Rates

-

Investor interest is warming up following a colder spell over the past several years.

-

While rates have “definitely come down,” they were coming off a high base, Rachel Turk said.

-

Terms are expected to hold, underpinning the stronger recent performance of reinsurers.

-

Dedicated reinsurance capital is on track to increase by 8% in 2025, the broker said.

-

Last year marked the second consecutive year in which carriers made a positive return.

-

The reinsurer’s chair said cat pricing reductions are at a “miniscule level”.

-

The model becomes the second in the state to get approval to affect ratemaking applications.

-

The investment consultancy said yields increased in Q2 by less than could have been expected.

-

The cost comes in at $530.6bn, roughly $20mn lower than budgeted.

-

Florida’s top regulator says he’s eyeing eventual tweaks to the state’s cat fund, too.

-

The rating allows IQUW to access $1bn in group capital.

-

Compressed cat bond spreads could drive some rebalancing, as M&A remains a prospect.

-

Twia filed for the rate hike in August after an actuarial analysis showed that rates were inadequate.

-

The rate change will be implemented in November.

-

The board of directors has voted for a 10% rate hike.

-

-

Twia’s analysis showed existing rates were inadequate.

-

The broker estimated ILS capacity reached a record $107bn as cat bond interest surged.

-

The proposal now goes to the Florida Office of Insurance Regulation for review.

-

The ratings agency noted robust profit margins for reinsurers.

-

Top layer competition is an added pressure on ILS firms, but the impact can be overstated.

-

The firm received a long-term ICR of a- and the outlook for both ratings is stable.

-

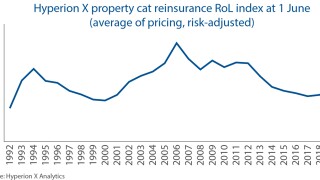

European rates on line increased by 7.60%, while in the US prices were up 5.25%.

-

The broker’s report also hailed the best risk-adjusted margins for ILS investors in a decade.

-

The broker’s 1st View report predicted that cat bond issuance should remain elevated until at least Q2 2024.

-

Reinsurers are making some adjustments to secure target signings but appetite to grow is finely balanced.

-

Projected 2024 ILS returns remain historically high, but signs of increased appetite for top-layer cat risk and top-end retro raise questions over how long this will last.

-

Anticipations of a tug-of-war around a ‘flat to slightly up’ pricing renewal have indeed come to fruition.

-

Profits are expected to widen thanks to improved rates and higher average attachment points.

-

TWIA has raised its net operating expenses to $40.2mn.

-

E+S Rück said that natural disasters and persistently high inflation have again "taken a toll" on the German insurance industry.

-

Fermat’s John Seo said the industry can “see the wall of money coming in, but it’s coming in slowly”.

-

Prabis does not envisage market softening at this stage, for reasons including wider macroeconomic impacts.

-

The downgrades reflect the negative impact of challenging macro-economic trends on underwriting results and risk-adjusted capitalization.

-

Board members voted five to four in favor of rate increases but fell short of the two-thirds majority required.

-

The ratings agency is currently in discussions with Clear Blue’s management regarding the company’s ability to replace certain programs or letters of credit.

-

The CEO said Chubb has ‘never seen better pricing’ on primary property.

-

Loss-free accounts were generally up 20%-50% at renewal, the reinsurance broker said.

-

The firm’s 1st View report on the July renewals also flagged that an oversupply of ILW capacity may bring down attachment points relative to early 2023.

-

The carrier is increasing underlying rates to counter increased reinsurance costs and inflation.

-

Considering recent reforms, Citizens’ rates, on average, are still 58.6% below actuarially sound levels, but the inadequacy would have been 88.3% without them.

-

Some cedants paid more than 40% increases depending on Florida concentration and Hurricane Ian losses.

-

Even clean accounts in the admitted space are seeing rate increases of 15% year on year, while loss-hit accounts in Florida were slapped with a 100% rate increase for June 1.

-

Early private deals have provided far more stability in this year’s renewal than last.

