-

Founder and CEO of Nascent Andre Perez will join Sephira’s board of directors.

-

Seller White Mountains will retain a roughly 15% fully diluted equity stake.

-

The business has been ~70% owned by White Mountains since January 2024.

-

Spectrum joins investors ForgePoint, Hudson and MTech.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

The leadership’s commentary spotlighted to value of ILS to the group.

-

It is understood that CyberCube has been considering a sale of the business.

-

The Japanese carrier faces integration challenges to make a success of the deal.

-

Aspen Capital Markets earned $169mn in fee income in 2024 alone.

-

The purchase brings Sompo an established ILS platform as part of the deal.

-

The Bermudian firm has an active ILS division, unlike the Japanese conglomerate’s insurance divisions.

-

The transaction is expected to close later this year.

-

Nationwide will delegate management of the policies to Ryan Specialty.

-

M&A and shifts in distribution arrangements bring risks and opportunities.

-

The deal leaves premier surety as Travelers' sole Canadian portfolio.

-

The reinsurer said the probe concerns the alleged involvement of its former chairman.

-

The acquisition expands its global employee benefits business to ~4,000 global employees.

-

Guernsey’s TISE listed the world’s first private cat bond issued by Solidum Re in 2011.

-

The firm will match segregated accounts of portfolios to investor mandates.

-

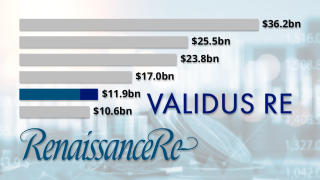

The combined entity ranks third in the Insurance Insider ILS leaderboard.

-

Compressed cat bond spreads could drive some rebalancing, as M&A remains a prospect.

-

The deal comes around three years after Markel sold a controlling interest in Velocity for $181.3mn.

-

Casualty ILS made inroads, while hurricane hedging strategies came into focus.

-

The Swiss-based team of Siglo has transferred to Cambridge Associates.

-

Redington provides services to UK pension funds, wealth managers and institutional investors.

-

The Risk International team will remain in its current location, under Jennifer Gallagher.

-

The denial followed this publication’s report that Covéa had renewed its intentions to buy the reinsurer.

-

The mutual’s approach comes as Scor continues efforts to fight back from performance issues including a flare-up in L&H.

-

The transaction complements its previous acquisition of RMS in 2021.

-

The deal will boost the investment consultancy’s ILS capabilities.

-

Winning higher-fee private ILS mandates will strengthen firms’ negotiating positions.

-

The deal will include Axa IM’s alternatives funds including ILS.

-

The combined Twelve-Securis entity would be a top-five ILS firm currently.

-

Urs Ramseier will be CEO and Herbie Lloyd CIO.

-

The sale is expected to be completed by the end of the year.

-

Sources said that Japanese big-three carrier Sompo and Italian insurance giant Generali are circling.

-

Former Teneo M&A head Alexander Schnieders will lead the unit.

-

The management’s buyback acquisition brings an end to the two-year relationship.

-

GeoVera’s MGAs will sell to SageSure and insurance companies will merge with SafePort.

-

The Lloyd’s legacy business has been placed up for sale, along with other units.

-

The outlook for M&A activity is brighter after 2023 returns.

-

Arm is based in Guernsey and has a Bermudan management licence.

-

The newly launched Marco Re will be led by Mark Elliott as CEO.

-

A non-binding term sheet was signed on October 6, whereby the buyer will acquire 100% of Interboro’s issued and outstanding securities in exchange for cash.

-

BCCL will be rebranded to Nascent Advisory Services Ltd as part of the transaction.

-

-

The private equity firm is targeting $1trn in assets under management for the combined segment.

-

Frontier’s employees, including director and co-founder Peter Brodsky and CEO Derek Winch, will remain in their current roles.

-

The two parametric businesses will be brought together as the UK and German governments sell out.

-

The vehicle will focus on middle-market transactions in the US and Europe across the insurance value chain.

-

The firm has moved to defend its plans against a rival strategy supported by a small group of investors.

-

The carrier has agreed to acquire the former Credit Suisse ILS unit, following the acquisition of sister company Humboldt Re in 2021.

-

Financials Acquisitions Corp is looking to extend its merger deadline and raise “substantial” extra funds.

-

Removing any competitor is a positive for ILS peers in a competitive time for fundraising, but it is not clear how much of a boost this will give RenRe.

-

The takeover will push it up two places to rank as the fifth-largest writer of P&C reinsurance by gross premium.

-

AIG will invest a significant amount into Fontana and DaVinci.

-

The Bermudian reinsurer launched a public offering of 6,300,000 common shares and anticipates raising around $1.15bn to finance the transaction.

-

The deal includes AIG's AlphaCat platform.

-

The AJ Gallagher-owned ILS services provider is expanding its footprint globally.

-

The non-catastrophe ILS platform hit a valuation of $1bn after a Series C funding round.

-

The acquisition gives UK asset manager Liontrust a broader European footprint and cat bond products.

-

Bay Risk will become part of Gallagher Re’s Global Programmes practice group, led by Andrew Moss.

-

The reinsurer said in its Q4 earnings call that Argo’s takeover further diversifies its operations and adds a foundational piece to its expanding P&C activity in the US.

-

The international reinsurance unit booked almost EUR1bn in revenue in 2022.

-

-

Bowood managing director Stephen Greener will chair the entity, which is to place $6bn in GWP.

-

Vesttoo's aim for the partnership is to bridge the gap between the insurance and capital markets, scaling insurance-linked investments as a source for reinsurance capacity.

-

The acquisition will enable the Japanese carrier to expand further into the US and across a host of insurance lines, including property and marine.

-

There is no guarantee that the process will yield a particular transaction.

-

The former Chubb exec will remain on the board as an independent director, along with president and CEO Jacques Bonneau.

-

The French mutual’s CEO Thierry Derez and chief of staff Sylvestre Frezal said the deal is a strategic move to adapt to new forms of risk.

-

Kiln and UPC partnered to form the insurer in 2018, but it was merged into American Coastal earlier this year

-

FedNat will retain a minority interest along with representation on the board.

-

Elliott Management, the other key suitor for the business, is understood to have dropped out of the auction.

-

This is UPC’s latest attempt to downsize after offloading part of its personal lines business to HCI.

-

After securing a $1.6bn deal to acquire TigerRisk, Howden said the transaction will create a “much-needed fourth global player” in reinsurance.

-

This publication first revealed that the two parties were working on the deal last month.

-

Sources indicated talks have been conducted using an adjusted Ebitda figure for TigerRisk of around $85mn-$90mn, which is far higher than previously thought.

-

It is understood that the highest bidder was a consortium formed by Fortitude and Global Atlantic.

-

A takeover would boost Howden’s burgeoning reinsurance portfolio.

