-

The ILS start-up was founded in January by Hanni Ali and Peter Dunlop.

-

Pre-tax income at the vehicle was $30mn in the first nine months of 2025.

-

The reinsurer-linked manager now offers three ILS funds encompassing private ILS and cat bonds.

-

The storm devastated Jamaica and Cuba, but insurance penetration on the islands is low.

-

The sponsor has $200mn of cat bond protection maturing in December this year.

-

The firm said this was due to planned returns of capital to ongoing investors.

-

Cassis joins from Swiss Re, where she was a senior ILS structurer since February 2022.

-

Brant Loucks is one of four promotions across the Capital Partnerships and reinsurance units.

-

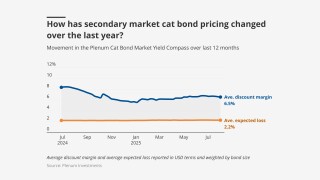

Total yield is down from 11.18% in the last week of October 2024.

-

Widespread underinsurance and low exposures will limit losses.

-

Covea’s Hexagon IV Re deal priced 13% below the initial target on a weighted average basis.

-

Since 2007, the Caribbean country has received $100.9mn in payments from the CCRIF.

-

Total gains for the year reached 7.71%.

-

Some experienced investors are pivoting out of cat bonds and into the top layers of private ILS deals.

-

The French reinsurer improved its P&C combined ratio by 7.4 points to 80.9%.

-

The syndicate is expected to write ~$300mn of business in 2026.

-

Operating revenues were also up on the $29.1mn reported over Q2.

-

O’Donnell believes RenRe is well positioned to produce longer-tail risk to third-party investors.

-

Third-party investors made a net income of $415mn in the quarter.

-

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

Central pressure of 900mb or below would trigger a full loss of the $150mn deal.

-

The legacy cover will backstop policies written by its North American insurance business.

-

Pricing on Friday implied a potential $45mn loss to the bond, before the storm outlook deteriorated.

-

So far this year, there have been 11 first-time sponsors to place a deal.

-

Competition on price from traditional markets is weighing on bond market momentum.

-

The insurer of last resort’s exposure was $696bn as of last September.

-

The bond will provide protection against US wind with a PCS trigger.

-

The sidecar was launched today by the Bermudian reinsurer and investment firm Carlyle.

-

The capital will provide retro cover for life-focused reinsurer Fortitude Re.

-

Majority shareholder Fosun will continue to hold the remaining 86.7% of shares.

-

Spreads on USAA’s latest deal priced below comparative issuances in 2023-2024.

-

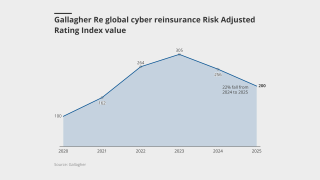

Investor interest is warming up following a colder spell over the past several years.

-

EMEA CEO Laurent Rousseau said reinsurance must retain its relevance to investors.

-

While rates have “definitely come down,” they were coming off a high base, Rachel Turk said.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

The award of the mandates marks the California public pension plan’s entry into ILS.

-

The reinsurer stressed it “did not shy” from cat business in 2023.

-

ILS has been a driver of innovation in reinsurance, Convergence 2025 attendees heard Wednesday.

-

Mory Katz joined the broker earlier this year.

-

The carrier will continue to write assumed retro in Bermuda.

-

Guy Carpenter will rebrand as Marsh Re, as a new central tech/operations unit is created.

-

Ryan Saul will work at Ledger’s broker-dealer subsidiary Ledger Capital Markets.

-

The hire is the hedge fund manager’s third ILS appointment in the past year.

-

Key topics include private ILS growth prospects and the longevity of longtail interest.

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

Returns from cat risk investments stood at 20.1% for the year to 30 June 2025.

-

A cat-focused vehicle is “the missing piece” of Hannover Re’s ILS offerings, said Silke Sehm.

-

The allocation is around 3% of the fund’s total assets.

-

The insurer of last resort currently has $2.15bn of cat bond protection on risk.

-

Toh joins from Nephila, where he spent the last decade, bringing expertise in ILS.

-

The alternative asset manager was founded in 2021 with offices in London, New York and Abu Dhabi.

-

Founder and CEO of Nascent Andre Perez will join Sephira’s board of directors.

-

Sources have said $1bn+ of fresh capital from the region is expected to be deployed in 2026.

