-

So far this year, there have been 11 first-time sponsors to place a deal.

-

Spreads on USAA’s latest deal priced below comparative issuances in 2023-2024.

-

Key topics include private ILS growth prospects and the longevity of longtail interest.

-

Sources have said $1bn+ of fresh capital from the region is expected to be deployed in 2026.

-

The new Verisk SCS model is increasing expected losses on aggregate bonds.

-

Despite the formation of Gabrielle, there is "a very high probability" of a below-average season.

-

Deals would need to be sized at $50mn plus for transfer to capital markets.

-

ILS executives talked pricing, capacity and opportunities in casualty at an ILS roundtable in Monte Carlo.

-

Terms are expected to hold, underpinning the stronger recent performance of reinsurers.

-

The Japanese carrier faces integration challenges to make a success of the deal.

-

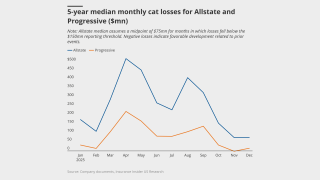

After the LA wildfires in Q1, carriers got some relief in Q2 ahead of wind season.

-

Reinsurers are confident on cat rates and ready to deploy ILS capital.

-

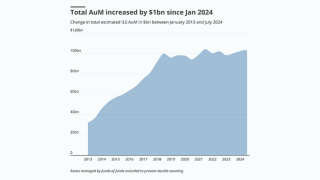

The merged business of Twelve Securis ranked third among ILS managers for AuM, behind Fermat and RenRe.

-

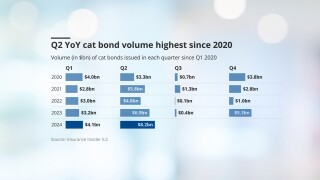

Some $400mn of bonds priced in the past week, after a record-setting H1.

-

The recommended “AIF lite” structure could be suited to cat bond lites.

-

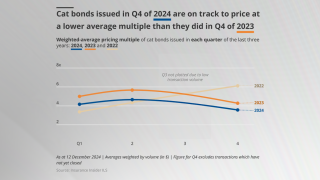

Weighted average multiples were down as sponsors capitalised on demand to push spreads lower.

-

Everest Re increased the targeted size of Kilimanjaro Re across all four classes of notes.

-

The California Earthquake Authority upsized its Ursa Re deal by 60% to $400mn.

-

Buyers have turned to retro markets for covers where ILW pricing is less attractive.

-

Investors eyeing private ILS include opportunistic allocators keeping watch on storm season.

-

Everest Re has structured its deal into two sections targeting aggregate and per occurrence cover.

-

A total $225mn of fresh limit entered the market across two deals.

-

ILS offers efficient capital for underwriters, but casualty ILS transactions are complex.

-

The deals covered Euro wind and Italy quake, Florida hurricane and a retro bond.

-

As with 2024, pricing pressure has been most acute on top layers.

-

One dollar-denominated deal has opted to hold collateral in EBRC notes.

-

Berkshire Hathaway lost market share but remained the largest traditional reinsurer, our study shows.

-

Some $200mn of fresh limit entered the ILS market as $3.4bn of deals priced.

-

Sources believe the market will grow gradually over years after its initial cluster of dealmaking.

-

Florida Citizens upsized its latest Everglades Re deal by 50%.

-

Cat bond sponsors continue to secure higher limits and lower rates versus their targets.

-

Portfolio rebalancing was not triggered last week, but investors are now distracted and nervous.

-

US Coastal Property and Utica Mutual Insurance have brought out their first cat bond deals.

-

Market participants expect pricing will be flat to down through Q2.

-

Insurance share prices were more resilient than the US stock market.

-

Scor is targeting limit of $200mn with its latest Atlas DAC retro cat bond.

-

Many UK pension funds are over-funded and lack appetite for higher-risk, higher-yield products.

-

Cat losses last month were lighter than historical trends, but all eyes are on Q1 figures.

-

Caution about capital markets volatility is leading sponsors to stagger bond renewals.

-

The ILS segment is not ready to gloss over loss-heavy years in renewal discussions.

-

Sources warned some property XoL books are already running 50% loss ratios.

-

Flood Re’s bond Vision 2039 bucked the trend by pricing up 7% as its secured £140mn ($174mn) of limit.

-

Some $625mn of new issuance entered the market in the first week of March.

-

Deal sizes increased by 84% on average across the six tranches that saw an increase.

-

Climate change and other loss impacts were not adequately incorporated, sources said.

-

Pricing fell by 13.5% on a weighted average basis across deals that updated last week.

-

A higher loss quantum will put a greater burden on retro programmes.

-

New limit of $474mn entered the market across two deals.

