-

The Italian asset manager also plans to relaunch its multi-strategy ILS fund.

-

The industry has continued to build and innovate through a third strong year of performance.

-

Man AHL Cat Bond Strategy has $1bn in assets, around 2% of Man AHL Partners’ total of $54bn.

-

The TPA approach to investing was adopted by US pension fund Calpers last month.

-

Competition on price from traditional markets is weighing on bond market momentum.

-

The cedant’s current deal is due to mature at the end of January 2026.

-

Investor interest is warming up following a colder spell over the past several years.

-

The award of the mandates marks the California public pension plan’s entry into ILS.

-

ILS has been a driver of innovation in reinsurance, Convergence 2025 attendees heard Wednesday.

-

The funds will combine credit and ILS holdings.

-

Returns from cat risk investments stood at 20.1% for the year to 30 June 2025.

-

The allocation is around 3% of the fund’s total assets.

-

Sources have said $1bn+ of fresh capital from the region is expected to be deployed in 2026.

-

The facility will initially focus on US, Bermudian and European business.

-

The Bermuda firm said HS Sawmill reflected its continued focus on life insurance.

-

The resource was developed by leading ILS managers and investors.

-

Samild held multiple roles including head of alternatives at the Future Fund.

-

The ILS manager has $6.8bn in assets and will be led by MariaGiovanna Guatteri.

-

ILS executives talked pricing, capacity and opportunities in casualty at an ILS roundtable in Monte Carlo.

-

The target allocation to Munich Re, Elementum and the run-off AlphaCat funds fell in the year to 30 June 2025.

-

The capital supported sidecar-style syndicates and reinsurance start-ups.

-

The agency noted inflows to cat bond funds and investor interest in private ILS.

-

Dedicated reinsurance capital is on track to increase by 8% in 2025, the broker said.

-

ILS accounted for 2.5% of the pension fund’s total AuM.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

The sidecar took $19mn of cat losses relating to the California wildfires.

-

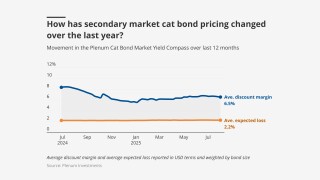

The yield figure comprises 6.53% of insurance discount margin and 4.28% risk-free.

-

Investors are drawing lessons from life deals to find new routes into insurance markets.

-

The Bermuda SPI will write a quota share of SageSure’s captive Anchor Re.

-

Canio spent over 19 years with PGGM, with nine of those managing ILS.

-

We discuss progress in collateral management with our Outstanding Contributor winner.

-

Former ILS lead Matt Holland left the company in May.

-

Some $400mn of bonds priced in the past week, after a record-setting H1.

-

The recommended “AIF lite” structure could be suited to cat bond lites.

-

The fund’s ILS portfolio is split between 70% property cat and 30% cyber risk.

-

The investment consultancy said yields increased in Q2 by less than could have been expected.

-

The Cayman Islands-domiciled SPI now has four institutional backers.

-

Initial responses to ESMA’s report welcomed the long timeframes for any changes.

-

Michael Hamer recognised for his work with investors and on reporting frameworks.

-

The awards celebration took place at the Hilton Bankside on 25 June.

-

The pensions scheme’s existing ILS holdings to Aeolus and HSCM are in run-off.

-

M&A and shifts in distribution arrangements bring risks and opportunities.

-

The fund lists Twelve, Swiss Re and Cambridge Associates as managers.

-

Investors eyeing private ILS include opportunistic allocators keeping watch on storm season.

-

The pension plan noted in June 2024 that it was exploring new options in ILS.

-

The man is alleged to have conspired with others to falsify LOCs and collateral letters.

-

The investment is a response to shifts in stock-bond correlations.

-

A total $225mn of fresh limit entered the market across two deals.

-

ILS offers efficient capital for underwriters, but casualty ILS transactions are complex.

-

The Swiss pension fund has not disclosed an ILS allocation before.

-

The pension plan has been allocating to ILS since 2005.

-

One dollar-denominated deal has opted to hold collateral in EBRC notes.

-

The bond will cover named storms in five US states.

-

Price guidance for the bond is 4.00%-4.50%.

-

The platform is based in Bermuda and will focus on strategic capital partnerships.

-

The buzz in the air at ILS Connect told of a market entering its next growth phase.

-

Richard Pennay also addressed the dip in cyber ILS activity.

-

Investor interest and capital flows point to potential for ILS proliferation.

-

This year’s ceremony will include the inaugural Women in ILS Award presentation.

-

An allocation to insurance could “feel like a nice, calm port in the storm” amid wider market volatility.

-

This is the first time the Texas Fair Plan has entered the cat bond market.