-

Improved performance and growing investment returns played a role in the upgrade.

-

The executive has worked at Aon for almost two decades.

-

The figure comprises 5.48% of insurance discount margin and 3.96% of risk-free rate.

-

The facility will initially focus on US, Bermudian and European business.

-

Pricing has hit historically soft market lows, based on secondary market pricing.

-

The vehicle will now cover an E&S program jointly launched with Accredited.

-

Bellal Rahman joins from Catalina Life Re, where he was head of finance for two years.

-

The manager’s largest ILS holding is in the cat-bond-heavy High Yield fund.

-

Cat bonds have outpaced the returns on private strategies in the year to date.

-

Marlon Williams will focus on the placement of reinsurance and retro business.

-

The new Verisk SCS model is increasing expected losses on aggregate bonds.

-

The hire comes as Guy Carpenter fills the void created by the Willis Re raid earlier this year.

-

In the new role, Edward Johnson will be rejoining former Aon Securities colleague Chris Parry.

-

The Bermuda firm said HS Sawmill reflected its continued focus on life insurance.

-

Equivalent to a Category 5 hurricane, Ragasa is the world's strongest storm this year.

-

The ILS services specialist has worked in the ILS market in Bermuda for 10 years.

-

Charles Mixon joined the firm a year ago in a business development role.

-

Despite the formation of Gabrielle, there is "a very high probability" of a below-average season.

-

The resource was developed by leading ILS managers and investors.

-

Deals would need to be sized at $50mn plus for transfer to capital markets.

-

The economic loss from the event was around EUR7.6bn.

-

The Bermuda reinsurer has been active in ILS since launching in 2007.

-

Samild held multiple roles including head of alternatives at the Future Fund.

-

The CEA had $19.3bn of claim-paying capacity as of 31 July.

-

The ILS manager has $6.8bn in assets and will be led by MariaGiovanna Guatteri.

-

The sidecar will support five programs providing specialty frequency coverages.

-

Axa IM’s acquisition by BNP Paribas was confirmed in July this year.

-

Reinsurer executives during a Aon reinsurer panel stressed that the industry worked hard on setting the right structure.

-

ILS executives talked pricing, capacity and opportunities in casualty at an ILS roundtable in Monte Carlo.

-

The market has learned lessons from earlier soft market phases that it will apply now.

-

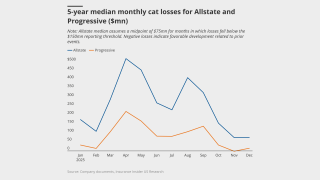

Losses were primarily driven by personal property lines.

-

Nick Fallon is the latest in a string of retro-broker moves in the market.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

Arch set up Bermuda investment manager Arch Fund Management in February.

-

The syndicate is targeting capital allocation for 1 January, the company confirmed.

-

Sources said that the carrier has held preliminary talks with private debt investors.

-

Scott Cobon's most recent title was MD, insurance management services.

-

Fleming’s attempt follows those of other legacy carriers that have had recent successes raising capital.

-

The figure comprises 6.07% of insurance discount margin and 4.15% of risk-free rate.

-

He added that Munich Re does not rely on retro or third-party.

-

Hannover Re Capital Partners is in talks with two investors for 1 January launch.

-

The leadership’s commentary spotlighted to value of ILS to the group.

-

The sponsor extended two notes issued in 2022.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.

-

The volume of property cat aggregates placed grew 50% in 2025.

-

The vehicle will be capitalised by an asset manager with more than $100bn in AuM.

-

The target allocation to Munich Re, Elementum and the run-off AlphaCat funds fell in the year to 30 June 2025.

-

Bohm has held senior roles at BMS, Swiss Re and Aon during his career.

-

The trend for private credit in alternative asset management is “set to continue”.

-

The capital supported sidecar-style syndicates and reinsurance start-ups.

-

Syndicate 1440 was approved to assume business incepting January 2026.

-

The investment bank had stopped offering ILS services last September.

-

The ratings agency warned negative PYD on US casualty will likely continue.

-

The agency noted inflows to cat bond funds and investor interest in private ILS.

-

Competition from cat bonds in the top layers of programmes applied downward pressure on reinsurance pricing in 2025.

-

Dedicated reinsurance capital is on track to increase by 8% in 2025, the broker said.

