-

The firm’s external AuM has grown by 175% from 2019 to $3.3bn in 2025.

-

Secondary market pricing implies the sponsor could recoup a total of $50mn on the 2022-1 A note.

-

An “extraordinary” proportion of storms reached Category 5 status this year.

-

The peril has been historically difficult to model compared to others.

-

Insurers with SCS exposure reaped fewer benefits but still improved over Q3 2024.

-

The shuttering of Munich Re Ventures reflected a focus on the reinsurer’s “core offering”.

-

The (re)insurer has a higher-than-average Jamaican market share.

-

The largest net individual loss was January’s California wildfires at EUR615mn.

-

Widespread underinsurance and low exposures will limit losses.

-

Since 2007, the Caribbean country has received $100.9mn in payments from the CCRIF.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

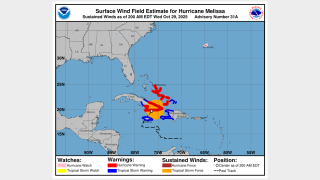

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

Economic losses from the Cat 5 storm could run 30%-250% of the country’s GDP.

-

Central pressure of 900mb or below would trigger a full loss of the $150mn deal.

-

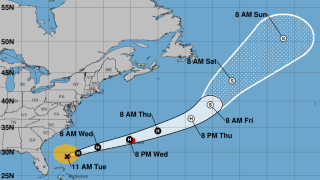

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

Pricing on Friday implied a potential $45mn loss to the bond, before the storm outlook deteriorated.

-

The storm could bring flooding to Jamaica, Cuba and Haiti.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

The reinsurer stressed it “did not shy” from cat business in 2023.

-

Jonathan Rinderknecht was arrested Tuesday on destruction of property charges.

-

Winds have strengthened to 80 mph, and the hurricane is expected to intensify further over the next 48 hours.

-

The tropical cyclone is expected to be named Imelda.

-

Equivalent to a Category 5 hurricane, Ragasa is the world's strongest storm this year.

-

Despite the formation of Gabrielle, there is "a very high probability" of a below-average season.

-

The major storm is set to move on to mainland China later in the week.

-

The economic loss from the event was around EUR7.6bn.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

Losses were primarily driven by personal property lines.

-

The sponsor extended two notes issued in 2022.

-

The volume of property cat aggregates placed grew 50% in 2025.

-

The data modeling firm said losses previously averaged $132bn annually.

-

The ratings agency warned negative PYD on US casualty will likely continue.

-

After the LA wildfires in Q1, carriers got some relief in Q2 ahead of wind season.

-

The firm has also updated the loss-calculation engines of existing Jeannie tools.

-

The group claims the White House is undermining disaster preparedness.

-

The US has been lucky over recent decades to avoid a $100bn insured hurricane event.

-

The estimate covers property and vehicle claims.

-

The firm booked net losses from the LA wildfires of EUR615.1mn in the first half.

-

ILS investors have fought shy of multi-peril aggs due to low confidence in SCS modelling.

-

Both organisations still predict an above-average hurricane season.

-

The sidecar took $19mn of cat losses relating to the California wildfires.

-

The forecast has increased since the early July update due to several additional factors.

-

California wildfires account for $40bn of the insured loss tally in H1.

-

The model becomes the second in the state to get approval to affect ratemaking applications.

-

The firm attributed a 9% drop in reinsurance NWP partly to higher cession rates.

-

Millions are evacuating after one of the strongest earthquakes in modern history.

-

Mercury’s recovery from the guaranteed percentage of losses is $47mn.

-

Insured losses produced the second highest first-half tally since records began in 1980.