-

The deal propels HSCM total AuM and capital commitments to above $4bn.

-

Many hybrids, unless they are willing to take a meaningful financial hit to secure a divestiture, will have to stick with their reinsurance businesses through the current cycle.

-

The carrier also revealed $30mn in Russia-Ukraine Q1 losses.

-

Jefferies has been awarded the mandate to seek a buyer for the segment.

-

Acrisure entered into a definitive agreement with Markel in March to acquire the MGA.

-

The retro fund has redeemed 99% of share capital, returning around $106mn to public fund investors.

-

The deal will also provide $100mn in new equity funding to the legacy carrier.

-

The purchaser is known for having a very low cession ratio, although it said it would leave Alleghany to operate independently.

-

The acquirer has forecast premiums of $1bn by 2025 at the multi-class coverholder

-

The transaction will create a reinsurance entity roughly on a par with Scor in terms of net reinsurance premium.

-

The deal values the TransRe owner at 1.26 times book value as of 31 December 2021, and represents a 29% premium on its stock price.

-

Completion of the buyout remains subject to US bankruptcy courts recognising the agreement.

-

-

The new company will focus on expanding into US coastal areas.

-

-

The firm has been in run-off since late 2020, and another former Credit Suisse affiliate was recently sold to legacy writer Marco.

-

Nephila will maintain a minority holding in the MGA, which is looking for paper from more reinsurers and ILS firms.

-

The deal follows a similar transaction on northeast business in January.

-

The reincarnated $9bn deal is moving a step closer to completion.

-

The target firm deals in engineering, energy, P&C and specie.

-

The investor agreed to buy Ascot in 2016 and Wilton in 2014.

-

The deal was struck in the wake of the collapse of Aon and Willis Towers Watson’s merger.

-

As part of the deal, Heritage will transfer ownership of carrier Pawtucket and MGA First Access, as well as claims and underwriting data.

-

As a result of the deal, EY, through its wholly owned subsidiary Shackleton, becomes a minority shareholder in IncubEx.

-

The Bermudian fund bought £280,000 of shares in the Lloyd’s investment platform.

-

The watchdog had been due to announce a decision on a further inquiry by 29 November.

-

Fairfax has entered into an agreement with the Canada Pension Plan Investment Board (CPPIB) and the Ontario Municipal Employees Retirement System (Omers), where each of them will acquire a 4.995% stake in Odyssey Group for an aggregate cash consideration of $900mn.

-

Markel Catco announced that its proposed buyout of investors will be delayed until the first quarter, as a Bermuda court adjourned hearings on the scheme into early December.

-

However, the deal is low-to-mid ranking in terms of book multiple.

-

The two parties had previously negotiated a $9bn deal for the reinsurer last year, which was later scrapped.

-

The speciality insurer is also providing multi-year capacity and paper to the climate risk shop.

-

The transaction is to increase the run-off specialist’s balance sheet significantly.

-

The deal marks a return for Spencer Re founder and Taussig CEO Joseph Taussig.

-

After the acquisition, the Beech team will continue to be led by Geoff Stilwell, Andrew Woodhams and Matt Gates.

-

The Competition and Markets Authority will investigate whether the deal lessens competition in the UK.

-

The Credit Suisse-backed firm produced a small profit in the first quarter of 2021, the ratings agency said.

-

The managing general agency is looking for new lines of business, having seen its cyber team and capacity provider depart ahead of renewals earlier this year.

-

The broker has explained the rationale for its $3.25bn acquisition of Willis Re on an investor call.

-

After the collapse of the Aon-Willis merger, Gallagher has successfully resurrected the deal that will catapult its reinsurance operation into the big league.

-

American National CEO Jim Pozzi said the acquisition would be an “energizing moment” in the carrier’s history.

-

Moody’s expects RMS, which had about $320mn in revenue around $55mn in operating income last year, to become accretive to earnings by 2025.

-

Sources have said a deal could be signed as soon as the middle of the week, with a valuation higher than the last agreement.

-

The collapse of the Aon-Willis deal will have no noticeable impact on the ILS broking business, as the market waits to see what the fate of the Willis Re team will be.

-

The companies disclosed that Aon will pay Willis the $1bn break fee.

-

As part of expansion plans, Ki has also signed a stock purchase agreement to acquire an inactive insurance carrier that holds licenses in more than 40 states.

-

The potential transaction is expected to complete in the third quarter.

-

The brokers have offered to divest Willis’ largest corporate risk and broking clients to Gallagher’s Crombie Lockwood.

-

The competition watchdog has approved the acquisition of Willis Towers Watson by Aon if the latter complies with a ‘substantial set of commitments’, including the divestment of central parts of Willis’s business to Gallagher.

-

Aon will have to wait until November at the earliest to argue the case in Federal Court for its $30bn merger with Willis Towers Watson.

-

The Commerce Commission has extended its review of the merger by another six weeks.

-

The French mutual has been looking to expand, with recent unsuccessful attempts to acquire Scor and PartnerRe.

-

The broking houses also said they "remain fully committed to the benefits of [their] proposed combination".

-

The deal is designed to assuage the Department of Justice’s concerns over the Aon-Willis merger.

-

Century Equity Partners and WT Holdings are backing the new venture.

-

The US government reportedly has around 20 attorneys at work in case it decides to sue to block the deal.

-

The carrier cut back its treaty limit by around 13% and lowered its deductible.

-

The transaction will create London’s largest independent specialty and wholesale broking business.

-

The merging brokers have also agreed a two-year non-compete agreement on transferring Willis business.

-

There are few areas of overlap in the Willis Re-Gallagher Re combination but some details to be ironed out on the new executive team.

-

The AJG CEO vowed to invest in Willis Re assets while stressing the quality and security of the team.

-

The buyer says the deal involves revenue of about $1.3bn and earnings of around $357mn.

-

The merger partners are working towards a third-quarter completion after a side-deal they say addresses EC concerns.

-

CEO Talbir Bains founded the business in 2017 with backing from the market’s largest ILS manager.

-

The cat bond will renew an expired 2017 multi-peril deal for the US insurer.

-

The regulator had previously set a 27 July deadline after the merger partners offered divestments to secure regulatory approval.

-

Chairman Paul Folino said he expected the deal to be completed over the second quarter.

-

European regulators are not expected to demand additional concessions of the deal partners.

-

Credit Agricole served as the debt arranger, with Sompo Japan and Aioi Nissay Dowa Insurance acting as insurers.

-

The move follows Willis’ explorations of sales of Willis Re and European units.

-

Fallout from the 2019 JLT Re integration intensifies after a group including Brad Maltese were earlier reported to be set to join Howden.

-

It is understood that the ~$300mn fac business will be packaged along with the treaty unit.

-

The market has reached the stage of price hardening at which clients will challenge brokers and carriers on continuing increases, according to Aon president Eric Andersen.

