PYD on US casualty will likely continue.

-

The CUO has added the role of head of private ILS, joining the executive team.

-

The reinsurer’s capacity is hugely important to ILS firms, with few alternative providers.

-

Reinsurers are confident on cat rates and ready to deploy ILS capital.

-

The firm’s ILS vehicles posted low single-digit growth in assets under management in Q2.

-

The reinsurer plans to repeat its 2025 purchasing for property and specialty protections.

-

The firm booked net losses from the LA wildfires of EUR615.1mn in the first half.

-

This brings the carrier’s total limit on the program to $1.8bn.

-

The Bermuda SPI will write a quota share of SageSure’s captive Anchor Re.

-

The broker has nearly 20 years of experience in the reinsurance and retro markets.

-

The Diversified Alternative Fund’s allocation to cat bonds was up by 31% from $386mn at 31 January.

-

The fund’s ILS portfolio is split between 70% property cat and 30% cyber risk.

-

The third-party capital manager is a new entrant to the retro space.

-

Buyers have turned to retro markets for covers where ILW pricing is less attractive.

-

The Bermuda-based team is led by John Fletcher.

-

ILS offers efficient capital for underwriters, but casualty ILS transactions are complex.

-

The Altamont-backed broker has been building out its team since launching in 2023.

-

One dollar-denominated deal has opted to hold collateral in EBRC notes.

-

Price guidance for the bond is 4.00%-4.50%.

-

The reinsurer has already dipped into the cat bond market with its Stabilitas Re retro deals.

-

Wildfire losses from fronting and ILS activities were EUR438mn.

-

The team will focus on building out Miller’s property treaty, retro and ILS capabilities, it’s understood.

-

The buzz in the air at ILS Connect told of a market entering its next growth phase.

-

Investor interest and capital flows point to potential for ILS proliferation.

-

The firm announced CEO Trevor Carvey will retire and is returning to the UK from Bermuda.

-

The deal is 45% larger than 2024’s issuance after attracting a “greater number of investors”.

-

This will be the third cat bond issuance through Baltic Re PCC.

-

The cat bond manager warned of excess downside risk owing to an accumulation of losses.

-

The reinsurer had taken the opportunity to buy more limit across event and aggregate covers.

-

The largest individual net loss at EUR230mn was caused by Hurricane Milton.

-

The role will focus on international treaty, specialty lines and strategic advisory.

-

The role oversees the $187bn Canadian pension plan’s ILS allocation.

-

The cost of reinstatement was included in $170mn wildfire net loss figure.

-

The terrorism pool has shifted its programme from facultative to an XoL arrangement.

-

DaVinci equity plus debt stood at $3.25bn as of 31 December.

-

The firm ceded $417mn of premiums to the sidecar in 2024.

-

Wildfire loss ‘serves as a strong reminder not to unwind hard-fought for rates and terms’, the executive said.

-

Scrocca will be based in Bermuda on focus on underwriting and risk sourcing, among other things.

-

The deal is being issued through Lloyd’s London Bridge 2 PCC.

-

The bond will provide coverage for named storms in North Carolina.

-

The reinsurer has cut the cession rate to 33% from 40% last year.

-

Theokli joined the company in 2021 as a senior underwriter.

-

The reinsurer added two new tranches to its 2025 issuance.

-

Peril- and geography-specific deals are being well received by investors.

-

A negative January return will be unprecedented for ILS industry.

-

The index delivered a total return of 1.29% for the month of December.

-

The renewal marks the seventh issue of the retro vehicle.

-

Investment in the space comes mainly from the cat bond market, Gallagher Re said.

-

Over-subscriptions have been evident on well-priced US cat treaties.

-

Increased reinsurance capacity was more than sufficient to meet continued growth in global demand.

-

The firm has commenced writing collateralised retro and reinsurance but its rated launch is still pending.

-

First-time sponsor QBE secured $250mn of quake and storm coverage.

