-

The Italian asset manager also plans to relaunch its multi-strategy ILS fund.

-

The industry has continued to build and innovate through a third strong year of performance.

-

Man AHL Cat Bond Strategy has $1bn in assets, around 2% of Man AHL Partners’ total of $54bn.

-

The TPA approach to investing was adopted by US pension fund Calpers last month.

-

Competition on price from traditional markets is weighing on bond market momentum.

-

The cedant’s current deal is due to mature at the end of January 2026.

-

Investor interest is warming up following a colder spell over the past several years.

-

The award of the mandates marks the California public pension plan’s entry into ILS.

-

ILS has been a driver of innovation in reinsurance, Convergence 2025 attendees heard Wednesday.

-

The funds will combine credit and ILS holdings.

-

Returns from cat risk investments stood at 20.1% for the year to 30 June 2025.

-

The allocation is around 3% of the fund’s total assets.

-

Sources have said $1bn+ of fresh capital from the region is expected to be deployed in 2026.

-

The facility will initially focus on US, Bermudian and European business.

-

The Bermuda firm said HS Sawmill reflected its continued focus on life insurance.

-

The resource was developed by leading ILS managers and investors.

-

Samild held multiple roles including head of alternatives at the Future Fund.

-

The ILS manager has $6.8bn in assets and will be led by MariaGiovanna Guatteri.

-

ILS executives talked pricing, capacity and opportunities in casualty at an ILS roundtable in Monte Carlo.

-

The target allocation to Munich Re, Elementum and the run-off AlphaCat funds fell in the year to 30 June 2025.

-

The capital supported sidecar-style syndicates and reinsurance start-ups.

-

The agency noted inflows to cat bond funds and investor interest in private ILS.

-

Dedicated reinsurance capital is on track to increase by 8% in 2025, the broker said.

-

ILS accounted for 2.5% of the pension fund’s total AuM.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

The sidecar took $19mn of cat losses relating to the California wildfires.

-

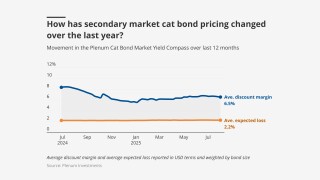

The yield figure comprises 6.53% of insurance discount margin and 4.28% risk-free.

-

Investors are drawing lessons from life deals to find new routes into insurance markets.

-

The Bermuda SPI will write a quota share of SageSure’s captive Anchor Re.

-

Canio spent over 19 years with PGGM, with nine of those managing ILS.

-

We discuss progress in collateral management with our Outstanding Contributor winner.

-

Former ILS lead Matt Holland left the company in May.

-

Some $400mn of bonds priced in the past week, after a record-setting H1.

-

The recommended “AIF lite” structure could be suited to cat bond lites.

-

The fund’s ILS portfolio is split between 70% property cat and 30% cyber risk.

-

The investment consultancy said yields increased in Q2 by less than could have been expected.

-

The Cayman Islands-domiciled SPI now has four institutional backers.

-

Initial responses to ESMA’s report welcomed the long timeframes for any changes.

-

Michael Hamer recognised for his work with investors and on reporting frameworks.

-

The awards celebration took place at the Hilton Bankside on 25 June.

-

The pensions scheme’s existing ILS holdings to Aeolus and HSCM are in run-off.

-

M&A and shifts in distribution arrangements bring risks and opportunities.

-

The fund lists Twelve, Swiss Re and Cambridge Associates as managers.

-

Investors eyeing private ILS include opportunistic allocators keeping watch on storm season.

-

The pension plan noted in June 2024 that it was exploring new options in ILS.

-

The man is alleged to have conspired with others to falsify LOCs and collateral letters.

-

The investment is a response to shifts in stock-bond correlations.

-

A total $225mn of fresh limit entered the market across two deals.

-

ILS offers efficient capital for underwriters, but casualty ILS transactions are complex.

-

The Swiss pension fund has not disclosed an ILS allocation before.

-

The pension plan has been allocating to ILS since 2005.

-

One dollar-denominated deal has opted to hold collateral in EBRC notes.

-

The bond will cover named storms in five US states.

-

Price guidance for the bond is 4.00%-4.50%.

-

The platform is based in Bermuda and will focus on strategic capital partnerships.

-

The buzz in the air at ILS Connect told of a market entering its next growth phase.

-

Richard Pennay also addressed the dip in cyber ILS activity.

-

Investor interest and capital flows point to potential for ILS proliferation.

-

This year’s ceremony will include the inaugural Women in ILS Award presentation.

-

An allocation to insurance could “feel like a nice, calm port in the storm” amid wider market volatility.

-

This is the first time the Texas Fair Plan has entered the cat bond market.

-

Fellow Swedish pension fund AP3 is phasing out its ILS allocation after being active in the sector since 2008.

-

Portfolio rebalancing was not triggered last week, but investors are now distracted and nervous.

