-

The deal is offering a multiplier of 6.6x on the expected loss.

-

A degree of pricing volatility was evident in the market this week.

-

The bond has priced at the mid-point of guidance.

-

The firm is the sole provider to offer index services in the US.

-

The cat bond will provide coverage across multiple territories in Europe.

-

Pricing on the Class A notes settled 11% below guidance.

-

State National has been lined up to front for the vehicle, which would be a rare example of third-party capital in this space.

-

The reinsurer narrowed the scope of perils in its latest issuance versus its 3264 2022 cat bond.

-

-

He will continue to play a role as a fund director and firm ambassador.

-

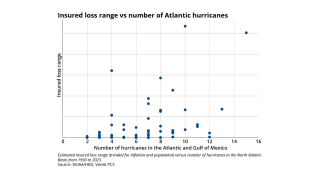

Reinsurers are much better placed to absorb cat losses; insurers are carrying more risk.

-

Former Teneo M&A head Alexander Schnieders will lead the unit.