-

Total yield is down from 11.18% in the last week of October 2024.

-

Covea’s Hexagon IV Re deal priced 13% below the initial target on a weighted average basis.

-

Total gains for the year reached 7.71%.

-

Some experienced investors are pivoting out of cat bonds and into the top layers of private ILS deals.

-

Operating revenues were also up on the $29.1mn reported over Q2.

-

O’Donnell believes RenRe is well positioned to produce longer-tail risk to third-party investors.

-

Third-party investors made a net income of $415mn in the quarter.

-

Central pressure of 900mb or below would trigger a full loss of the $150mn deal.

-

The legacy cover will backstop policies written by its North American insurance business.

-

Pricing on Friday implied a potential $45mn loss to the bond, before the storm outlook deteriorated.

-

So far this year, there have been 11 first-time sponsors to place a deal.

-

The insurer of last resort’s exposure was $696bn as of last September.

-

The bond will provide protection against US wind with a PCS trigger.

-

Spreads on USAA’s latest deal priced below comparative issuances in 2023-2024.

-

Investor interest is warming up following a colder spell over the past several years.

-

The award of the mandates marks the California public pension plan’s entry into ILS.

-

ILS has been a driver of innovation in reinsurance, Convergence 2025 attendees heard Wednesday.

-

The hire is the hedge fund manager’s third ILS appointment in the past year.

-

Key topics include private ILS growth prospects and the longevity of longtail interest.

-

Returns from cat risk investments stood at 20.1% for the year to 30 June 2025.

-

A cat-focused vehicle is “the missing piece” of Hannover Re’s ILS offerings, said Silke Sehm.

-

The allocation is around 3% of the fund’s total assets.

-

The alternative asset manager was founded in 2021 with offices in London, New York and Abu Dhabi.

-

The facility will initially focus on US, Bermudian and European business.

-

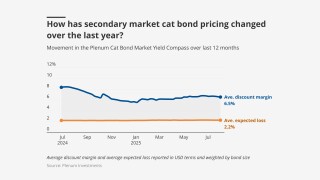

Pricing has hit historically soft market lows, based on secondary market pricing.

-

The manager’s largest ILS holding is in the cat-bond-heavy High Yield fund.

-

Cat bonds have outpaced the returns on private strategies in the year to date.

-

The new Verisk SCS model is increasing expected losses on aggregate bonds.

-

The Bermuda firm said HS Sawmill reflected its continued focus on life insurance.

-

The resource was developed by leading ILS managers and investors.

-

Deals would need to be sized at $50mn plus for transfer to capital markets.

-

Samild held multiple roles including head of alternatives at the Future Fund.

-

The ILS manager has $6.8bn in assets and will be led by MariaGiovanna Guatteri.

-

Axa IM’s acquisition by BNP Paribas was confirmed in July this year.

-

ILS executives talked pricing, capacity and opportunities in casualty at an ILS roundtable in Monte Carlo.

-

The market has learned lessons from earlier soft market phases that it will apply now.

-

Victory Pioneer Cat Bond Fund also added assets in the past month.

-

Arch set up Bermuda investment manager Arch Fund Management in February.

-

The figure comprises 6.07% of insurance discount margin and 4.15% of risk-free rate.

-

The leadership’s commentary spotlighted to value of ILS to the group.

-

The agency noted inflows to cat bond funds and investor interest in private ILS.

-

Competition from cat bonds in the top layers of programmes applied downward pressure on reinsurance pricing in 2025.

-

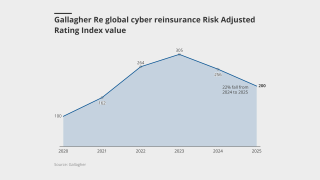

Dedicated reinsurance capital is on track to increase by 8% in 2025, the broker said.

-

Funds encompassing private ILS outperformed cat bond strategies in July.

-

Aspen Capital Markets earned $169mn in fee income in 2024 alone.