-

Recoletos Re DAC SPI takes its name from the Paseo de Recoletos boulevard in Madrid.

-

The firm said it benefited from favourable retro market conditions.

-

The firm has added three new retro partners during 2024.

-

Former ILS investors who left the space have looked again and re-allocated.

-

Management track record has been a factor in capital raising for 2025.

-

Fidelis is seeking more cat bond cover than it did almost a year ago.

-

The firm is understood to be reviewing contracts to bind coverage for 1 January.

-

The reinsurer took $743mn of nat-cat losses in the quarter.

-

Tyler left Gallagher Re earlier this year.

-

The reinsurer confirmed its intention to reduce the K-Cession sidecar for 2025.

-

The low PCS number is presenting a challenge for ILW buyers and sellers.

-

The reinsurer is planning to drop its cession rate from 40% to 30%-35%.

-

The loss tally is considerably lower than estimates issued by model vendors.

-

Cat bonds, private ILS and retro were all kept at “strongly overweight”.

-

Managers expect Hurricane Milton losses to shore up pricing.

-

Many in the ILS sector are bullish on Milton losses falling at the lower end of earnings impacts.

-

Post-Milton investor interest in ILS has yet to translate into dollars allocated.

-

The Dutch scheme is the largest ILS allocator with a long list of mandates within the sector.

-

The ILS industry alumnus is understood to have two ILS investors lined up.

-

Hurricane Milton will show the ILS product behaving as investors expect it to.

-

A $40bn Milton loss should barely dent many ILS returns but will trap some capital.

-

The reinsurer said retro pricing had ‘moved slightly in our favour’ at 1 January.

-

The depth of the retro market recovery will be an influential factor in the pace of the cat market slowdown from here.

-

The investment firm said cat bond spreads that are elevated relative to historical levels continue to offer an attractive entry point for investors.

-

Projected 2024 ILS returns remain historically high, but signs of increased appetite for top-layer cat risk and top-end retro raise questions over how long this will last.

-

The pricing on the deal has settled below initial guidance at 7.5%.

-

The firm said it would cut its K-cession ‘significantly below 2023 levels’ and buy ‘broadly similar towers of non-proportional retro’ at 1 January.

-

Sang Hun Park previously spent nine years at Allianz before joining Munich Re as a senior origination manager in August 2021.

-

The capital management platform remains active but January renewals were fronted by the balance sheet.

-

The carrier has increased its retro capacity by 56% to EUR1.34bn.

-

More retrocession capacity is likely to be deployed during 2023 as pricing holds up across the primary, reinsurance and retro markets, according to Conduit Re.

-

The intermediary recorded “one of the hardest reinsurance markets in living memory” as primary rate increases slowed.

-

The exit highlights increasingly difficult conditions in the retro and reinsurance markets.

-

The carrier has become the latest in a string of reinsurers unwilling to write retro at 1 January.

-

The RenRe vehicle, formerly a major retro writer, has been a reduced force this year.

-

It is understood that Ascot will continue to write worldwide retro business.

-

Hannover Re said that it expected its total gross Ian losses to be slightly below EUR400mn.

-

Fidelis and MS Reinsurance are among the ceding companies that have support from Ajit Jain’s unit.

-

The firm’s European regional treaty cover shrank 9% to $398m.

-

The firm assigned a neutral outlook overall to ILS but is strongly positive on many non-life risks as it seeks diversifying strategies that can withstand inflation.

-

Rates have climbed 20%-35% since 1 January, and 40%-50% year on year, sources estimated.

-

It noted that its aviation and marine books are covered by retro although its exposure is “not very material”.

-

It will offer components for buyers looking for indemnity, parametric or blended coverage.

-

The carrier took a net EUR838mn of cat losses in the full year.

-

The carrier’s whole-account XoL retro also shrank by a similar margin.

-

Greater participation of cat bond investors in the retro market has some advantages alongside the risks.