-

The Japanese carrier faces integration challenges to make a success of the deal.

-

Funds encompassing private ILS outperformed cat bond strategies in July.

-

The global specialty player is also exploring ILS offerings across specialty and cat bonds.

-

A trend towards higher-risk ILW bonds helped keep yields in double-digits despite softer rates.

-

Aspen Capital Markets earned $169mn in fee income in 2024 alone.

-

The CUO has added the role of head of private ILS, joining the executive team.

-

The purchase brings Sompo an established ILS platform as part of the deal.

-

Last year marked the second consecutive year in which carriers made a positive return.

-

The ILS play will make the business more capital efficient under new owner Sixth Street.

-

Hagood will stay on as sole CEO of Nephila Holdings, with Taylor continuing as president.

-

The group claims the White House is undermining disaster preparedness.

-

Benjamin Baltesar spent more than six years at Euler ILS.

-

The reinsurer’s capacity is hugely important to ILS firms, with few alternative providers.

-

The US has been lucky over recent decades to avoid a $100bn insured hurricane event.

-

This is the latest in a string of appointments made by the firm’s ILS unit.

-

The Bermudian firm has an active ILS division, unlike the Japanese conglomerate’s insurance divisions.

-

ILS accounted for 2.5% of the pension fund’s total AuM.

-

Aaron Garcia will hold a senior role at the operation, sources have confirmed.

-

Reinsurers are confident on cat rates and ready to deploy ILS capital.

-

The vehicle will support Platinum Specialty Underwriters, XPT Group’s MGA underwriting unit.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

The P&C division booked a combined ratio of 81.1% for the first half of 2025.

-

The firm’s ILS vehicles posted low single-digit growth in assets under management in Q2.

-

The ILS manager revised down slightly its forecast for the syndicate’s 2023 YOA.

-

The reinsurer plans to repeat its 2025 purchasing for property and specialty protections.

-

The firm booked net losses from the LA wildfires of EUR615.1mn in the first half.

-

ILS investors have fought shy of multi-peril aggs due to low confidence in SCS modelling.

-

The Florida carrier said ceded premiums will rise slightly to $106mn in Q3.

-

The reinsurer’s chair said cat pricing reductions are at a “miniscule level”.

-

Aspen’s gross premium cession ratio grew 7.1 percentage points to 42.2%.

-

The sidecar took $19mn of cat losses relating to the California wildfires.

-

The yield figure comprises 6.53% of insurance discount margin and 4.28% risk-free.

-

The forecast has increased since the early July update due to several additional factors.

-

The Texas insurer of last resort previously had to have funding for a 1-in-100 year storm.

-

Around 95% of the Hiscox Re & ILS portfolio is rated rate “adequate” or better.

-

The unit said capital in the ILS market remains more than adequate to meet rising demand.

-

California wildfires account for $40bn of the insured loss tally in H1.

-

The reinsurance CoR fell 2.3 points to 79.5% while the primary CoR rose 4.7 points to 98.7%.

-

Investors are drawing lessons from life deals to find new routes into insurance markets.

-

The vehicle will support Ascot’s casualty business in the US and Bermuda.

-

Markel announced the sale of its global reinsurance renewal rights to Nationwide.

-

Amid $17bn of new deals, cat bond activity included aggregate and cascading structures.

-

The firm attributed a 9% drop in reinsurance NWP partly to higher cession rates.

-

Millions are evacuating after one of the strongest earthquakes in modern history.

-

This brings the carrier’s total limit on the program to $1.8bn.

-

The legacy player is working to secure its first deal, and could look to expand to US E&S.

-

The Bermuda SPI will write a quota share of SageSure’s captive Anchor Re.

-

The bond will provide protection on an industry-loss basis, as reported by PCS.

-

The merged business of Twelve Securis ranked third among ILS managers for AuM, behind Fermat and RenRe.

-

Reserve releases helped to recapture deferred fees.

-

The consultation period around UK ISPVs was opened in November last year.

-

George Cantlay will also assume the additional position of president of the Bermuda business.

-

The reinsurer returned $216.7mn to investors in Q2.

-

The proposed reforms are designed to put the UK’s regulatory framework on par with Bermuda and the US.

-

He replaces Andrew Hughes, who held the role since 2021.

-

The broker has nearly 20 years of experience in the reinsurance and retro markets.