-

Hagood will stay on as sole CEO of Nephila Holdings, with Taylor continuing as president.

-

Benjamin Baltesar spent more than six years at Euler ILS.

-

The reinsurer’s capacity is hugely important to ILS firms, with few alternative providers.

-

This is the latest in a string of appointments made by the firm’s ILS unit.

-

Aaron Garcia will hold a senior role at the operation, sources have confirmed.

-

Reinsurers are confident on cat rates and ready to deploy ILS capital.

-

The firm’s ILS vehicles posted low single-digit growth in assets under management in Q2.

-

The ILS manager revised down slightly its forecast for the syndicate’s 2023 YOA.

-

ILS investors have fought shy of multi-peril aggs due to low confidence in SCS modelling.

-

The sidecar took $19mn of cat losses relating to the California wildfires.

-

The yield figure comprises 6.53% of insurance discount margin and 4.28% risk-free.

-

Around 95% of the Hiscox Re & ILS portfolio is rated rate “adequate” or better.

-

The unit said capital in the ILS market remains more than adequate to meet rising demand.

-

The ILS Advisers Fund Index reported a profit of 1.11% in June.

-

Markel announced the sale of its global reinsurance renewal rights to Nationwide.

-

Amid $17bn of new deals, cat bond activity included aggregate and cascading structures.

-

The bond will provide protection on an industry-loss basis, as reported by PCS.

-

The merged business of Twelve Securis ranked third among ILS managers for AuM, behind Fermat and RenRe.

-

Brian Hickey joins the firm from PE specialist AE Industrial Partners.

-

The reinsurer returned $216.7mn to investors in Q2.

-

The firm reported a net pre-tax cat loss of $414mn from January’s LA wildfires.

-

Managers believed end-investors value diversification and non-correlation of cat bonds over liquidity.

-

Cat bonds remain attractive for investors seeking risk-adjusted return and diversification.

-

He had spent 10 years at Securis, with seven of them as COO.

-

The fund was renamed from the Pioneer Cat Bond Fund.

-

The recommended “AIF lite” structure could be suited to cat bond lites.

-

The Diversified Alternative Fund’s allocation to cat bonds was up by 31% from $386mn at 31 January.

-

The Bermudian ILS manager has recently changed its name from Mereo Advisors.

-

The fund’s ILS portfolio is split between 70% property cat and 30% cyber risk.

-

This comes in at the lower end of the initial spread guidance of 725-775 bps.

-

Property cat-focused sidecar capital was up by approximately 10% in H1.

-

The sidecars will provide capacity for reinsurers and large insurance carriers.

-

Initial responses to ESMA’s report welcomed the long timeframes for any changes.

-

The third-party capital manager is a new entrant to the retro space.

-

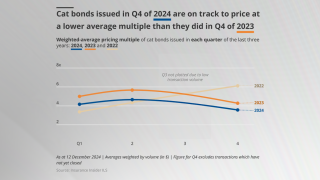

Weighted average multiples were down as sponsors capitalised on demand to push spreads lower.

-

The total return for the Swiss Re Global Cat Bond Index stood at 0.61% for the month.

-

The body said cat bonds are closer to an insurance product than a security.

-

The awards celebration took place at the Hilton Bankside on 25 June.

-

Twelve Securis is now a challenger for the top spot on the Insurance Insider ILS leaderboard.

-

The bond is split across a Series 1 and Series 2 structure, with eight notes in total.

-

Everest Re increased the targeted size of Kilimanjaro Re across all four classes of notes.

-

The pensions scheme’s existing ILS holdings to Aeolus and HSCM are in run-off.

-

M&A and shifts in distribution arrangements bring risks and opportunities.

-

The fund lists Twelve, Swiss Re and Cambridge Associates as managers.

-

Pricing on all classes of notes are being offered at the bottom of the guided range.

-

AuM in GAIA Cat Bond Fund had grown to $3.9bn as of 31 May.

