-

The SPV will underwrite a “broad and highly diversified” portion of Amwins’ ~$6bn delegated authority premiums.

-

The finance committee discussed shifting market dynamics as tort reform takes effect.

-

The offering is born out of software Ledger developed to manage its own portfolio since 2021.

-

Cassis joins from Swiss Re, where she was a senior ILS structurer since February 2022.

-

EMEA CEO Laurent Rousseau said reinsurance must retain its relevance to investors.

-

While rates have “definitely come down,” they were coming off a high base, Rachel Turk said.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

Mory Katz joined the broker earlier this year.

-

Guy Carpenter will rebrand as Marsh Re, as a new central tech/operations unit is created.

-

Ryan Saul will work at Ledger’s broker-dealer subsidiary Ledger Capital Markets.

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

The executive has worked at Aon for almost two decades.

-

The facility will initially focus on US, Bermudian and European business.

-

Marlon Williams will focus on the placement of reinsurance and retro business.

-

The hire comes as Guy Carpenter fills the void created by the Willis Re raid earlier this year.

-

The ILS services specialist has worked in the ILS market in Bermuda for 10 years.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

Nick Fallon is the latest in a string of retro-broker moves in the market.

-

Bohm has held senior roles at BMS, Swiss Re and Aon during his career.

-

The trend for private credit in alternative asset management is “set to continue”.

-

The investment bank had stopped offering ILS services last September.

-

A trend towards higher-risk ILW bonds helped keep yields in double-digits despite softer rates.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

American Integrity grew GWP by 30% to $287mn and Slide GWP was up 25% to $435mn in Q2.

-

The transaction is expected to close later this year.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

Matthew Flynn joins from RenaissanceRe.

-

Cat bond broking growth contributed to 6% organic growth in reinsurance.

-

George Cantlay will also assume the additional position of president of the Bermuda business.

-

The broker has nearly 20 years of experience in the reinsurance and retro markets.

-

Matthew Towsey has spent 14 years at Aon.

-

US events accounted for more than 90% of global insured losses.

-

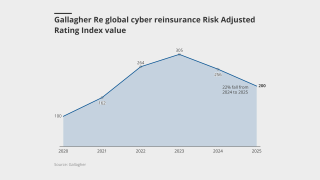

In the US, the index fell 6.7% year on year.

-

Richardson has been with the firm since 2015 and was most recently vice chair and chair of international.

-

The measure could have landed insurers with extra tax on US business.

-

A group of Bermuda staff also left the broker.

-

The awards celebration took place at the Hilton Bankside on 25 June.

-

John Kulik will work within Ledger’s broking team, Ledger Investing.

-

The documents figure in a potential criminal case against a CCB employee.

-

The Bermuda-based team is led by John Fletcher.

-

The executive has 15 years of experience in meteorology and cat analytics.

-

David Baldwin joins from EIRS where he was a senior reinsurance consultant.

-

Lyon joins the reinsurance broker from law firm Skadden, Arps, Slate, Meagher & Flom.

-

Up to nine million acres of US land are considered likely to burn.

-

Property cat XoL rates were off by around 10% on average on a blended risk-adjusted basis.

-

SCS can no longer be considered a "secondary" peril for the US insurance market, Steve Bowen said.

-

Two large storms hit the Midwest and Ohio Valley regions on 14-17 May and 18-20 May.

-

As with 2024, pricing pressure has been most acute on top layers.

-

The Altamont-backed broker has been building out its team since launching in 2023.

-

Sources believe the market will grow gradually over years after its initial cluster of dealmaking.

-

The team will focus on building out Miller’s property treaty, retro and ILS capabilities, it’s understood.

-

Commutations need to be optimal for the sponsor and the investor to avoid sponsors taking back chunky risks.

-

The renewal and upsizing of the Trouvaille E&S sidecar highlighted the market’s potential.

-

Growing economic and population exposures are driving potentially larger insured losses.

-

This year’s ceremony will include the inaugural Women in ILS Award presentation.

-

SCS losses were also above average in Q1 due to “lingering” La Niña conditions.

-

Insured losses were the second highest on record for the first quarter.

-

Sykes has spent over 31 years with Aon, with the last 15 of those in Guernsey.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

Markets have taken a battering across the globe following the “Liberation Day” announcement.

-

The cat bond market surpassed $50bn by the end of Q1 2025.

-

The reinsurance broker said total reinsurance market capacity was up 5.3% year over year.

-

The acquisition expands its global employee benefits business to ~4,000 global employees.

-

The March 13-16 storms would mark the first billion-dollar US SCS event of the year.

-

The broker has promoted Oriol Gaspa Rebull to global head of analytics strategy.

-

The firm also promoted Devin Inskeep to an expanded role as SVP, head of ratings and advisory.