-

US Coastal Property and Utica Mutual Insurance have brought out their first cat bond deals.

-

The Swiss rail pension scheme has been cutting its ILS allocation since 2018.

-

The Swiss pension fund’s ILS allocation stood at 4.9% of the total fund as of 25 March.

-

The asset manager has hired Rom Aviv as head of ILS.

-

Most of the ILS investments were made via the cat bond heavy High Yield Fund.

-

Palm Re will provide Florida named storm cat bond coverage for Florida Peninsula, Edison and Ovation Home Insurance Exchange.

-

The ETF will invest solely in natural catastrophe-exposed bonds.

-

Many UK pension funds are over-funded and lack appetite for higher-risk, higher-yield products.

-

Recent transactions on the platform include cat bonds from Flood Re and Brit.

-

Caution about capital markets volatility is leading sponsors to stagger bond renewals.

-

Industry sources estimate the market to be around $3bn.

-

ILS as a percentage of the pension fund’s total assets grew to 1.5%.

-

The bond was trading at around 12.3c on the dollar in the secondary market last month.

-

The UK listed investment manager has almost doubled its ILS allocation since April last year.

-

The bond will provide fire protection for MGA Bamboo’s California business.

-

The role oversees the $187bn Canadian pension plan’s ILS allocation.

-

The Class A section of the bond has doubled in size, at lower pricing.

-

UCITS fund diversification targets limit their capacity for US wind bonds.

-

Insurance Insider ILS revealed last week that the executive was leaving Property Claims Services.

-

Wildfire is rarely singled out as an exposure that can shift portfolio outcomes.

-

The fall marks this the first time in 20 years the index has been negative in January.

-

Neuberger Berman’s AuM stood at $3.2bn as of 1 January 2025.

-

AuM remains generally flat at UCITS funds over the weeks since LA fires started.

-

The value of its investment in RenRe stood at $330.4mn as of 30 June 2024.

-

Standards and guidelines address institutional investors’ concerns over valuation risks.

-

Company touts growing investor demand for Asian cat risks.

-

Both the Class A and Class B notes increased in size.

-

PFZW’s insurance allocation stood at $8.7bn as of year-end.

-

The bond is split into five tranches, with two notes offered on a zero-coupon basis.

-

Aetna, Inigo and GeoVera were the three sponsors seeking lower multiples.

-

The index’s performance in November was stronger than the prior year, although YTD returns are behind 2023.

-

The deal is split into two tranches compared with the single note issued last year.

-

Spread guidance anticipates a lower multiple compared to 2024’s Vitality Re issuance.

-

The broker anticipates strengthening investor demand for collateralised re.

-

The Bermuda based entity is expected to continue on its “responsible growth trajectory”.

-

The $600mn fund could allocate up to 10% of assets to cat bonds from 2025.

-

Initial spread guidance for the three-year bond is set at 425-500bps.

-

The bond offers a higher multiple than a similar Fuchsia Re deal placed last year.

-

Mapfre Re CEO Miguel Rosa was “very satisfied” with the debut cat bond deal.

-

The Swiss-based team of Siglo has transferred to Cambridge Associates.

-

The former co-head of ILS at Schroders left the bank last month.

-

The ILS manager will “pragmatically accept” a degree of credit risk in deals.

-

Former ILS investors who left the space have looked again and re-allocated.

-

The scheme’s ILS allocation has held steady at 0.7% of the total fund.

-

Fidelis is seeking more cat bond cover than it did almost a year ago.

-

Spreads at levels favourable to sponsors could power Q1 2025 pipeline.

-

The UK Local Government Pension Scheme (LGPS) has around £391bn in AuM.

-

The new funds will target the US wealth market through financial professionals.

-

The bond provides protection in France and its overseas territories.

-

The low PCS number is presenting a challenge for ILW buyers and sellers.

-

Pricing is expected to “stay neutral of soften” for January renewals.

-

The sovereign wealth fund’s ILS investments grew to $828mn.

-

The manager’s ILS allocation now spans six of its seven investment funds.

-

The ILS industry alumnus is understood to have two ILS investors lined up.

-

Plenum said wind damage from Milton could lead to “moderate” losses for its cat-bond funds.

-

Losses to the NFIP-sponsored cat bonds remains a key area of uncertainty, the investment manager reported.

-

The ETF format provides for publication of a daily NAV.

-

Cat bond funds continue to draw interest as private ILS more challenged.

-

The subject business of the deal is Ascot’s ~$1bn property portfolio.

-

The proportion of total fund assets invested in non-life ILS held steady at 0.6%.

-

Florian Steiger’s strategy is seeking institutional capital for the Q4 primary issuance season.

-

The ILS allocation has posted returns of 5.5% for the year to date.

-

The pension scheme’s holdings in ILS delivered varying returns in run-off.

-

The Swedish fund AP2 invests in Fermat GAM, Elementum and Credit Suisse.