-

PCS's loss estimate for the March Missouri SCS pushed the bond beyond its exhaustion point.

-

The California Earthquake Authority upsized its Ursa Re deal by 60% to $400mn.

-

Buyers have turned to retro markets for covers where ILW pricing is less attractive.

-

The Californian insurer had a private deal, Randolph Re, that provided pure wildfire protection.

-

The firm said it was the first time a UCITS cat bond fund passed the $4.0bn mark.

-

Investors eyeing private ILS include opportunistic allocators keeping watch on storm season.

-

Everest Re has structured its deal into two sections targeting aggregate and per occurrence cover.

-

The sidecar renewed at $230mn for 2025.

-

The pension plan noted in June 2024 that it was exploring new options in ILS.

-

The fund was set up 18 months ago by cat bond investor Florian Steiger.

-

Total yield was 10.93% as of 30 May, including 4.34% of risk-free rate.

-

She was previously head of investor relations and business development for North America and Australia at Securis.

-

This followed a $650mn fall in April, after management change of the fund.

-

ILS offers efficient capital for underwriters, but casualty ILS transactions are complex.

-

The index provider revised up its return for March by 0.39 percentage points to 1.21%.

-

The Swiss pension fund has not disclosed an ILS allocation before.

-

The deals covered Euro wind and Italy quake, Florida hurricane and a retro bond.

-

The ILS market has won market share at the top of programmes as buying expands.

-

The bond will provide protection for Allstate’s Florida subsidiary, Castle Key.

-

The Italian sponsor has $237mn of limit maturing this July.

-

Some assets in the Medici Fund were transferred to a new UCITS strategy.

-

The bond will provide named storm and quake coverage in the US.

-

The bond is offering a spread range of 850-925bps.

-

The ILS manager’s total AuM increased to $2.2bn in 2024 from $1.7bn the year prior.

-

The fund was set up in 2015 to capitalise on higher post-event yields.

-

Debut sponsor SV SparkassenVersicherung also secured its target size of $100mn.

-

Fales will focus on creating investment opportunities for the carrier’s specialty reinsurance portfolios.

-

Some $200mn of fresh limit entered the ILS market as $3.4bn of deals priced.

-

Sources believe the market will grow gradually over years after its initial cluster of dealmaking.

-

The bond provides coverage on personal-lines property in Florida.

-

The series one notes will provide protection to the benefit of Twia.

-

The total yield, inclusive of the risk-free rate, was down on the same period last year.

-

The bond will provide multi-peril coverage on an industry loss basis.

-

The bond will provide storm protection in Florida and South Carolina.

-

Fermat and GAM announced that the former will take sole control of the GAM FCM Cat Bond Fund.

-

The deal will provide named Florida storm protection on an indemnity, per occurrence basis.

-

Florida Citizens upsized its latest Everglades Re deal by 50%.

-

The buzz in the air at ILS Connect told of a market entering its next growth phase.

-

Commutations need to be optimal for the sponsor and the investor to avoid sponsors taking back chunky risks.

-

The CEO said private ILS funds can generate additional returns of 10%-20%.

-

Richard Pennay also addressed the dip in cyber ILS activity.

-

Private ILS would benefit from extension spreads to manage investor concerns, the CEO argued.

-

The unit’s premium reduced by 4% for the first quarter.

-

The ILS manager also swung to an operating profit after posting a loss in Q1 2024.

-

All 29 funds tracked by the index returned a positive performance.

-

The bond will provide protection against named storm and thunderstorm.

-

The casualty ILS business now has $175mn in capital.

-

Cat bond sponsors continue to secure higher limits and lower rates versus their targets.

-

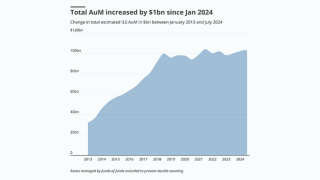

Investor interest and capital flows point to potential for ILS proliferation.