-

Canio spent over 19 years with PGGM, with nine of those managing ILS.

-

The firm reported a net pre-tax cat loss of $414mn from January’s LA wildfires.

-

Managers believed end-investors value diversification and non-correlation of cat bonds over liquidity.

-

Cat bonds remain attractive for investors seeking risk-adjusted return and diversification.

-

Matthew Towsey has spent 14 years at Aon.

-

The US accounted for 92% of all global insured losses for the period.

-

US events accounted for more than 90% of global insured losses.

-

The PRA will also have to report on turnaround time for new approvals against 10-day and six-week targets.

-

We discuss progress in collateral management with our Outstanding Contributor winner.

-

Former ILS lead Matt Holland left the company in May.

-

He had spent 10 years at Securis, with seven of them as COO.

-

His last role was ILW practice leader at Acrisure Re.

-

The weather-modelling agency is predicting a below-normal season.

-

The fund was renamed from the Pioneer Cat Bond Fund.

-

The total yield was 11.03% as of 27 June, including 4.3% of risk-free rate.

-

Some $400mn of bonds priced in the past week, after a record-setting H1.

-

The recommended “AIF lite” structure could be suited to cat bond lites.

-

The Diversified Alternative Fund’s allocation to cat bonds was up by 31% from $386mn at 31 January.

-

The Bermudian ILS manager has recently changed its name from Mereo Advisors.

-

The fund’s ILS portfolio is split between 70% property cat and 30% cyber risk.

-

This comes in at the lower end of the initial spread guidance of 725-775 bps.

-

The investment consultancy said yields increased in Q2 by less than could have been expected.

-

The Cayman Islands-domiciled SPI now has four institutional backers.

-

Property cat-focused sidecar capital was up by approximately 10% in H1.

-

The company said the reduction was due to years of steady improvements.

-

The programme’s total limit this year is down $594mn to $1.36bn.

-

The sidecars will provide capacity for reinsurers and large insurance carriers.

-

Initial responses to ESMA’s report welcomed the long timeframes for any changes.

-

The third-party capital manager is a new entrant to the retro space.

-

Weighted average multiples were down as sponsors capitalised on demand to push spreads lower.

-

The measure could have landed insurers with extra tax on US business.

-

The total return for the Swiss Re Global Cat Bond Index stood at 0.61% for the month.

-

A group of Bermuda staff also left the broker.

-

The body said cat bonds are closer to an insurance product than a security.

-

Michael Hamer recognised for his work with investors and on reporting frameworks.

-

The awards celebration took place at the Hilton Bankside on 25 June.

-

The new unit – Ceded Re – will operate under the leadership of Guy Van Hecke.

-

Twelve Securis is now a challenger for the top spot on the Insurance Insider ILS leaderboard.

-

The bond is split across a Series 1 and Series 2 structure, with eight notes in total.

-

The cost comes in at $530.6bn, roughly $20mn lower than budgeted.

-

Everest Re increased the targeted size of Kilimanjaro Re across all four classes of notes.

-

The pensions scheme’s existing ILS holdings to Aeolus and HSCM are in run-off.

-

The fund lists Twelve, Swiss Re and Cambridge Associates as managers.

-

Slide is putting faith in tort reforms and will lean into Florida, CEO Lucas said.

-

Pricing on all classes of notes are being offered at the bottom of the guided range.

-

AuM in GAIA Cat Bond Fund had grown to $3.9bn as of 31 May.

-

PCS's loss estimate for the March Missouri SCS pushed the bond beyond its exhaustion point.

-

The California Earthquake Authority upsized its Ursa Re deal by 60% to $400mn.

-

Buyers have turned to retro markets for covers where ILW pricing is less attractive.

-

The Californian insurer had a private deal, Randolph Re, that provided pure wildfire protection.

-

Rachel Bardon will also join the board of Compre's Bermuda-based reinsurer Pallas Re.

-

Harry White has been with Verisk for 14 years, while Ted Gregory has been with PCS for 12.

-

John Kulik will work within Ledger’s broking team, Ledger Investing.

-

In April, the loss modeller pegged losses at A$2.57bn.

-

The documents figure in a potential criminal case against a CCB employee.

-

The Bermuda-based team is led by John Fletcher.

-

The firm said it was the first time a UCITS cat bond fund passed the $4.0bn mark.