-

The Canadian pension plan’s investment rose to 1.2% of its total fund.

-

Sources said that Gallagher Re had ‘first mover’ advantage as the exclusive broker.

-

Sub-1% management fee and performance fee-only structures have evolved in ILS.

-

The regulation now allows pension funds a more flexible benchmark for measuring alternatives.

-

The Canadian pension’s sole remaining ILS allocation is with Fermat.

-

The capital will be deployed by Bermuda-based special purpose insurer Arachne.

-

Gordon was set to join start-up brokerage Juniper Re last month.

-

The pension fund’s ILS allocation as of the end of 2023 was CHF300.3mn ($356.8mn).

-

Various trends may work together to hold the cat markets up for longer than some had feared.

-

ILS returned 3.2% for the scheme in the first quarter.

-

The new global bond fund can take a ‘marginal allocation’ to cat bonds.

-

The fund is a continuation vehicle for five of HSCM's life insurance interests.

-

The platform’s ILS holdings comprise cat bonds and UCITs funds, and were up 8% over January and February.

-

The pension fund handed an ILS mandate to Hiscox in September 2023.

-

Retained earnings resulting from reduced loss activity also helped to boost ILS capital.

-

The group has also scaled back holdings with AlphaCat’s Soteria Fund.

-

The platform distributed ~$50mn to investors for 2023.

-

The fund will follow an existing Twelve strategy and add short-term corporate bonds.

-

The Cayman Islands entity raised $2.4mn last June.

-

-

-

ILS platform London Bridge II has had a good year as volumes reached $750mn, the CFO said.

-

It is only the second year in the last eight that the allocation grew.

-

Head of alternatives Gareth Abley believes the asset class remains attractive following a 16% return in 2023.

-

The firm was founded in 2015 to help clients raise capital.

-

Aside from the one-year view, 2023 remixes the track record.

-

The allocation last autumn amounted to around 1.4% of the investment manager’s total funds under management.

-

The asset manager’s largest ILS allocation across two multi-strategy funds is to a Leadenhall fund.

-

The fund will promote environmental and social characteristics under Article 8 of the SFDR.

-

The asset manager’s flagship ILS funds posted stellar returns for its 2023 fiscal year.

-

TRUE will use the capital injection to provide underwriting capacity in Florida “at a crucial time” and to expand its footprint nationally, according to a statement.

-

The US pension fund investor had altered its ILS portfolio, with a new investment to Pillar in 2021.

-

The Australian sovereign wealth fund first allocated to the ILS manager in 2016.

-

This latest funding round brings total committed capital for the collateralized reinsurer to $75mn.

-

The firm’s follow-only Syndicate 2358 has grown its stamp by 67% to £150mn.

-

ILS managers are still waiting for hard market growth.

-

Research by Kepler Absolute Hedge showed that seven out of the 10 best-performing alt credit funds were cat bond strategies.

-

The fund’s allocation to ILS decreased for the first time in three years.

-

As of year-end 2022, the fund’s largest ILS allocation was in a RenRe fund.

-

The fund has been adapting its investment strategy in light of inflation and rising interest rates.

-

Stress-test numbers were increased to 112, including scenarios of losses in multiple years, up from 105.

-

Fermat’s John Seo said the industry can “see the wall of money coming in, but it’s coming in slowly”.

-

The fund is on course for its strongest year of returns since inception in 2014.

-

The IOP will be integrated into the Open Protocol reporting template.

-

The Middle Eastern investor had built up a billion-dollar portfolio, but personnel turnover has ultimately driven it to reverse course.

-

A challenge facing the industry in the years to come is the question of how can it move through a rotation of its investor base to capture the growth opportunities that have arisen.

-

Ambassador was set up in 2021 with Embassy Asset Management the named investment adviser.

-

Interest income also boosted the results, with net assets of $9mn rising to $10.8mn by the half-year point.

-

The transaction covered a portfolio of $250mn in casualty risk premiums.

-

The pension fund is seeking a strategy with “low or negative correlation to public equity”.

-

The firm has moved to defend its plans against a rival strategy supported by a small group of investors.

-

The investment firm’s ILS holdings were worth around $746mn at year-end 2022.

-

The UK asset manager’s ILS strategy is operating across six of its multi-asset funds.

-

The manager has gained increments from existing investors and inflows from new ones.

-

At Trading Risk’s annual ILS conference, Lloyd’s CFO Burkhard Keese explained how the Corporation is working with the market to attract investors to participate in risk transfer across the Lloyd’s market.

-

The asset class is finding favour particularly with allocators that have been watching returns play out over the long-term horizon.

-

The firm identified market inefficiencies in its analysis of loss data.

-

The new higher-rate world brings the threat of some investors staying in a risk-off mentality.

-

The AP2 fund noted currency-hedging effects, turbulent financial markets and Hurricane Ian as factors in its alternatives segment loss for the 2022 year.

