Rates

-

Investor interest is warming up following a colder spell over the past several years.

-

While rates have “definitely come down,” they were coming off a high base, Rachel Turk said.

-

Terms are expected to hold, underpinning the stronger recent performance of reinsurers.

-

Dedicated reinsurance capital is on track to increase by 8% in 2025, the broker said.

-

Last year marked the second consecutive year in which carriers made a positive return.

-

The reinsurer’s chair said cat pricing reductions are at a “miniscule level”.

-

The model becomes the second in the state to get approval to affect ratemaking applications.

-

The investment consultancy said yields increased in Q2 by less than could have been expected.

-

The cost comes in at $530.6bn, roughly $20mn lower than budgeted.

-

Florida’s top regulator says he’s eyeing eventual tweaks to the state’s cat fund, too.

-

The rating allows IQUW to access $1bn in group capital.

-

Compressed cat bond spreads could drive some rebalancing, as M&A remains a prospect.

-

Twia filed for the rate hike in August after an actuarial analysis showed that rates were inadequate.

-

The rate change will be implemented in November.

-

The board of directors has voted for a 10% rate hike.

-

-

Twia’s analysis showed existing rates were inadequate.

-

The broker estimated ILS capacity reached a record $107bn as cat bond interest surged.

-

The proposal now goes to the Florida Office of Insurance Regulation for review.

-

The ratings agency noted robust profit margins for reinsurers.

-

Top layer competition is an added pressure on ILS firms, but the impact can be overstated.

-

The firm received a long-term ICR of a- and the outlook for both ratings is stable.

-

European rates on line increased by 7.60%, while in the US prices were up 5.25%.

-

The broker’s report also hailed the best risk-adjusted margins for ILS investors in a decade.

-

The broker’s 1st View report predicted that cat bond issuance should remain elevated until at least Q2 2024.

-

Reinsurers are making some adjustments to secure target signings but appetite to grow is finely balanced.

-

Projected 2024 ILS returns remain historically high, but signs of increased appetite for top-layer cat risk and top-end retro raise questions over how long this will last.

-

Anticipations of a tug-of-war around a ‘flat to slightly up’ pricing renewal have indeed come to fruition.

-

Profits are expected to widen thanks to improved rates and higher average attachment points.

-

TWIA has raised its net operating expenses to $40.2mn.

-

E+S Rück said that natural disasters and persistently high inflation have again "taken a toll" on the German insurance industry.

-

Fermat’s John Seo said the industry can “see the wall of money coming in, but it’s coming in slowly”.

-

Prabis does not envisage market softening at this stage, for reasons including wider macroeconomic impacts.

-

The downgrades reflect the negative impact of challenging macro-economic trends on underwriting results and risk-adjusted capitalization.

-

Board members voted five to four in favor of rate increases but fell short of the two-thirds majority required.

-

The ratings agency is currently in discussions with Clear Blue’s management regarding the company’s ability to replace certain programs or letters of credit.

-

The CEO said Chubb has ‘never seen better pricing’ on primary property.

-

Loss-free accounts were generally up 20%-50% at renewal, the reinsurance broker said.

-

The firm’s 1st View report on the July renewals also flagged that an oversupply of ILW capacity may bring down attachment points relative to early 2023.

-

The carrier is increasing underlying rates to counter increased reinsurance costs and inflation.

-

Considering recent reforms, Citizens’ rates, on average, are still 58.6% below actuarially sound levels, but the inadequacy would have been 88.3% without them.

-

Some cedants paid more than 40% increases depending on Florida concentration and Hurricane Ian losses.

-

Even clean accounts in the admitted space are seeing rate increases of 15% year on year, while loss-hit accounts in Florida were slapped with a 100% rate increase for June 1.

-

Early private deals have provided far more stability in this year’s renewal than last.

-

Softening cat bond rates are among the bearish signals for cat rates, but latent new demand and still-cautious supply should prolong reinsurer gains.

-

The pace of rate hikes will ease back from the 1 January reset as buyers seek to lock up capacity early after last year’s dislocated renewal.

-

Capital has begun to flow again after a challenging time for ILS fundraising in 2022 – but there is a clear shift underway.

-

The recommendations await approval from the Florida Office of Insurance Regulation.

-

Reinsurers are also increasing their attention on per-risk contracts protecting Japanese interests abroad.

-

A trend for slightly riskier bonds has brought with it a rise in the absolute margin on offer.

-

Hamilton Re said early signs point to 25%-30% rate rises on Japanese wind.

