Insurers

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

Newsom has yet to sign a pending bill to create a public cat model.

-

Winds have strengthened to 80 mph, and the hurricane is expected to intensify further over the next 48 hours.

-

The hire comes as Guy Carpenter fills the void created by the Willis Re raid earlier this year.

-

Deals would need to be sized at $50mn plus for transfer to capital markets.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

Vantage Group Holdings received a BBB- long-term issuer credit rating.

-

The tech firm is building a joint stock company with insurers and investors.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.

-

Syndicate 1440 was approved to assume business incepting January 2026.

-

The data modeling firm said losses previously averaged $132bn annually.

-

The violations included not using propertly appointed adjusters and failing to pay claims.

-

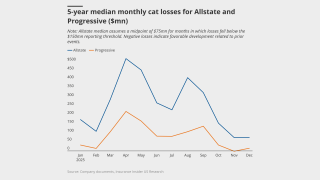

After the LA wildfires in Q1, carriers got some relief in Q2 ahead of wind season.

-

The ILS play will make the business more capital efficient under new owner Sixth Street.

-

The group claims the White House is undermining disaster preparedness.

-

Property MGA Arden Insurance Services specialises in multi-family habitations.

-

The company plans to launch in New York and New Jersey next year.

-

The estimate covers property and vehicle claims.

-

The carrier posted its H1 results earlier today, beating analyst consensus.

-

The company also purchased $15mn of SCS parametric coverage.

-

The reinsurance CoR fell 2.3 points to 79.5% while the primary CoR rose 4.7 points to 98.7%.

-

Scor's CEO said the P&C market had experienced a “competitive” first half.

-

Nationwide will delegate management of the policies to Ryan Specialty.

-

Mercury’s recovery from the guaranteed percentage of losses is $47mn.

-

Insured losses produced the second highest first-half tally since records began in 1980.

-

The figure updates an April estimate of EUR696mn.

-

At least 14 new companies have opened up shop in the state in recent years.

-

The losses were below May’s $777mn, but almost 3x higher than for June 2024.

-

The suit claims billions of dollars are being illegally withheld.

-

The US accounted for 92% of all global insured losses for the period.

-

State legislation has led to major strides in rate adequacy.

-

Category 4 and 5 storms could become more common and hit further north.

-

Despite predicting fewer hurricanes, the numbers are still above average.

-

The Australian carrier’s nat cat losses are A$200mn lower than its annual allowance.

-

The measure could have landed insurers with extra tax on US business.

-

The cost comes in at $530.6bn, roughly $20mn lower than budgeted.

-

Allstate attributed the bulk of its losses to three major wind and hail events.

-

In 2024, MGA GWP reached approximately $20bn in Europe.

-

The bond will provide protection for storms, quakes and fires in seven US states.

-

The $2.59bn renewal is up 45% from last year.

-

Up to nine million acres of US land are considered likely to burn.

-

Last week, TSR updated its forecast and is now predicting above-average storm activity.

-

The total cost excluding a 15% quota share was $201.85mn, with rates down 12.2% from last year.

-

The company also has $100mn for US hurricane events.

-

The Floridian also secured $352mn of multi-year coverage extending to 2027.

-

The deal leaves premier surety as Travelers' sole Canadian portfolio.

-

Florida’s top regulator says he’s eyeing eventual tweaks to the state’s cat fund, too.

-

The firm is pressing ahead with IPO plans just ahead of the start of the Atlantic storm season.

-

Almost 50,000 people have been forced to evacuate.

-

TSR previously predicted activity slightly below the 1995-2024 average.

-

The agency forecasts up to five major hurricanes and 19 named storms.

-

The cat bond limit total is an uplift of around 60% on the carrier’s 2024 bonds.

-

Fox highlighted the increasing role of alternative capital and creative financial vehicles.

-

The group reported an 89.7% combined ratio for the quarter.

-

As with 2024, pricing pressure has been most acute on top layers.

-

Tornadoes have killed at least 32 people in three states.

-

The targeted uplift comes after Mercury ceded nearly $1.3bn of wildfire losses to reinsurers in Q1.

-

The revision is significantly lower than the $4.5bn October estimate.

-

Tropical Cyclone Alfred and Queensland flooding brought thousands of claims.

-

With plenty of reinsurance capacity, CEO Patel said it’s been a “boring year” for treaty negotiations.

-

California homeowners are also expected to move admitted business to E&S.

-

The insurer has not decided whether to sell its Eaton subrogation rights.

-

AIG, HDI Global and others have settled, while Chubb’s fight continues.

-

Commutations need to be optimal for the sponsor and the investor to avoid sponsors taking back chunky risks.

-

The state insurer of last resort is set to purchase $2.89bn of reinsurance this year.

-

The initial offering will include 6,875,000 shares of common stock.

-

Renewal rates were favorable compared to what could have happened after several hurricanes.

-

The carrier increased its cession by around 13% year over year.

-

The carrier surpassed the retention on its annual aggregate reinsurance cover for the year to March 31.

-

The Floridian company applied to be traded on the NYSE.

-

Suzanne Wells is also joining the company from Arch as COO.

-

The announcement spurred a quick spike in stock market valuations.

-

Markets have taken a battering across the globe following the “Liberation Day” announcement.

-

Colorado State University is predicting 17 named storms, nine hurricanes and four major hurricanes.

-

Insurance share prices were more resilient than the US stock market.

-

The reinsurance broker said total reinsurance market capacity was up 5.3% year over year.

-

Since leaving Hiscox Krefta has founded a consultancy.

-

The carrier has received 12,300 claims as of 28 March.

-

The insurer has lined up Piper Sandler and KBW to run the process.

-

Cat losses last month were lighter than historical trends, but all eyes are on Q1 figures.

-

Commissioner Lara also proposed a $500mn cash infusion from parent State Farm.

-

Both carriers have extensive reinsurance coverage.

-

-

The Class A section of the bond has doubled in size, at lower pricing.

-

Several Florida start-ups are poised to begin writing business this year.

-

The Class B segment of the bond has priced below initial guidance.

-

The bond provides coverage for storms, earthquakes and severe weather events.

-

The carrier is “extremely well capitalised” to achieve its strategic ambitions.

-

The bond will provide coverage for named storms in North Carolina.

-

The carrier has recognised two separate losses for the Palisades and Eaton fires.

-

Compared with its initial figure, CatIQ’s latest estimate has increased by 40%.

-

-

The total includes fire and smoke damage plus living expenses for evacuees.

-

The carrier’s Milton loss came in below expectations, but its fire claims will be “material” in Q1.

-

Losses from the larger fire will amount to $20bn-$25bn, the modeller said.

-

The estimate has reduced slightly since the modeler’s last update in October.