-

The alternatives manager acquired retirement services firm Athene in January, ahead of its $2bn ADIP sidecar raise.

-

The securitised reinsurance tokens require a minimum investment of $20,000 in the US and $2,500 outside of the US.

-

The Indiana Public Retirement System has in past years allocated to Aeolus several times, as well as to HSCM Bermuda and Nephila’s Palmetto Catastrophe Fund.

-

Fermat’s John Seo divided the potential incoming capital broadly into “fast” and “slow” capital.

-

The ILS manager said the cat bond sector could double to become a $70bn market in the next three to five years.

-

Hudson Structured Capital Management (HSCM) Bermuda has set up an insurance credit strategy seeded with $400mn of initial capital from Security Benefit Life Insurance Company.

-

The ILS manager’s analysis highlighted that Lloyd’s nat cat exposure had lowered over the six years to 2021.

-

The investment analysts wrote that market dislocation offered an opportunity to invest on attractive historic yields.

-

Conviction for ILS has shifted to ‘overweight’ from ‘neutral’ at the manager.

-

For the ILS market, perhaps more than any other, the outcome of this year’s high inflation is still to be determined. Unlike other industries that are suffering increased immediate costs, this sector’s performance – as always – is ultimately driven by events no one can foresee.

-

ILS strategies specialist Siti Dawson is moving from LGT ILS Partners.

-

The pension investor re-directed capital to the Pillar Opportunity fund as of January 2022.

-

Frontier Advisors said sentiment continues to be challenged by performance.

-

Ludlow Re will grow “opportunistically” where there is confidence of producing attractive returns.

-

Most ILS firms are marking the Ian loss as a $50bn+ event, although there are exceptions.

-

The manager received a mandate from a new investor who had taken the call to come in ahead of Hurricane Ian.

-

The Massachusetts retirement system issued a request for proposals from ILS managers.

-

The major ILS investor described 2023 opportunities as attractive but said they were set to get more selective in the industry.

-

Buyers are more open than ever to different sources of capacity, but the timing of entry will not be on the industry’s terms.

-

Hurricane Ian could present a challenge for ILS fundraising conversations this autumn if ILS firms do not find more financing solutions to manage trapped capital, according to panellists at Trading Risk New York 2022 last week.

-

Some are suggesting a rotation of the investor base may be underway, with a move back towards more opportunistic funds.

-

HSCM Ventures partner Vikas Singhal will join the Inclined board.

-

The implications for the Abu Dhabi investor’s billion-dollar ILS portfolio are not yet known.

-

The Lloyds-centric reinsurer has become a signatory member of the Standards Board for Alternative Investments.

-

The fund’s allocations to general and life insurance investments have grown year over year.

-

The industry is sharpening its exposure forecasting capabilities in response to investor demand.

-

Craig Dandurand is to depart Australia’s Future Fund after nine years, as the pension scheme reorganised its investment team, putting its ILS portfolio under the responsibility of new head of alternatives Tammi Fischer.

-

The move would enable the Lloyd’s ILS platform to access investors with lower risk-return appetites after launching with quota share options only.

-

The Australian investor made 5.0% on its ILS investments in the 12 months to 31 March.

-

The hardening rate environment in Florida provided a mid-year opportunity for some, but overall there was little growth.

-

Investors, fund managers and service providers are adapting in the face of potential large losses from secondary perils.

-

The decade from 2010 ran the full gamut of catastrophe loss experience, reminding us that there is no such thing as a "new normal" in the world of ILS.

-

The asset manager also invests in Pimco ILS and has an inactive mandate with Nephila.

-

AP3 noted a ‘very interesting market with widening spreads’ as it made an ILS profit in 2021.

-

Markel Catco reported a small gain for its February result on 2019 side pocket releases, ahead of its early buyout of investors.

-

The firm recently invested $15mn in FedNat’s Monarch National.

-

The increase in allocation by the railways scheme contrasts with steady or declining ILS holdings at other UK pension funds.

-

The Dutch pension adviser hopes to scale the vehicle to $2bn-$2.5bn over time, as it reported a slightly negative ILS return for 2021 and revealed Integral ILS allocation.

-

ESG products can provide sustainable returns, panellists suggested.

-

Lloyd’s CFO and COO Burkhard Keese told delegates at the London ILS 2022 Conference that the platform’s scope will widen beyond quota share structures.

-

The Swiss rail fund made a 2.4% loss within its ILS portfolio.

-

The feeder fund to Neuberger Berman ILS strategies took a defensive stance ahead of 2021 Atlantic hurricane season.

-

DE Shaw issued a stinging rebuke to the company last week, and called for it to reposition as a pure-play insurance data firm.

-

Even though underlying ILS market conditions are improving, getting a hearing from investors could become harder.

-

The investment firm said that pivoting to a pure-play insurance data business would unlock up to $20bn of value.