-

Softening cat bond rates are among the bearish signals for cat rates, but latent new demand and still-cautious supply should prolong reinsurer gains.

-

The pace of rate hikes will ease back from the 1 January reset as buyers seek to lock up capacity early after last year’s dislocated renewal.

-

Capital has begun to flow again after a challenging time for ILS fundraising in 2022 – but there is a clear shift underway.

-

The recommendations await approval from the Florida Office of Insurance Regulation.

-

Reinsurers are also increasing their attention on per-risk contracts protecting Japanese interests abroad.

-

A trend for slightly riskier bonds has brought with it a rise in the absolute margin on offer.

-

Hamilton Re said early signs point to 25%-30% rate rises on Japanese wind.

-

This was the highest single-year increase for the US index since 2006.

-

This price hike contributed to a premium increase of $695mn in the month, bringing the year-to-date impact of 2022 rate increases to $3.6bn.

-

High-yielding alternatives are taking away attention from this sector, with its complex narrative around recent losses, and diversification only goes so far in selling its story.

-

Expansion is set to be a trend across Lloyd’s as syndicates look to capitalise on a hardening market.

-

Early reporters emphasised an ongoing demand for structural change.

-

Winter storms in the first half of 2022 are expected to result in claims totalling EUR1.4bn.

-

Reinsurers and brokers alike have warned of a rocky 1 January renewal process ahead as the industry grapples with multiple issues including inflation, climate change and geopolitical uncertainty.

-

The reinsurer is working to find the right inflation indicators for individual client portfolios.

-

The ratings agency predicts a combined ratio of 95.2% for the companies on its watch this year.

-

The broker said some reinsurers were planning for significant growth in property catastrophe as demand is expected to pick up pace.

-

A report warns that recent rate increases may not be enough to protect against headwinds.

-

A Moody’s survey of reinsurance cedants found most are expecting cat rate increases to remain in a high-single-to-low-double-digit bandwidth.

-

Demotech wrote to more than 15 carriers to warn of a possible downgrade last month.

-

The Florida senator described the agency’s market influence as “deeply troubling”.

-

The start-up’s top team predicted further rate hardening at 1 January.

-

Joe Petrelli said Demotech would continue to follow its independent methodology, despite outside pressure.

-

The forecast for real-term premium growth was depressed by anticipated claims inflation.

-

The state-backed carrier has seen massive growth in the distressed Florida market.

-

Rates have climbed 20%-35% since 1 January, and 40%-50% year on year, sources estimated.

-

Overall, the CIAB Q1 survey recorded rates were up 6.6% in Q1.

-

The Floridian carrier must improve its financial strength rating ahead of its 1 July reinsurance renewal.

-

Downgrades are expected to be announced next week for some Florida carriers that are “already winding down”.

-

There is a tension between securing payback and negotiating higher retentions.

-

Wind excess-of-loss treaties renew with gains between 2% and 5% in “underwhelming” renewal.

-

The carrier expanded premium by 8.3% at the January renewal.

-

There is a lack of capacity for aggregate deals, and moves towards more named peril coverage.

-

Inflationary pressure and climate change meant the market effectively gave ground to cedants despite nominal price rises.

-

The firm has been in run-off since late 2020, and another former Credit Suisse affiliate was recently sold to legacy writer Marco.

-

European loss experience drove the firm’s index back in line with 2014 levels.

-

Noting concerns about rapid growth, the Citizens board approves rate hikes up to the legal limit.

-

The projections are slightly worse than they were three months ago, as heightened cat losses and Covid-related pressures impact rates.

-

S&P suggested that an “abrupt rethinking” was a more likely outcome than gradual pricing increases – but a third way is possible if ratings agencies set a glidepath to change.

-

The Hannover Re subsidiary said the event would incur insured losses in Germany alone of “well in excess” of EUR8bn.

-

The state body supporting earthquake cover has seen risk transfer requirements swell over the past decade.

-

Strategic Review Committee chairman Bruce Simberg sets out the challenge ahead for FedNat as natural catastrophes continue to hit southern policyholders.