-

Fellow Swedish pension fund AP3 is phasing out its ILS allocation after being active in the sector since 2008.

-

Portfolio rebalancing was not triggered last week, but investors are now distracted and nervous.

-

US Coastal Property and Utica Mutual Insurance have brought out their first cat bond deals.

-

The Swiss rail pension scheme has been cutting its ILS allocation since 2018.

-

The Swiss pension fund’s ILS allocation stood at 4.9% of the total fund as of 25 March.

-

The asset manager has hired Rom Aviv as head of ILS.

-

Most of the ILS investments were made via the cat bond heavy High Yield Fund.

-

Palm Re will provide Florida named storm cat bond coverage for Florida Peninsula, Edison and Ovation Home Insurance Exchange.

-

The ETF will invest solely in natural catastrophe-exposed bonds.

-

Many UK pension funds are over-funded and lack appetite for higher-risk, higher-yield products.

-

Recent transactions on the platform include cat bonds from Flood Re and Brit.

-

Caution about capital markets volatility is leading sponsors to stagger bond renewals.

-

Industry sources estimate the market to be around $3bn.

-

ILS as a percentage of the pension fund’s total assets grew to 1.5%.

-

The bond was trading at around 12.3c on the dollar in the secondary market last month.

-

The UK listed investment manager has almost doubled its ILS allocation since April last year.

-

The bond will provide fire protection for MGA Bamboo’s California business.

-

The role oversees the $187bn Canadian pension plan’s ILS allocation.

-

The Class A section of the bond has doubled in size, at lower pricing.

-

UCITS fund diversification targets limit their capacity for US wind bonds.

-

Insurance Insider ILS revealed last week that the executive was leaving Property Claims Services.

-

Wildfire is rarely singled out as an exposure that can shift portfolio outcomes.

-

The fall marks this the first time in 20 years the index has been negative in January.

-

Neuberger Berman’s AuM stood at $3.2bn as of 1 January 2025.

-

AuM remains generally flat at UCITS funds over the weeks since LA fires started.

-

The value of its investment in RenRe stood at $330.4mn as of 30 June 2024.

-

Standards and guidelines address institutional investors’ concerns over valuation risks.

-

Company touts growing investor demand for Asian cat risks.

-

Both the Class A and Class B notes increased in size.

-

PFZW’s insurance allocation stood at $8.7bn as of year-end.

-

The bond is split into five tranches, with two notes offered on a zero-coupon basis.

-

Aetna, Inigo and GeoVera were the three sponsors seeking lower multiples.

-

The index’s performance in November was stronger than the prior year, although YTD returns are behind 2023.

-

The deal is split into two tranches compared with the single note issued last year.

-

Spread guidance anticipates a lower multiple compared to 2024’s Vitality Re issuance.

-

The broker anticipates strengthening investor demand for collateralised re.

-

The Bermuda based entity is expected to continue on its “responsible growth trajectory”.

-

The $600mn fund could allocate up to 10% of assets to cat bonds from 2025.

-

Initial spread guidance for the three-year bond is set at 425-500bps.

-

The bond offers a higher multiple than a similar Fuchsia Re deal placed last year.

-

Mapfre Re CEO Miguel Rosa was “very satisfied” with the debut cat bond deal.

-

The Swiss-based team of Siglo has transferred to Cambridge Associates.

-

The former co-head of ILS at Schroders left the bank last month.

-

The ILS manager will “pragmatically accept” a degree of credit risk in deals.

-

Former ILS investors who left the space have looked again and re-allocated.

-

The scheme’s ILS allocation has held steady at 0.7% of the total fund.

-

Fidelis is seeking more cat bond cover than it did almost a year ago.

-

Spreads at levels favourable to sponsors could power Q1 2025 pipeline.

-

The UK Local Government Pension Scheme (LGPS) has around £391bn in AuM.

-

The new funds will target the US wealth market through financial professionals.

-

The bond provides protection in France and its overseas territories.

-

The low PCS number is presenting a challenge for ILW buyers and sellers.

-

Pricing is expected to “stay neutral of soften” for January renewals.

-

The sovereign wealth fund’s ILS investments grew to $828mn.

-

The manager’s ILS allocation now spans six of its seven investment funds.

-

The ILS industry alumnus is understood to have two ILS investors lined up.

-

Plenum said wind damage from Milton could lead to “moderate” losses for its cat-bond funds.

-

Losses to the NFIP-sponsored cat bonds remains a key area of uncertainty, the investment manager reported.

-

The ETF format provides for publication of a daily NAV.

-

Cat bond funds continue to draw interest as private ILS more challenged.

-

The subject business of the deal is Ascot’s ~$1bn property portfolio.