-

Coca Cola has downsized its ILS holdings almost every year since 2017.

-

A recent final sweetener to the offer led to US litigation being withdrawn.

-

The latest raise takes the satellite firm’s total financing to $304mn.

-

Many investors are in a “hold and assess” pattern on ILS, but some changes in the broader landscape could be more positive for the industry.

-

The firm will look to grow its offerings on climate change and natural catastrophe risk.

-

The Swedish pension scheme is ‘happy to absorb concentrated [cat] peril risk’.

-

The London fund has been transitioning its diversifying portfolio to a pooled scheme, which has posted some growth in insurance holdings.

-

Alecta said it was "convinced" ILS could produce high-quality, uncorrelated returns.

-

The Swedish pension fund will participate in Swiss Re’s natural catastrophe business.

-

The move follows an ongoing battle between board members and staff over investment tactics, according to local reports.

-

The Singaporean authority is understood to have pursued a higher risk-return strategy within the asset class.

-

The investor agreed to buy Ascot in 2016 and Wilton in 2014.

-

The insurer said the European flooding loss did not qualify as a European windstorm for the purpose of the transaction.

-

The Australian investor said it was talking to reinsurers about fine tuning catastrophe portfolios as it reported an 0.9% ILS return in Q3.

-

The Canadian pension plan Ontario Teachers’ will support three Lloyd’s syndicates – CFC, Beazley and Beat – via its initial deal.

-

The Dutch firm had given the AIG-owned platform a mandate that could range from EUR500mn to EUR1bn, covering US cat reinsurance.

-

The monthly loss on the Eurekahedge ILS Advisers index accelerated from 0.4% in August.

-

The new London Bridge framework is less useful to the bulk of specialist ILS asset managers than it is end investors.

-

The fund acted on advice from Aon Hewitt Investment Consulting.

-

The larger fund PK SBB revealed it made a loss of 7.0% in its ILS portfolio for 2020.

-

The pension insurer is seeking others to form an investor group challenging a Markel buyout.

-

The investor more than doubled its allocation to Elementum Advisors.

-

The investor has significantly cut back its allocation over the past few years.

-

Foundation Capital, Revolution’s Rise of the Rest Seed Fund, Clocktower Technology Ventures, Sure Ventures, and several angel investors, also joined the seed funding round.

-

The consultant recommended the pension fund allocate $95mn to Pillar in 2022 after pulling a $41mn mandate from Nephila.

-

One of the ongoing trends within the ILS market over past years has been an increasing demand from existing investors to look for something different within their portfolio.

-

NatWest cited a reduction in relative risk-adjusted returns as it decreased allocations, while North Yorkshire reported outperformance across its trio of ILS investments.

-

Local government pensions funds in the UK are partnering up, creating new strategies and may seek diversification.

-

The Canadian pension fund and the ILS fund provide Funds at Lloyd’s capital alongside traditional reinsurers.

-

Just a few months into 2021, the first natural-disaster headlines of the year are already occupying the minds of ILS insurance risk-takers. The snowstorms that brought freezing conditions to Texas will be a challenging event to evaluate for a number of reasons.

-

The company said the funds raised would kick-start its effort to become a full-stack insurer.

-

It will also encompass impact investment manager BlueOrchard, although the microfinancier will keep its independent identity.

-

ILS Capital has invested seed capital in start-up InsurTech provider Pouch, which provides auto coverage for small businesses.

-

The manager says cedant demand is growing for larger transactions.

-

The report also found that reinsurance capital increased by 7% to $658bn.

-

The move is part of a wider strategic effort by the broking goliath to quantify the value of intangible assets.

-

Its quota share partnerships provide the equivalent of $4.1bn of capital support based on 1-in-250-year loss scenarios.

-

The ILS manager offered to repurchase 20% of Interval fund shares, but this failed to meet investor demand to exit.

-

The Indiana Public Retirement System (INPRS) added $75mn of capital to an existing mandate with Aeolus's Keystone funds in January, according to reports.

-

Class C investors who entered the retro fund after the 2017 hurricane season made a 1.3% loss for the year, although wildfire subrogation meant a gain for ordinary shares.

-

Trapped capital subdued the firm's overall fund return to a 1.6% gain, as primary insurance gains outweighed reinsurance losses.

-

Helios said the deal is part of a £60mn share offering to fund further Lloyd’s capacity acquisitions.

-

The ILS investments were up 5% year on year and make up around 4.2% of total assets.

-

The fund’s worst ILS return to date is understood to be driven by investments hit by Covid-19.

-

Parent company AIG posted an underwriting loss for the period.

-

Investor interest in the asset class should continue through 2021, but the firm has stepped back its outlook from an “overweight” recommendation.

-

The move follows the company hiring new InsurTech partner Adrian Jones last month.

-

Returns have disappointed some institutional investors, but prospective rates may attract fresh investment, sources said.