-

The bond will cover China, India and Japan quake and Japan typhoon.

-

The bond will provide protection against German and Japan quake.

-

Secondary market traders are baking in further loss potential after PCS increased its wildfire and Helene loss estimates.

-

This year’s ceremony will include the inaugural Women in ILS Award presentation.

-

January’s California wildfires meant third-party investors suffered a loss of $195.3mn.

-

Franklin Templeton’s allocations to ILS are managed by fund of funds manager K2 Advisors.

-

An allocation to insurance could “feel like a nice, calm port in the storm” amid wider market volatility.

-

He joined what was then Credit Suisse ILS in 2019, moving from Hiscox Re & ILS.

-

The executive formerly served in senior leadership roles at Nomura, Credit Suisse and Goldman Sachs.

-

The deal of the size was unchanged at $100mn.

-

He joined Nephila in 2023 from Lancashire as a senior underwriter.

-

Portfolio rebalancing was not triggered last week, but investors are now distracted and nervous.

-

Gokul Sudarsana has been with the company since 2020, having joined from Deloitte.

-

The Swiss rail pension scheme has been cutting its ILS allocation since 2018.

-

The Swiss pension fund’s ILS allocation stood at 4.9% of the total fund as of 25 March.

-

The bond will provide protection against China, India and Japan quake, and Japan typhoon.

-

The subject business covers a portfolio of residential insurance.

-

The sponsor is estimating a loss of ~$300mn in relation to one of last month’s US tornado events.

-

Sutton National and Bamboo Ide8 secured $170mn of sidecar and cat bond protection.

-

The bond will provide coverage against named storm or severe thunderstorm over three years.

-

The issuance is split across three tranches with varying degrees of risk.

-

The deal is split across four tranches, with the riskiest note Class D targeting $150mn.

-

Market participants expect pricing will be flat to down through Q2.

-

The bond will provide protection against Louisiana named storm.

-

Fees on the GAM Star cat bond funds will drop in May in a recognition of fee competition in the market.

-

The asset manager has hired Rom Aviv as head of ILS.

-

The sponsor secured $240mn of limit as the bond upsized by 20% on its initial target.

-

The insurance discount margin is now at a similar level to where it was in the final week of March 2022.

-

Most of the ILS investments were made via the cat bond heavy High Yield Fund.

-

Martin Bisping has moved to CRO and Bernard Bachmann was named CEO of SRILIM.

-

Rachel Barnes Binnie joins as portfolio manager.

-

Multiples in March were below historic averages from 2001 through 2024.

-

LA wildfire-exposed ILS positions experienced further declines.

-

Scor is targeting limit of $200mn with its latest Atlas DAC retro cat bond.

-

Many UK pension funds are over-funded and lack appetite for higher-risk, higher-yield products.

-

The vehicle will take a quota share of all of the risks underwritten by Ryan Specialty’s MGA arm.

-

The notes replace a 2021 issuance that matured in January this year.

-

The ILS segment is not ready to gloss over loss-heavy years in renewal discussions.

-

Industry sources estimate the market to be around $3bn.

-

Founding partners DeCaro and Rettino will continue to provide oversight and investment advice.

-

The cat bond manager warned of excess downside risk owing to an accumulation of losses.

-

Flood Re’s bond Vision 2039 bucked the trend by pricing up 7% as its secured £140mn ($174mn) of limit.

-

Indirect exposure to cat risk through long-term investors gives Markel optionality.

-

ILS as a percentage of the pension fund’s total assets grew to 1.5%.

-

GP Affluent Markets will look to serve high-net-worth individuals.

-

The UK listed investment manager has almost doubled its ILS allocation since April last year.

-

Tom Fealey has assumed lead portfolio manager responsibilities.

-

Some $625mn of new issuance entered the market in the first week of March.

-

There is the potential for cat bond H1 issuance to be a record breaking six months.