-

The proportion of total fund assets invested in non-life ILS held steady at 0.6%.

-

Florian Steiger’s strategy is seeking institutional capital for the Q4 primary issuance season.

-

The ILS allocation has posted returns of 5.5% for the year to date.

-

The pension scheme’s holdings in ILS delivered varying returns in run-off.

-

The Swedish fund AP2 invests in Fermat GAM, Elementum and Credit Suisse.

-

The Canadian pension plan’s investment rose to 1.2% of its total fund.

-

Sources said that Gallagher Re had ‘first mover’ advantage as the exclusive broker.

-

Sub-1% management fee and performance fee-only structures have evolved in ILS.

-

The regulation now allows pension funds a more flexible benchmark for measuring alternatives.

-

The Canadian pension’s sole remaining ILS allocation is with Fermat.

-

The capital will be deployed by Bermuda-based special purpose insurer Arachne.

-

Gordon was set to join start-up brokerage Juniper Re last month.

-

The pension fund’s ILS allocation as of the end of 2023 was CHF300.3mn ($356.8mn).

-

Various trends may work together to hold the cat markets up for longer than some had feared.

-

ILS returned 3.2% for the scheme in the first quarter.

-

The new global bond fund can take a ‘marginal allocation’ to cat bonds.

-

The fund is a continuation vehicle for five of HSCM's life insurance interests.

-

The platform’s ILS holdings comprise cat bonds and UCITs funds, and were up 8% over January and February.

-

The pension fund handed an ILS mandate to Hiscox in September 2023.

-

Retained earnings resulting from reduced loss activity also helped to boost ILS capital.

-

The group has also scaled back holdings with AlphaCat’s Soteria Fund.

-

The platform distributed ~$50mn to investors for 2023.

-

The fund will follow an existing Twelve strategy and add short-term corporate bonds.

-

The Cayman Islands entity raised $2.4mn last June.

-

-

-

ILS platform London Bridge II has had a good year as volumes reached $750mn, the CFO said.

-

It is only the second year in the last eight that the allocation grew.

-

Head of alternatives Gareth Abley believes the asset class remains attractive following a 16% return in 2023.

-

The firm was founded in 2015 to help clients raise capital.

-

Aside from the one-year view, 2023 remixes the track record.

-

The allocation last autumn amounted to around 1.4% of the investment manager’s total funds under management.

-

The asset manager’s largest ILS allocation across two multi-strategy funds is to a Leadenhall fund.

-

The fund will promote environmental and social characteristics under Article 8 of the SFDR.

-

The asset manager’s flagship ILS funds posted stellar returns for its 2023 fiscal year.

-

TRUE will use the capital injection to provide underwriting capacity in Florida “at a crucial time” and to expand its footprint nationally, according to a statement.

-

The US pension fund investor had altered its ILS portfolio, with a new investment to Pillar in 2021.

-

The Australian sovereign wealth fund first allocated to the ILS manager in 2016.

-

This latest funding round brings total committed capital for the collateralized reinsurer to $75mn.

-

The firm’s follow-only Syndicate 2358 has grown its stamp by 67% to £150mn.

-

ILS managers are still waiting for hard market growth.

-

Research by Kepler Absolute Hedge showed that seven out of the 10 best-performing alt credit funds were cat bond strategies.

-

The fund’s allocation to ILS decreased for the first time in three years.

-

As of year-end 2022, the fund’s largest ILS allocation was in a RenRe fund.

-

The fund has been adapting its investment strategy in light of inflation and rising interest rates.

-

Stress-test numbers were increased to 112, including scenarios of losses in multiple years, up from 105.

-

Fermat’s John Seo said the industry can “see the wall of money coming in, but it’s coming in slowly”.

-

The fund is on course for its strongest year of returns since inception in 2014.

-

The IOP will be integrated into the Open Protocol reporting template.

-

The Middle Eastern investor had built up a billion-dollar portfolio, but personnel turnover has ultimately driven it to reverse course.

-

A challenge facing the industry in the years to come is the question of how can it move through a rotation of its investor base to capture the growth opportunities that have arisen.

-

Ambassador was set up in 2021 with Embassy Asset Management the named investment adviser.

-

Interest income also boosted the results, with net assets of $9mn rising to $10.8mn by the half-year point.

-

The transaction covered a portfolio of $250mn in casualty risk premiums.

-

The pension fund is seeking a strategy with “low or negative correlation to public equity”.

-

The firm has moved to defend its plans against a rival strategy supported by a small group of investors.

-

The investment firm’s ILS holdings were worth around $746mn at year-end 2022.

-

The UK asset manager’s ILS strategy is operating across six of its multi-asset funds.