-

The executive, who was confirmed in her role earlier this month, bought 19,950 shares at the IPO price of 500 pence per share.

-

The move marks its second fundraise after an initial allocation from Canada’s PSP Investments in November.

-

Net assets have grown 5% year-on-year to $876mn as of 31 October 2020.

-

Target investments could include cat bonds and other reinsurance, though the allocation size is unknown.

-

The deal is the carrier’s fourth ILS transaction of 2020.

-

The 12 Days of ILS Christmas

-

The carrier’s long-standing client Alfa has become an equity investor.

-

A more diverse investor base is supplanting continued cutbacks from some ILS players, although Stone Ridge's participations are holding more stable than in prior years.

-

-

The ILS manager expects investments will have low correlation with the financial markets.

-

The Florida Retirement System's ILS allocations reached $740mn at the end of last year and the body will consider scaling up further in 2021.

-

The downward move reflects the lagging impact of cutbacks in 2019.

-

Investment returns rebounded to a 2.7 percent gain for the half-year to 30 April.

-

With a target range of up to EUR100mn ($108.3mn), the PartnerRe stake is one of the fund’s smaller ILS allocations.

-

The assets are divided between the company’s pension fund and a post-retirement benefit plan.

-

A surge in earned premiums and reserve releases helped profits climb to $108mn in the first quarter.

-

All cat bond funds across the Eurekahedge ILS Advisers index finished lower in March due to the mark-to-market hit from Covid-19.

-

The pension scheme made low single digit returns on ILS holdings with Aeolus and Nephila in 2019.

-

The investment comes as R&Q positions itself to take advantage of pandemic-related market dislocation.

-

Investment case is the strongest in more than half a decade, but competition for new inflows is still strong in the buyers’ market.

-

The top ILS manager expects assets under management to decline by 7% in H1.

-

The major buyback was completed before the Covid-19 pandemic sparked a market crisis.

-

The Teacher Retirement System of Texas has increased its allocation amid continuing losses.

-

Endowments and family offices have been showing interest in the asset class.

-

The sidecar investor kept its major stake in Munich Re’s Eden Re vehicle stable but made few new investments in the latest renewals.

-

The finance company is led by ex-Leadenhall deputy CIO Dan Knipe.

-

-

This is the first time premium income has outpaced claims in three years.

-

The insurer will offer to buy out side-pocketed assets at a discount, with several hundred millions of capacity available if needed.

-

The investor bought a minority stake in Elementum last year.

-

The fund also lifted the size of a new mandate to Hudson Structured Capital Management as it withdraws from Nephila’s loss-making Palmetto fund.

-

The drinks manufacturer first invested in reinsurance in 2012.

-

The fund intends to pay 90 percent of its current cash to investors with much of its portfolio held in side pockets.

-

Interim CEO Kevin Rehnberg was confirmed as CEO following Mark Watson’s resignation in November last year.

-

Youssef Sfaif has worked at the Dutch pension fund since 2017 and was most recently an associate director.

-

Third-party investors recorded a $2.6mn underwriting profit for the year.

-

The carrier posted $1mn investment income from its investment in AlphaCat funds for the period, compared to a $12mn loss in Q4 2018.

-

The deal's spreads are in line with those on the 2019 FloodSmart deal, with slightly higher multiples of premium to risk.

-

The platform delivered $5.9mn in profit to Lancashire from its 10 percent stake in the funds.

-

The sovereign wealth entity has taken an equity stake in the Bermuda (re)insurer after also building up an ILS portfolio in the past year.

-

The Everest Re sidecar began 2020 with $819mn of assets under management.

-

The bond giant's ILS strategies have now reached $150mn.

-

Co-CEO Richie Whitt also highlighted an expectation that Nephila will seek to raise capital and return to growth.

-

The investment comes as the Indiana Public Retirement System exited Nephila’s Palmetto fund in pursuit of a more diversified ILS strategy.

-

Bernard Van der Stichele will head the pension fund’s new ILS portfolio.

-

The manager said Irma deterioration pushed its 2017 loss out by 1 percent, taking it to 65.9 percent.

-

The transaction remains popular with investors given that it has never had a loss and is a diversifier, sources said.

-

The reinsurance fund manager is targeting expansion outside the catastrophe space with private funds.

-

Overall sidecar capacity has been cut by more than 20 percent, sources estimate.

-

The Bermuda-listed component shrank by $8mn year on year, as the insurer said it expected overall alternative support to remain stable.

-

The broker said reinsurers were looking to address the earnings impact of higher retrocession costs, lower interest rates and greater reserving uncertainty.

-

The sums raised for a Cayman Islands fund are in line with expectations that the firm would have under $200mn to deploy in the January renewals.

-

The vehicle sits alongside Munich Re's more broadly placed Eden Re sidecar.

-

Deputy CIO Dan Knipe is setting up a new credit platform.