-

Investors eyeing private ILS include opportunistic allocators keeping watch on storm season.

-

Everest Re has structured its deal into two sections targeting aggregate and per occurrence cover.

-

The sidecar renewed at $230mn for 2025.

-

The pension plan noted in June 2024 that it was exploring new options in ILS.

-

The man is alleged to have conspired with others to falsify LOCs and collateral letters.

-

The number has expanded by around 40% from an earlier update, sources said.

-

The latest update brings the agency’s combined estimate for Milton and Helene to $32.4bn.

-

The investment is a response to shifts in stock-bond correlations.

-

The fund was set up 18 months ago by cat bond investor Florian Steiger.

-

William Soares moves from casualty and specialty CUO to president.

-

Total yield was 10.93% as of 30 May, including 4.34% of risk-free rate.

-

She was previously head of investor relations and business development for North America and Australia at Securis.

-

HCI secured three towers with $3.5bn in XoL coverage.

-

This followed a $650mn fall in April, after management change of the fund.

-

David Baldwin joins from EIRS where he was a senior reinsurance consultant.

-

Lyon joins the reinsurance broker from law firm Skadden, Arps, Slate, Meagher & Flom.

-

A total $225mn of fresh limit entered the market across two deals.

-

Weston Tompkins spent 10 years in an investor relations role at Securis.

-

ILS offers efficient capital for underwriters, but casualty ILS transactions are complex.

-

The bond will provide protection for storms, quakes and fires in seven US states.

-

The bond protects against losses in the US, Canada, Europe and Australia.

-

The $2.59bn renewal is up 45% from last year.

-

The total cost excluding a 15% quota share was $201.85mn, with rates down 12.2% from last year.

-

Most of the losses are attributable to a supercell storm in Texas.

-

The company also has $100mn for US hurricane events.

-

Property cat XoL rates were off by around 10% on average on a blended risk-adjusted basis.

-

The index provider revised up its return for March by 0.39 percentage points to 1.21%.

-

The Swiss pension fund has not disclosed an ILS allocation before.

-

The Peak Re subsidiary mainly writes US motor and casualty reinsurance.

-

The deals covered Euro wind and Italy quake, Florida hurricane and a retro bond.

-

The ILS market has won market share at the top of programmes as buying expands.

-

SCS can no longer be considered a "secondary" peril for the US insurance market, Steve Bowen said.

-

The bond will provide protection for Allstate’s Florida subsidiary, Castle Key.

-

The Italian sponsor has $237mn of limit maturing this July.

-

The cat bond limit total is an uplift of around 60% on the carrier’s 2024 bonds.

-

Some assets in the Medici Fund were transferred to a new UCITS strategy.

-

Fox highlighted the increasing role of alternative capital and creative financial vehicles.

-

Two large storms hit the Midwest and Ohio Valley regions on 14-17 May and 18-20 May.

-

The bond will provide named storm and quake coverage in the US.

-

The bond is offering a spread range of 850-925bps.

-

As with 2024, pricing pressure has been most acute on top layers.

-

The ILS manager’s total AuM increased to $2.2bn in 2024 from $1.7bn the year prior.

-

The targeted uplift comes after Mercury ceded nearly $1.3bn of wildfire losses to reinsurers in Q1.

-

The Altamont-backed broker has been building out its team since launching in 2023.

-

One dollar-denominated deal has opted to hold collateral in EBRC notes.

-

The bond will cover named storms in five US states.

-

Price guidance for the bond is 4.00%-4.50%.

-

The platform’s aim is to support the ILS industry in ‘getting the marks right’.

-

The reinsurer had $2.8bn of natural catastrophe business up for renewal in the year so far.

-

The fund was set up in 2015 to capitalise on higher post-event yields.

-

Debut sponsor SV SparkassenVersicherung also secured its target size of $100mn.

-

Proceeds will expand the company’s reinsurance protection in Florida and South Carolina.

-

The reinsurer has already dipped into the cat bond market with its Stabilitas Re retro deals.

-

The headcount at the start-up now stands at around 40.

-

Fales will focus on creating investment opportunities for the carrier’s specialty reinsurance portfolios.

-

Wildfire losses from fronting and ILS activities were EUR438mn.

-

The platform is based in Bermuda and will focus on strategic capital partnerships.

-

Some $200mn of fresh limit entered the ILS market as $3.4bn of deals priced.

