Axis Capital

-

The average weighted spread on the deals was 651bps, skewed upward by cyber and wildfire deals.

-

Carriers are grappling with a rush of investor interest in longer-tail lines.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

The cedant’s current deal is due to mature at the end of January 2026.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.

-

Reinsurers are confident on cat rates and ready to deploy ILS capital.

-

The firm attributed a 9% drop in reinsurance NWP partly to higher cession rates.

-

The headcount at the start-up now stands at around 40.

-

Commutations need to be optimal for the sponsor and the investor to avoid sponsors taking back chunky risks.

-

The carrier increased its cession by around 13% year over year.

-

The executive has also worked for Guy Carpenter during her 20-year career.

-

Axis Capital’s fee income from strategic capital partners grew 39% to $85mn in the year to 31 December 2024, up from $61mn the year prior, the firm’s Q4 earnings release said.

-

Strong growth in fee income builds on the favourable rating environment.

-

The company’s reinsurance premiums ceded fell by 58% to $149mn.

-

The firm also posted a 56% increase in fee income.

-

The executive will replace Habib Kattan, who joined the company last summer.

-

Sub-1% management fee and performance fee-only structures have evolved in ILS.

-

The rise in ceded reinsurance premiums written impacted net premiums written.

-

The firm is focusing on developing specialty offerings.

-

The ILS platform ceded around 40% of its total managed premiums of $1.8bn.

-

The $75mn Long Walk Re deal secured broad market support from ILS investors.

-

Coburn will report to Jason Busti, Axis Re president of North America.

-

The $75mn cat bond will cover systemic cyber events on a per-occurrence basis.

-

The $75mn cat bond is expected to close in late November.

-

Axis set up a new casualty sidecar in the quarter.

-

Sources have raised concerns that cedant demand could outpace available capacity for cyber cat bonds.

-

The sidecar has been launched alongside partner Stone Point Credit Adviser.

-

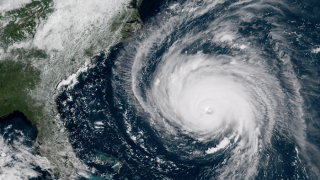

The industry’s ability to draw new capital will hinge on the outcome of the Atlantic hurricane season.

-

The firm’s PML on its Southeast wind business has increased after Northshore Re coverage was not renewed at 1 July.

-

The firm earned higher fees off the back of growth in insurance premiums ceded to reinsurers, as premiums ceded to third-party capital partners declined.

-

Most forecasters predict below-average activity in the region – but opposing weather phenomena mean uncertainty is higher than usual.

-

Remaining ILS staff will now report into the group’s CFO.

-

The withdrawal from the aviation reinsurance class announced yesterday represented ~$10mn of non-renewed premium.

-

-

Inmaculada Gonzalez was previously US head of ceded reinsurance placements.

-

The carrier estimated losing less than $10mn of desired renewals due to exits from property and property cat reinsurance.

-

The (re)insurer has been reorienting itself away from writing property cat.

-

The outgoing CEO will step down in May and spend six months as a strategic adviser to the company.

-

Benchimol said there was a risk of losing business, but more important was the transition to a specialty carrier with low volatility.

-

The insurance group reduced premiums ceded to strategic partners but upped them to reinsurers.

-

The firm’s insurance business recorded $100mn of Ian-related losses while the reinsurance unit booked $60mn.

-

The two ILS firms were among those participating in a $20mn fundraise for Elpha Secure Technology.

-

Hurricane Ian could present a challenge for ILS fundraising conversations this autumn if ILS firms do not find more financing solutions to manage trapped capital, according to panellists at Trading Risk New York 2022 last week.

-

How much capacity is available to meet rising cat reinsurance demands was a key theme throughout this year’s Rendez-Vous.

-

Berkley also increased its position in Global Indemnity and now owns around 8.5% of the firm.

-

The company aims to run off its cat and property business by 2024.

-

Fee income dropped 24% year on year, as premiums ceded to other strategic partners fell by 7%.

-

The property reinsurance underwriter had joined Axis Re’s London team three years ago.

-

Market orthodoxy suggests cross-class reinsurers secure more leverage – but are there too many implicit offsets in this game?

-

The ILS manager’s half-year report showed significantly lower holdings with Everest Re, as much of its portfolio has gone private.

-

The segment’s lustre has been dulled by losses and capital trapping.

-

-

The pricing on the storm and quake cover has shifted down from initial guidance, bucking early Q2 trends.

-

The issuance comes as Axis is set to exit the property reinsurance market.

-

Sources said the company is to part ways with around 60 staff as it completes the pivot to specialty (re)insurance.

-

Many hybrids, unless they are willing to take a meaningful financial hit to secure a divestiture, will have to stick with their reinsurance businesses through the current cycle.

-

The carrier has shared insurance and reinsurance risk with ILS partners in the past, but the ILS team reports to Axis Re CEO Steve Arora.