-

Australian investors were among the ILS pioneers and some speculate that consolidation of Australian pensions into mega funds could help grow the industry’s local presence further.

-

The pension plan is hiring a portfolio manager to lead the new programme.

-

The Denver-based health insurance company plans to push individual and small group health insurance plans.

-

The Axa XL cat bond was so oversubscribed that some investors had their allocations reduced by 60-70 percent, Trading Risk can report.

-

More than $2bn of reinsurance quotes have been placed on the platform, with ILS funds among the market participants.

-

Victor has significant ties to the ILS space, having launched the Nephila-backed Alternus distribution facility in 2017.

-

The vehicle was set up as a Bermuda fund funnelling capital through a Lloyd's corporate member.

-

Arthur Jones succeeds Alastair Barbour who in February indicated his intention to retire from the board towards the end of this year.

-

The agreement would provide JP Morgan with equity in Scor in the event of a major disaster, or if the carrier’s share price falls below EUR10 in the next three years.

-

He will have a similar mandate at New York-based One William Street as he had at recently-sold hedge fund BlueMountain.

-

Artex reserved for an 8 percent loss to the $18mn aggregate retro transaction, a BSX note said

-

The fund manager holds just over $100mn in the Bermudian's Keystone funds.

-

Genworth Mortgage Insurance CEO Rohit Gupta said market response to the transaction had been strong.

-

The market is pricing Unipol's EUR45mn ($49.50mn) Atmos Re I cat bond for a full loss.

-

Hudson Structured founder Michael Millette joins the board of directors after his company led the InsurTech’s latest funding round.

-

The pension fund holds 0.6 percent of its assets in ILS.

-

The class C notes are being offered with an initial guidance of 525-575 bps.

-

Pricing for both tranches of the deal stayed within the midpoint of the initial target range

-

Phil Kane has been appointed senior credit officer, reporting to CEO Luca Albertini.

-

Currently, most people trying to describe the ILS manager world might break the peer group into three broad categories: reinsurer-affiliated platforms, independent owner-operated firms and asset manager-backed vehicles.

-

However, executives agreed that 2020 would end with an increase in alternative capital levels.

-

The sovereign wealth fund for the United Arab Emirates has allocated more than $0.5bn to the sector, sources said.

-

A group of ILS funds tracked by Trading Risk produced more robust returns in Q3 compared to last year’s third quarter, despite Typhoon Faxai and Hurricane Dorian.

-

New Zealand’s sovereign wealth fund posted a 2 percent drop in its ILS holdings over its financial year while Ontario Teachers’ Pension Plan and Caisse de dépôt et placement du Québec invested $500mn in a new insurance investment platform.

-

Access to risk has been the biggest driver of M&A deals for independent ILS funds, TigerRisk Capital Markets & Advisory co-CEO Jarad Madea said at Trading Risk’s conference in New York last month.

-

The discussions are very much at the early stage with any developments likely to be in “phase two or three”, according to Lloyd’s regional director for the APAC region.

-

Aon’s Dominic Christian says a 35 percent cost base for the (re)insurance industry is not sustainable.

-

The sovereign wealth fund held NZ$351mn ($236mn) in the asset class at 30 June.

-

The New Zealand Government Superannuation Fund’s ILS holding has dropped to 5.5 percent of total assets.

-

The platform will invest in P&C and life companies seeking growth capital, and stronger ratings and scale efficiencies.

-

The sovereign wealth fund’s allocation to its alternatives portfolio fell in percentage terms as the fund grew overall.

-

The availability of new capital – or the lack thereof – was a hot topic at the Monte Carlo Rendez-Vous.

-

The RBS pension scheme increased its allocation to insurance in 2018, including catastrophe and life insurance risks, according to its most recent annual report.

-

The allocation to ILS was 5.4 percent of the fund’s $7.4bn assets at the end of 2018.

-

At Munich Re's ILS roundtable in Monte Carlo, one of the speakers raised the concept of whether a "flight to quality" amongst ILS investors might be better labelled a "flight to alignment".

-

Managing director Philipp Graf said the new arrangement with Allen Partners would bring the full suite of Twelve’s products to institutional investors in Australia and New Zealand.

-

Reinsurance conditions began moving in investors’ favour in mid-year 2019, marking a delayed reaction to 2017-2018 losses.

-

Danish pension fund PKA is to close its ILS strategies and will no longer have any investments in the sector at the end of 2019, a spokesperson for the fund told Trading Risk.

-

The North Yorkshire Pension Fund upped its ILS investments while the BBC Pension Scheme pulled back.

-

ILS funds posted gains in June and July, clawing back four consecutive months of declines, according to the Eurekahedge ILS Advisers Index.

-

It holds $241mn in catastrophe reinsurance after lifting its allocation in 2018.

-

The fund now has £159.4mn allocated to ILS through Leadenhall Capital Partners.

-

The scheme now holds £41.2mn via Securis, compared with £98.1mn last year.

