-

The negative L&H result was driven by reserve updates.

-

The negative L&H result was driven by reserve updates.

-

The backing represents a rare move from a collateralized reinsurer to take on risk in the legacy space.

-

The insured loss from Beryl in the US was pegged at $2.7bn.

-

He left his role as portfolio manager at Hiscox Re & ILS last year.

-

Industry losses of $800mn-$1.2bn are expected from Beryl's impact in Texas.

-

The $1.6bn of cat bond limit on-risk includes $1.1bn Everglades Re mega-bond.

-

Chief science officer Steve Bowen said it was still too early to provide precise insured-loss estimates.

-

-

Secondary market activity and hedging would be likely if a Beryl-sized storm tracked toward the US.

-

The executive joined in January after a decade at Liberty Mutual.

-

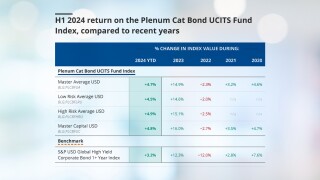

This is lower compared to 8.2% recorded by the index in H1 2023.