RenaissanceRe

-

Fontana 2.0 will encompass a more flexible investment strategy than the 2022 vehicle.

-

Growth included a $240mn increase in partner capital in DaVinci equity plus debt.

-

Carriers are grappling with a rush of investor interest in longer-tail lines.

-

O’Donnell believes RenRe is well positioned to produce longer-tail risk to third-party investors.

-

Third-party investors made a net income of $415mn in the quarter.

-

The allocation is around 3% of the fund’s total assets.

-

Improved performance and growing investment returns played a role in the upgrade.

-

Reinsurers are confident on cat rates and ready to deploy ILS capital.

-

The firm’s ILS vehicles posted low single-digit growth in assets under management in Q2.

-

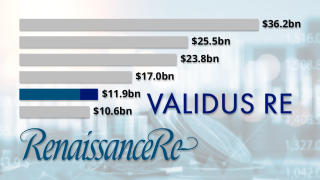

The merged business of Twelve Securis ranked third among ILS managers for AuM, behind Fermat and RenRe.

-

Reserve releases helped to recapture deferred fees.

-

The reinsurer returned $216.7mn to investors in Q2.

-

The awards celebration took place at the Hilton Bankside on 25 June.

-

Some assets in the Medici Fund were transferred to a new UCITS strategy.

-

The firm’s assets under management were down $300mn in Q1 as performance fee income was hit.

-

January’s California wildfires meant third-party investors suffered a loss of $195.3mn.

-

Sources warned some property XoL books are already running 50% loss ratios.

-

The fund is open to European and other global investors.

-

There was a slight increase in DaVinci and Fontana from 31 December 2024 to 1 January 2025.

-

Models will need to steepen the curve in the tail to reflect severe event frequency.

-

-

The ILS manager’s existing Medici cat bond strategy stood at $1.68bn in assets under management (AuM) as of 30 September.

-

The headline figure of $7.72bn includes $3.11bn of DaVinci equity plus debt.

-

Strong growth in fee income builds on the favourable rating environment.

-

In other property, Helene and Milton will assure rates remain attractive, he added.

-

The firm’s AuM in four key vehicles rose $526mn in Q3.

-

The deal freed up capital held against deals written in 2019 and 2020.

-

Cat bond funds continue to draw interest as private ILS more challenged.

-

The headline figure of $7.15bn includes $2.91bn of DaVinci equity plus debt.

-

The property market remains “one of the most favorable ... I've seen in my career,” the executive said.

-

The reinsurer raised $84.5mn of third-party capital in the quarter.

-

A degree of pricing volatility was evident in the market this week.

-

Pricing on the Class A notes settled 11% below guidance.

-

The bond is offering investors a spread range of 1,050-1,150 bps.

-

The firm said it expects Capital Partners to continue to grow.

-

Performance fees soared by 605% to $27.5mn from $3.9mn in Q1 2023.

-

Chris Parry said the denominator effect remains a suppressant on ILS inflows after a strong phase of returns.

-

The acquiring reinsurer will now run off the business.

-

The rise was helped by performance fees at DaVinci.

-

The Bermudian said its third-party vehicles were “sufficiently capitalised”.

-

Fourth quarter inflows also included $111mn for its retro platform Upsilon

-

The Medici cat bond fund experienced the largest growth in AuM.

-

The year brought a degree of closure on the loss-hit years of 2017-2021, while the outlook remains changeable for ILS managers.

-

Key names taking up senior roles at Validus include Sven Wehmeyer and Pablo Nunez.

-

Prior-year cat loss years that are finally shaking out drove fee benefits in Q3.

-

The Bermudian firm said it expects the acquisition could drive more growth than the prior forecast of $2.7bn incremental premium.

-

The carrier returned $369mn of capital to third-party investors in Q3 from investors in the Upsilon and Vermeer vehicles.

-

As of year-end 2022, the fund’s largest ILS allocation was in a RenRe fund.

-

The industry’s ability to draw new capital will hinge on the outcome of the Atlantic hurricane season.

-

The AuM total hits $12.1bn when including Top Layer Re and RenRe’s own participation.

-

The reinsurer said it was monitoring conditions in the property E&S markets, where it has been reducing capacity to grow in property treaty, as rate gains could provide fertile ground for future growth.

-

The reinsurer’s ILS vehicles delivered returns of $174.9mn to investors during the quarter, with improved returns from PGGM joint venture Vermeer and the Medici cat bond fund.

-

The investment firm’s ILS holdings were worth around $746mn at year-end 2022.

-

Removing any competitor is a positive for ILS peers in a competitive time for fundraising, but it is not clear how much of a boost this will give RenRe.

-

RenRe will be taking control of ILS manager AlphaCat as part of its purchase of Validus Re.

-

The takeover will push it up two places to rank as the fifth-largest writer of P&C reinsurance by gross premium.

