-

The LA wildfires resulted in the largest insured loss of the year, at $40bn.

-

The two bonds offered are both replacing expiring deals.

-

The breadth of strategies targeted by ILS start-ups signals where the industry is heading.

-

The unit will be led by Ed Hochberg, global risk solutions leader at Guy Carpenter.

-

The broker deal has projected cat bond new issuance of $19bn-$21bn for 2026.

-

The index returned 10.4% for the 11 months to the end of November.

-

Ashleigh Edwards will report to group CUO Mark Pepper.

-

The Aon Cat Bond Total Return Index delivered gains of 11.6% in 2025.

-

Investor appetite for bonds is exerting pressure on traditional retro providers, according to Gallagher Re.

-

Both lower multiples and potential Fed rate cuts will pressure returns.

-

New issuance will be supported by new sponsors as well as over $13bn in maturities.

-

The ILS AuM in its flagship cat funds rose 13% over the half year to $6bn as of 31 October.

-

There have been few retro exits despite softening amid cat bond competition.

-

Non-loss impacted major property program rates were down by up to 20% at the renewal period.

-

The ILW segment shrank in 2025 to around $6bn, the broker estimated.

-

Potential sidecar investors include alternative asset managers and ILS firms.

-

Q2 was the largest quarter for issuance, with $9.6bn of limit placed.

-

The casualty-focused retro vehicle has produced an annualised RoE of 20% since 2020.

-

Cedants pursued property renewals “aggressively” amid excess reinsurer capacity.

-

The transition reflects ongoing growth at Swiss Re’s ILS platform, the firm said.

-

The placement showed investor preference for slightly riskier aggregate deal.

-

Cat bond market growth has exceeded broker-dealers' 2025 forecasts by some distance.

-

This was the second issuance completed by Farmers via its Bermuda reinsurance vehicle Topanga Re.

-

The SPV will underwrite a “broad and highly diversified” portion of Amwins’ ~$6bn delegated authority premiums.

-

The finance committee discussed shifting market dynamics as tort reform takes effect.

-

Los Angeles wildfires and SCS pushed US losses to $89bn.

-

CA Fairplan’s Golden Bear Re deal upsized 200% to $750mn.

-

The industry has continued to build and innovate through a third strong year of performance.

-

The outlook flags “large uncertainties” amid possible El Niño through summer 2026.

-

The note is paying a spread of 975bps, 11.3% below the midpoint of the initial guidance range.

-

Man AHL Cat Bond Strategy has $1bn in assets, around 2% of Man AHL Partners’ total of $54bn.

-

The TPA approach to investing was adopted by US pension fund Calpers last month.

-

The offering is born out of software Ledger developed to manage its own portfolio since 2021.

-

Global insurance premiums reached an all-time high of $15.3bn by year end 2024.

-

Migdal Insurance placed its debut cat bond Turris Re for $100mn of quake limit.

-

Several Lloyd’s syndicates are also now providing cover for the federal insurer.

-

The sponsor is offering two notes but will only place one depending on market interest.

-

Secondary market pricing implies the sponsor could recoup a total of $50mn on the 2022-1 A note.

-

An “extraordinary” proportion of storms reached Category 5 status this year.

-

One fund tracked by the index had a negative month.

-

The fund held $10mn in AuM, with $3mn the minimum investment required.

-

North Carolina Farm Bureau raised $500mn with its latest Blue Ridge Re cat bond deal.

-

The single note is offering an effective coupon of 23.5% at the midpoint of guidance.

-

Fontana 2.0 will encompass a more flexible investment strategy than the 2022 vehicle.

-

The cat bond market is on course for $56bn of notional outstanding by the end of this year.

-

The outcome of Eaton Fire subrogation is an uncertainty for some vehicles.

-

The peril has been historically difficult to model compared to others.

-

Insurers with SCS exposure reaped fewer benefits but still improved over Q3 2024.

-

The issuance will be the fourth deal offered by the Lloyd’s carrier.

-

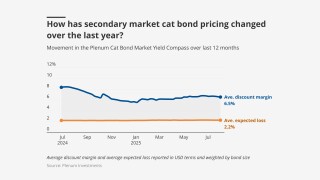

The shift in multiples is indicative of price softening in the cat bond the past two years.

-

Japanese firm MS&AD acquired 80% of ILS manager Leadenhall Capital Partners in 2019 from another affiliate.

-

The average weighted spread on the deals was 651bps, skewed upward by cyber and wildfire deals.

-

Carriers are grappling with a rush of investor interest in longer-tail lines.

-

The ratings agency first indicated it would consider a new methodology in March.