-

The erstwhile suitor cites falling valuations for residential property technology companies.

-

The $7.5bn bid requires more certainty of value and a higher cash consideration, according to CoreLogic's CEO.

-

EU antitrust regulators will warn Aon that its $30bn bid to acquire Willis Towers Watson may hurt competition in the broking marketplace, according to a Reuters report.

-

The merger may cause price increases or reduced service levels for major insurance buyers.

-

The two PE firms each take a 30% stake in the business, alongside Arch management.

-

Executives reiterate the mid-single expansion guidance announced in March, despite growing organically by 1% in 2020.

-

The modeller had reportedly been the subject of an $86-per-share bid from real estate analytics firm CoStar prior to its $80 deal.

-

Gebauer, Kent, Pullum and Garrard are among the Willis execs named to big jobs.

-

Co-founders Joe King, Enda McDonnell and Adrian Ryan remain in their posts and retain minority stakes in the business.

-

The vehicle raised $240mn in an offering priced at $10 a share.

-

The deal is the latest in a slew of recent blank check listings this year.

-

The deal “may reduce choice” for cedants in choosing reinsurance brokers, the EC said.

-

The 12 Days of ILS Christmas

-

HCI is offering $5.2mn in stock plus up to $3.1mn cash for the portfolio.

-

The broker will operate as Acrisure Re and Acrisure London Wholesale.

-

The unit will advise on M&A, capital raising and risk securitisation.

-

The deal will help the Aquiline-owned syndicate diversify away from motor insurance.

-

This is the fourth acquisition by Ardonagh's Geo this year, following transactions involving Rural, Thames Underwriting and KGM Underwriting.

-

The Day 1 launch via a listing without PE cornerstone investors is an effective first for the (re)insurance sector.

-

The deal will accelerate the pivot of the acquirer from motor insurer to multi-class specialty player.

-

ILS manager Hudson Structured is among the prior owners selling Compre, after buying into the legacy firm in January.

-

As part of the deal Pelican Ventures and JC Flowers will provide capital for 2021 onwards, with Argo maintaining responsibility for years prior.

-

The tactic comes after the investors had three nominees installed on the risk modeller’s board this week.

-

The subsidiary was formed in the summer and is deploying capital from the sale of Maison.

-

The three director changes fall short of a proposal by former bidders Senator and Cannae.

-

It is expected that the transaction will close in the first quarter of 2021 and that Vault will retain its A- rating from AM Best.

-

The exec was speaking after the broker was acquired by Cinven and GIC in a multi-hundred million deal.

-

The transaction brings to an end five years of Willis’ majority ownership of the London market broking house.

-

The deal continues HSCM's progression into primary markets.

-

Ariel Re will focus on key lines of business, including cat, retro, marine and professional lines.

-

Southern Fidelity has struggled during a busy 2020 storm season because of its exposure to the Gulf states.

-

Former CEO Ryan Mather returns to helm Ariel, and will also oversee underwriting for SPA 6133 under a pact between the acquirers and Apollo.

-

Including offshore losses of up to $1.5bn, the firm's total loss estimate ranges from $0.8bn-$1.5bn.

-

The $622mn agreement is just 10 cents a share higher than Enstar's $31.00-per-share proposal.

-

Former RenaissanceRe CEO and founder Jim Stanard looks set to pick up the reinsurance platform.

-

The per-share price is a 35% premium to yesterday’s close.

-

The Howden parent has more than doubled its valuation in the three years since CDPQ invested.

-

BMS plans to expand into the retro sector but will avoid being drawn into bidding "frenzy".

-

The funding for the deal was set to come from Cantor Fitzgerald and its billionaire CEO Howard Lutnick.

-

Both companies secure more than 95% shareholder support for the transaction.

-

The companies claim “overwhelming” investor support at meetings today.

-

The agreement, which will leave Enstar with 26% of StarStone US, fulfills a long-term ambition for Stone Point.

-

The business will be known as SiriusPoint and led by ex-AIG CFO Sid Sankaran, who will become chairman and CEO.

-

KKR described the $4.4bn deal as a “transformative event” and a “highly strategic” investment for the company.

-

The deal will generate proceeds of more than $1.5bn for the Karfunkel family and including a dividend is pitched at 69 percent more than Tuesday's close.

-

The deal will give Buckle access to Gateway’s 47 US state insurance licences.

-

The deal will see HSCM founder Millette and HSCM Bermuda clients assume majority control of the holding company.

-

SkyKnight, Dragoneer and Aquiline have led the investment.

-

The fronting carrier will allow the MGA to extend its geographical reach.

-

The statements come after an outline agreement, signed by Covea 10 weeks ago, collapsed this week.

-

The Bermudian’s owner Exor refused to renegotiate terms due to the Covid-19 crisis.

-

The company’s remaining underwriting teams will transfer to San Diego-based MGA platform K2.

-

The deal will “capitalise on a dynamic competitive landscape and continue our strong growth trajectory”, Rod Fox says.

-

-

The M&A deals were predominantly mergers, but there was some activity on the acquisition side as well.

-

French insurer is reportedly confident despite stock prices having plummeted since the takeover was agreed.

-

The start-up received a financial strength rating of A- from AM Best as it announced its new funding.

-

The pandemic financial crisis led to the M&A deal being dropped.

-

Lighthouse CEO Patrick White bought a majority stake in Prepared in 2017.

-

Canadian pension funds have shown an interest in buying assets in the London market.

-

But the merger will still create opportunities for rival brokers to claim market share.

-

Having a $20bn-revenue organisation would create the ability to invest more heavily in new solutions, including tech.

-

The combined company will retain the Aon name, with Willis CEO John Haley taking the chairman role.

-

The insurer will offer to buy out side-pocketed assets at a discount, with several hundred millions of capacity available if needed.

-

Exor would receive cash consideration of $9bn plus a cash dividend of $50mn to be paid before closing.

-

Further growth of the carrier will be constrained if it can’t bolster its balance sheet.

-

The broker said it was considering next steps for the wholesale arm to maximise its growth.

-

-

The January 2020 sidecar renewal season could emerge as a turning point in the evolution of reinsurer ILS tactics and strategies.

-

Some reductions in demand might follow as policies change hands, but this will not be a key influence on renewal dynamics.

-

The rating agency highlighted the increased underwriting risk associated with Weston's pending acquisition of Texas and Louisiana writer Anchor Specialty.

-

Florida-based Centauri Specialty is to sell its Louisiana homeowners' insurer offshoot.

-

The MGA start-up offers $25mn lines in property per risk.

-

Hiscox sold the parametric cyber cover to an as-yet-undisclosed buyer.

-

The pension fund will acquire the stake from Fairfax for a cash sum of $560mn.

-

The firms, which provide banking and ILS services, have joined to create the sixth largest US commercial bank.

-

The deal is set to close in the first half of 2020 and will see the Singaporean reinsurer enter run-off.