-

AIG will invest a significant amount into Fontana and DaVinci.

-

The Bermudian reinsurer launched a public offering of 6,300,000 common shares and anticipates raising around $1.15bn to finance the transaction.

-

The deal includes AIG's AlphaCat platform.

-

The CEO said the reinsurer has already written some private deals ahead of the June 1 deadline and expects to continue a pivot away from E&S in favour of property cat reinsurance.

-

The reinsurer’s core management fee income was up by 50% year on year to $40.9mn.

-

RenaissanceRe won the Manager of the Year title, while Beazley’s cyber cat bond won the non-life transaction of the year.

-

The executive will stand for election at RenRe’s AGM in May.

-

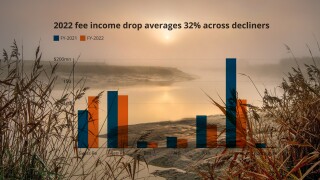

Reinsurer-owned ILS platforms were challenged to grow fee income in a tough year for nat cat losses and as cat market economics shifted.

-

The capital commitments to the vehicle have expired.

-

Shea has worked at RenRe for seven years, most recently having served as head of underwriting for credit before the promotion.

-

The CEO said the reinsurer expects to post $35mn of fee income a quarter after raising more capital.

-

All four of the firm’s key third-party vehicles were profitable in the quarter.

-

The headline market drop in AuM belies a more lively growth story for funds operating outside of the ILS major league.

-

The world’s largest investment company has assets under management of more than $10tn.

-

The firm elevated Justin O'Keefe, Cathal Carr, Fiona Walden and Bryan Dalton to US and Bermuda, Europe, casualty & specialty, and property CUOs, respectively.

-

The bond includes two layers protecting against annual aggregate and occurrence losses.

-

The market is characterised by rising prices and shrinking deal sizes as investors pick and choose over which bonds to back.

-

The transaction across two tranches is offering higher multiples compared to the 2021 Mona Lisa issuance, with pricing on the aggregate layer almost 80% up despite carrying a lower risk level.

-

The RenRe vehicle, formerly a major retro writer, has been a reduced force this year.

-

The reinsurer is ready to “walk away from business” where it feels pricing and terms and conditions are not good enough.

-

Some firms have fared better than others in the competition to raise funds during the year.

-

The Bermudian reinsurer said both appointments are effective January 1, 2023.

-

The reinsurer raised $122mn in Q3, including $100mn for PGGM joint venture Vermeer and $22mn in its cat bond fund.

-

The company’s third-party assets dropped $178mn during Q3 to $4.2bn.

-

A 3.9-point decline in the casualty and specialty segment offset a 2.5-point deterioration in the company’s property business.

-

The estimate is driven by $540mn of losses attributable to Hurricane Ian.

-

Ratings agencies suggest that carriers must do better on controlling volatility – but diverging risk appetites give the lie to the idea that the industry is walking away from risk.

-

In its Q2 earnings call, CEO Kevin O’Donnell said that the company held its PMLs flat while taking the benefit of increased rate.

-

The firm’s Medici and Fontana vehicles were hit by foreign exchange losses.

-

The company’s property segment booked a combined ratio of 57.6%, 13.8 points higher compared to Q2 2021 due to a higher attritional loss ratio.

-

The hardening rate environment in Florida provided a mid-year opportunity for some, but overall there was little growth.

-

The segment’s lustre has been dulled by losses and capital trapping.

-

The hire of the senior Horseshoe executive follows two earlier ones, as Bryce Wojciechowski and Alex Staab joined as analysts.

-

RenaissanceRe CEO Kevin O’Donnell explained on an earnings call his take on the mid-year renewals and a relatively low impact of the Ukraine war.

-

Higher interest rates drove investment write-downs that offset a turnaround in underwriting performance after last year’s first quarter was hit by Uri losses.

-

The committee is the most senior management team at the Bermuda company, responsible for governance and strategy of the firm.

-

Fontana investors will face a short lock-up period in the sidecar’s ramp-up phase, but thereafter there will be some “embedded liquidity.”

-

The new platform extends RenRe’s suite of ILS and reinsurance strategies.

-

The carrier has introduced a number of ESG-focused roles, which sees Cathal Carr, SVP, underwriting, appointed as global head of climate and sustainability strategy.

-

Executive pay at RenaissanceRe fell for the second year in a row in 2021 after a “disappointing” return for shareholders in a year of elevated natural catastrophes.

-

Carr was previously SVP, global head of property catastrophe at the reinsurer.

-

RenaissanceRe has nominated Shyam Gidumal to its board, while Jean Hamilton is set to retire from the board in May 2022.

-

RenaissanceRe had raised $470mn for the high-risk fund platform a year earlier.