-

The single Class A note is offering an initial spread range of 1,050-1,150 to investors.

-

Hole will spearhead the launch of the underwriting and analytics platform.

-

One William Street priced its debut cat bond 13% below the midpoint of guidance.

-

As the P&C market shifts, carriers are looking for growth from acquisitions.

-

The sponsor has $200mn of cat bond protection maturing in December this year.

-

Cassis joins from Swiss Re, where she was a senior ILS structurer since February 2022.

-

Covea’s Hexagon IV Re deal priced 13% below the initial target on a weighted average basis.

-

Total gains for the year reached 7.71%.

-

Some experienced investors are pivoting out of cat bonds and into the top layers of private ILS deals.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

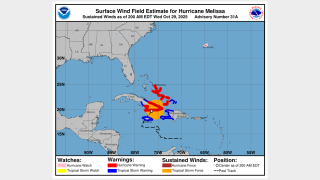

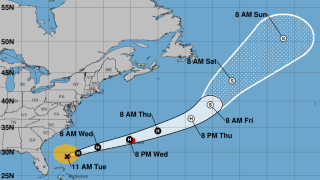

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

Economic losses from the Cat 5 storm could run 30%-250% of the country’s GDP.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

Pricing on Friday implied a potential $45mn loss to the bond, before the storm outlook deteriorated.

-

So far this year, there have been 11 first-time sponsors to place a deal.

-

Competition on price from traditional markets is weighing on bond market momentum.

-

The insurer of last resort’s exposure was $696bn as of last September.

-

The bond will provide protection against US wind with a PCS trigger.

-

The cedant’s current deal is due to mature at the end of January 2026.

-

Spreads on USAA’s latest deal priced below comparative issuances in 2023-2024.

-

The executive is charged with defrauding investors out of nearly $500mn.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

ILS has been a driver of innovation in reinsurance, Convergence 2025 attendees heard Wednesday.

-

Mory Katz joined the broker earlier this year.

-

Guy Carpenter will rebrand as Marsh Re, as a new central tech/operations unit is created.

-

The funds will combine credit and ILS holdings.

-

Ryan Saul will work at Ledger’s broker-dealer subsidiary Ledger Capital Markets.

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

Newsom has yet to sign a pending bill to create a public cat model.

-

Returns from cat risk investments stood at 20.1% for the year to 30 June 2025.

-

The allocation is around 3% of the fund’s total assets.

-

Jonathan Rinderknecht was arrested Tuesday on destruction of property charges.

-

The insurer of last resort currently has $2.15bn of cat bond protection on risk.

-

Seller White Mountains will retain a roughly 15% fully diluted equity stake.

-

The business has been ~70% owned by White Mountains since January 2024.

-

The facility will initially focus on US, Bermudian and European business.

-

Spectrum joins investors ForgePoint, Hudson and MTech.

-

Pricing has hit historically soft market lows, based on secondary market pricing.

-

Winds have strengthened to 80 mph, and the hurricane is expected to intensify further over the next 48 hours.

-

The manager’s largest ILS holding is in the cat-bond-heavy High Yield fund.

-

Cat bonds have outpaced the returns on private strategies in the year to date.

-

The new Verisk SCS model is increasing expected losses on aggregate bonds.

-

The tropical cyclone is expected to be named Imelda.

-

In the new role, Edward Johnson will be rejoining former Aon Securities colleague Chris Parry.

-

Despite the formation of Gabrielle, there is "a very high probability" of a below-average season.

-

Deals would need to be sized at $50mn plus for transfer to capital markets.

-

The CEA had $19.3bn of claim-paying capacity as of 31 July.

-

The ILS manager has $6.8bn in assets and will be led by MariaGiovanna Guatteri.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

The sidecar will support five programs providing specialty frequency coverages.

-

Reinsurer executives during a Aon reinsurer panel stressed that the industry worked hard on setting the right structure.

-

ILS executives talked pricing, capacity and opportunities in casualty at an ILS roundtable in Monte Carlo.

-

The market has learned lessons from earlier soft market phases that it will apply now.

-

Victory Pioneer Cat Bond Fund also added assets in the past month.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

Scott Cobon's most recent title was MD, insurance management services.

-

The sponsor extended two notes issued in 2022.

-

It is understood that CyberCube has been considering a sale of the business.

-

The volume of property cat aggregates placed grew 50% in 2025.

-

Bohm has held senior roles at BMS, Swiss Re and Aon during his career.

-

The trend for private credit in alternative asset management is “set to continue”.

-

The investment bank had stopped offering ILS services last September.