-

As part of the deal, 1347 PIH received five-year rights of first refusal to provide reinsurance on up to 7.5 percent of FedNat’s catastrophe reinsurance programme.

-

The Grahame Chilton-founded firm will become Gallagher's reinsurance partner if a deal is finalised.

-

Private equity firm The Carlyle Group has lifted its stake in Fortitude above 70 percent.

-

EWI provides services for captives and mutual insurance companies as well as run-off and legacy solutions.

-

Currently, most people trying to describe the ILS manager world might break the peer group into three broad categories: reinsurer-affiliated platforms, independent owner-operated firms and asset manager-backed vehicles.

-

The insurer is buying a new £500mn cover to sit beneath its SuperCat and MegaCat treaty cover for 1 January.

-

New owner AJ Gallagher will be able to support tech and other investments in the ILS platform.

-

The deal follows up a EUR10mn ($11.7mn) private subordinated debt placement in July 2017.

-

The transaction makes Canopius a top-five insurer in the Lloyd’s marketplace.

-

Horseshoe CEO Andre Perez and other employees will continue to operate from their present locations, reporting to Artex CEO Peter Mullen.

-

The acquisition will not impact the ILS fund manager, managing partner and president Richard Pennay has said.

-

The Japanese carrier will acquire the White Plains, New York-based high-net-worth specialist via Tokio Marine HCC.

-

Assured Guaranty paid $160mn in cash for the alternative asset management firm which has $18.9bn in assets under management.

-

Bold Penguin has raised $32mn from a series B funding round.

-

Michael Halsband was formerly a partner at Drinker Biddle & Reath.

-

José Manuel González will lead the combined business as CEO.

-

The deal announced in May takes the reinsurer’s ILS assets to $2.1bn.

-

M&A activity has made analysing structural conflicts in ILS platforms harder but winners may be those that offer a range of means of access to risk, consultants say.

-

Do we need new labels for the different types of ILS managers that exist?

-

The MGU will be integrated into the Arch platform, enabling third-party capital to provide capacity alongside Arch’s product offerings.

-

Just two percent of the insurer’s portfolio has exposure to US risk.

-

The insurer said it was looking forward to expanding Barbican’s relationships with third-party capital.

-

BlueOrchard manages the InsuResilience Investment Fund which provides access to insurance in the developing world.

-

The firm was previously reported as being in the process of tapping the ILS market for capital to support its underwriting portfolio.

-

The institutional asset manager ownership model could help the ILS asset class shed its niche feel, Secquaero founder Dirk Lohmann suggested to Trading Risk.

-

The service provider will be merged with Inflexion private equity’s existing portfolio manager Ocorian.

-

The ILS manager will be integrated into the Schroders Private Assets unit and renamed Schroder Secquaero.

-

There will be no change to the running of the ILS fund Merion Square or its strategy, managing partner Richard Pennay told Trading Risk.

-

Fosun said Tenax Capital will become one of its most important European asset management platforms.

-

Ultimately, with advantages and challenges in any ownership situation, the parentage of an ILS platform is not going to be the determining factor in its success.

-

Elementum is a “well-positioned business in an attractive sector,” the asset manager said in a Securities and Exchange Commission filing.

-

The industry’s market heavyweights remain split amongst different types of ownership models.

-

This comes as Lockton has also been on a recruitment drive to boost its reinsurance division.

-

An existing longevity swap held by the Rolls-Royce UK Pension Fund was restructured as part of the transaction.

-

The deal valued BMS at £500mn and is expected to close in the third quarter.

-

The minority sale will leave the firm operating independently, the firm’s co-founders told Trading Risk.

-

The firm will invest $50mn in Elementum’s ILS funds.

-

The combination would have around $2.1bn of assets under management.

-

M&A deals have resulted in reinsurer affiliated businesses overtaking the market share of independent ILS firms, but asset managers have also grown their share via new launches since 2014.

-

Coriolis execs Diego Wauters and Martin Jones will stay for at least two years to continue to run the business.

-

Scor chairman and CEO Denis Kessler said the acquisition would help its ILS platform move into the top tier of the market.

-

Cohen & Company’s head of US insurance strategies sees ILS opportunities from the new venture and wider business.

-

FedNat agreed to acquire 1347 PIH’s homeowners’ insurance operations.

-

The Bermuda-based ILS manager has signed up to use the specialist’s climate risk tools.

-

The takeover was announced in October last year and all parties now anticipate closing the transaction “as soon as possible”.

-

Irish regulations required an early announcement from the firm that it had considered a deal.

-

A deal would take the combined entity to the top spot by (re)insurance broking business revenue.

-

-

The ‘blank cheque’ company, led by John Butler, will look to acquire a company within the (re)insurance and InsurTech space.

-

The private equity firm has brought in Mark Cloutier as CEO.

-

The deal could boost its Lloyd’s capacity by 50 percent.

-

The insurer plans to shed 7.5 percent of its global workforce.

-

Mitsui Sumitomo Insurance (MSI) now owns 80 percent of Leadenhall Capital Partners after taking over the holding from its international subsidiary MS Amlin.

-

A large reinsurer is looking at launching an ILS fronting business to fill the gap left by the pending departure from the space of Tokio Millennium Re.

-

The Luca Albertini-led ILS manager will become a direct subsidiary of the Japanese insurance group, rather than being held by MS Amlin.

-

Many Bermuda staff have only been offered short-term transition roles.

-

Matthias Meyenhofer had taken up his role last September.

-

He moves across from the broker’s former securities division.

-

There was also evidence of one investment manager renewing its interest in the asset class.

-

The fund manager’s scarce capacity contributed to a generally difficult retro renewal at 1 January for buyers

-

ILS broker-dealers expect 2019 cat bond issuance to range from $7bn to above $10bn.

-

Nephila Climate has done a couple of recent swaps covering wind farms.

-

The Dodeka XX notes were listed on the Bermuda Stock Exchange yesterday.

-

Orchid CEO Brad Emmons will continue in his role after the sale.

-

The Latin American investment bank has backed the ILS start-up to launch a new low volatility fund in 2019.

-

The retro manager also warned 2018 wildfire losses could exceed those of last year.

-

This comes after the (re)insurer shifted away from offering market-facing ILS vehicles.

-

Nephila's sale to Markel has completed, giving the (re)insurance holding company a 20 percent share of the overall ILS market.

-

Two M&A deals in the ILS sector in the past month provide a contrasting view on what kind of acquirers may step forward in the future.

-

Insurers and reinsurers of the future will have more of a focus on packaging and ceding out risk, but there may be cultural challenges to reaching that goal, according to speakers at the Trading Risk New York Rendez-Vous.

-

Neuberger Berman has a diverse base of investors in areas Cartesian Re's ILS platform has not drawn from.