-

Retro renewals have made major progress in early January, but programme gaps remain at some levels, with reinsurers left carrying more risk net.

-

Some programs had to be restructured as rates hardened and capacity flowed away from cat risk in some cases.

-

The move comes amid limited availability of annual aggregate cover.

-

CyberCube forecast further capital market capacity will hit the cyber insurance market next year.

-

1 January renewals are running late across the board as reinsurers hold out for improved terms, but the retro segment is the most challenged for capacity.

-

The carrier is looking to raise annual aggregate protection from the new ILS deal.

-

The retro renewals are barely underway, as a challenging fundraising environment and queries over loss experience has delayed the typical pace of progress.

-

The insurer said its plan was to fully transition the book to the fund.

-

The CFO said today’s favourable nine-month numbers were due to a sustained effort to improve P&C underwriting discipline.

-

Surpassing the $30bn threshold will trigger more occurrence covers, as another painful year looms for aggregate writers.

-

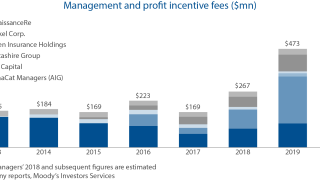

The convergence of traditional reinsurance and ILS has seen reinsurers’ fee income rocket over the past three years.

-

Retro rates were in some cases falling by mid-year, ahead of the recent losses.

-

Hannover Re CEO Jean-Jacques Henchoz told Trading Risk there was a “question mark” about whether demand would carry over into next year.

-

Outside the US, two Indian cyclones are expected to have caused more than $4.5bn of economic losses.

-

The former Peak Capital CEO has left the ILS platform he set up.

-

Initially, negotiations are likely to be led by risk takers but there could be a case to model a future role for service providers.

-

There is little sign of retro demand returning after buyers cut back in January.

-

-

The start-up's new hire was a founding member of the leadership team at Fosun-owned Peak Re.

-

The former Bermuda Brokers and JLT Re broker says ILW appetite is expected to remain strong after benefitting from pandemic trading activity.

-

The executive will take up the Hong Kong-based post on 1 September.

-

The carrier last year said its K sidecar would pick up Covid claims over time.

-

One swallow doesn't make a summer, but what do two retro "cashback" transactions portend for hurricane season?

-

Simon Moore has joined Lockton Re as a senior broker in the company’s non-marine retro and property specialty team, based in London.

-

Hannover Re and Fidelis provided significant capacity on the Munich Re-led programme.

-

ARPC said the move improves the pool’s capital strength.

-

ARPC said the move improves the pool’s capital strength.

-

The reinsurer was chasing a high 15% net return target but said lower demand and capital trapping made this unachievable

-

The Bermuda-based broker is believed to be heading to Corant along with other hires.

-

Some markets on the programme have pushed back on the inclusion of event cancellation exposures.

-

A new mandate from an institutional investor has seeded the strategy.

-

The capital supports the MGA’s excess retro portfolio.

-

The retro specialist joins the firm as it prepares to expand its reinsurance interests after spinning out of Willis.

-

The broker forecast that this hard market may be more akin to the “discriminate and relatively short-lived" phase following 2005.

-

Aggregate retro capacity has “reduced enormously” but rate increases were less severe than some had feared, the Willis Re international chairman said.

-

Capacity was constrained but some ILS funds were able to grow, while cat bonds also propped up supply.

-

New capacity and fewer problems with trapping contributed to a smoother renewal than some had expected.

-

This is the carrier’s first public cat bond after a private deal done through Guy Carp’s Cerulean platform in 2019.

-

The executive will lead the retrocession and property specialty segments.

-

If the fundraise closes, the business will operate as a “permanent capital” monoline retrocessionaire.

-

Pessimism around trapped capital is growing, but low reported losses may mitigate the issue.

