-

ILS has been a driver of innovation in reinsurance, Convergence 2025 attendees heard Wednesday.

-

The Bermuda reinsurer has been active in ILS since launching in 2007.

-

The sidecar will support five programs providing specialty frequency coverages.

-

ILS executives talked pricing, capacity and opportunities in casualty at an ILS roundtable in Monte Carlo.

-

The tech firm is building a joint stock company with insurers and investors.

-

Fleming’s attempt follows those of other legacy carriers that have had recent successes raising capital.

-

It is understood that CyberCube has been considering a sale of the business.

-

The global specialty player is also exploring ILS offerings across specialty and cat bonds.

-

The ILS play will make the business more capital efficient under new owner Sixth Street.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

The Bermuda SPI will write a quota share of SageSure’s captive Anchor Re.

-

The fund’s ILS portfolio is split between 70% property cat and 30% cyber risk.

-

The Cayman Islands-domiciled SPI now has four institutional backers.

-

Michael Hamer recognised for his work with investors and on reporting frameworks.

-

M&A and shifts in distribution arrangements bring risks and opportunities.

-

Slide is putting faith in tort reforms and will lean into Florida, CEO Lucas said.

-

ILS offers efficient capital for underwriters, but casualty ILS transactions are complex.

-

The $2.59bn renewal is up 45% from last year.

-

The cat bond limit total is an uplift of around 60% on the carrier’s 2024 bonds.

-

Fox highlighted the increasing role of alternative capital and creative financial vehicles.

-

Proceeds will expand the company’s reinsurance protection in Florida and South Carolina.

-

The buzz in the air at ILS Connect told of a market entering its next growth phase.

-

The initial offering will include 6,875,000 shares of common stock.

-

The carrier is offering shares priced at $29-$31.

-

The casualty ILS business now has $175mn in capital.

-

An allocation to insurance could “feel like a nice, calm port in the storm” amid wider market volatility.

-

Portfolio rebalancing was not triggered last week, but investors are now distracted and nervous.

-

The Swiss pension fund’s ILS allocation stood at 4.9% of the total fund as of 25 March.

-

Fees on the GAM Star cat bond funds will drop in May in a recognition of fee competition in the market.

-

The vehicle will take a quota share of all of the risks underwritten by Ryan Specialty’s MGA arm.

-

The bond upsized by around 20% as pricing settled 2% below initial guidance at 7%.

-

Indirect exposure to cat risk through long-term investors gives Markel optionality.

-

DaVinci equity plus debt stood at $3.25bn as of 31 December.

-

The investors are led by PE firm NMS Capital Group.

-

Two ILS funds featured in the top five asset-raisers within the index.

-

The departures include North American Arcas head Alex Orloff.

-

The start-up has achieved an A- credit rating from AM Best.

-

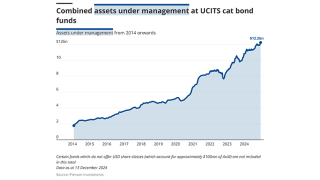

Capital inflows, notably into UCITS funds, and accumulated returns supported issuance of $17.2bn in 2024.

-

The offering is a collaboration with Generali and parametric carrier Descartes.

-

Barthelemy Thomas joins from PartnerRe Capital Management in Zurich

-

The reinsurer added two new tranches to its 2025 issuance.

-

The capital partners unit was launched via London Bridge 2 in Lloyd’s last year.

-

-

Graeme Bell (pictured) will continue in his role as group legal officer.

-

-

Amin Touahri spent five years in a variety of roles at Munich Re.

-

Compressed cat bond spreads could drive some rebalancing, as M&A remains a prospect.

-

The vehicle is smaller by 8% as White Mountains’ participation grew.

-

The sponsor has expanded its target deal size compared with a year ago.

-

The first cat bond deal from the carrier achieved its target size of C$150mn.

-

The reinsurer is seeking index-based cover for a wide scope of perils and territories.

-

The broker anticipates strengthening investor demand for collateralised re.

-

The firm has commenced writing collateralised retro and reinsurance but its rated launch is still pending.

-

The UCITS cat bond segment has added 54% in AuM since Hurricane Ian.

-

Casualty ILS made inroads, while hurricane hedging strategies came into focus.

-

The bond offers a higher multiple than a similar Fuchsia Re deal placed last year.

-

The company no longer has any exposure to reinsurance contracts.

-

Everest is in the process of transforming its ILS offering.

-

The reinsurer said investors were interested in expanding after benefiting from good results.

-

Magnani has served for more than 14 years in ILS broking roles.

-

The ILS manager will “pragmatically accept” a degree of credit risk in deals.

-

Former ILS investors who left the space have looked again and re-allocated.

-

CEO Jonathan Zaffino said he saw opportunities for expansion in casualty.

-

Management track record has been a factor in capital raising for 2025.

-

The start-up has secured BMA approval as it looks to a 1 January kick-off.

-

Shareholders are voting to approve being wound up on 18 December.