-

Fairfax has taken its total share of Brit to 88 percent with the purchase from the Canadian pension fund.

-

The $1bn ILW specialist will be remained NB Insurance-Linked Strategies after the sale.

-

The reinsurer said the fronting operations were “a very different business” than its own ventures division.

-

The deal also brings RenRe one of the largest fronting providers.

-

The $1.5bn deal also entails a reinsurance co-operation agreement between buyer and seller.

-

The insurer revealed the sum in its Q3 results.

-

BGC Partners has agreed to buy Lloyd's broker Ed Broking from private equity house Lightyear Capital, adding to its previous acquisition of London market intermediary Besso.

-

The asset manager and Oppenheimer’s former owner MassMutual have entered into an agreement which will bring Invesco’s total assets under management to $1.2 trillion.

-

Terms of the deal were not disclosed.

-

Reinsurance buyer preferences may influence the direction of M&A, suggested panellists at the Baden-Baden Guy Carpenter symposium.

-

Primary insurer consolidation poses more risk to the reinsurance sector than the merging of insurers and reinsurers, Scor’s Adrian Jones said.

-

The sale, expected to be completed in the fourth quarter of 2018, will generate net proceeds of $130mn, Man Group said.

-

The buyer expects to pay about £102mn ($134.7mn) in cash for Beaufort Underwriting Agency and its Syndicate 318.

-

Apollo committed an additional $700mn of equity capital to Catalina on completion of the buy-in deal.

-

M&A is once again at the forefront of industry minds, as Scor and RenaissanceRe have been fending off bidders and activist investors in recent weeks.

-

The new platform connects holders of long-tail insurance risks with investment funds.

-

But the reinsurer will likely retain its independence, experts say.

-

JLT CEO Dominic Burke said acquirer MMC valued the entrepreneurial culture at the firm.

-

-

Moving a step away from short-tail risks could be on the agenda after the insurer's takeover of the ILS giant.

-

A change of ownership is envisaged comfortably before year-end, it is understood.

-

The French carrier has received final regulatory approval for its $15.3bn acquisition of XL Group.

-

Duperreault recognises the quality of the Bermudian reinsurance industry.

-

Recent M&A deals point to the prospect of the ILS market disintermediating the reinsurance channel in future, said KBW analyst Christopher Campbell.

-

Aon Securities CEO Paul Schultz said he expects more transactions like the Markel-Nephila deal in the year to come.

-

Human behaviour now has a smaller role in determining pricing, according to the broker's president and global head of casualty.

-

Covea put in an all-cash offer of EUR43 ($49.85) per share for the French reinsurer, however the offer was turned down.

-

If you rewind to Monte Carlo a decade ago, Nephila and other ILS managers were merely an exotic corner of the reinsurance markets – independent, small teams slugging away at building up franchises. Ten years on and the industry’s largest manager has just sold up to Markel in a landmark M&A deal, and the ILS top 10 have boomed from under $10bn to $68bn in size.

-

Chaucer may be the first of a number of Lloyd’s and London market insurers that are up for sale to change hands, sister publication The Insurance Insider has reported.

-

Nephila’s sale to Markel is likely to accelerate the ILS manager’s push into primary insurance by bringing it closer to one of its key fronting partners as well as a carrier with distribution reach to the ultimate insurance buyers.

-

Co-founder says the ILS manager's relationship with fronting carrier Allianz will continue.

-

It affirmed the carrier’s A financial strength rating.

-

-

Sirius International Insurance Group and Easterly Acquisition Group have named Gallatin Point Capital as one of the investors on a private placement that will raise at least $213mn.

-

Aspen CEO Chris O’Kane said the acquisition by Apollo would help the group have additional scale and “take Aspen to the next level”.

-

Beat Capital Partners is merging with Paraline UK, owner of the Icat Lloyd’s syndicate 4242.

-

The deal would boost the Hartford’s ranking in the US commercial insurance market.

-

The (re)insurer said it had already bought an aggregate reinsurance cover for the combined Axa-XL entity and has decreased its cat exposure by about 40 percent relative to 2017.

-

M&A activity in the ILS manager market is continuing despite last year’s catastrophe activity, with one start-up being acquired by its cornerstone investor and the industry’s largest firm seeking new partners.

-

The reinsurer said a listing on the stock market will facilitate its growth.

-

The executive previously worked for Deutsche Bank's asset management division but left when the bank closed down its $100mn ILS fund last year.

-

The acquisition is expected to close in the second half of the year.

-

Swiss Re said it had ended talks with the Japanese technology investor Softbank about a possible minority stake deal.

-

A number of senior staff will leave XL Catlin ahead of its $15.3bn takeover by Axa.

-

Discussions between the reinsurer and technology investor SoftBank are at a standstill, Bloomberg News reported yesterday.

-

Florida carrier HCI has revealed details of an unsuccessful takeover bid it made for Federated National (FedNat) which resulted in a stock offer of at least $229mn.

-

HCI Group made an unsuccessful M&A approach to Federated National earlier this year.

-

Increased (re)insurance M&A activity may spark an increase in reinsurance buying and bring more risk to ILS markets, according to Aon Securities CEO Paul Schultz.

-

Swiss Re CEO Christian Mumenthaler said yesterday that M&A was "definitely on the table" for its corporate solutions division, which has become an area of scrutiny for analysts following poor results.

-

Lloyd's managing agency Argenta has been given the go ahead to launch a special purpose arrangement (SPA) sponsored and capitalised by Hannover Re.

-

Japanese technology firm SoftBank is now closer to buying a 25 percent stake in Swiss Re for up to CHF$9.23bn ($9.66bn), according to Bloomberg News.

-

New York-listed insurer The Hanover has confirmed that it has hired Goldman Sachs to run a strategic review that could lead to the sale of its Lloyd's business, Chaucer.

-

Aspen is preparing to run a bid process after being approached by several potential buyers, sister publication The Insurance Insider revealed last night.

-

Blue Capital reported a 0.03 percent loss in February for its London-listed Alternative Income fund, as an ILS industry benchmark is also showing negative returns for the month based on current data.

-

Axa's plans to significantly expand its risk transfer to reinsurers and capital market partners after its $15.3bn acquisition of XL are a positive sign for the ILS sector amid another expected wave of (re)insurance consolidation.

-

Japanese technology firm SoftBank has requested several board positions as part of its proposed purchase of 20 to 30 percent of Swiss Re, according to the Financial Times.

-

AIG's surprise move to take over AlphaCat parent Validus continues the trend for reinsurer-affiliated asset managers to dominate M&A activity within the ILS management sector.

-

The intellectual capital that AlphaCat will bring AIG will be an important factor in AIG's success going forward, an analyst has said commenting on the AIG-Validus buy-out.

