-

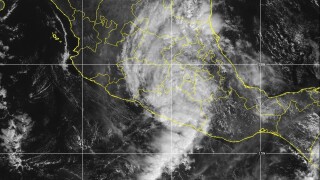

The ratings agency also said economic and insured losses caused by Otis have reached $16bn.

-

More than three-quarters of local exposure is ceded to highly rated reinsurers through excess of loss protection, according to the rating agency.

-

The firm entered new aggregate excess of loss reinsurance contracts in 2023 that have multiple layers of coverage.

-

Asagao VI is fourth largest private cat bond deal this year.

-

The Floridian insurer’s loss from the hurricane was within its reinsurance retentions.

-

The company’s on-risk Kilimanjaro Re cat bond volumes have been gradually shrinking in the past year.

-

The 2020 bond provides $125mn of parametric, per occurrence coverage.

-

Investors will have to wait for official Verisk data before knowing if the bond will trigger.

-

The CCRIF has paid out $265mn since its inception in 2007.

-

A strong outlook for sidecar profits in 2023 is rebuilding investor confidence but one to three years of good performance will be needed to sustain it more fully.

-

Top-layer cat risk is attracting additional capacity but reinsurers remain firm on attachment points, the broker said.

-

By region, convective storms in the US alone accounted for 60% of global insured losses.