-

Moody’s expects RMS, which had about $320mn in revenue around $55mn in operating income last year, to become accretive to earnings by 2025.

-

Environmental, social and governance (ESG) factors were the primary driver in 13% of ratings actions in the year to the end of March, according to AM Best.

-

The new adjustments will increase rates 7.6% on average after February 1, 2022.

-

Rates are still more than 40% ahead of the pre-Hurricane Irma trough in late 2016.

-

Willis Re international chairman James Vickers said that the ILS market played a strong role in the Florida renewals, but it was becoming more difficult to judge the overall impact of the sector as more capacity stays behind rated balance sheets.

-

The broker said a buoyant ILS market contributed to the reinsurance market nearing a new equilibrium at the end of mid-year renewals.

-

The intermediary also warned that inflation headwinds could affect the future cost of claims.

-

There is little sign of retro demand returning after buyers cut back in January.

-

The first-time ILS sponsor expects to pay a coupon at the lower end of its initial forecast.

-

Pockets of the distressed Florida market are still expected to face a challenging renewal, but much of the remediation was carried out last year.

-

Spreads have fallen 14% on a weighted average basis on new deals marketed in the quarter to date.

-

Cat bond market exuberance seems to be mismatched against overall ILS sentiment.

-

The French carrier grew its top line by 14.3% at the April renewals.

-

The market has reached the stage of price hardening at which clients will challenge brokers and carriers on continuing increases, according to Aon president Eric Andersen.

-

Christopher Swift says more rate is needed in some areas including the London market and certain excess lines.

-

Assets under management at the sidecar rose 12.5% year-on-year to $900mn by the start of 2021

-

The carrier predicts Covid’s reinsurance impact will drive market hardening.

-

The carrier maintains its 2021 profit forecast amid 8.5% 1 January premium growth.

-

The intermediary cited Convex and Vantage among new entrants adding capacity to the market at the renewal.

-

Property insurance rates are rising by high single digits to 15% on clean accounts.

-

The carrier is legally obligated to sell cover at “actuarially sound rates”.

-

US contracts are still pricing at a 10%-15% premium to January 2020 levels, but excess retro capacity may impact the smaller market.

-

Quarterly report reveals that bond prices went “sideways” in Q4, but market remains hard.

-

Second- and third-event retentions rise from the year-ago arrangement.

-

Defence costs are expected to remain elevated, as weather losses have also weighed on results.

-

The carrier aims to regain its role as insurer of last resort after “unsustainable” customer growth.

-

The Singapore-based cat bond deal offers a 400 bps spread 16% below the carrier's initial target.

-

Occurrence retro rates are among the segments where rate pressure is abating, although the outlook remains somewhat opaque in a late renewal.

-

The Credit Suisse-managed firms will stop underwriting new business as of 1 January.

-

Cat events in 2017 and 2018 were a significant test of alternative capital.

-

Cedants and reinsurers perform a "slow dance" around pandemic losses, with claims negotiations deferred beyond renewal.

-

Scor sought higher-priced agg cover, but Munich Re achieved below-average uplift on its occurrence treaty.

-

The ratings agency cites the “significant support” provided by parent Axa as well as divisional restructuring moves.

-

The German carrier says P&C gross written premiums expanded 3% to $27.3bn in the period.

-

Q4 issuance will likely be robust owing to new investors and increased allocations, the CEO said.

-

The carrier says higher retro renewal costs will act as a counterweight to rising rates.

-

The reinsurers point to falling interest rates and loss experience as the basis for further hardening.

-

Lower capacity will have an effect, but the company hopes to avoid severe retro rate rises.

-

Some fund managers were negative on the deal, given the continuing uncertainty caused by the Covid-19 pandemic.

-

The company has requested state-wide changes to its multi-peril homeowners account.

-

The Peter Scales-led vehicle is reunited with the private equity house.

-

The CEOs of Aon Reinsurance Solutions, Willis Re and TigerRisk predict limited rate gains, but up to $10bn of incoming capital.