-

Strong growth in fee income builds on the favourable rating environment.

-

The fund will be denominated in US dollars and digital currencies.

-

The sidecar was established to enhance RGA’s access to capital for its US asset intensive business.

-

The capital being returned to shareholders is part of a compulsory partial redemption.

-

The firm’s AuM in four key vehicles rose $526mn in Q3.

-

The company’s reinsurance premiums ceded fell by 58% to $149mn.

-

The deal would represent a diversifying auto risk deal.

-

Many in the ILS sector are bullish on Milton losses falling at the lower end of earnings impacts.

-

Post-Milton investor interest in ILS has yet to translate into dollars allocated.

-

The Dutch scheme is the largest ILS allocator with a long list of mandates within the sector.

-

Hurricane Milton will show the ILS product behaving as investors expect it to.

-

The company is monitoring the NFIP’s flood-exposed bonds.

-

The Canadian pension plan put its Lloyd’s portfolio under review earlier this year.

-

The raise includes minority investments from Nationwide, Enstar and others.

-

The manager is hopeful of closing all contracts by the end of 2024.

-

Maya Henry will be tasked with raising capital and managing clients in North America.

-

Floir approved nearly 650,000 policies for takeout from Citizens for October and November.

-

The new commingled fund will target investors with $5mn or higher potential investments.

-

ILS brokers are pitching for Sanders Re and ResRe transactions.

-

Cat bond funds continue to draw interest as private ILS more challenged.

-

The Brian Duperreault-led reinsurer start-up has secured a cornerstone investor and aims to have an ILS fund running from day one.

-

-

Sidecar vehicles are being tailored to match investors’ objectives.

-

The executive explored ILS options as MD of hedge fund Horton Point post financial crisis.

-

The board of directors has voted for a 10% rate hike.

-

The moves mark a major step in realising “trillion dollar” casualty ILS potential, according to Ledger Investing CEO Samir Shah.

-

The reinsurer raised $84.5mn of third-party capital in the quarter.

-

The firm has observed a “more widespread investor base” in cat bonds.

-

-

Availability of ILS has so far fulfilled investor demand.

-

Benefits of ILS smart contracts include transparency and tradeability.

-

The broker said high ILS maturities would boost cat bond issuance though the hurricane season would impact capital availability.

-

The broker said it did not anticipate a slew of new entrants, with the possible exception of casualty start-ups.

-

Sébastien Bamsey joins from JP Morgan, where he has worked for 18 years.

-

Schmidt will lead Markel's Global Strategy team and work with Nephila.

-

Park assumed the role earlier this month.

-

Evercore is leading the capital raise process and Aon is assisting with the Lloyd’s application process.

-

State National has been lined up to front for the vehicle, which would be a rare example of third-party capital in this space.

-

The Florida portion of the program provides $1bn in protection.

-

Concerning hurricane forecasts are among the factors driving tighter reinsurer capacity.

-

The program includes all perils coverage and third-event protection.

-

The former Everest executive will look to roll out a range of new product lines at the MGA.

-

The firm’s AuM was down 17% on $1.8bn as of 31 December.

-

Performance fees soared by 605% to $27.5mn from $3.9mn in Q1 2023.

-

Aspen said reduced reinsurance appetite made it a good time to seek alternative capacity.

-

The announcement confirms earlier reports from this publication.

-

Sources said the deal was roughly three times over-subscribed as cat becomes hot.

-

The platform distributed ~$50mn to investors for 2023.

-

The carrier closed its Sussex Diversified Fund in October last year.

-

Managers are hoping strong returns in 2023 will aid capital raising efforts.

-

Pockets of new capital will not shift pricing at mid-year.

-

ILS platform London Bridge II has had a good year as volumes reached $750mn, the CFO said.

-

-

The vehicle’s loss ratio improved 66 percentage points YoY.

-

The firm was founded in 2015 to help clients raise capital.

-

The carrier booked a reserve charge of $392mn for casualty insurance.

-

The ILS platform ceded around 40% of its total managed premiums of $1.8bn.

-

Fourth quarter inflows also included $111mn for its retro platform Upsilon

-

The Medici cat bond fund experienced the largest growth in AuM.

-

Of the 18 top-tier ILS managers, 10 recorded growth, while eight were flat or down.

-

Phoenix Re renewal ‘shows commitment to doing Asia ILS, for Asia in Asia’, according to MS Amlin Asia Pacific CEO Will Ho.

-

The allocation last autumn amounted to around 1.4% of the investment manager’s total funds under management.

-

Leadenhall Capital Partners (LCP) has named Yuko Hoshino as senior managing director for Japan and Asia within its business development team.

-

Projected 2024 ILS returns remain historically high, but signs of increased appetite for top-layer cat risk and top-end retro raise questions over how long this will last.

-

The “convenience claims” route to payout will be limited to claims up to $200,000.

-

The year brought a degree of closure on the loss-hit years of 2017-2021, while the outlook remains changeable for ILS managers.