-

Earlier today, Aon confirmed president Eric Andersen had stepped down from his role.

-

The executive will remain with the firm as a senior adviser to the CEO until mid-2026.

-

The executive worked in investment banking before joining the reinsurance industry.

-

There is the potential for cat bond H1 issuance to be a record breaking six months.

-

The executive spent a brief period at Wakam in a capital and reinsurance role.

-

The role will focus on international treaty, specialty lines and strategic advisory.

-

Bolding will focus on aligning Gallagher Securities with Gallagher Re.

-

Derrick Easton has led Willis’s US ART team since joining the company in 2015.

-

Shreeve’s role will encompass the Aon Captive & Insurance Managers’ ILS business.

-

Capital inflows, notably into UCITS funds, and accumulated returns supported issuance of $17.2bn in 2024.

-

The broker also plans to hire from LSN Re and Aon Re, as part of a build-out of its team in the French capital.

-

Graeme Bell (pictured) will continue in his role as group legal officer.

-

Guy Carpenter said personal lines exposure would account for 85% of the aggregate loss.

-

Severe convective storms accounted for 41% of last year’s insured loss load.

-

Kusche and Rosenberg will co-lead the firm’s global ILS business.

-

The ILS and reinsurance broker was established last October by Raj Jadeja.

-

The Palisades fire is estimated at $9bn-$12bn, while Eaton is $6bn-$8bn.

-

Paul Poschmann joins from Gallagher Re, where he was a divisional director.

-

The deal comes around three years after Markel sold a controlling interest in Velocity for $181.3mn.

-

Cat bond investors have earned a cumulative 39.6% over 2023 and 2024.

-

The forecasts anticipate a large volume of maturities and rising sponsor demand.

-

Cat bonds were a key supply-side driver at 1 January 2025.

-

Investment in the space comes mainly from the cat bond market, Gallagher Re said.

-

The broker estimated ILS capital has reached $107bn.

-

The executive will play a key role in capital arrangements for Acrisure’s suite of underwriting units.

-

The reinsurance veteran joins from Artex Risk Solutions.

-

Magnani has served for more than 14 years in ILS broking roles.

-

WTW sold Willis Re to Gallagher in 2021 for $3.5bn.

-

The facility will also provide a dividend to clients for the first time.

-

Tyler left Gallagher Re earlier this year.

-

A client presentation from the broker put total insured losses at $25bn-$40bn, leaving the Citizens and the National Flood Insurance Programs clear of reinsurance impacts.

-

Roman Romeo was named CEO of Reinsurance Solutions in Bermuda in April this year.

-

Richard Pennay will become CEO of Aon Securities.

-

The broker replaces Goldman Sachs on the business after the bank ceased offering ILS services.

-

AI’s ability to analyse vast datasets will help in matching risk to capital.

-

Growth was driven by strong returns and new investors entering the market.

-

The July downtime will increase relevance, demand and innovation for the market.

-

The broker said the mid-year reinsurance renewals benefitted from “more than ample” capacity.

-

Sébastien Bamsey joins from JP Morgan, where he has worked for 18 years.

-

Torrential rain caused flash floods in the Gulf States in the middle of April.

-

He will report to Kelly Superczynski, Aon’s global head of capital advisory.

-

The practice aligns existing capabilities from Marsh Specialty and others.

-

The former Ledger director was joined by fellow ex-Ledger employees to “hit the ground running”.

-

Juniper Re Bermuda received preliminary approval from the BMA last month.

-

The RfP covers the CEA and/or the California Wildfire Fund.

-

Driscoll and Lubert have been promoted to presidents.

-

The ILS executive will head up structuring for the Americas.

-

The challenger broker is continuing to build out its presence on the island.

-

The hire has 20 years’ experience in asset management and corporate finance.

-

The client lacked options in the conventional insurance market.

-

He is succeeded by interim co-CEOs Andrew Wheeler and Russ McGuire.

-

The broker platform has managed nearly $100mn of capacity.

-

2023 was the fourth consecutive year insured cat losses surpassed $100bn.

-

Wind and tornado in the US may already have led to losses in the hundreds of millions, according to Aon’s report.

-

The head of the ILS international team at Gallagher Securities Europe expects ILS issuance in the region to grow following rises in the European Central Bank rate.

-

While it is too early to determine the total financial loss, the US Geological Survey believes there is a 64% likelihood it will reach into the billions of US dollars.

-

The broker’s 1st View report predicted that cat bond issuance should remain elevated until at least Q2 2024.

-

Top-layer cat risk is attracting additional capacity but reinsurers remain firm on attachment points, the broker said.

-

Bohm joins from Swiss Re Capital Markets, where he was head of structuring for the Americas.

-

Mark Shumway joins from Howden Capital Markets, where he has been managing director since 2020.

