-

The breadth of strategies targeted by ILS start-ups signals where the industry is heading.

-

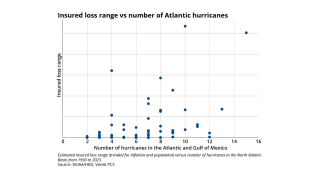

Demand for top layer coverage may also need to be supported by underlying market growth.

-

As the P&C market shifts, carriers are looking for growth from acquisitions.

-

Competition on price from traditional markets is weighing on bond market momentum.

-

Investor interest is warming up following a colder spell over the past several years.

-

The market has learned lessons from earlier soft market phases that it will apply now.

-

The leadership’s commentary spotlighted to value of ILS to the group.

-

The reinsurer’s capacity is hugely important to ILS firms, with few alternative providers.

-

M&A and shifts in distribution arrangements bring risks and opportunities.

-

The ILS market has won market share at the top of programmes as buying expands.

-

The buzz in the air at ILS Connect told of a market entering its next growth phase.

-

Investor interest and capital flows point to potential for ILS proliferation.

-

Indirect exposure to cat risk through long-term investors gives Markel optionality.

-

Island appetite remains stable, but early 2025 loss activity has injected fresh uncertainty.

-

Several Florida start-ups are poised to begin writing business this year.

-

Wildfire is rarely singled out as an exposure that can shift portfolio outcomes.

-

Management track record has been a factor in capital raising for 2025.

-

Many in the ILS sector are bullish on Milton losses falling at the lower end of earnings impacts.

-

A $40bn Milton loss should barely dent many ILS returns but will trap some capital.

-

Floir approved nearly 650,000 policies for takeout from Citizens for October and November.

-

Winning higher-fee private ILS mandates will strengthen firms’ negotiating positions.

-

ILS investors’ stress over Gibson Re is unlikely to inhibit legacy ILS’s future.

-

Reinsurer-managers are building out asset management infrastructure as they expand.

-

Relentless focus on annual outcomes provides a packaging that doesn’t fit the purpose.

-

Reinsurers are much better placed to absorb cat losses; insurers are carrying more risk.

-

Top layer competition is an added pressure on ILS firms, but the impact can be overstated.

-

Various trends may work together to hold the cat markets up for longer than some had feared.

-

Pockets of new capital will not shift pricing at mid-year.

-

The depth of the retro market recovery will be an influential factor in the pace of the cat market slowdown from here.

-

Cat bonds and sidecars are well positioned for growth, while private ILS will benefit from further innovations to improve liquidity.

-

Competition for remote risk deals intensified as more capital has targeted the swathe of business that has historically been the heartland of ILS.

-

The cost of maintaining a team to service institutional investors does not always weigh favourably versus bringing in ILS capital.

-

Prior-year cat loss years that are finally shaking out drove fee benefits in Q3.

-

Fermat’s John Seo said the industry can “see the wall of money coming in, but it’s coming in slowly”.

-

A number of players suggested that the cost components of first-party claims were up between 30%-50% on that seen during Ransomware Wave One.

-

A challenge facing the industry in the years to come is the question of how can it move through a rotation of its investor base to capture the growth opportunities that have arisen.