-

The debate over how far Covid losses will escalate is not the only key to January renewal dynamics.

-

ILS outperformed major financial benchmarks in terms of returns, Aon said.

-

Covid-19 losses and other catastrophe events have exhausted the catastrophe budgets of many companies, the ratings agency said.

-

Underwriting margins need to improve by as much as 7-12 percentage points to compensate for lower interest rates, the carrier states.

-

As new PE inflows arrive in the sector, it remains to be seen how this will be matched on the ILS side.

-

Coronavirus is just one factor driving rate increases, (re)insurers said.

-

The outgoing CUO emphasises large pro-rata book and interest rate impact.

-

The utility spent 13% more to secure its insurance but cut back third-party cover to $870mn.

-

The French reinsurer guides away from an equity raise as it predicts further rate hardening.

-

A hardening market could encourage diversification away from property catastrophe, the ratings agency says.

-

Cat programmes have been completed this year, but a heavy hurricane season could shake up the market, the broker said.

-

The start-up carrier had initially sought $150mn of North American storm and earthquake cover from its first-ever cat bond.

-

The rating could fall if the company fails to meet deadlines, the agency has warned.

-

Twelve Capital's Urs Ramseier says the potential for more distressed opportunities to appear will depend on the extent to which carriers pass on increased reinsurance costs to policyholders

-

The European earthquake bond will pay investors a 450 basis point spread.

-

Cat bond investors received better risk-adjusted rates on new issuances, but lower risk levels meant average spreads fell year on year.

-

The consultancy firm also argued that the World Bank should buy more pandemic cover after receiving a payout under its cat bond programme.

-

Rate increases should continue but may be increasingly fragmented by January 2021.

-

Reduced exposures take the vertical limit on carrier’s cat programme down to A$6.5bn from A$7.2bn.

-

An influx of underwriting capacity will likely limit the extent to which reinsurance rates rise, the agency said.

-

RoLs could rise moderately in July with stronger gains in January, market participants said.

-

The Florida Senator says tackling legal fees is a priority as demand for reform grows – but it will take time to implement.

-

An active hurricane season could further amplify RoL increases, the investment bank warns.

-

The insurer has raised its projected policy count by 20 percent.

-

Florida Citizens received more than 500 new Irma claims each month up until April, which has slowed 30 percent from 2019.

-

Lower deployable capacity and looming Covid risks added pressure, the firm said.

-

The early renewal approach has been met with opposition from Lloyd’s reinsurers.

-

The US wind deal by the Nephila fronting partner comes amid a flurry of activity in the cat bond market in recent weeks.

-

The move bucks the trend of cedants hiking spreads on their cat bonds to attract sufficient investor capacity this renewal.

-

To what extent does the business opportunity for new start-ups rely on BI losses that the industry is vigorously rebutting?

-

The capital raise boosted Fidelis’ share base by 45 percent of pre-transaction equity.

-

Avatar has increased the spreads on its new Casablanca Re bond just a week after hiking them by 16-18 percent.

-

Trading was brought forward this year and more cedants could head to bond market.

-

RPP covers, previously dominated by ILS writers, were one of the areas in shortest supply.

-

Property catastrophe reinsurance rates rose by 26 percent at the 1 June renewals, according to the London broker.

-

Multiple carriers had to revise official terms to get programmes home as reinsurers held firm on price demands.

-

The CIAB’s latest market survey also found carriers pushing for higher deductibles.

-

Small increases on international cat treaties such as the New Zealand EQC are being welcomed by reinsurers, with US nationwide deals also rising by up to 15%.

-

Earlier this month, the carrier said it wouldn’t renew its 2017 Torrey Pines Re cat bond.

-

After the immediate claims hit, reinsurers face the prospect of harder rates but shrinking premium volumes in some lines.

-

Reinsurers have held the line on pricing as cedants seek to close out deals, with the market showing further hardening.

-

Capitol Preferred cancelling over 23,000 policies could drive customers to state-backed insurer Citizens.