-

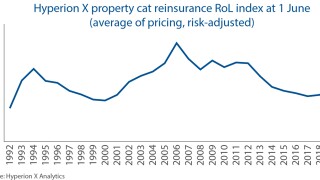

This was the highest single-year increase for the US index since 2006.

-

This price hike contributed to a premium increase of $695mn in the month, bringing the year-to-date impact of 2022 rate increases to $3.6bn.

-

High-yielding alternatives are taking away attention from this sector, with its complex narrative around recent losses, and diversification only goes so far in selling its story.

-

Expansion is set to be a trend across Lloyd’s as syndicates look to capitalise on a hardening market.

-

Early reporters emphasised an ongoing demand for structural change.

-

Winter storms in the first half of 2022 are expected to result in claims totalling EUR1.4bn.

-

Reinsurers and brokers alike have warned of a rocky 1 January renewal process ahead as the industry grapples with multiple issues including inflation, climate change and geopolitical uncertainty.

-

The reinsurer is working to find the right inflation indicators for individual client portfolios.

-

The ratings agency predicts a combined ratio of 95.2% for the companies on its watch this year.

-

The broker said some reinsurers were planning for significant growth in property catastrophe as demand is expected to pick up pace.

-

A report warns that recent rate increases may not be enough to protect against headwinds.

-

A Moody’s survey of reinsurance cedants found most are expecting cat rate increases to remain in a high-single-to-low-double-digit bandwidth.

-

Demotech wrote to more than 15 carriers to warn of a possible downgrade last month.

-

The Florida senator described the agency’s market influence as “deeply troubling”.

-

The start-up’s top team predicted further rate hardening at 1 January.

-

Joe Petrelli said Demotech would continue to follow its independent methodology, despite outside pressure.

-

The forecast for real-term premium growth was depressed by anticipated claims inflation.

-

The state-backed carrier has seen massive growth in the distressed Florida market.

-

Rates have climbed 20%-35% since 1 January, and 40%-50% year on year, sources estimated.

-

Overall, the CIAB Q1 survey recorded rates were up 6.6% in Q1.

-

The Floridian carrier must improve its financial strength rating ahead of its 1 July reinsurance renewal.

-

Downgrades are expected to be announced next week for some Florida carriers that are “already winding down”.

-

There is a tension between securing payback and negotiating higher retentions.

-

Wind excess-of-loss treaties renew with gains between 2% and 5% in “underwhelming” renewal.

-

The carrier expanded premium by 8.3% at the January renewal.

-

There is a lack of capacity for aggregate deals, and moves towards more named peril coverage.

-

Inflationary pressure and climate change meant the market effectively gave ground to cedants despite nominal price rises.

-

The firm has been in run-off since late 2020, and another former Credit Suisse affiliate was recently sold to legacy writer Marco.

-

European loss experience drove the firm’s index back in line with 2014 levels.

-

Noting concerns about rapid growth, the Citizens board approves rate hikes up to the legal limit.

-

The projections are slightly worse than they were three months ago, as heightened cat losses and Covid-related pressures impact rates.

-

S&P suggested that an “abrupt rethinking” was a more likely outcome than gradual pricing increases – but a third way is possible if ratings agencies set a glidepath to change.

-

The Hannover Re subsidiary said the event would incur insured losses in Germany alone of “well in excess” of EUR8bn.

-

The state body supporting earthquake cover has seen risk transfer requirements swell over the past decade.

-

Strategic Review Committee chairman Bruce Simberg sets out the challenge ahead for FedNat as natural catastrophes continue to hit southern policyholders.

-

Moody’s expects RMS, which had about $320mn in revenue around $55mn in operating income last year, to become accretive to earnings by 2025.

-

Environmental, social and governance (ESG) factors were the primary driver in 13% of ratings actions in the year to the end of March, according to AM Best.

-

The new adjustments will increase rates 7.6% on average after February 1, 2022.

-

Rates are still more than 40% ahead of the pre-Hurricane Irma trough in late 2016.

-

Willis Re international chairman James Vickers said that the ILS market played a strong role in the Florida renewals, but it was becoming more difficult to judge the overall impact of the sector as more capacity stays behind rated balance sheets.

-

The broker said a buoyant ILS market contributed to the reinsurance market nearing a new equilibrium at the end of mid-year renewals.

-

The intermediary also warned that inflation headwinds could affect the future cost of claims.

-

There is little sign of retro demand returning after buyers cut back in January.

-

The first-time ILS sponsor expects to pay a coupon at the lower end of its initial forecast.

