Securis Investment Partners

-

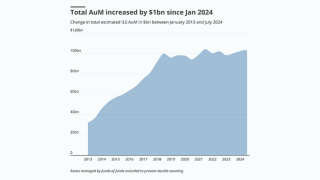

The ILS manager leaderboard demonstrates the ongoing popularity of cat bonds.

-

The combined Twelve-Securis entity would be a top-five ILS firm currently.

-

Urs Ramseier will be CEO and Herbie Lloyd CIO.

-

The Swiss Re veteran left her former employer last year.

-

Various trends may work together to hold the cat markets up for longer than some had feared.

-

A diverse investor base is among market characteristics seen as important for growth.

-

-

The allocation last autumn amounted to around 1.4% of the investment manager’s total funds under management.

-

A market-wide loss of $700mn would amount to around 15% of the total amount of life ILS assets under management .

-

The manager has made four appointments including two internal promotions.

-

The project which began last year in Zurich has now expanded to a group standing for $29bn of ILS assets under management globally.

-

The distribution arrangement will cover Securis's full range of ILS offerings.

-

The life segment has shifted from its genesis in mortality and morbidity risk transfer as lapsed risk deals have proliferated.

-

The executive spent the past 10 years working for Scor Investment Partners.

-

The ILS firm’s CEO Nilsen said life ILS was “poised for growth in a higher interest rate environment”.

-

Some might see the ILS sector as more institutionalised compared to personality-driven hedge funds, but there is little doubt that the original generation of ILS leaders will be hard to replace.

-

The investor has significantly cut back its allocation over the past few years.

-

The underwriter had worked with the ILS firm since 2018.

-

Could a back-to-basics approach see ILS firms shun Lloyd's advantages for lower-cost alternatives?

-

The pension decided to invest in ILS in 2018 allocating 1.5% of the £1.9bn fund to Securis.

-

The manager is now the sixth specialist ILS firm to join the SBAI.

-

-

The scheme now holds £41.2mn via Securis, compared with £98.1mn last year.

-

The NAV per share has dropped by 2.6 percent since the turn of the year.

-

The manager gained approval from a majority of investors in its Guernsey-listed Securis I fund to implement side pocket shares.

-

Investors sought to redeem about $200mn in 2019 from the shrinking Securis I fund, but the London manager has grown its lower-risk non-life fund.

-

The Securis SPA faced the highest deterioration in underwriting losses as Nephila and Arcus both improved their combined ratios.

-

The co-founder had moved from the CEO role to chief investment officer last April.

-

The decision followed a review of the primary insurance business written at each carrier.

-

January 2018 opened the year of the “great reload” for ILS managers.

-

January renewals were creaking into order in December after the wildfires locked up the process.

-

The exit comes ahead of Lloyd’s closure of SPA 6129.

-

CEO Vegard Nilsen said direct capital provision at Lloyd's didn't meet its return targets.

-

The BBC pension scheme has returned to the ILS market for 2018 after pulling out several years ago.

-

The ILS manager is likely to revisit plans to launch full syndicate at a later stage.

-

Many ILS entrepreneurs have already successfully cashed out.

-

Securis Investment Partners has recruited Paul Wilson from RMS and former MS Amlin executive Adam Tidball to lead its non-life catastrophe analytics team for the firm.

-

The average second quarter returns for a group of ILS funds tracked by Trading Risk has increased to 1.36 percent, compared with 0.79 percent for the same quarter last year.

-

People moves in the ILS market.

-

Securis is considering establishing a full Lloyd’s syndicate for 2019 as it looks to trade forward in the 330-year-old market following the pending discontinuation of its joint venture with Axis, Trading Risk can reveal.

-

Insurers with huge exposure to "silent cyber" risk present a significant opportunity to the ILS sector, according to panellists at the Trading Risk ILS conference in London held last week.

-

Vegard Nilsen has been promoted to the role of chief executive officer of London-based ILS manager Securis Investment Partners after a fresh organisational restructure.

-

Securis will need to find a new partner for its Lloyd's special purpose arrangement (SPA) in 2019 after Axis gave the fund manager notice to discontinue their arrangement, sources told sister publication The Insurance Insider.