-

The data modeling firm said losses previously averaged $132bn annually.

-

The agency noted inflows to cat bond funds and investor interest in private ILS.

-

Competition from cat bonds in the top layers of programmes applied downward pressure on reinsurance pricing in 2025.

-

Dedicated reinsurance capital is on track to increase by 8% in 2025, the broker said.

-

Funds encompassing private ILS outperformed cat bond strategies in July.

-

The global specialty player is also exploring ILS offerings across specialty and cat bonds.

-

The violations included not using propertly appointed adjusters and failing to pay claims.

-

Market participants have until 13 October to provide any comments.

-

A trend towards higher-risk ILW bonds helped keep yields in double-digits despite softer rates.

-

After the LA wildfires in Q1, carriers got some relief in Q2 ahead of wind season.

-

The purchase brings Sompo an established ILS platform as part of the deal.

-

Last year marked the second consecutive year in which carriers made a positive return.

-

The group claims the White House is undermining disaster preparedness.

-

The US has been lucky over recent decades to avoid a $100bn insured hurricane event.

-

Reinsurers are confident on cat rates and ready to deploy ILS capital.

-

The vehicle will support Platinum Specialty Underwriters, XPT Group’s MGA underwriting unit.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

The company plans to launch in New York and New Jersey next year.

-

American Integrity grew GWP by 30% to $287mn and Slide GWP was up 25% to $435mn in Q2.

-

The estimate covers property and vehicle claims.

-

The reinsurer plans to repeat its 2025 purchasing for property and specialty protections.

-

The firm booked net losses from the LA wildfires of EUR615.1mn in the first half.

-

ILS investors have fought shy of multi-peril aggs due to low confidence in SCS modelling.

-

Both organisations still predict an above-average hurricane season.

-

The Florida carrier said ceded premiums will rise slightly to $106mn in Q3.

-

The sidecar took $19mn of cat losses relating to the California wildfires.

-

The yield figure comprises 6.53% of insurance discount margin and 4.28% risk-free.

-

The forecast has increased since the early July update due to several additional factors.

-

The Texas insurer of last resort previously had to have funding for a 1-in-100 year storm.

-

California wildfires account for $40bn of the insured loss tally in H1.

-

The company also purchased $15mn of SCS parametric coverage.

-

In Q2 last year, Everest ceded $26mn in losses to Mt Logan.

-

The reinsurance CoR fell 2.3 points to 79.5% while the primary CoR rose 4.7 points to 98.7%.

-

The ILS Advisers Fund Index reported a profit of 1.11% in June.

-

The model becomes the second in the state to get approval to affect ratemaking applications.

-

The vehicle will support Ascot’s casualty business in the US and Bermuda.

-

Markel announced the sale of its global reinsurance renewal rights to Nationwide.

-

Nationwide will delegate management of the policies to Ryan Specialty.

-

Amid $17bn of new deals, cat bond activity included aggregate and cascading structures.

-

The firm attributed a 9% drop in reinsurance NWP partly to higher cession rates.

-

Millions are evacuating after one of the strongest earthquakes in modern history.

-

Mercury’s recovery from the guaranteed percentage of losses is $47mn.

-

This brings the carrier’s total limit on the program to $1.8bn.

-

The Bermuda SPI will write a quota share of SageSure’s captive Anchor Re.

-

The bond will provide protection on an industry-loss basis, as reported by PCS.

-

Insured losses produced the second highest first-half tally since records began in 1980.

-

The merged business of Twelve Securis ranked third among ILS managers for AuM, behind Fermat and RenRe.

-

At least 14 new companies have opened up shop in the state in recent years.

-

Cat bond broking growth contributed to 6% organic growth in reinsurance.

-

Brian Hickey joins the firm from PE specialist AE Industrial Partners.

-

Insurers must write policies in high-risk areas in order to incorporate the model.

-

Canio spent over 19 years with PGGM, with nine of those managing ILS.

-

The firm reported a net pre-tax cat loss of $414mn from January’s LA wildfires.

-

Cat bonds remain attractive for investors seeking risk-adjusted return and diversification.

-

The losses were below May’s $777mn, but almost 3x higher than for June 2024.

-

The suit claims billions of dollars are being illegally withheld.

-

The US accounted for 92% of all global insured losses for the period.

-

US events accounted for more than 90% of global insured losses.

-

State legislation has led to major strides in rate adequacy.

-

We discuss progress in collateral management with our Outstanding Contributor winner.

-

Category 4 and 5 storms could become more common and hit further north.

-

Former ILS lead Matt Holland left the company in May.