-

Pockets of the distressed Florida market are still expected to face a challenging renewal, but much of the remediation was carried out last year.

-

Spreads have fallen 14% on a weighted average basis on new deals marketed in the quarter to date.

-

Cat bond market exuberance seems to be mismatched against overall ILS sentiment.

-

The French carrier grew its top line by 14.3% at the April renewals.

-

The market has reached the stage of price hardening at which clients will challenge brokers and carriers on continuing increases, according to Aon president Eric Andersen.

-

Christopher Swift says more rate is needed in some areas including the London market and certain excess lines.

-

Assets under management at the sidecar rose 12.5% year-on-year to $900mn by the start of 2021

-

The carrier predicts Covid’s reinsurance impact will drive market hardening.

-

The carrier maintains its 2021 profit forecast amid 8.5% 1 January premium growth.

-

The intermediary cited Convex and Vantage among new entrants adding capacity to the market at the renewal.

-

Property insurance rates are rising by high single digits to 15% on clean accounts.

-

The carrier is legally obligated to sell cover at “actuarially sound rates”.

-

US contracts are still pricing at a 10%-15% premium to January 2020 levels, but excess retro capacity may impact the smaller market.

-

Quarterly report reveals that bond prices went “sideways” in Q4, but market remains hard.

-

Second- and third-event retentions rise from the year-ago arrangement.

-

Defence costs are expected to remain elevated, as weather losses have also weighed on results.

-

The carrier aims to regain its role as insurer of last resort after “unsustainable” customer growth.

-

The Singapore-based cat bond deal offers a 400 bps spread 16% below the carrier's initial target.

-

Occurrence retro rates are among the segments where rate pressure is abating, although the outlook remains somewhat opaque in a late renewal.

-

The Credit Suisse-managed firms will stop underwriting new business as of 1 January.

-

Cat events in 2017 and 2018 were a significant test of alternative capital.

-

Cedants and reinsurers perform a "slow dance" around pandemic losses, with claims negotiations deferred beyond renewal.

-

Scor sought higher-priced agg cover, but Munich Re achieved below-average uplift on its occurrence treaty.

-

The ratings agency cites the “significant support” provided by parent Axa as well as divisional restructuring moves.

-

The German carrier says P&C gross written premiums expanded 3% to $27.3bn in the period.

-

Q4 issuance will likely be robust owing to new investors and increased allocations, the CEO said.

-

The carrier says higher retro renewal costs will act as a counterweight to rising rates.

-

The reinsurers point to falling interest rates and loss experience as the basis for further hardening.

-

Lower capacity will have an effect, but the company hopes to avoid severe retro rate rises.

-

Some fund managers were negative on the deal, given the continuing uncertainty caused by the Covid-19 pandemic.

-

The company has requested state-wide changes to its multi-peril homeowners account.

-

The Peter Scales-led vehicle is reunited with the private equity house.

-

The CEOs of Aon Reinsurance Solutions, Willis Re and TigerRisk predict limited rate gains, but up to $10bn of incoming capital.

-

The debate over how far Covid losses will escalate is not the only key to January renewal dynamics.

-

ILS outperformed major financial benchmarks in terms of returns, Aon said.

-

Covid-19 losses and other catastrophe events have exhausted the catastrophe budgets of many companies, the ratings agency said.

-

Underwriting margins need to improve by as much as 7-12 percentage points to compensate for lower interest rates, the carrier states.

-

As new PE inflows arrive in the sector, it remains to be seen how this will be matched on the ILS side.

-

Coronavirus is just one factor driving rate increases, (re)insurers said.

-

The outgoing CUO emphasises large pro-rata book and interest rate impact.

-

The utility spent 13% more to secure its insurance but cut back third-party cover to $870mn.

-

The French reinsurer guides away from an equity raise as it predicts further rate hardening.

-

A hardening market could encourage diversification away from property catastrophe, the ratings agency says.

-

Cat programmes have been completed this year, but a heavy hurricane season could shake up the market, the broker said.

-

The start-up carrier had initially sought $150mn of North American storm and earthquake cover from its first-ever cat bond.

-

The rating could fall if the company fails to meet deadlines, the agency has warned.

-

Twelve Capital's Urs Ramseier says the potential for more distressed opportunities to appear will depend on the extent to which carriers pass on increased reinsurance costs to policyholders

-

The European earthquake bond will pay investors a 450 basis point spread.

-

Cat bond investors received better risk-adjusted rates on new issuances, but lower risk levels meant average spreads fell year on year.