-

Collateralised operators are among the leading reinsurance providers to Validus, which will need to reshape its buying strategies after it becomes part of the vast AIG network

-

AlphaCat's business has "great growth potential" to expand beyond its $3bn of assets under management, AIG president and CEO Brian Duperreault said on a call to discuss the carrier's $5.6bn takeover of Validus.

-

AlphaCat Managers has told investors that the business will have direct access to a "deeper and broader universe" of insurance risk after its acquisition by AIG

-

AIG said that the AlphaCat asset management franchise was one of the attractions of its $5.56bn bid for Bermudian (re)insurer Validus Group.

-

Lincoln Financial Group has agreed to purchase Liberty Life Assurance Company of Boston from Liberty Mutual for $3.3bn.

-

Renaissance Re has made a minority investment in run-off specialist Catalina, it confirmed in a press release yesterday.

-

Private equity firm Stone Point Capital is backing the bid by the founding family of AmTrust to buy out the company's other shareholders and take the beleaguered company private in a $1.37bn transaction.

-

Legacy manager Armour has confirmed that an investor group led by Aquiline Capital Partners has raised $500mn to finance a takeover of the firm, following earlier reports of the deal.

-

Run-off specialist Armour has been bought by private equity house Aquiline, sister publication The Insurance Insider has reported

-

Leadenhall-backed Gryphon Group Holdings is to take on the Guardian brand name for its start-up which plans to take a technology-focused approach to providing life insurance products

-

Canadian institutional investor Caisse de dépôt et placement du Québec (CDPQ) will invest $400mn in Hyperion to take a significant minority stake in the firm, in its second major insurance broking investment of the year.

-

Florida insurer Federated National has agreed to buy out joint venture partner Crosswinds' stake in Monarch Delaware, the parent of Monarch Insurance.

-

Chandler CEO Steven Butler and senior administrator Beverly Hodkin are to join Artex Risk Solutions' existing captive and insurance management team in the Cayman Islands following Artex's acquisition of the company

-

Hurricane Maria is expected to cost Lloyd's insurers $900mn, the corporation said today as it revised down its combined loss estimate for hurricanes Harvey and Irma.

-

The Hartford has agreed to acquire Aetna's US group life and disability business in a $1.45bn deal that it said would make it the second largest group life and disability insurer in the US market with approximately $5bn in expected earned premium.

-

Novae is to adopt the Axis brand and will be merged into the company's international insurance business following the completion of its £477.6mn ($631.1mn) takeover deal.

-

Sompo Canopius is to change ownership through a $952mn management buyout (MBO), the company has confirmed

-

Axis has boosted its cash bid for Lloyd's insurer Novae by 2.1 percent to 715 pence per share, in a move that Axis CEO Albert Benchimol said the aim of the improved offer was to "bring certainty" to the transaction.

-

Australian insurer Suncorp's Vero subsidiary has appealed the decision by the New Zealand regulator to prevent its NZ$236.1mn ($172.3mn) takeover of Tower.

-

Heritage Insurance Holdings announced yesterday that it was seeking to raise $125mn of debt from a private offering to help finance its $250mn acquisition of Rhode Island-based insurer Narragansett Bay

-

Heritage Insurance Holdings is to buy Rhode Island-based insurer Narragansett Bay Insurance for $250mn to create a leading "super-regional" personal lines carrier.

-

Novae reported continued growth in its property division in the first half of 2017 due to its fronting arrangement with Securis Investment Partners

-

Axis Re lifted the amount of reinsurance premium it ceded to third party capital partners in Q2 by more than a third year-on-year

-

Markel executives said the firm's acquisition of fronting carrier State National will help it develop more products for managing third party capital

-

State National, one of Nephila Capital's insurance fronting partners, has agreed a $919mn sale to Markel, the companies announced today.

-

Axis Capital CEO Albert Benchimol said the carrier could look to share more property cat risk with third-party capital providers after its $604mn acquisition of Lloyd's insurer Novae

-

Axis Capital CEO Albert Benchimol said the carrier could look to share more property cat risk with third-party capital providers after its $604mn acquisition of Lloyd's insurer Novae.

-

Bermuda-based Axis Capital has bought Lloyd's insurer Novae for $604mn

-

Homeowners' carrier United Insurance Holdings (UIH) and American Coastal have joined forces to create the third largest player in the Florida residential property market

-

Canada's largest P&C carrier Intact Financial is set to acquire OneBeacon from White Mountains in a $1.7bn deal

-

Two of the largest wholesale insurance brokers in the US are combining as market leader Amwins has agreed to acquire Partners Specialty Group, the companies said today.

-

PartnerRe completed its $286mn purchase of North American life reinsurer Aurigen on Friday.

-

Sompo Holdings has acquired Endurance Specialty for $6.3bn which will also give it ownership of ILS investment manager Blue Capital Management.

-

Lloyd's managing agent Argenta has been acquired by Hannover Re after a lengthy negotiation, the companies announced today.

-

A KKR affiliate and Caisse de dépôt et placement du Québec (CDPQ) have agreed to buy US broker USI Insurance from Onex Corporation in a deal valuing the company at $4.3bn.

-

US property cat specialist Icat and its parent Paraline Group have appointed Evercore to advise on strategic options that could include an eventual sale, sister publication The Insurance Insider reported.

-

The owners of legacy specialist Catalina - Apollo and two Canadian pension fund investors - have retained banking advisors that could lead to a partial or full sale of the firm.

-

The parent company of Louisiana and Texas homeowners' insurer Maison Insurance has received a licence to operate in Florida

-

Avatar Partners is to acquire Elements Property Insurance Holdings and its subsidiaries in a deal that pulls together two of Florida's smaller homeowners' carriers

-

QBE said it was not in discussions with Allianz or any other potential buyer after German media reported that the Munich group had made an informal bid

-

The Ontario Municipal Employees Retirement System (Omers) will take a 21 percent stake in Allied World after agreeing to put $1bn towards Fairfax Financial's acquisition of the insurer

-

Italian bank Intesa Sanpaolo has confirmed it is considering making a bid for Generali as part of its growth plans in the savings, banking and insurance industries.

-

Generali's shares rose more than 8 percent in trading today after the insurer disclosed a new EUR1.2bn ($1.29bn) investment that gave credence to M&A speculation surrounding the carrier.

-

Aon is reportedly close to announcing a sale of part of the Hewitt business it acquired in 2009

-

Canadian pension fund giant the Ontario Municipal Employees Retirement System (Omers) is in talks with Fairfax Financial to help fund the latter's takeover of Allied World, according to Bloomberg

-

Elliott Management has closed its previously announced acquisition of a controlling interest in ILS manager Aeolus, the companies announced.

-

Allied World's investment portfolio will transfer to Fairfax when its $4.85bn sale to the Canadian company closes next year, but this will cover only one aspect of its partnership with Bermudian ILS manager Aeolus.

-

M&A activity among smaller Floridian insurers is expected to increase after a challenging year for the local market, as Elements Property Insurance Company (Epic) has been put up for sale, sources said.