-

The company’s DaVinci fund grew by $500mn as it took in a higher share of cat risk from the group.

-

The third-party capital raise came in 24% lower than January 2021, as the DaVinci sidecar took most inflows.

-

Manjit Varwandkar, who managed the parametrics product line at Sompo, will manage the Medici Fund.

-

The CEO and president said he expects to shrink the portfolio for retro-focussed sidecar Upsilon.

-

Performance declined at the reinsurer’s third-party ventures owing to Q3’s big cat events.

-

The reinsurer grew GWP by 55% – to $1.77bn – helped by a surge in reinstatement premiums, but the company was weighed down by $727mn in net cat claims.

-

Its $725mn estimated losses equated to 10% of shareholders’ equity and came in ahead of its Q3 2017 losses of $617mn.

-

The figure – which included $440mn in losses from Hurricane Ida and $210mn from severe flooding in Europe – exceeds the $617mn in claims in the third quarter of 2017.

-

From ESG to social inflation, systemic risk to cat risk, we highlight some of the top discussions from this year’s four-day virtual conference.

-

Kevin O’Donnell also said he saw social inflation as more of a concern for the industry than climate change.

-

Fee income – an area of patchy disclosure by reinsurers – was generally stable amongst early reporters.

-

The reinsurer stepped off five Florida domestic insurance programmes but has taken more E&S risk in the southeast US.

-

The reinsurer posted intakes to its Medici and Upsilon funds.

-

The reinsurer upsized the transaction to $250mn, from a $150mn initial target.

-

The catastrophe bond’s price guidance was also tightened from the initial offer.

-

The issue, in conjunction with the DaVinci Re sidecar, follows a $400mn sale of the bond last year.

-

New and growing carriers helped to fill out treaties as Sompo stepped back from a market that came in flatter than expected for remote risk.

-

The reinsurer said it had significantly grown its casualty underwriting portfolio, but also returned $230mn via share buybacks to mid-April.

-

Last year, RenRe reported an operating profit of $33mn in Q1 due to Covid-19 losses.

-

Lynette Pirilla Walter takes on the chief legal officer role as John Drnek joins the firm in Bermuda as general counsel.

-

Significant moves over the past month included the appointment of Chris Parry as global head of RenaissanceRe Capital Partners and the departure of Axis head of risk funding Ben Rubin, as well as an ILS launch at ERS and a new bond team moving to Credit Suisse ILS.

-

The division had been led by group CEO Kevin O’Donnell on an interim basis following Aditya Dutt’s departure.

-

The move follows Fidelis’ decision to hand back $275mn it had raised for a retro vehicle.

-

RenRe said it had “ample dry powder” even after fully deploying its $1.1bn 2020 capital raise.

-

RenRe boosted its stake in DaVinci to 29% after buying $119mn of shares from third parties.

-

The additional $730mn in capital for its Upsilon RFO, DaVinci and Medici funds include $130mn of the company’s own money.

-

The reinsurer anticipates a $175mn hit from Covid-19 claims during the quarter.

-

The move comes as environmental policies move up the list of investor priorities.

-

RenRe thinks the major cat losses of Q3 will cause the property cat market to harden throughout 2021.

-

The Bermuda carrier will be an initial investor in Griffin Highline.

-

Rising capital costs, not losses, will support reinsurance rate increases, the CEO argued.

-

Nephila’s fall in AuM contributed to the trend of specialist firms shrinking, as reinsurer-backed assets were up modestly.

-

CEO Kevin O'Donnell also noted that RenRe had dropped one-third of its Florida clients.

-

The reinsurer did not provide an updated Covid-19 loss estimate.

-

The former RenRe third-party capital chief joins the Bermudian ILS firm.

-

RenaissanceRe CEO Kevin O'Donnell will take on responsibility for the firm's Ventures business on an interim basis.

-

RenaissanceRe raised $913mn from a new share issuance last week, with joint venture partner State Farm investing a further $75mn.

-

The shares change hands at a 0.6 percent premium to the undisturbed price, though more than 5 percent below Tuesday's close.

-

The sale of about 5.5 million shares would increase the carrier’s outstanding common stock by 12.5 percent.

-

Even as Florida rates improve, the reinsurer said it expects to hold back capacity for net growth and potential new demand.

-

Two large ILS managers bucked the trend for alternative retractions, but traditional carriers recorded the fastest expansion.

-

CEO Kevin O’Donnell said the firm was relying on cedents who advised of minimal property BI exposure.

-

A surge in earned premiums and reserve releases helped profits climb to $108mn in the first quarter.

-

Kevin O’Donnell said that several domestic insurers in Florida are now close to exhausting their 2017 treaties.

-

The carrier contributed more than $100mn of the January intakes for its retro-focused Upsilon fund and the Medici cat bond fund.