-

The consultancy firm also argued that the World Bank should buy more pandemic cover after receiving a payout under its cat bond programme.

-

Rate increases should continue but may be increasingly fragmented by January 2021.

-

Reduced exposures take the vertical limit on carrier’s cat programme down to A$6.5bn from A$7.2bn.

-

An influx of underwriting capacity will likely limit the extent to which reinsurance rates rise, the agency said.

-

RoLs could rise moderately in July with stronger gains in January, market participants said.

-

The Florida Senator says tackling legal fees is a priority as demand for reform grows – but it will take time to implement.

-

An active hurricane season could further amplify RoL increases, the investment bank warns.

-

The insurer has raised its projected policy count by 20 percent.

-

Florida Citizens received more than 500 new Irma claims each month up until April, which has slowed 30 percent from 2019.

-

Lower deployable capacity and looming Covid risks added pressure, the firm said.

-

The early renewal approach has been met with opposition from Lloyd’s reinsurers.

-

The US wind deal by the Nephila fronting partner comes amid a flurry of activity in the cat bond market in recent weeks.

-

The move bucks the trend of cedants hiking spreads on their cat bonds to attract sufficient investor capacity this renewal.

-

To what extent does the business opportunity for new start-ups rely on BI losses that the industry is vigorously rebutting?

-

The capital raise boosted Fidelis’ share base by 45 percent of pre-transaction equity.

-

Avatar has increased the spreads on its new Casablanca Re bond just a week after hiking them by 16-18 percent.

-

Trading was brought forward this year and more cedants could head to bond market.

-

RPP covers, previously dominated by ILS writers, were one of the areas in shortest supply.

-

Property catastrophe reinsurance rates rose by 26 percent at the 1 June renewals, according to the London broker.

-

Multiple carriers had to revise official terms to get programmes home as reinsurers held firm on price demands.

-

The CIAB’s latest market survey also found carriers pushing for higher deductibles.

-

Small increases on international cat treaties such as the New Zealand EQC are being welcomed by reinsurers, with US nationwide deals also rising by up to 15%.

-

Earlier this month, the carrier said it wouldn’t renew its 2017 Torrey Pines Re cat bond.

-

After the immediate claims hit, reinsurers face the prospect of harder rates but shrinking premium volumes in some lines.

-

Reinsurers have held the line on pricing as cedants seek to close out deals, with the market showing further hardening.

-

Capitol Preferred cancelling over 23,000 policies could drive customers to state-backed insurer Citizens.

-

The combined ratio for select firms could rise 2.4 points to 103.5 percent this year, the agency predicts.

-

Reinsurance rates increased were manageable, a number of carriers said.

-

Even as Florida rates improve, the reinsurer said it expects to hold back capacity for net growth and potential new demand.

-

Reinsurers push back on aggregate exposure from cascading covers as market gets more differentiated.

-

The Floridian insurer said it has secured most of the reinsurance limit it requires ahead of the 2020 hurricane season.

-

The midpoint of the updated spread range promises a multiple of 5.8x the expected loss.

-

Trapped capital will become an issue in the coming months, CEO of Lancashire Capital Management Darren Redhead said.

-

The carrier’s CFO said Florida pricing “could return to more rational levels” after years of underpricing.

-

Uncertainty created by Covid-19 is driving demand, as insurers move to protect capital, Jean-Paul Conoscente said this week.

-

Ahead of the renewal, Scor’s CEO had been pushing for double-digit rate increases in Japan.

-

AM Best said Kelvin Re and Humboldt Re were targeting lower levels of underwriting risk in 2020.

-

The fund generated more than double the return on the Swiss Re Cat Bond Index in Q4 19.

-

The bonds could trigger this year if the pandemic drives mortality rates sufficiently high.

-

The ILS market has used every reversal as a base for its future growth and this should happen again after Covid-19, the firm argued.

-

Underwriters will likely keep pushing for higher rates, the rating agency said.

-

Pre-Covid-19 mortality risks generally provided low single-digit returns, but significant repricing is underway.

-

Allstate sets the spread for riskier second layer at 1,275 bps in the upper range of the initial guidance.

-

Pricing for quake exposures is understood to be broadly flat.

-

Pricing has moved to the top of the guidance range, sources said.

-

John Seo noted the diversification benefits ILS offers in tumultuous times as cat bond segment avoids spillover from market turmoil.

-

The carrier is pushing for “payback across portfolios”, Scor’s global P&C CEO Jean-Paul Conoscente said.

-

The carrier said it has already secured two-thirds of the private reinsurance limit it will place this year.