-

Sources believe the market will grow gradually over years after its initial cluster of dealmaking.

-

The bond provides coverage on personal-lines property in Florida.

-

The series one notes will provide protection to the benefit of Twia.

-

Former Aviva and AIA CEO Mark Wilson will lead the new initiative.

-

The (re)insurer used alternative capital in the reinsurance coverage.

-

The team will focus on building out Miller’s property treaty, retro and ILS capabilities, it’s understood.

-

Ark's combined ratio included 25 points of catastrophe losses in Q1.

-

The total yield, inclusive of the risk-free rate, was down on the same period last year.

-

The bond will provide multi-peril coverage on an industry loss basis.

-

Gallagher Re said rates had softened in 2025 versus the prior two years.

-

CEO Thierry Léger expects overall P&C pricing to be “stable” through 2025.

-

The bond will provide storm protection in Florida and South Carolina.

-

Fermat and GAM announced that the former will take sole control of the GAM FCM Cat Bond Fund.

-

Investors want transparency from managers regarding the impacts of climate change.

-

The deal will provide named Florida storm protection on an indemnity, per occurrence basis.

-

Florida Citizens upsized its latest Everglades Re deal by 50%.

-

The buzz in the air at ILS Connect told of a market entering its next growth phase.

-

AIG, HDI Global and others have settled, while Chubb’s fight continues.

-

Commutations need to be optimal for the sponsor and the investor to avoid sponsors taking back chunky risks.

-

The CEO said private ILS funds can generate additional returns of 10%-20%.

-

The state insurer of last resort is set to purchase $2.89bn of reinsurance this year.

-

Richard Pennay also addressed the dip in cyber ILS activity.

-

The renewal and upsizing of the Trouvaille E&S sidecar highlighted the market’s potential.

-

Private ILS would benefit from extension spreads to manage investor concerns, the CEO argued.

-

The bond will offer retrocession coverage for Hannover Re.

-

Its 2025 programme exhausts at $9.5bn excess $1bn.

-

The ILS manager also swung to an operating profit after posting a loss in Q1 2024.

-

All 29 funds tracked by the index returned a positive performance.

-

The bond will provide protection against named storm and thunderstorm.

-

Growing economic and population exposures are driving potentially larger insured losses.

-

Cat bond sponsors continue to secure higher limits and lower rates versus their targets.

-

Investor interest and capital flows point to potential for ILS proliferation.

-

Renewal rates were favorable compared to what could have happened after several hurricanes.

-

The bond will cover China, India and Japan quake and Japan typhoon.

-

The bond will provide protection against German and Japan quake.

-

The firm’s assets under management were down $300mn in Q1 as performance fee income was hit.

-

Secondary market traders are baking in further loss potential after PCS increased its wildfire and Helene loss estimates.

-

This year’s ceremony will include the inaugural Women in ILS Award presentation.

-

January’s California wildfires meant third-party investors suffered a loss of $195.3mn.

-

The carrier increased its cession by around 13% year over year.

-

SCS losses were also above average in Q1 due to “lingering” La Niña conditions.

-

Franklin Templeton’s allocations to ILS are managed by fund of funds manager K2 Advisors.

-

An allocation to insurance could “feel like a nice, calm port in the storm” amid wider market volatility.

-

Insured losses were the second highest on record for the first quarter.

-

Fully placed, this would equate to $275mn on the per-occurrence tower and $675mn on agg.

-

Sykes has spent over 31 years with Aon, with the last 15 of those in Guernsey.

-

The industry loss data provider also increased its estimate for Hurricane Helene to $15.3bn.

-

He joined what was then Credit Suisse ILS in 2019, moving from Hiscox Re & ILS.

-

The executive formerly served in senior leadership roles at Nomura, Credit Suisse and Goldman Sachs.

-

This is the first time the Texas Fair Plan has entered the cat bond market.

-

Fellow Swedish pension fund AP3 is phasing out its ILS allocation after being active in the sector since 2008.

-

The deal of the size was unchanged at $100mn.

-

He joined Nephila in 2023 from Lancashire as a senior underwriter.

-

Portfolio rebalancing was not triggered last week, but investors are now distracted and nervous.

-

US Coastal Property and Utica Mutual Insurance have brought out their first cat bond deals.

-

The Swiss rail pension scheme has been cutting its ILS allocation since 2018.