-

The firms said their relationship would see RenRe sourcing capital to provide Beazley with cyber catastrophe reinsurance cover.

-

Both tranches of the transaction priced at the bottom of the guidance range.

-

Pricing across the deal has slipped 1.5-3.2 percent, according to sources.

-

RenaissanceRe CEO Kevin O’Donnell estimated the market took $12bn of losses and brought in $20bn of new capital in 2017.

-

In its first public cat bond since 2013, the firm joins peers in seeking aggregate retro cover.

-

Retro fundraising hits the wall, with Eklund downing tools on start-up.

-

Wildfire recoveries benefitted DaVinci investors and RenRe's retro partners in Q3.

-

Sidecar sponsor RenaissanceRe also posted a 40 percent uplift in Q3 fee income.

-

The Bermudian reinsurer expects to pay out about $100mn in losses from Faxai and about $55mn for Dorian claims.

-

The RenRe CEO also warned that the market must be wary of repeating its errors in estimating Typhoon Jebi losses.

-

Former Tokio Millennium Re CEO Tatsuhiko ‘Tats’ Hoshina is now the chief commercial officer at the start-up.

-

Trading Risk looks at the dominant themes that the ILS market will be discussing at the 63rd Monte Carlo Reinsurance Rendez-Vous in September.

-

The catastrophe fund’s cover shrank by $80mn as it extracted flat pricing from carriers.

-

The former Tokio Millennium Re CEO said he believed the timing was right for an electronic marketplace in reinsurance.

-

The follow-up investments take its overall ILS allocation to up to $950mn, as it put in place mandates to respond to higher rates.

-

Industry leaders have lifted the expected total loss to a new high.

-

The growth contrasted with a 2 percent slide in collective assets among the top tier of ILS players.

-

The retro-focussed Upsilon fund saw limited growth, while the Medici cat bond fund attracted $107mn in new capital.

-

The RenRe CEO also flagged changes to the firm’s purchased and written retro portfolios in mid-year renewals.

-

The withdrawal of Catco created retro opportunities for the reinsurer, according to the CEO.

-

The reinsurer’s Q2 catastrophe property GWP rose by 37.7 percent year on year.

-

A total of $23.3mn is being held across bonds from 2017 and 2018.

-

The executive will work alongside head of international catastrophe Andrew Mellor at the Bermuda reinsurer.

-

With Nephila’s market share slightly shrinking, RenaissanceRe and Gen Re moved up the Florida leaderboard.

-

The former Tokio Millennium Re executive will help encourage uptake of the firm’s trial launch.

-

Everest Re and RenaissanceRe have given their support to the initiative.

-

Increased retro costs mean RenaissanceRe will likely be retaining more risk.

-

The DaVinci Re result drove net income from $29.9mn in the first quarter of 2018 to $70.2mn at the end of Q1 this year.

-

New registrations are expected from the ILS market.

-

The takeover was announced in October last year and all parties now anticipate closing the transaction “as soon as possible”.

-

Juan Prado was previously a senior vice president at RenaissanceRe Ventures.

-

Renaissance Re issued $857mn new shares for the vehicle last year, as well as $457mn in the January 2019 renewals.

-

Both Axis and RenaissanceRe significantly lifted fee income from third-party partners in 2018 as increased volumes and reinstatement income drove more business to be transferred to ILS partners.

-

Many Bermuda staff have only been offered short-term transition roles.

-

Kevin O’Donnell, CEO of the Bermuda-based company, said he expected reinsurance rates to rise in later 2019 renewals.

-

This came as the reinsurer’s DaVinci Re vehicle took heavy wildfire claims in Q4.

-

RenaissanceRe’s funds platform has taken significant losses.

-

Assets under management fell by around $5bn.

-

The Munich Re vehicle funded by Dutch pension fund service provider PGGM has reached $400mn for 2019.

-

The most recent cat bond lite issued by Kaith Re brings the total of Seaside Re deals to $112mn, up from $97mn for last year.

-

The reinsurer will write a line on any risk that Vermeer writes to ensure alignment of interest with PGGM.

-

The ILS investor says 7 percent annual returns have made the asset class an attractive opportunity for the fund.

-

Chubb and Travelers also face losses of around $400mn each should total insured losses hit $10bn, the analyst said.

-

Third-quarter catastrophe losses resulted in a 1.8 percent to 5.2 percent hit to the shareholder equity of global reinsurers, with major catastrophe writers all impacted.

-

Tokio Millennium Re’s agreed sale to RenaissanceRe will open up an opportunity for competitors to enter the fronting market.

-

The firm warned that it expected continuing industry adverse development into 2019.

-

The world of so-called collateralised reinsurance has always been a bit of a misnomer as significant volume is transacted behind several rated fronts.

-

The insurer’s Irma losses have risen by a further 25 percent to $754mn.