-

American Integrity is seeking expanded limit on more favourable terms.

-

FY24 disclosures show shifting fortunes at reinsurer ILS platforms.

-

Peril- and geography-specific deals are being well received by investors.

-

A negative January return will be unprecedented for ILS industry.

-

Fermat stayed in the top spot surpassing $10.0bn for the first time.

-

Secondary market pricing indicated anticipated California wildfire losses.

-

As fires still rage, many fear early $10bn-$20bn estimates were too optimistic.

-

Aetna, Inigo and GeoVera were the three sponsors seeking lower multiples.

-

Compressed cat bond spreads could drive some rebalancing, as M&A remains a prospect.

-

The forecasts anticipate a large volume of maturities and rising sponsor demand.

-

First-time sponsor QBE secured $250mn of quake and storm coverage.

-

Some $1.2bn of limit was placed in the cat bond market this week.

-

Casualty ILS made inroads, while hurricane hedging strategies came into focus.

-

Mapfre Re CEO Miguel Rosa was “very satisfied” with the debut cat bond deal.

-

Overall, reinsurers accepted that rate cuts were still leaving them with strong margins.

-

Full year 2023 set the record to beat of $15.8bn in new issuance volume.

-

The top quartile, which includes Nephila 2357, were set to shrink overall.

-

Beazley returned with its second Fuchsia cat bond issuance.

-

Former ILS investors who left the space have looked again and re-allocated.

-

Fidelis is seeking more cat bond cover than it did almost a year ago.

-

Lloyd’s has taken around 6% of aggregate US hurricane losses in recent years, and disclosed estimated net losses from Helene and Milton of $1.8bn to $3.4bn.

-

The 2024 hurricane season stayed within predictions for high activity but lacked market-moving events.

-

The latest clutch of offerings indicates pricing discipline in the bond market.

-

Moderate impacts to ILS returns are anticipated from Hurricane Milton.

-

Spreads at levels favourable to sponsors could power Q1 2025 pipeline.

-

Helene losses were spread wider than initially suggested, in contrast to Milton claims.

-

Strong growth in fee income builds on the favourable rating environment.

-

Cheaper traditional reinsurance as of mid-year may have dampened deal pipeline.

-

The failure of a Jamaica bond to pay out following Hurricane Beryl damage has brought focus onto the deals.

-

Some $409mn of volume entered the market in the week to 4 November.

-

The low PCS number is presenting a challenge for ILW buyers and sellers.

-

Reserve risk specialist Enstar has struck its first deals in the ILS space this year.

-

Assuming Munich Re takes roughly a 3% market share of hurricane losses suggests a ~$20bn industry loss for Helene.

-

Managers expect Hurricane Milton losses to shore up pricing.

-

Many in the ILS sector are bullish on Milton losses falling at the lower end of earnings impacts.

-

Hurricane Milton will show the ILS product behaving as investors expect it to.

-

Milton made landfall south of Tampa Bay at Category 3 on Wednesday night.

-

Collateralised reinsurance and retro are in the firing line.

-

Most sources noted expectations of a $50bn+ event, but the range of outcomes is huge.

-

The class of 2023-24 cat bond funds will grow existing investors and add new ones.

-

Praedicat CEO Bob Reville outlined the firm’s approach to "casualty cat" as liability risk modeling continues to mature.

-

The storm made landfall as a major hurricane in Florida’s Big Bend region.

-

Tallahassee avoided a major hit – but flood and storm-surge losses remain unknown.

-

Brokers expect strong competition at remote risk layers at the 1 January renewal.

-

Cat bond funds continue to draw interest as private ILS more challenged.

-

The Bermuda regulator is consulting on a refresh of its rules that will be in force as of 1 January 2025.

-

Building better exposure datasets could draw a broader range of investors.

-

The James River-Long Tail Re deal is the latest example of deal-specific investor capital.

-

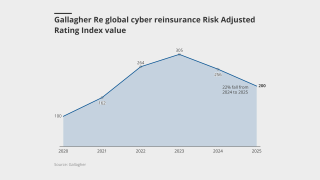

The peril can no longer be considered secondary, according to Gallagher Re.

-

Sidecar vehicles are being tailored to match investors’ objectives.

-

Several bonds suffered declines in value from February to July.

-

The ILS manager leaderboard demonstrates the ongoing popularity of cat bonds.

-

The event could unpack issues around accumulation risk and cloud services.

-

The deal economics take into account the investment return that Longtail Re can leverage.

-

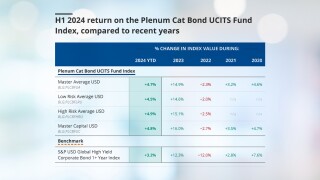

This is lower compared to 8.2% recorded by the index in H1 2023.