-

The Swiss pension fund’s ILS allocation stood at 4.9% of the total fund as of 25 March.

-

Suzanne Wells is also joining the company from Arch as COO.

-

The bond will provide protection against China, India and Japan quake, and Japan typhoon.

-

The subject business covers a portfolio of residential insurance.

-

KCC is part of the CDI’s review into creating a public wildfire cat model for insurers.

-

The sponsor is estimating a loss of ~$300mn in relation to one of last month’s US tornado events.

-

Sutton National and Bamboo Ide8 secured $170mn of sidecar and cat bond protection.

-

The bond will provide coverage against named storm or severe thunderstorm over three years.

-

The issuance is split across three tranches with varying degrees of risk.

-

The prediction comes after a highly active hurricane season in 2024.

-

The deal is split across four tranches, with the riskiest note Class D targeting $150mn.

-

The cat bond will initially cover named storms in Florida and South Carolina.

-

Market participants expect pricing will be flat to down through Q2.

-

The bond will provide protection against Louisiana named storm.

-

Fees on the GAM Star cat bond funds will drop in May in a recognition of fee competition in the market.

-

The reinsurer said the probe concerns the alleged involvement of its former chairman.

-

The sponsor secured $240mn of limit as the bond upsized by 20% on its initial target.

-

Most of the ILS investments were made via the cat bond heavy High Yield Fund.

-

Martin Bisping has moved to CRO and Bernard Bachmann was named CEO of SRILIM.

-

Rachel Barnes Binnie joins as portfolio manager.

-

Losses stemmed from ex-Tropical Cyclone Alfred and North Queensland flooding.

-

Palm Re will provide Florida named storm cat bond coverage for Florida Peninsula, Edison and Ovation Home Insurance Exchange.

-

Multiples in March were below historic averages from 2001 through 2024.

-

The cat bond market surpassed $50bn by the end of Q1 2025.

-

The ETF will invest solely in natural catastrophe-exposed bonds.

-

LA wildfire-exposed ILS positions experienced further declines.

-

The firm announced CEO Trevor Carvey will retire and is returning to the UK from Bermuda.

-

Scor is targeting limit of $200mn with its latest Atlas DAC retro cat bond.

-

The carrier has received 12,300 claims as of 28 March.

-

Many UK pension funds are over-funded and lack appetite for higher-risk, higher-yield products.

-

The vehicle will take a quota share of all of the risks underwritten by Ryan Specialty’s MGA arm.

-

The notes replace a 2021 issuance that matured in January this year.

-

The deal is 45% larger than 2024’s issuance after attracting a “greater number of investors”.

-

Cat losses last month were lighter than historical trends, but all eyes are on Q1 figures.

-

The cedant’s Namaka Re bond is offering a spread range of 200-250 bps.

-

The acquisition expands its global employee benefits business to ~4,000 global employees.

-

The bond is being issued through Lloyd’s London Bridge 2 platform.

-

The bond upsized by around 20% as pricing settled 2% below initial guidance at 7%.

-

The rating allows IQUW to access $1bn in group capital.

-

The bond will provide coverage for Japan typhoon and flood on an indemnity, per-occurrence basis.

-

Caution about capital markets volatility is leading sponsors to stagger bond renewals.

-

The ILS segment is not ready to gloss over loss-heavy years in renewal discussions.

-

The mega cat bond season in Q2 last year recorded issuance of $8.2bn.

-

The agency said introduction of a new methodology will depend on the feedback it receives from the ILS market.

-

Lara Martiner joined Allianz in 2011 as group legal compliance officer and legal counsel.

-

The March 13-16 storms would mark the first billion-dollar US SCS event of the year.

-

The broker has promoted Oriol Gaspa Rebull to global head of analytics strategy.

-

MAP’s Christopher Smelt said impact on nationwide programmes will cause risk aversion.

-

Both syndicates also reported a deterioration in their combined ratios.

-

Industry sources estimate the market to be around $3bn.

-

Guernsey’s TISE listed the world’s first private cat bond issued by Solidum Re in 2011.

-

Sources warned some property XoL books are already running 50% loss ratios.

-

This will be the third cat bond issuance through Baltic Re PCC.

-

The cat bond manager warned of excess downside risk owing to an accumulation of losses.

-

Flood Re’s bond Vision 2039 bucked the trend by pricing up 7% as its secured £140mn ($174mn) of limit.