-

The scope of QRT’s new ILS strategy will include cat bonds and private ILS.

-

The fund is open to European and other global investors.

-

Dispersion of returns was high, with the range 0.87% to -3.71%.

-

The third-party capital platform is looking to enhance its tailored strategy offerings.

-

Deal sizes increased by 84% on average across the six tranches that saw an increase.

-

Climate change and other loss impacts were not adequately incorporated, sources said.

-

The firm has rotated capital in sidecar Voussoir toward direct investor relationships.

-

The NCIUA had initially sought $350mn of limit.

-

DaVinci equity plus debt stood at $3.25bn as of 31 December.

-

There was a slight increase in DaVinci and Fontana from 31 December 2024 to 1 January 2025.

-

The firm reported record fee income of $128.2mn in 2024, up 26%.

-

UCITS fund diversification targets limit their capacity for US wind bonds.

-

Pricing fell by 13.5% on a weighted average basis across deals that updated last week.

-

Total combined losses for the agency’s Helene and Milton estimates stand at $31.8bn.

-

Scrocca will be based in Bermuda on focus on underwriting and risk sourcing, among other things.

-

The aim is to capitalise on cat bond market’s robust growth and US peril concentration.

-

New limit of $474mn entered the market across two deals.

-

Two ILS funds featured in the top five asset-raisers within the index.

-

The firm will match segregated accounts of portfolios to investor mandates.

-

The combined entity ranks third in the Insurance Insider ILS leaderboard.

-

Liquid alternative strategies accounted for around $1.4bn of the total.

-

The firm said the appointment would support its ambitious growth strategy.

-

Neuberger Berman’s AuM stood at $3.2bn as of 1 January 2025.

-

AuM remains generally flat at UCITS funds over the weeks since LA fires started.

-

American Integrity is seeking expanded limit on more favourable terms.

-

FY24 disclosures show shifting fortunes at reinsurer ILS platforms.

-

Tower Hill secured $400mn of Winston Re limit in 2024.

-

The group ceded 55% more premium to Nephila over the year at $1.3bn.

-

The sponsor secured $100mn limit last year, paying a multiple of 8.3x.

-

The value of its investment in RenRe stood at $330.4mn as of 30 June 2024.

-

The offering is a collaboration with Generali and parametric carrier Descartes.

-

Barthelemy Thomas joins from PartnerRe Capital Management in Zurich

-

The index delivered a total return of 1.29% for the month of December.

-

The latest issuance will add extra cat bond limit, with a $100mn note still on risk.

-

-

PFZW’s insurance allocation stood at $8.7bn as of year-end.

-

He joins from Pillar Capital and will be based in Bermuda and New York.

-

Fermat stayed in the top spot surpassing $10.0bn for the first time.

-

Secondary market pricing indicated anticipated California wildfire losses.

-

Two 2021 worldwide aggregate ILW notes are also among the markdowns.

-

The former Credit Suisse ILS head Niklaus Hilti said working on life buyout hedges could rejuvenate the life ILS market.

-

The bond is likely replacing the 2021-1 Class F bond, which matured in December.

-

The fund returned 15.69% in calendar year 2024.

-

This comes after the firm’s distribution partner GAM has had a challenging few years.

-

ILS managers expect the losses to have some impact on future cat bond spreads.

-

The strategy launched on 1 January, winning mandates from several investors

-

Compressed cat bond spreads could drive some rebalancing, as M&A remains a prospect.

-

The ILS manager analysed 16 UCITS fund portfolios to compare risk levels.

-

The vehicle is smaller by 8% as White Mountains’ participation grew.

-

The manager’s Interval Fund returned 28.25% over the financial year.

-

Nicole Chase was central to the build-out of Mt Logan while at Everest.

-

The Bermuda based entity is expected to continue on its “responsible growth trajectory”.

-

The firm has commenced writing collateralised retro and reinsurance but its rated launch is still pending.