-

The leadership change follows Howden’s landmark acquisition of TigerRisk at the beginning of the year.

-

Nichols joins from Aeolus Capital Management, where he’d served as a portfolio manager after previously spending nearly a decade at Guy Carpenter.

-

The broker said it believes it has meritorious defenses and intends to vigorously fight the claims and seek recourse against third parties where appropriate.

-

The firm said it had identified two specific transactions in which “collateral inconsistencies” were in question.

-

Skilton will be chair of the team with Wheeler and Murray heading up the global re specialty unit.

-

The specialty leader had worked at recent acquisition Willis Re since 1998.

-

Former retro broker Erik Manning is leading the initiative having joined BMS Re in January.

-

Minesh Jani will report to Bradley Maltese, CEO of international and global specialties.

-

Bay Risk will become part of Gallagher Re’s Global Programmes practice group, led by Andrew Moss.

-

The appointments aim to provide clients with a product-agnostic view on accessing capital in a capacity-constrained market.

-

Their view that “investors have never had it so good” speaks of a market in an upbeat mood as of January.

-

The outgoing McGill and Partners head of structured solutions will become CEO of Augment after fulfilling his contact at McGill.

-

The broker said clients can move fast in a harder market but need time to review quotes.

-

The broker is looking to solve the severe capacity crunch for its clients as rising demand meets falling supply.

-

Paul Shedden joins from Sompo International, where he was head of portfolio design, pricing and analytics – global insurance.

-

Jason Bolding adds to the growing team recently joined by Alexandre Delacroix and Keshav Gupta.

-

The CEO said the (re)insurance industry is not doing enough to meet the climate challenge ahead.

-

The broker said it would help clients to think creatively and act quickly in accessing capital.

-

The broker said some reinsurers were planning for significant growth in property catastrophe as demand is expected to pick up pace.

-

The former Gallagher Re broker is the second departure from the firm in Bermuda since the Willis Re sale.

-

The appointment to the ILS unit follows news of Howden’s move to buy TigerRisk.

-

The property reinsurance underwriter had joined Axis Re’s London team three years ago.

-

The rate-on-line index rise is the steepest uplift in 16 years.

-

Its total risk transfer programme is sized at just over $9bn, down $400mn from year-end 2021.

-

The scope of McCann’s new role spans across various property segments, including retrocession.

-

After securing a $1.6bn deal to acquire TigerRisk, Howden said the transaction will create a “much-needed fourth global player” in reinsurance.

-

The intermediary’s reinsurance solutions business has appointed Joanna Parsons as it looks to expand its capital advisory unit.

-

Sources indicated talks have been conducted using an adjusted Ebitda figure for TigerRisk of around $85mn-$90mn, which is far higher than previously thought.

-

The broker said its capital markets unit would be “fully aligned with the broking and analytics teams.

-

The state insurer expects to face a 29% increase in its premium rates, driven by exposure growth.

-

TigerRisk Partners has added two new brokers to its delegated authority business, including entering the Australian market as it appointed Simon Chandler as head of reinsurance broking programmes and binders.

-

The broker’s appointment of Jim Fiore follows his decision last year to leave QBE after nearly 30 years at the carrier.

-

Michael Fitzgerald has also been promoted to head of the firm’s North Carolina office.

-

The broker and ratings agency AM Best said total deployed capital grew 2.7% in 2021.

-

At Lockton Re, Cheney spent the last 18 months as senior broker and co-leader of its property practice.

-

European loss experience drove the firm’s index back in line with 2014 levels.

-

The new coverage marks the first time that sovereign debt repayments have been protected by a parametric catastrophe clause.

-

Madison Dearborn has increased its shareholding, while HPS has reinvested.

-

The BMS meteorologist said early data indicated “truly historic outbreak”, and that similar events typically cost the industry in the low-single digit billions of dollars.

-

1 January renewals are running late across the board as reinsurers hold out for improved terms, but the retro segment is the most challenged for capacity.

-

The target firm deals in engineering, energy, P&C and specie.

-

The partnership seeks to help response and recovery organisations manage the “entire lifecycle” of a catastrophe.

-

Insured losses from severe weather events in the US are on course to exceed $20bn, following the second highest October tornado tally on record, according to a report from Aon.

-

The broker said that weather-related losses had become more severe in the past decade because of climate change.

-

Lockton Re has hired James Boon from Aon to work as a senior broker in the expansive non-marine retrocession and property specialty division.

-

The broking group has hired Sussex Capital’s Adam Champion and investment banker Niall Baird for the new venture.

-

Howden said passing risks onto governments would degrade the value of the insurance industry.

-

The Competition and Markets Authority will investigate whether the deal lessens competition in the UK.

-

The company has also confirmed that new recruit Tim Ronda will join as president later this month.

-

The former Aon US reinsurance president will join the challenger broker in just two weeks.