-

The carrier also revealed $30mn in Russia-Ukraine Q1 losses.

-

The result comes as the firm prepares to sell its reinsurance unit as it has slashed catastrophe reinsurance premium.

-

Jefferies has been awarded the mandate to seek a buyer for the segment.

-

A New Jersey judge writes a scathing decision criticizing hospitality firms for attempting to claim physical damage from virus and misinterpreting policy language.

-

CEO Albert Benchimol pledged to grow the company’s specialty business as the catastrophe portion of its 1.1 book shrank by 10 percentage points.

-

Axis did not share any insurance premium with capital partners in Q4, while reinsurance cessions continued.

-

The company lowered its full-year core loss ratio 2.6 points to 55.1% and posted a $266mn full-year underwriting gain.

-

Axis Capital has signed up Patrick Witteveen, European head of investor relations at Securis, for a new role in its ILS division, Trading Risk has learned.

-

The executive said there was a strong case for meaningful rate increases in reinsurance.

-

The company generated a $10mn underwriting gain in insurance, reversing last year’s $80mn loss, though the reinsurance division’s loss widened to $69mn.

-

Axis estimates Hurricane Ida will be a $35bn industry loss event while the European floods – from which Axis expects a $55mn bill – are projected to cost the industry $13bn.

-

CEO Albert Benchimol said it would continue to ‘manage down’ catastrophe volatility.

-

He will join on 22 July, after Ben Rubin left the firm earlier this year.

-

The former Swiss Re ILS specialist has joined the carrier after its debut sidecar launch.

-

Ann Haugh will lead the new global property division, with Andy Hottinger heading up international and Jonathan Gray specialties.

-

The insurer returned to underwriting profit after last year’s Covid hit, but the reinsurance segment faced higher non-Covid cat losses.

-

The carrier says it expects winter storms Uri and Viola to account for between $80mn and $90mn of claims absorbed during the period.

-

Climate change risk is not yet being properly reflected in pricing, the company chief warned.

-

The carrier’s combined ratio increased to 109.6% last quarter, up over 2 points year on year.

-

The deal took Alturas transactions to $115mn for the year to date as syndicated sidecars are expected to continue shrinking.

-

David Bangs joins from Willis Re Singapore where he worked for more than 15 years.

-

The carrier has returned to the bond market after a 2017 Northshore Re deal lapsed in June.

-

The carrier also reported lower managed premiums, which weighed on its results.

-

The president and CEO urges wordings precision to avoid cyber-related litigation.

-

The carrier has reduced its frequency risk while lifting exposure to tail events.

-

Bobby Kwan will help manage the reinsurer’s property portfolio in the region.

-

The insurer said it was two thirds of the way to attaching a UK reinsurance treaty.

-

This comes after Stone Ridge, one of the firm's third-party providers, reduced its sidecar holdings.

-

Carrier books $10mn loss on WHO pandemic bond

-

Countless other insurance executives have made similar remarks as they face the prospect of legislators pushing through such bills.

-

After 13 years at Axis, Kiernan has completed gardening leave and taken up a new role.

-

Michael Butt said the company is in “good hands”.

-

The (re)insurer has cut its peak risk exposures by more than a third in some cases.

-

Fee income from capital partners nearly doubled to $80.2mn in 2019, up from $48.5mn in 2018.

-

The (re)insurer faced increased losses from Hurricane Irma alongside Typhoon Hagibis and wildfire claims.

-

Sidecar capacity is likely to be down by at least 20 percent year on year after a renewal in which ILS investors have pulled back significant capacity, sources estimated.

-

The deal may replace a $55mn sidecar listed this time last year, which sources said provided reinsurance for a short-tail property insurance book.

-

The government secured a slight expansion in the level of cover obtained across the middle layer of the programme.

-

The firm made less fee income from reinsurance partnerships, but lifted insurance-related fees.

-

The provider said the losses were driven by the impact of Hurricane Dorian and Japanese typhoons.

-

Martin McCarty’s new responsibilities will include servicing Axis’ strategic capital partners.

-

The reinsurer’s Bermuda president is exiting after 13 years with the carrier.

-

The firm’s third-party capital total includes $600mn from the Harrington Re joint venture.

-

The executive joins after 22 years at Swiss Re.

-

Industry leaders have lifted the expected total loss to a new high.

-

Developments this year indicate third-party capital will be a disciplined participant requiring adequate risk-adjusted returns, Axis president and CEO Albert Benchimol said.

-

Fee income rises by over two thirds to surpass $19mn for the quarter.

-

Former Swiss Re and Rewire executive Vincent Myers is hired following the departure of ILS vice president Livingston.

-

The 2019-3 notes bring the total Alturas sidecar support for the year up to $230mn.

-

The reinsurer is looking to pay more rate to secure retro cover in a tightening market.

-

Buckingham Research analyst Amit Kumar noted that insured loss estimates had been revised up since the early weeks following the August and September events.