-

First-time sponsor QBE secured $250mn of quake and storm coverage.

-

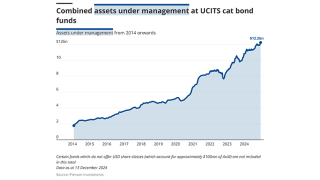

The UCITS cat bond segment has added 54% in AuM since Hurricane Ian.

-

Some $1.2bn of limit was placed in the cat bond market this week.

-

Casualty ILS made inroads, while hurricane hedging strategies came into focus.

-

The firm will also act as sub-adviser to the Brookmont ETF cat bond fund.

-

The company no longer has any exposure to reinsurance contracts.

-

Everest is in the process of transforming its ILS offering.

-

Full year 2023 set the record to beat of $15.8bn in new issuance volume.

-

The reinsurer said investors were interested in expanding after benefiting from good results.

-

The top quartile, which includes Nephila 2357, were set to shrink overall.

-

The bond will provide multi-peril coverage in the US and District of Columbia.

-

The pricing multiple on the deal is 12.1x the sensitivity case expected loss.

-

Beazley returned with its second Fuchsia cat bond issuance.

-

Former ILS investors who left the space have looked again and re-allocated.

-

The scheme’s ILS allocation has held steady at 0.7% of the total fund.

-

The ILS manager’s existing Medici cat bond strategy stood at $1.68bn in assets under management (AuM) as of 30 September.

-

CEO Jonathan Zaffino said he saw opportunities for expansion in casualty.

-

Management track record has been a factor in capital raising for 2025.

-

The firm is understood to be reviewing contracts to bind coverage for 1 January.

-

Losses from Hurricane Milton are expected to affect only select junior structures.

-

The ruling indicated it was unlikely all claims would be dismissed, as defendants had requested.

-

The fund will invest in listed and private transactions.

-

The ILS manager has hit back at an attempt by the defendants to have the case dismissed.

-

Euler ILS Partners and Tropical Storm Risk teamed up to produce an updated version of an earlier study.

-

Moderate impacts to ILS returns are anticipated from Hurricane Milton.

-

The UCITS fund was launched in 2021 and invests in cat bonds and the money markets.

-

The headline figure of $7.72bn includes $3.11bn of DaVinci equity plus debt.

-

Shareholders are voting to approve being wound up on 18 December.

-

Strong growth in fee income builds on the favourable rating environment.

-

The ILS unit’s AuM was higher by $100mn compared to $1.9bn as of 30 June.

-

The fund will be denominated in US dollars and digital currencies.

-

The new funds will target the US wealth market through financial professionals.

-

The reinsurer confirmed its intention to reduce the K-Cession sidecar for 2025.

-

Cheaper traditional reinsurance as of mid-year may have dampened deal pipeline.

-

The failure of a Jamaica bond to pay out following Hurricane Beryl damage has brought focus onto the deals.

-

Daniel Ineichen, former co-head of ILS, had been with the company for nearly two decades.

-

The firm’s AuM in four key vehicles rose $526mn in Q3.

-

Michael Rich left the portfolio management role in May.

-

Latest pricing suggests secondary market traders are baking in further loss development.

-

Some $409mn of volume entered the market in the week to 4 November.

-

The low PCS number is presenting a challenge for ILW buyers and sellers.

-

Nephila revenues would likely have been higher, but for an ‘elevated climate signal’ this year.

-

Fee income fell by 42% to $25.1mn in Q3 over the prior-year quarter.

-

The pension scheme has been winding down its ILS portfolio in recent years.

-

The deal would represent a diversifying auto risk deal.

-

The ILS allocation increased in dollar terms and held steady in euros.

-

Managers expect Hurricane Milton losses to shore up pricing.

-

Risk remote strategies, including private ILS, have outperformed higher risk strategies over the last decade.

-

Florida domestics, aggregate retro and flood deals were all marked down.

-

The ILS industry alumnus is understood to have two ILS investors lined up.