-

Scor sought higher-priced agg cover, but Munich Re achieved below-average uplift on its occurrence treaty.

-

Retro deals make up a third of this year's volumes, versus a quarter in 2019.

-

Investors from the ILS boom era are also those who've had the least luck, so fundraising remains a slog.

-

Covid-19 may have been the biggest talking point in the (re)insurance markets this year but arguably, the pandemic is being overtaken by several other factors – ILS market dynamics amongst them.

-

RenRe thinks the major cat losses of Q3 will cause the property cat market to harden throughout 2021.

-

The carrier says higher retro renewal costs will act as a counterweight to rising rates.

-

Hannover Re's K sidecar includes exposure to the aviation market, but overall ILS participation in such risks is limited.

-

The move marks the company’s fifth round of share redemptions since going into run-off.

-

If reinsurers prevail in limiting insurers from aggregating BI claims, this will shield retro markets.

-

Total insured losses are well up on 2019, but the severity of individual blazes is not likely to impact reinsurers extensively.

-

Retro structural change will provide a lot of the gains in 2021, with trapping negotiations complicating the mix.

-

Collateralised capacity will retain an important role in the retro niche.

-

The carrier's Ada Re vehicle will join its Turing Re sidecar, but its capacity is not known.

-

The CEOs of Aon Reinsurance Solutions, Willis Re and TigerRisk predict limited rate gains, but up to $10bn of incoming capital.

-

A much harder retro market is driving reinsurance price increases.

-

Having fuelled up on retro to grow, some carriers may need to focus on managing net exposures.

-

The retro space is expected to move towards named peril covers as rates approach post-Hurricane Katrina levels.

-

The market is also interested in more liquid cat bonds, the reinsurer said at a press conference on Monday.

-

The release from side pockets will be paid to the company in October.

-

Retro specialist Richard Wheeler will head the unit, which will focus on sourcing third-party capacity.

-

Earlier this month, we recapped some of the issues causing rising tensions in the retro market, where providers are pushing for release of capital trapped in connection to Covid-19 claims.

-

The P&C business posted a EUR167.9mn underwriting deficit on EUR380mn in Covid-19-related losses.

-

With the fundraising season approaching, tensions are rising over several points of dispute.

-

CEO Kevin O'Donnell also noted that RenRe had dropped one-third of its Florida clients.

-

Following two decades at Aon Benfield, he will join Lockton sometime next year after his gardening leave.

-

The (re)insurer placed a new $100mn enterprise cover, ahead of the $350mn bond elapsing.

-

Willis Re's head of international says clear reinsurance rating momentum falls short of being a true hard market phase.

-

An influx of underwriting capacity will likely limit the extent to which reinsurance rates rise, the agency said.

-

People moves in the ILS marketplace.

-

Bond spreads settled at the lower end of the revised guidance.

-

Jeremy Lee had been at Aon and Benfield for over 22 years.

-

Limited mid-year trading has continued but buyers have cut back.

-

The capital release was largely connected to 2019 side pockets.

-

RenaissanceRe raised $913mn from a new share issuance last week, with joint venture partner State Farm investing a further $75mn.

-

Trading was brought forward this year and more cedants could head to bond market.

-

The bond will renew only part of previous Blue Halo cover benefitting Nephila's fronting partner.

-

Collateralised re and sidecars are more likely to become subject to legal disputes around wording, the agency said.

-

The ratings agency said positive innovation efforts were partly offset by high dependency on retro.

-

If Covid-19 is a slow-growing loss, fundraising may not come in through fast-access ILS routes.

-

Reinsurers push back on aggregate exposure from cascading covers as market gets more differentiated.

-

Retro deals are seen as a particular concern over growing fears that trapped capital will again be an issue in 2021, as post-2017 innovations will be tested out.

-

BI may seep into some reinsurance and retrocession covers but insurers will take the biggest hit, said the head of ILS at Schroders.