-

The combined ratio for select firms could rise 2.4 points to 103.5 percent this year, the agency predicts.

-

Reinsurance rates increased were manageable, a number of carriers said.

-

Even as Florida rates improve, the reinsurer said it expects to hold back capacity for net growth and potential new demand.

-

Reinsurers push back on aggregate exposure from cascading covers as market gets more differentiated.

-

The Floridian insurer said it has secured most of the reinsurance limit it requires ahead of the 2020 hurricane season.

-

The midpoint of the updated spread range promises a multiple of 5.8x the expected loss.

-

Trapped capital will become an issue in the coming months, CEO of Lancashire Capital Management Darren Redhead said.

-

The carrier’s CFO said Florida pricing “could return to more rational levels” after years of underpricing.

-

Uncertainty created by Covid-19 is driving demand, as insurers move to protect capital, Jean-Paul Conoscente said this week.

-

Ahead of the renewal, Scor’s CEO had been pushing for double-digit rate increases in Japan.

-

AM Best said Kelvin Re and Humboldt Re were targeting lower levels of underwriting risk in 2020.

-

The fund generated more than double the return on the Swiss Re Cat Bond Index in Q4 19.

-

The bonds could trigger this year if the pandemic drives mortality rates sufficiently high.

-

The ILS market has used every reversal as a base for its future growth and this should happen again after Covid-19, the firm argued.

-

Underwriters will likely keep pushing for higher rates, the rating agency said.

-

Pre-Covid-19 mortality risks generally provided low single-digit returns, but significant repricing is underway.

-

Allstate sets the spread for riskier second layer at 1,275 bps in the upper range of the initial guidance.

-

Pricing for quake exposures is understood to be broadly flat.

-

Pricing has moved to the top of the guidance range, sources said.

-

John Seo noted the diversification benefits ILS offers in tumultuous times as cat bond segment avoids spillover from market turmoil.

-

The carrier is pushing for “payback across portfolios”, Scor’s global P&C CEO Jean-Paul Conoscente said.

-

The carrier said it has already secured two-thirds of the private reinsurance limit it will place this year.

-

Pricing on the new cat bond moved to the top end of guidance.

-

The firm will consider writing more retro after raising $300mn new equity.

-

The Don Kramer-backed fund's Bermuda reinsurer Prospero Re has been given an A rating.

-

Kevin O’Donnell said that several domestic insurers in Florida are now close to exhausting their 2017 treaties.

-

Pricing slipped to the lower ends of the guidance ranges as the reinsurer upsized a hurricane tranche of the trade, sources said.

-

CEO Mike Sapnar said losses in the last two years have wiped out premiums.

-

Pricing dropped 6 percent from the midpoint of the initial range to reach 9.75 percent.

-

Aetna Life achieved its lowest coupon ever on the Class A tranche.

-

Some reductions in demand might follow as policies change hands, but this will not be a key influence on renewal dynamics.

-

Social inflation is not just a Florida issue – it's also top of mind in the casualty market.

-

Rates jumped in aerospace after recent costly losses.

-

Intermediaries called the renewal “asymmetric” and “divergent” as rates began to move up after a pressured few years.

-

Alternative capital made up $60mn of the capacity Tremor priced last year, the company announced.

-

The retro transaction priced below the target range, according to sources.

-

Recent disasters have tested the idea of catastrophe risk as a short-tail risk.

-

Both tranches of the transaction priced at the bottom of the guidance range.

-

Hyperion X estimated retro rates have risen to around 140 percent of their pre-Irma levels.

-

Over the past year, Willis Re's index shows riskier deals and a hardening market have lifted average cat bond yields.

-

The broker's chairman of international business James Vickers said reinsurers are only trimming capacity on the edges of the cat market.

-

The reinsurer was among the blue-chip cedants to benefit from an earlier renewal and occurrence structure.

-

Underlying rate increases are ranging from 10-25 percent for US regional insurance binders.

-

The main disrupted segments are still aggregate retro and sidecar vehicles, where negotiations over the level of trapped capital have held up the renewal process.

