-

Projected 2024 ILS returns remain historically high, but signs of increased appetite for top-layer cat risk and top-end retro raise questions over how long this will last.

-

The bond, which increased in size by 25% to $125mn, priced at the lower end of the previously guided range.

-

The insurer confirmed it would be targeting 77% of the original principal amount.

-

The carrier has also lifted the effective coupon to 29.9%.

-

New and returning sponsors, diversifying European wind risks and early placement of US hurricane coverage all helped new issuance to smash market expectations.

-

CFO Christoph Jurecka said losses for 2023 were in line with its expectations, but he added that the events producing the losses differed from those of years previous.

-

Global cat-bond capacity has grown by about 4% annually over the last six years, according to a report by the Swiss Re Institute.

-

The Florida Building Code was introduced following the impacts of Hurricane Andrew.

-

The firm said it would cut its K-cession ‘significantly below 2023 levels’ and buy ‘broadly similar towers of non-proportional retro’ at 1 January.

-

Anticipations of a tug-of-war around a ‘flat to slightly up’ pricing renewal have indeed come to fruition.

-

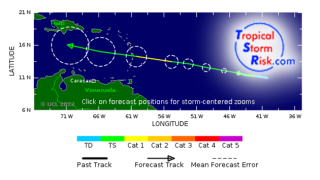

Next year will see North Atlantic hurricane activity about 30% above the 1991-2020 30-year norm, according to Tropical Storm Risk.

-

The sponsor had initially sought $150mn of coverage last month.