-

Peak Capital will continue to focus on its flagship retro strategy as it develops fresh offerings.

-

-

Spillover from the Covid-19 stock and bond market crashes made for some turbulence towards the end of the quarter despite the impressive volumes issued.

-

The reinsurer is moving to expand its North American business.

-

Catastrophe losses saw a 31 percent hit to the fund's 2019 portfolio with attritional losses coming in more than three times as high as budgeted.

-

The firm's K sidecar avoided major Dorian claims, as the firm also grew its whole-account covers.

-

This came as major losses ceded to retro partners reached EUR541mn.

-

The mutual added a £100mn lower layer to reduce the attachment point to £400mn.

-

Collateral negotiations are coming to the fore in retro renewals.

-

The fund has cut back in retro but plans US insurance expansion.

-

The fund intends to pay 90 percent of its current cash to investors with much of its portfolio held in side pockets.

-

The UK terrorism insurance scheme looks to add additional layers to its main 1 March retrocession renewal.

-

The carrier said the market was in the early stages of rate change and it was hard to know how long improvements would last.

-

The firm will consider writing more retro after raising $300mn new equity.

-

Pricing slipped to the lower ends of the guidance ranges as the reinsurer upsized a hurricane tranche of the trade, sources said.

-

The former Aon retro broker was previously CEO of the UK arm at Fidelis.

-

Bermuda carrier tactics highlight increased reliance.

-

Further retro price increases at 1 January may not have yet produced much impact on the underlying reinsurance markets, but the true test will come at 1 June.

-

New issuances fell to the lowest level since 2011, amid an uptick in risk levels and US exposures, according to Trading Risk data.

-

The retro transaction priced below the target range, according to sources.

-

Trapped collateral left overall capacity flat, despite a 5 percent increase in rated capital.

-

Hyperion X estimated retro rates have risen to around 140 percent of their pre-Irma levels.

-

Over the past year, Willis Re's index shows riskier deals and a hardening market have lifted average cat bond yields.

-

The broker's chairman of international business James Vickers said reinsurers are only trimming capacity on the edges of the cat market.

-

The broker’s 1st View report highlighted diverging reinsurer tactics and segmented renewal outcomes.

-

US cat reinsurance renewals moved flatter than expected as 1.1 neared.

-

The reinsurer was among the blue-chip cedants to benefit from an earlier renewal and occurrence structure.

-

Risk-adjusted rate increases have put returns back to 2014 era benchmarks, sources estimated.

-

The main disrupted segments are still aggregate retro and sidecar vehicles, where negotiations over the level of trapped capital have held up the renewal process.

-

The cat bond is the second Matterhorn deal to be launched by the (re)insurer this year.

-

In its first public cat bond since 2013, the firm joins peers in seeking aggregate retro cover.

-

Despite early fears that the storm could rival last year’s Jebi in losses, expectations are converging around the $10bn level.

-

The reinsurer said use of third-party capital will limit its net retentions while permitting overall growth.

-

We've been talking about the reinsurance market being the “squeezed middle” caught in between accelerating primary and retro markets for some time, but could Neon be the first casualty of collateral damage from this phenomenon?

-

A lockup in retro capacity linked to the Japanese typhoons will further encourage reinsurers to raise rates, AIG’s Kean Driscoll said yesterday.

-

Hagibis losses have become the most costly event this year for the retro fund

-

The retro renewals are still in the calm-before-the storm phase but it seems that capacity limitations are set to open up more of a role for opportunistic players.

-

The firm also added former Aon brokers Robert Johnston and Peter Komposch to the Bermuda office amid the reshuffle.

-

Lodgepine departs from the pillared structure of Markel Catco, Markel co-CEO Richie Whitt said.

-

The reinsurer reported a gross loss of EUR207.7mn ($230.2mn) for Dorian and EUR167.2mn for Faxai.

-

Retro fundraising hits the wall, with Eklund downing tools on start-up.