-

The latest Kilimanjaro Re, 3264 Re and Gateway Re deals all priced.

-

Cat bond spreads stabilised as maturities brought capital to deploy into the market, after an earlier spike.

-

Cat bond deals placed last week amounted to $150mn of issuance.

-

ILS capital so far is viewed by sponsors as strategic rather than essential.

-

A degree of pricing volatility was evident in the market this week.

-

The firm is the sole provider to offer index services in the US.

-

The shift in market dynamics reflects $1.8bn of maturities last week.

-

Sub-1% management fee and performance fee-only structures have evolved in ILS.

-

Market sources are speculating on the reasons behind the spread widening on index-based deals.

-

The regulation now allows pension funds a more flexible benchmark for measuring alternatives.

-

Forecasters have warned that a number of meteorological factors could make this year the most active on record.

-

Torrey Pines, Atlas Capital and Marlon priced and sized up.

-

Florida Citizens' Everglades Re bond priced up by 6% across three tranches.

-

Traditional reinsurers such as Berkshire Hathaway and Arch pushed for more share, our annual study of Florida cessions shows.

-

Longleaf Pine Re priced, while spreads on Everglades Re deal moved higher.

-

Spreads could continue widening throughout the rest of the year.

-

Cession ratios declined at three of the four publicly listed Floridians.

-

Rates are still materially higher than pre-pandemic and lower layers are holding firmer.

-

The Mexican government’s IBRD quake bond priced 4% ahead of guidance.

-

The flat growth is a result of multiple forces influencing capital flows in both directions.

-

Increased ILW purchasing reflects cash-rich funds looking to protect return levels.

-

Managers have tightened buffer terms and added extension spreads to enhance illiquid strategies.

-

Retained earnings resulting from reduced loss activity also helped to boost ILS capital.

-

Reinsurers have a "strong desire" for growth, but not at the expense of underwriting.

-

The broker said 1 April Japanese renewals reinforced positive trends in the US at 1 January.

-

Drop-in capital has now largely left the cat bond market.

-

Some $415mn of capacity entered the market last year.

-

Exposure updates played a greater role than expected.

-

The outlook for M&A activity is brighter after 2023 returns.

-

The carrier is designing an investable portfolio of long-tail risk.

-

Sponsors still secured terms that were favourable relative to traditional cover.

-

Aside from the one-year view, 2023 remixes the track record.

-

The conflict between US and Bermuda legal systems offers no easy route for counterparties to fraud-impacted transactions.

-

Of the 18 top-tier ILS managers, 10 recorded growth, while eight were flat or down.

-

Typical ILW attachment points for US peak perils have fallen from $60bn to $40bn-$50bn as the market awaits the final Hurricane Ian number from PCS.

-

The sidecars segment has been attracting inflows after returns hit a high note in 2023.

-

Broker-dealers' year-ahead forecasts have undershot total final issuance in three of the last five years.

-

Reinsurers are making some adjustments to secure target signings but appetite to grow is finely balanced.

-

Projected 2024 ILS returns remain historically high, but signs of increased appetite for top-layer cat risk and top-end retro raise questions over how long this will last.

-

New and returning sponsors, diversifying European wind risks and early placement of US hurricane coverage all helped new issuance to smash market expectations.

-

Anticipations of a tug-of-war around a ‘flat to slightly up’ pricing renewal have indeed come to fruition.

-

The year brought a degree of closure on the loss-hit years of 2017-2021, while the outlook remains changeable for ILS managers.

-

ILS managers are still waiting for hard market growth.

-

Analysis by Lane Financial concluded that ILS returns will likely be double-digit-to-high-teens in 2024.

-

With more ILS managers chasing the popular bond space, how will new operators differentiate themselves?

-

A strong outlook for sidecar profits in 2023 is rebuilding investor confidence but one to three years of good performance will be needed to sustain it more fully.

-

Experts at the Trading Risk New York conference emphasised in-built cyber risk protections from defences to exclusions, as ILS managers grapple with understanding the peril.

-

Cat bond investors are sufficiently capitalised to fulfil demand from an anticipated strong pipeline of new issuance in Q4.

-

ILS capacity in the form of retained earnings and new inflows is shaping up to meet growing demand for reinsurance and retro coverage.

-

The broker studied the impact of 14 major cyber events in its attempt to dispel ILS manager fears of a ‘double whammy’ cyber event that would also impact financial markets.

-

The supply-demand dynamics are all pointing in ILS markets’ favour, so long as hurricane season goes quietly.

-

The ratings agency has said ILS firms could encounter “pent-up demand” from cedants during the January 2024 renewal.

-

Hurricane Idalia is still live, but the storm’s track reassured market participants that it will be a relatively minor loss.