-

The (re)insurer pulled two layers of cover from the deal as it affirmed pricing targets on three others.

-

A lockup in retro capacity linked to the Japanese typhoons will further encourage reinsurers to raise rates, AIG’s Kean Driscoll said yesterday.

-

The Ursa Re 2019 issuance priced at the upper end of the California Earthquake Authority's expectations.

-

Pricing for the earthquake notes settled above the midpoints of the initial guidance.

-

The industry can put a much better and more accurate price on risk, according to Michael Butt.

-

The Kincade Fire in Sonoma County, the Simi Fire in Ventura County and the Getty Fire on the outskirts of Los Angeles are almost extinguished.

-

The significant pricing difference between the reinsurance and retrocession markets does not make a lot of sense, TigerRisk president Rob Bredahl said.

-

Rates fell back to their Q1 levels after experiencing an uplift in the second quarter of the year.

-

As more ILS managers look into setting up rated platforms, commentary from two of the latest firms considering this move highlights the variety of motivations that are driving the trend.

-

The lift in ILW pricing seen at mid-year has been unilateral across most products and was a further increase on the 2018 pricing correction following 2017 events, according to Aon.

-

Sidecar renewals have already begun kicking into gear with new potential sponsors and buoyant demand expected.

-

The major continental reinsurers are looking to continue strengthening their US positions in reaction to the 2019 price increases.

-

Participants predicted the rate pressure that has been centred on Japan and Florida would have a broader spill-over next year.

-

The CEO was speaking as Aon launched a new auction platform in Monte Carlo.

-

Rewind a few years and “hot money” was one of the pejorative labels thrown at a burgeoning ILS sector.

-

Trading Risk looks at the dominant themes that the ILS market will be discussing at the 63rd Monte Carlo Reinsurance Rendez-Vous in September.

-

The ratings agency also raised concerns about the long-term stability of the reinsurance market.

-

The start-up fronting and risk sharing carrier was given a preliminary A- rating in March.

-

Improvements to models and peril exclusions are expected to encourage growth once losses have been settled, the ratings agency said.

-

Non-renewals initiated by insurers surged by 10 percent in the areas of California worst affected by wildfires between 2015 and 2017.

-

The market is seeing substantial rate rises as more business flows in from the admitted market.

-

Since the 2017 and 2018 California wildfires reinsurers have become increasingly cautious of the risk, the rating agency said.

-

Axa XL cut back revenues on property cat reinsurance business by 7 percent in H1.

-

The carrier has meaningful available capacity to deploy, according to CFO François Morin.

-

Some four to six carriers are working on rated collateralised vehicles, following in the footsteps of Lumen Re and Humboldt Re, according to Aon managing director of ILS management Steve Britton.

-

The rate increases were less differentiated than the 1 June Florida rises.

-

The personal line carrier’s Camp Fire loss estimate is believed to have fallen from $1.8bn to $1.75bn.

-

The small first layer of its A$7bn reinsurance treaty was expected to face a significant rate increase but upper layers remained flat.

-

ILS funds have been among the top sources of new demand since 2017, the broker said at an Aon United ILS day in London last week.

-

The capped increase compares with an 8.5 percent rise envisaged before the measures to curb assignment of benefits abuse.

-

The insurer paid a rate on line of 11.25 percent for its new personal lines cover.

-

The California Earthquake Authority’s total risk transfer limit has almost doubled since 2015.

-

The ILS fund manager reports that the cost of reinsurance via cat bonds is now “painfully expensive” for some cedants.

-

The research found that commercial insurance prices rose by just over 2 percent in aggregate in Q1.

-

The size of the Integrity Re coverage may shrink to $50mn.

-

The company is now targeting $250mn for its latest cat bond, which is being issued in the UK.

-

The Floridian insurer has reduced the target size of the deal from $75mn to $70mn, as spreads on the transaction have risen 23-24 percent year on year.

-

The deal will take the organisation’s cat bond cover up to $1bn including past transactions.