-

Despite predicting fewer hurricanes, the numbers are still above average.

-

His last role was ILW practice leader at Acrisure Re.

-

The weather-modelling agency is predicting a below-normal season.

-

The fund was renamed from the Pioneer Cat Bond Fund.

-

The Diversified Alternative Fund’s allocation to cat bonds was up by 31% from $386mn at 31 January.

-

The Bermudian ILS manager has recently changed its name from Mereo Advisors.

-

The fund’s ILS portfolio is split between 70% property cat and 30% cyber risk.

-

This comes in at the lower end of the initial spread guidance of 725-775 bps.

-

The investment consultancy said yields increased in Q2 by less than could have been expected.

-

The Cayman Islands-domiciled SPI now has four institutional backers.

-

Property cat-focused sidecar capital was up by approximately 10% in H1.

-

The company said the reduction was due to years of steady improvements.

-

Richardson has been with the firm since 2015 and was most recently vice chair and chair of international.

-

The programme’s total limit this year is down $594mn to $1.36bn.

-

The sidecars will provide capacity for reinsurers and large insurance carriers.

-

Weighted average multiples were down as sponsors capitalised on demand to push spreads lower.

-

The measure could have landed insurers with extra tax on US business.

-

The total return for the Swiss Re Global Cat Bond Index stood at 0.61% for the month.

-

The awards celebration took place at the Hilton Bankside on 25 June.

-

The bond is split across a Series 1 and Series 2 structure, with eight notes in total.

-

The cost comes in at $530.6bn, roughly $20mn lower than budgeted.

-

Everest Re increased the targeted size of Kilimanjaro Re across all four classes of notes.

-

The pensions scheme’s existing ILS holdings to Aeolus and HSCM are in run-off.

-

M&A and shifts in distribution arrangements bring risks and opportunities.

-

Slide is putting faith in tort reforms and will lean into Florida, CEO Lucas said.

-

Allstate attributed the bulk of its losses to three major wind and hail events.

-

Pricing on all classes of notes are being offered at the bottom of the guided range.

-

PCS's loss estimate for the March Missouri SCS pushed the bond beyond its exhaustion point.

-

The California Earthquake Authority upsized its Ursa Re deal by 60% to $400mn.

-

Buyers have turned to retro markets for covers where ILW pricing is less attractive.

-

The Californian insurer had a private deal, Randolph Re, that provided pure wildfire protection.

-

John Kulik will work within Ledger’s broking team, Ledger Investing.

-

The documents figure in a potential criminal case against a CCB employee.

-

In 2024, MGA GWP reached approximately $20bn in Europe.

-

Investors eyeing private ILS include opportunistic allocators keeping watch on storm season.

-

Everest Re has structured its deal into two sections targeting aggregate and per occurrence cover.

-

The pension plan noted in June 2024 that it was exploring new options in ILS.

-

The man is alleged to have conspired with others to falsify LOCs and collateral letters.

-

The number has expanded by around 40% from an earlier update, sources said.

-

The latest update brings the agency’s combined estimate for Milton and Helene to $32.4bn.

-

The executive has 15 years of experience in meteorology and cat analytics.

-

Total yield was 10.93% as of 30 May, including 4.34% of risk-free rate.

-

She was previously head of investor relations and business development for North America and Australia at Securis.

-

HCI secured three towers with $3.5bn in XoL coverage.

-

This followed a $650mn fall in April, after management change of the fund.

-

A total $225mn of fresh limit entered the market across two deals.

-

Weston Tompkins spent 10 years in an investor relations role at Securis.

-

The bond will provide protection for storms, quakes and fires in seven US states.

-

The $2.59bn renewal is up 45% from last year.

-

Up to nine million acres of US land are considered likely to burn.

-

Last week, TSR updated its forecast and is now predicting above-average storm activity.

-

The total cost excluding a 15% quota share was $201.85mn, with rates down 12.2% from last year.

-

Most of the losses are attributable to a supercell storm in Texas.

-

The company also has $100mn for US hurricane events.

-

The Floridian also secured $352mn of multi-year coverage extending to 2027.

-

Property cat XoL rates were off by around 10% on average on a blended risk-adjusted basis.

-

The index provider revised up its return for March by 0.39 percentage points to 1.21%.

-

The Peak Re subsidiary mainly writes US motor and casualty reinsurance.

-

The deal leaves premier surety as Travelers' sole Canadian portfolio.

-

Florida’s top regulator says he’s eyeing eventual tweaks to the state’s cat fund, too.

-

The company is a wholly owned subsidiary of AmTrust Financial.