-

Fairfax Financial Holdings has agreed to buy Allied World Assurance in a $4.9bn cash and equity deal.

-

Apollo-backed life and annuities reinsurer Athene Holding is set to raise $1.08bn from its New York initial public offering (IPO) after pricing shares in the middle of a previously announced range

-

Liberty Mutual has agreed to buy specialty insurer Ironshore from Fosun in a deal that values the company at around $3bn or 1.45x tangible book value.

-

United Insurance Holdings (UIHC) has agreed to a five-year restrictive covenant that will prohibit it from investing or acquiring managing general agencies (MGAs) as part of its deal to purchase American Coastal

-

Bermudian carrier Argo has agreed to buy catastrophe (re)insurer Ariel Re for $235mn in cash, confirming a report earlier today from sister publication The Insurance Insider

-

Nephila Capital's fronting partner State National reported a 2 percent year-on-year increase in programme services revenues to $19.3mn in the third quarter

-

Blue Capital Management said that it does not anticipate any management changes following the acquisition of its parent company Endurance by Sompo Holdings, the second ownership change for the firm in as many years after Endurance bought Montpelier Re in 2015.

-

XL-owned ILS manager New Ocean Capital Management has said its new backer Mitsui & Co would help it broaden its relationships with Asian investors.

-

Hedge fund manager Elliott Management Corporation plans to hold onto its investment in Aeolus Capital Management "for a long time", the Bermudian ILS manager's founder Peter Appel told Trading Risk.

-

Hedge fund manager Elliott Management Corporation has agreed to buy a controlling stake in Bermudian ILS manager Aeolus Capital Management, the companies announced.

-

Willis Capital Markets & Advisory (WCMA) has expanded its team with the appointment of investment banker Daniel Ohana as senior vice president

-

Verisk Analytics has acquired (re)insurance software analytics firm Analyze Re, which will be merged into its AIR Worldwide modelling business unit

-

US life insurance specialist Genworth has agreed a $2.7bn sale to China Oceanwide, it announced today, after PartnerRe last week inked a deal to buy North American life reinsurer Aurigen Capital for $286mn in cash.

-

Blue Capital Management said that it did not anticipate any management changes following the acquisition of its parent company Endurance by Sompo Holdings.

-

Bermudian (re)insurer Endurance has been sold to Sompo for $6.3bn, it was announced today

-

Japanese big three insurer Sompo is in advanced discussions with Endurance, the Bermudian (re)insurer confirmed.

-

The Canada Pension Plan Investment Board (CPPIB) has agreed to buy Lloyd's insurer Ascot in a $1.1bn deal, the company announced

-

Cooperation and joint ventures provide a better way for the insurance industry to consolidate and achieve efficiencies than M&A, Axis Re CEO Jay Nichols said at this morning's Pre Monte Carlo briefing, hosted by sister title The Insurance Insider

-

Twelve Capital is looking to bring in new backing as one of its original stakeholders wants to find an exit, Trading Risk understands.

-

The merger between United Insurance Holdings and American Coastal creates growth opportunities but there are questions over sourcing business after an exclusive deal with American Coastal's production partner expires, according to JMP analyst Matt Carletti

-

ILS managers Nephila and Aeolus are among the top providers of reinsurance to both United Insurance Holdings and American Coastal, which agreed a merger deal yesterday (17 August).

-

United Insurance Holdings CEO John Forney said that the company expected to achieve significant reinsurance synergies from its merger with fellow Floridian insurer American Coastal.

-

AIG has agreed to sell its mortgage insurance business United Guaranty Corporation (UGC) to Arch Capital in a $3.4bn deal.

-

Schroders lifted its share in Zurich-based ILS manager Secquaero Advisors to a majority 50.1 percent earlier this year after buying up an additional 20.1 percent of equity.

-

Horseshoe Group has acquired Ikonic Fund Services to set up an independent fund administrator and insurance manager for the ILS sector, with more than $20bn in assets under administration.

-

Fronting carrier State National is set to begin acquiring insurance shell companies for Nephila Capital this year, which will give it separate entities to write primary business on behalf of the Bermudian fund manager.

-

Apollo-backed Athene Holding is preparing for a public flotation and has filed a registration statement with the US Securities and Exchange Commission

-

Catastrophe reinsurance premiums at Endurance increased by 61.4 percent in Q1 to $200.8mn following the Montpelier Re acquisition last year.

-

Allied World Q1 premium drop; Ontario Teachers'sells ANV; Alternative capital hits $72bn: Aon Benfield; RMS on Ecuador quake; Record rainfall floods Texas...

-

Ontario Teachers' Pension Plan (OTPP) has agreed to sell Lloyd's insurer ANV for $218.7mn in cash to AmTrust, the fund announced today (19 April)

-

AJ Gallagher (AJG) subsidiary Artex Risk Solutions has entered a definitive agreement to acquire Guernsey-domiciled Hexagon Insurance PCC and its subsidiaries, building on the acquisition of Kane earlier this month.

-

Kane has announced that it expects to close the sale of its insurance management operations to Artex Risk Solutions, a subsidiary of international broking group Arthur J Gallagher (AJG), by 31 March.

-

The private equity backers of Kane are close to completing a sale of the firm's insurance services and captive operations to Guernsey-based Artex Risk Solutions, sources told Trading Risk.

-

Bermudian fund manager Aeolus is working with advisers as it considers bringing in new investors in early 2016, sources told Trading Risk.

-

Bermudian fund manager Aeolus is working with advisers as it considers bringing in new investors in early 2016, sources told Trading Risk.

-

Markel has completed the acquisition of Bermudian retro specialist Catco, it announced yesterday (8 December).

-

Towers Watson and Willis have agreed to double the value of a one-off cash dividend offered to Towers Watson investors before their proposed merger closes, in an attempt to secure sufficient approval to get the deal over the line

-

The Florida P&C market is set to be the next area of focus for mergers and acquisitions as companies seek liquidity, sources told sister publication The Insurance Insider

-

Markel has subscribed for 25 million voting rights in the Catco Reinsurance Opportunities Fund, equivalent to a 6.91 percent share.

-

Markel has disclosed that it will pay a total purchase price of about $200mn in cash for its acquisition of Catco Investment Management, the Bermudian retro-focused fund manager.

-

Catco is preparing to expand its listed retro fund, the Catco Reinsurance Opportunities Fund, by up to $750mn ahead of its integration by Markel.

-

The impact that (re)insurance consolidation would have on buying and underwriting discipline was a major point of debate at Monte Carlo, but commentators said demand for peak zone cover is less likely to be affected

-

Expansive Floridian insurer Heritage Insurance has agreed to buy Zephyr Insurance Company, a specialty insurer in Hawaii, in an all-cash deal worth around $120mn.