-

The Oregon Public Employees fund held $119.3mn in two Nephila funds at year end 2018.

-

The fund can meet the demand for ESG investments while at the same time providing a commercial return, advisors Global Parametrics said.

-

The insurer reported $17.7mn of income from sidecar investors and MGAs.

-

The follow-up investments take its overall ILS allocation to up to $950mn, as it put in place mandates to respond to higher rates.

-

Developments this year indicate third-party capital will be a disciplined participant requiring adequate risk-adjusted returns, Axis president and CEO Albert Benchimol said.

-

The Markel co-CEO also said that “noise” around the performance of new acquisition Nephila will clear up by year end.

-

Fee income rises by over two thirds to surpass $19mn for the quarter.

-

“We're not trying to grow for the sake of growing,” Everest Re’s reinsurance chief executive John Doucette told analysts yesterday.

-

The average ILS fund was down by 1.13% in May as measured by the Eurekahedge ILS Advisers Index.

-

The investment comes as Hudson Structured surpassed $2bn of assets under management.

-

Catastrophe losses contributed to a 3.1 percent fall in net asset value for the manager’s Diversified Income and Growth Trust in the past half-year.

-

The trio of companies have all given their support to the auto start-up, with Third Point Re also providing reinsurance.

-

All insurance has a social purpose but covers for lower income countries should probably be considered more impactful transaction than Florida coastal risk.

-

Swiss funds active in ILS recorded stable or slightly increased allocations after 2017’s losses.

-

The PK SBB scheme took a 4.5 percent gain from its ILS portfolio last year, as it and a number of peers reported slightly increased allocations to the sector.

-

The reinsurance fund has ramped up in recent years to $700mn-$800mn.

-

The fund’s net assets shrank by $4.4mn over the period.

-

The fund’s ordinary shares added 0.85 percent during the month.

-

The fair value of AP3's ILS portfolio rose by 10.7 percent to $560mn at year end in 2018.

-

It is “probably one of the best times to invest” in ILS, according to Leadenhall Capital Partners CEO Luca Albertini.

-

ILS investors were more frustrated by extended loss creep last year than by the overall hit, according to Michael Knecht of Siglo Capital Advisors.

-

Returns from ILS funds tracked by Trading Risk fell to an average Q1 return of 0.63 percent to 0.65 percent in cat bond and multi-instrument funds.

-

Shortfalls in retro capacity are not impacting all vehicles, said Tangency Capital co-founder Michael Jedraszak.

-

Market participants have welcomed Lloyd’s plans to attract ILS capital but emphasised that cost reductions will be key to making them work.

-

The New Mexico Educational Retirement Board pension fund invested in ILS via ILS Capital Management.

-

Massachusetts Pension Reserves Investment Management (MassPRIM) appears to have lifted its allocations to ILS managers Aeolus and Markel Catco for 2019, despite taking losses in its first year of investing in 2018.

-

The insurer kept its participation in the state reinsurance scheme stable at 45 percent.

-

The New York-based asset manager received an increased level of requests for redemptions from investors in its Reinsurance Risk Premium Interval Fund this quarter.

-

Third Point Re ended 2018 with a quarterly net loss of $298mn after suffering a net investment loss of $276.8mn.

-

The past two years challenged the catastrophe (re)insurance market more than any period since the Hurricane Katrina era in 2004-2005 – but it is far from clear what the outcome will be this time around.

-

John Doucette, president and CEO of reinsurance at parent company Everest Re, said the company had shrunk its January catastrophe portfolio.

-

Most investors in Markel Catco are expected to take up an offer to redeem their shares, as the platform further increased its loss reserves for 2017 events and had its value written down to zero by parent company Markel.

-

Cat bond prices in the secondary market have begun recovering following a pre-Christmas sell-off, as investors sought to release capital ahead of the renewal, brokers said.

-

Arguably the single biggest challenge to face reinsurers attempting to attract third-party ILS capital is nothing to do with engaging in fundraising, estimating monthly valuations, or any of the operational facets of asset management.

-

Allianz will participate in Pimco’s new ILS business both as an underwriter and an investor in its ILS funds, a spokesperson said.

-

The move has pared back the carrier’s aggregate losses, benefiting Caelus cat bond investors.

-

Regulatory investigations can move at a snail’s pace.

-

The new fund will invest 80 percent of its assets in ILS across various risks and regions.

-

The legal action follows losses in share value resulting from regulatory probes into Markel Catco.

-

The bond is the ILS market’s first terrorism cat bond since 2003.

-

The size of the vehicle was not disclosed.

-

Bernard Grzinic was promoted to oversee the ILS teams as well as credit and equity products.

-

The reinsurer will write a line on any risk that Vermeer writes to ensure alignment of interest with PGGM.

-

The ILS investor says 7 percent annual returns have made the asset class an attractive opportunity for the fund.