-

Hurricane Milton will show the ILS product behaving as investors expect it to.

-

This is a far narrower drop than post Ian, when the index was lost 10%.

-

A $40bn Milton loss should barely dent many ILS returns but will trap some capital.

-

Integrity Re 2024-D and Lightning Re 2023-1A are two bonds that were marked down, although no trading has occurred.

-

Hurricane Milton’s overall impact, based on the current pre-landfall scenario, could lead to “moderate losses” for Plenum’s funds.

-

Collateralised reinsurance and retro are in the firing line.

-

The class of 2023-24 cat bond funds will grow existing investors and add new ones.

-

The firm’s new name is inspired by 18th Century Swiss mathematician Leonard Euler.

-

Maya Henry will be tasked with raising capital and managing clients in North America.

-

The deal freed up capital held against deals written in 2019 and 2020.

-

The ILS industry offered 11 points of merit that justify cat bonds being eligible for UCITS funds.

-

The deal takes year-to-date cat bond lite issuance to $367.6mn

-

The CEO cited ‘no change’ in appetite from a shift in the capital mix.

-

The manager is looking to buy positions on the secondary market.

-

Schroders moves into fifth place in the Insurance Insider ILS leaderboard.

-

The ILS manager leaderboard demonstrates the ongoing popularity of cat bonds.

-

The combined Twelve-Securis entity would be a top-five ILS firm currently.

-

More than 30% of the fund's AuM is allocated to US windstorm-linked bonds.

-

-

Secondary market activity and hedging would be likely if a Beryl-sized storm tracked toward the US.

-

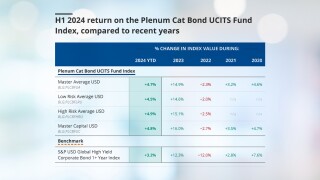

This is lower compared to 8.2% recorded by the index in H1 2023.

-

DeCaro is one of the cohort of pioneering ILS managers.

-

The Swedish fund AP2 invests in Fermat GAM, Elementum and Credit Suisse.

-

Sources said that Gallagher Re had ‘first mover’ advantage as the exclusive broker.

-

Sub-1% management fee and performance fee-only structures have evolved in ILS.

-

The Icosa Cat Bond Strategy now stands at $130mn in AuM.

-

Tanja Wrosch joins Twelve after more than a decade at Credit Suisse ILS.

-

The regulation now allows pension funds a more flexible benchmark for measuring alternatives.

-

Rich had spent 13 years at the firm where he began his career and oversaw a cat bond and ILS portfolio.

-

-

The Sussex Capital ILS platform managed $440mn at its 2019 peak.

-

Citizens also secured $1.1bn of limit for its Everglades Re cat bond.

-

The capital will be allocated to a pure cat bond strategy, sources have confirmed.

-

The capital will be deployed by Bermuda-based special purpose insurer Arachne.

-

Combined AuM of UCITS funds stood at $11.3bn as of 26 April 2024.

-

The pension fund’s ILS allocation as of the end of 2023 was CHF300.3mn ($356.8mn).

-

Over Q1, the loss ratio improved by 34.6 points year on year to 43.7%.

-

ILS returned 3.2% for the scheme in the first quarter.

-

The platform’s ILS holdings comprise cat bonds and UCITs funds, and were up 8% over January and February.

-

The syndicate snatched the number one spot from Chaucer’s Syndicate 1176.

-

Fee income was up by 30% year-over-year to $136mn in 2023.

-

The fund will follow an existing Twelve strategy and add short-term corporate bonds.

-

Chris Parry said the denominator effect remains a suppressant on ILS inflows after a strong phase of returns.

-

The Guernsey legacy carrier is working with an independent valuer.

-

Daniel Ineichen and Flavio Matter have been promoted to co-heads of ILS.

-

It is only the second year in the last eight that the allocation grew.

-

CEO Hussain said third-party capital in 2023 remained flat.