-

Tim Ronda was president of Aon’s US reinsurance business and was recently given a new global leadership role.

-

The Willis solution is designed to help companies access insurance as they transition to a low-carbon business model.

-

The broker has explained the rationale for its $3.25bn acquisition of Willis Re on an investor call.

-

After the collapse of the Aon-Willis merger, Gallagher has successfully resurrected the deal that will catapult its reinsurance operation into the big league.

-

He spent more than seven years as vice president of the firm’s capital markets and advisory division.

-

The companies disclosed that Aon will pay Willis the $1bn break fee.

-

The broker must ensure it is “leaving no stone unturned” in its search for capital, according to president and CEO of North America Pete Chandler.

-

The brokers have offered to divest Willis’ largest corporate risk and broking clients to Gallagher’s Crombie Lockwood.

-

BMS Re seeks to consolidate its presence in key areas such as Florida, Los Angeles, North Carolina and the greater Boston area.

-

The reinsurance broker will work in tandem with wider Marsh McLennan companies to provide an integrated service.

-

The new broker will sit within Steve Hearn’s capital solutions division.

-

The facility is the second in South America for the firm, which established a local presence in Argentina in 2016.

-

Frederick Streeton will join in September from Liberty Mutual Group, where he was head of underwriting strategy for the its global risk solutions business.

-

Trading Risk reported last year that the Aon executive had resigned to join Lockton.

-

The AJ Gallagher CEO said rate increases are providing tailwinds while the M&A pipeline remains strong.

-

The broking houses also said they "remain fully committed to the benefits of [their] proposed combination".

-

The model uses research and technology to provide insurers with a more in-depth view of risk when submitting risk filings in Florida.

-

Davies most recently served as head of global Re specialty Bermuda for the firm’s reinsurance division.

-

The executive will take on the role of chairman of retro, property specialty, Bermuda and market capital.

-

The company said the funds raised would kick-start its effort to become a full-stack insurer.

-

The new finance chief arrives from cyber InsurTech Resilience, where he was CFO, having previously spent 23 years at JLT.

-

The executive had previously been the head of third-party capital at Axis.

-

The transaction will create London’s largest independent specialty and wholesale broking business.

-

He is expected to join the firm’s property reinsurance broking team after his gardening leave ends.

-

The reinsurance broker is looking to recover over £10mn and impose an injunction to ensure the return of confidential information.

-

Around 15 producing brokers are on the move, with a number from the non-marine specialties team.

-

The broker says the ILS alliance will "meaningfully increase" its capacity in three segments.

-

Marcus Foley joins the Bermuda office, while Tim Radford will work in London.

-

The merger may cause price increases or reduced service levels for major insurance buyers.

-

The executive’s hire continues a run of talent that has joined BMS in the past year.

-

Along with its reinsurance platform, the company plans to help brokers hold in-house auctions.

-

The intermediary cited Convex and Vantage among new entrants adding capacity to the market at the renewal.

-

US contracts are still pricing at a 10%-15% premium to January 2020 levels, but excess retro capacity may impact the smaller market.

-

The move is part of a wider expansion in BMS’s reinsurance broking capabilities.

-

By year-end some bonds were trading at above-par levels that put implied spreads 15%-28% lower than mid-year when the deals were issued.

-

The new capacity for the sidecar first launched in 2019 will be invested solely in EBRD bonds.

-

The new classification will allow the carrier to increase GWP and third-party risk.

-

The retro specialist joins the firm as it prepares to expand its reinsurance interests after spinning out of Willis.

-

Slew of maturities and competitive pricing environment make the cat bond market attractive for sponsors, brokers say

-

Centeno has three decades of insurance experience and focuses on D&O, M&A and tax liability cover.

-

Tougher positioning by reinsurers at the 1.1 renewal accelerated the practice of placing business at differentiated terms, Irvan said.

-

The deal “may reduce choice” for cedants in choosing reinsurance brokers, the EC said.

-

The Lloyd’s CEO said it was not for business to set the tone on climate, as the Corporation laid out its first ESG report.

-

With a low initial expected loss of 0.25%, the notes offer a substantial 11.6x multiple.

-

The pact is Tremor’s first integration with a global broker.

-

The broker will operate as Acrisure Re and Acrisure London Wholesale.

-

Former president Widdicombe has taken the role of chairman, as planned, but won’t serve on any board committee.

-

The $100mn+ Bonanza deal is the Floridian’s third foray into the cat bond market

-

The busy storm season, Covid-19 uncertainty and a hardening market are driving demand.

-

The cyber insurance sector is set to grow to $20bn by 2025, the broker said.

-

Nearly 80% of respondents said underwriting capacity decreased in the quarter.

-

Purchasing the analytics firm will help Willis meet growing demand for climate change services.