-

United Insurance Holdings (UPC Insurance) is to buy Long Island-based carrier Interboro Insurance Company for $57mn as the expansive Floridian insurer looks to build its footprint outside the Sunshine State.

-

Reinsurance M&A could benefit ILS funds as larger carriers will be keen to reduce counterparty credit risk, two fund managers told Trading Risk.

-

Zurich has withdrawn its offer to buy UK insurer RSA after warning of a significant loss from the Tianjin port explosions and a $200mn operating loss on its general insurance business in the third quarter.

-

Vario Partners founders Quentin Moore and James McPherson say that Solvency II and insurance M&A will help drive take-up of securitised capital relief products

-

Japanese insurer Mitsui Sumitomo Insurance Company (MSI) has agreed terms with Amlin to acquire the London-listed specialty (re)insurer in a cash offer worth £3.47bn ($5.4bn), the company announced today (8 September).

-

Consolidation in the reinsurance industry is contributing to an uptick in demand for retro cover in 2015, although the impact is expected to be short-lived.

-

Traditional reinsurers are adapting to become "gatekeepers" of insurance risk as they share more of their portfolios with alternative capital, AM Best said in its pre-Monte Carlo report on the sector

-

Standard & Poor's (S&P) has warned that consolidation is unlikely to be a panacea for competitive conditions in the reinsurance market.

-

Endurance now owns a 25 percent share of the Blue Capital Global Reinsurance Fund - worth $50mn - after the completion of its takeover of Montpelier Re.

-

Italian investment firm Exor and PartnerRe have agreed on a $6.9bn sale of the reinsurer, as the carrier terminated its agreement to merge with Axis Capital.

-

European insurance powerhouse Zurich is considering a bid for its smaller rival RSA, the Swiss carrier revealed this morning (28 July).

-

Start-up Chinese investment company China Minsheng Investment (CMI) is to buy White Mountains reinsurance subsidiary Sirius in a $2.2bn deal, the company announced today.

-

Axis said it had halted work on its integration with PartnerRe after the reinsurer announced that it would enter into takeover talks with Exor.

-

PartnerRe will seek to open up negotiations with Exor after the investment company submitted a $140.50 per share cash offer for the reinsurer yesterday.

-

The run of stealth (re)insurance M&A deals continued in the past month, with the focus moving to the primary market as Ace agreed a $28.3bn acquisition of Chubb

-

M&A activity has taken off in the reinsurance market over the past year - with integration at some merged companies well underway while the fraught battle between Axis and Exor for PartnerRe continues

-

It is understood Catco founder Tony Belisle is keen for the company to tie up with a reinsurer as the Bermudian investment manager works towards a sale, but industry observers remain sceptical that this will be the outcome of the process.

-

Axis has lifted the pre-closing dividend offered to PartnerRe investors by more than 50 percent, taking the total face value of its bid to $138.08 per share.

-

Analysts have said that Exor's newly improved offer terms for PartnerRe could be sufficient to swing the crucial shareholder vote against the rival Axis bid later this month.

-

Reinsurers will be watching the fallout from the Ace-Chubb deal for signs on the extent of the role the recently launched ABR Re vehicle will play in the combined operation

-

Ace has agreed to buy rival US insurance carrier Chubb in a cash-and-stock $28.3bn deal, the companies announced today (1 July).

-

Consultancy Towers Watson and broker Willis Group have announced they are to combine in an all-stock merger transaction to form a new entity called Willis Towers Watson.

-

Retro market leader Catco Investment Manager could secure a valuation of around $300mn when the business is sold, according to analysis from Trading Risk

-

A combined Axis-PartnerRe hopes to earn an additional $60mn a year by 2017 from managing third-party capital.

-

A combined Axis-PartnerRe hopes to earn an additional $60mn a year by 2017 from managing third-party capital, according to a presentation released by Axis today (1 June)

-

PartnerRe is now proceeding to shareholder approval of its pending merger with Axis after rival bidder Exor confirmed yesterday (21 May) that it would not increase its $137.50-a-share takeover offer.

-

The holding company for MultiStrat Re, a platform set up to help hedge funds tap into the reinsurance space, has acquired Maryland-based Annapolis Consulting Group (ACG) for an undisclosed amount.

-

Exor has said it would not raise its $137.50 a share takeover offer for PartnerRe and that the board should allow shareholders to decide on the competing proposals for the reinsurer.

-

The board of PartnerRe has agreed to engage with Italian investment vehicle Exor over its latest $137.50 per share takeover proposal, but remained adamant that the offer wasn't enough to secure a deal.

-

Italian investment company Exor has increased its bid for PartnerRe from $130 to $137.50 per share and acquired a 9 percent stake to become the reinsurer's largest shareholder.

-

Italian investment vehicle Exor has increased its bid for PartnerRe from $130 to $137.50 per share and acquired enough shares in the reinsurer to become its largest shareholder.

-

PartnerRe has said that it will retrocede $36mn of agricultural premiums to its Lorenz Re sidecar in the April renewals, according to its first quarter earnings call.

-

Axis president and CEO Albert Benchimol said his firm was "fully committed" to a merger with PartnerRe after Exor made a rival proposal 15.8 percent higher than its bid.

-

Canadian pension giant Ontario Municipal Employees Retirement System (Omers) has agreed to buy up to 29.9 percent of Brit Insurance from Fairfax Financial.

-

The Agnelli family's investment firm Exor looks to have scuppered the proposed acquisition by Axis proposed of PartnerRe with a $6.4bn all-cash bid that values the company at a significant premium to the recommended all-paper offer.

-

BB&T Corporation has sold Florida insurer American Coastal to management at US hurricane managing general underwriter (MGU) AmRisc.

-

Endurance will maintain Montpelier Re's Blue Capital asset management platform after closing its $1.83bn acquisition of the Bermudian reinsurer, according to the company's chief financial officer Mike McGuire.

-

Endurance CEO John Charman said the company's proposed $1.83bn acquisition of Montpelier Re would provide the company with a "natural introduction" to the business of managing capital for third-party investors.

-

On 22 September 2014, the US Treasury and the Internal Revenue Service (IRS) gave notice that they intend to issue new regulations that would limit certain tax benefits many US corporations claimed were available from transactions in which they "inverted" or were taken over by a non-US corporation

-

XL and Catlin have agreed on the reinsurance leadership structure following their merger, which will establish five regional CEOs all reporting to group reinsurance head Greg Hendrick

-

Shareholders of Platinum Underwriters have today (27 February) overwhelmingly voted in favour of all proposals relating to the company's pending acquisition by RenaissanceRe.

-

Standard & Poor's (S&P) believes that the recent string of mergers and acquisitions will not slow down falling rates or ease competitive pressures in the reinsurance industry

-

Reinsurance brokers and carriers fear that the recent flurry of M&A activity in the sector may depress demand for cover.