-

The firm’s assets under management dropped to $1.6bn, as a capital return more than offset new inflows.

-

Head of alternatives Gareth Abley believes the asset class remains attractive following a 16% return in 2023.

-

The outlook for M&A activity is brighter after 2023 returns.

-

The parent also expects the ILS platform’s AuM to grow.

-

The acquiring reinsurer will now run off the business.

-

-

The reinsurer’s assets under management rose 14% to $3.3bn.

-

Aside from the one-year view, 2023 remixes the track record.

-

-

The firm told investors yields in the cat bond market are 'still very attractive'.

-

Of the 18 top-tier ILS managers, 10 recorded growth, while eight were flat or down.

-

The sidecars segment has been attracting inflows after returns hit a high note in 2023.

-

Cat bonds and sidecars are well positioned for growth, while private ILS will benefit from further innovations to improve liquidity.

-

In its semi-annual report for the six months to 31 July 2023, the manager said the fund had returned 2.74% over the half-year.

-

The bond will provide protection from named storms in Florida for three years.

-

The independent manager’s post-Ian growth has helped it more than double from prior estimated assets under management.

-

The Swiss Re Total Return Index climbed month-over-month throughout the year, to more than regain ground lost after Hurricane Ian in September 2022.

-

Nearly 90% of the fund’s allocation is in cat bonds, with a small allocation to other ILS securities and US Treasury Bills.

-

The firm will deploy newly developed, proprietary cat bond analysis platform Hubble.

-

Broker-dealers' year-ahead forecasts have undershot total final issuance in three of the last five years.

-

The new fund generated 11.2% in profits for the period from 27 January to 31 October last year.

-

Schwartz will set the firm’s investment process on its ILS, equity and debt strategies.

-

The asset manager’s flagship ILS funds posted stellar returns for its 2023 fiscal year.

-

The firm’s flagship reinsurance strategy delivered its best performance in its 10-year history.

-

Projected 2024 ILS returns remain historically high, but signs of increased appetite for top-layer cat risk and top-end retro raise questions over how long this will last.

-

The year brought a degree of closure on the loss-hit years of 2017-2021, while the outlook remains changeable for ILS managers.

-

The Eurekahedge ILS Advisers Index has posted the strongest performance for October since it started in 2008.

-

Swiss Re Alternative Capital Partners assets under management hit $3.3bn as of 30 September.

-

The Australian sovereign wealth fund first allocated to the ILS manager in 2016.

-

ILS managers are still waiting for hard market growth.

-

Research by Kepler Absolute Hedge showed that seven out of the 10 best-performing alt credit funds were cat bond strategies.

-

AuM stood at $1.5bn as of 30 September, up from $1.2bn as of January 2023.

-

The Zurich-based ILS manager has grown the fund by around 167% from $150mn as of mid-2021.

-

Artex hopes the rebrand will bring greater efficiency and a higher level of service to clients

-

A new pooling structure allowed the firm to free up historic side pockets and provides a template for future exit options.

-

Steiger is said to be moving to an “entrepreneurial” role after more than six years with the Zurich-based firm.

-

With more ILS managers chasing the popular bond space, how will new operators differentiate themselves?

-

The ILS sector grew in the context of 0% interest rates historically.

-

Hiscox said outflows from the ILS unit were offset by "record returns" in Q3.

-

De Klerk spent a decade at Artex Risk Solutions, where he created special purpose insurers and closed cat bonds.

-

The investment manager held its outlook at strongly overweight for cat bonds, retro and private ILS in Q4.

-

Prior-year cat loss years that are finally shaking out drove fee benefits in Q3.

-

The Bermudian firm said it expects the acquisition could drive more growth than the prior forecast of $2.7bn incremental premium.

-

The ILS firm reported $6.8bn of assets under management at the third-quarter mark.

-

A market-wide loss of $700mn would amount to around 15% of the total amount of life ILS assets under management .