Nephila Capital

-

There are various routes for ILS managers wanting to access the diversity of Lloyd’s underwriting.

-

New catastrophe reinsurance Syndicate 2359 has an approved stamp capacity of £100mn.

-

Carriers are grappling with a rush of investor interest in longer-tail lines.

-

Operating revenues were also up on the $29.1mn reported over Q2.

-

The syndicate is targeting capital allocation for 1 January, the company confirmed.

-

Hagood will stay on as sole CEO of Nephila Holdings, with Taylor continuing as president.

-

The ILS manager revised down slightly its forecast for the syndicate’s 2023 YOA.

-

Markel announced the sale of its global reinsurance renewal rights to Nationwide.

-

The ILS manager also swung to an operating profit after posting a loss in Q1 2024.

-

He joined Nephila in 2023 from Lancashire as a senior underwriter.

-

Both syndicates also reported a deterioration in their combined ratios.

-

Indirect exposure to cat risk through long-term investors gives Markel optionality.

-

The group ceded 55% more premium to Nephila over the year at $1.3bn.

-

The top quartile, which includes Nephila 2357, were set to shrink overall.

-

Strong growth in fee income builds on the favourable rating environment.

-

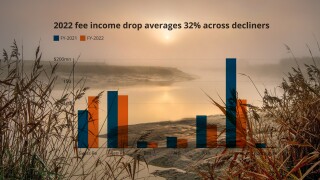

Fee income fell by 42% to $25.1mn in Q3 over the prior-year quarter.

-

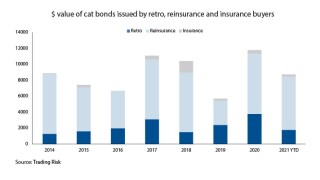

Collateralised reinsurance and retro are in the firing line.

-

Insurance Insider ILS reported in June that the company had bought substantial ILW coverage.

-

Nephila’s income rose steeply owing to changes in its funds’ product mix.

-

Aeolus increased its participation on the program more than fourfold.

-

-

He will continue to play a role as a fund director and firm ambassador.

-

Traditional reinsurers such as Berkshire Hathaway and Arch pushed for more share, our annual study of Florida cessions shows.

-

Parent company Markel said the ILS manager’s performance was subject to a reporting lag.

-

Operating revenue at the ILS manager climbed 49% to $19.2mn.

-

The coverage will be annual aggregate with an index trigger for wind and quake.

-

Increased ILW purchasing reflects cash-rich funds looking to protect return levels.

-

Managers have tightened buffer terms and added extension spreads to enhance illiquid strategies.

-

The coverage will be for named storm and quake.

-

Follow-only specialty Syndicate 2358 has reported a profit in both years since its launch.

-

The parent also expects the ILS platform’s AuM to grow.

-

The fund manager operations booked management fees of $31mn.

-

Of the 18 top-tier ILS managers, 10 recorded growth, while eight were flat or down.

-

The year brought a degree of closure on the loss-hit years of 2017-2021, while the outlook remains changeable for ILS managers.

-

The firm’s follow-only Syndicate 2358 has grown its stamp by 67% to £150mn.

-

A new pooling structure allowed the firm to free up historic side pockets and provides a template for future exit options.

-

Prior-year cat loss years that are finally shaking out drove fee benefits in Q3.

-

The ILS firm reported $6.8bn of assets under management at the third-quarter mark.

-

The industry’s ability to draw new capital will hinge on the outcome of the Atlantic hurricane season.

-

-

Citizens has disclosed that Nephila Capital increased its exposure to the carrier’s reinsurance program by 68% to a total $756mn line.

-

The investment firm’s ILS holdings were worth around $746mn at year-end 2022.

-

Nephila Syndicate CEO Adam Beatty said that the firm hopes to grow its new specialty syndicate to $500mn of premium within the next few years.

-

Markel’s ILS platform maintained assets under management at $7.2bn, down by $200mn from a January figure of $7.4bn.

-

The syndicate had the second-lowest combined ratio for 2022.

-

The £50mn syndicate made most of its profits in aviation.

-

The syndicate’s combined ratio was down for the fifth year in a row.

-

The reinsurance and ILS leader joined the firm in 2012 during a “rollercoaster” year for industry loss warranties.

-

Reinsurer-owned ILS platforms were challenged to grow fee income in a tough year for nat cat losses and as cat market economics shifted.

-

Markel gross written premiums ceded to Nephila grew by 45% year over year to $1bn, including program business.

-

The CFO of parent company Markel has said it aims to lean into property cat through Nephila.

-

Nephila achieved significant rate increases at 1 January and expected the strong rate environment to continue this year.

-

Cat activity and financial market volatility had impacted investor’s allocations to ILS and redemptions, Markel said.

-

She had served as director of underwriting at Nephila since mid-2018.

-

The incoming president for insurance also highlighted the role Nephila could play in the transition to net zero.

-

The firm has folded its former Nimbus weather strategy into the new vehicle.

-

The pension investor re-directed capital to the Pillar Opportunity fund as of January 2022.

-

The syndicate’s growth headroom is somewhat constrained compared to the Lloyd’s market average.

-

Some firms have fared better than others in the competition to raise funds during the year.

-

The insurer also emphasized that it realised more than $300mn from selling two MGA operations.

-

The ILS platform has dipped to $7.8bn in assets under management, as ILS revenues were down 44% after the sale of Velocity.

-

The product protects firms buying carbon credits from third-party negligence and fraud.

-

Evanston Insurance Company, a subsidiary of Markel, backed the move.

-

The ILS firm reported $8.5bn of assets under management at mid-year.

-

The hardening rate environment in Florida provided a mid-year opportunity for some, but overall there was little growth.

-

The asset manager also invests in Pimco ILS and has an inactive mandate with Nephila.

-

The increase in allocation by the railways scheme contrasts with steady or declining ILS holdings at other UK pension funds.

-

The ILS platform delivered stable revenues as Markel spent $102mn on its Catco buyout.

-

The firm’s Syndicate 2357 had halved losses to $41.5mn during the year.

-

The ILS manager’s Lloyd’s business delivered a $55.5mn profit, on an 86.5% combined ratio.

-

The new firm says ESG criteria will be embedded into the products.

-

The bond provides annual aggregate industry loss cover for named storm and earthquake.

-

The ILS firm’s management fees, however, fell back compared with 2020.

-

The new issuance is slightly less risky than 2020’s offering.

-

The change in plan comes as Lloyd’s restricts cyber growth.

-

The transaction provides reinsurance capital from four pension funds and marks the second use of the Lloyd’s ILS transformer vehicle.

-

Despite the drop-off in AuM, Markel boosted ILS operating revenues significantly in the quarter.

-

The consultant recommended the pension fund allocate $95mn to Pillar in 2022 after pulling a $41mn mandate from Nephila.

-

Both the firm’s underwriting and portfolio management functions will report into her.

-

The 2017 start-up has previously focussed on quota share investing.

-

SageLink will enable fully automated quoting capabilities for reinsurance.

-

The new retro fund launched with $98.9mn after an extended development phase.

-

Sources told Trading Risk that a different kind of investor was interested in ILWs compared with retro cat bonds.

-

NatWest cited a reduction in relative risk-adjusted returns as it decreased allocations, while North Yorkshire reported outperformance across its trio of ILS investments.