-

The insurance industry has experienced mounting losses from severe convective storms.

-

Indirect exposure to cat risk through long-term investors gives Markel optionality.

-

Premiums ceded to the ILS vehicle increased by 76% to $433mn.

-

Island appetite remains stable, but early 2025 loss activity has injected fresh uncertainty.

-

The reinsurer had taken the opportunity to buy more limit across event and aggregate covers.

-

ILS as a percentage of the pension fund’s total assets grew to 1.5%.

-

GP Affluent Markets will look to serve high-net-worth individuals.

-

The largest individual net loss at EUR230mn was caused by Hurricane Milton.

-

The bond was trading at around 12.3c on the dollar in the secondary market last month.

-

Both carriers have extensive reinsurance coverage.

-

This year’s coverage will involve $2.94bn of new risk transfer.

-

The UK listed investment manager has almost doubled its ILS allocation since April last year.

-

Tom Fealey has assumed lead portfolio manager responsibilities.

-

The executive worked in investment banking before joining the reinsurance industry.

-

This will be Brit’s first cat bond issuance since its 2020 deal through Sussex Capital.

-

This came as the market’s underwriting profit dipped 10% for 2024.

-

Some $4.8bn of reinsurance and cat bond limit will come up for renewal in 2025.

-

Almost 300,000 people have been left without power from the storm.

-

Some $625mn of new issuance entered the market in the first week of March.

-

There is the potential for cat bond H1 issuance to be a record breaking six months.

-

The scope of QRT’s new ILS strategy will include cat bonds and private ILS.

-

The executive spent a brief period at Wakam in a capital and reinsurance role.

-

The fund is open to European and other global investors.

-

The London D&F market will shoulder most of the losses.

-

The bond will provide fire protection for MGA Bamboo’s California business.

-

The role will focus on international treaty, specialty lines and strategic advisory.

-

Eric Paire was head of capital advisory at Aon for nearly seven years.

-

The reinsurer pegged the market loss at $40bn.

-

The role oversees the $187bn Canadian pension plan’s ILS allocation.

-

Dispersion of returns was high, with the range 0.87% to -3.71%.

-

The programme structure was expanded, but it is unclear what percentage was placed.

-

The coverage will be on an indemnity, per-occurrence basis.

-

The bond will cover named storms in the state of Florida.

-

The third-party capital platform is looking to enhance its tailored strategy offerings.

-

The cost of reinstatement was included in $170mn wildfire net loss figure.

-

The terrorism pool has shifted its programme from facultative to an XoL arrangement.

-

Deal sizes increased by 84% on average across the six tranches that saw an increase.

-

Climate change and other loss impacts were not adequately incorporated, sources said.

-

The Class A section of the bond has doubled in size, at lower pricing.

-

ILS is delivering “a growing contribution” to the group, according to CEO Cloutier.

-

The firm has rotated capital in sidecar Voussoir toward direct investor relationships.

-

The NCIUA had initially sought $350mn of limit.

-

DaVinci equity plus debt stood at $3.25bn as of 31 December.

-

The carrier increased premium by 7% at the January renewals.

-

There was a slight increase in DaVinci and Fontana from 31 December 2024 to 1 January 2025.

-

The firm reported record fee income of $128.2mn in 2024, up 26%.

-

The state-backed carrier has $2.1bn of Alamo Re cat bond coverage.

-

Hurricane Milton accounted for 60% of the firm’s Q4 large loss tally.

-

The carrier expects the market loss to land at $35bn-40bn.

-

The firm ceded $417mn of premiums to the sidecar in 2024.

-

UCITS fund diversification targets limit their capacity for US wind bonds.

-

The conglomerate reported after-tax cat losses of $1.2bn related to Hurricanes Helene and Milton in 2024.

-

Pricing fell by 13.5% on a weighted average basis across deals that updated last week.

-

Several Florida start-ups are poised to begin writing business this year.

-

Modest increases to reinsurance costs were partly offset by the Australia cyclone pool.

-

The investors are led by PE firm NMS Capital Group.

-

Wildfire loss ‘serves as a strong reminder not to unwind hard-fought for rates and terms’, the executive said.

-

Scrocca will be based in Bermuda on focus on underwriting and risk sourcing, among other things.

-

A higher loss quantum will put a greater burden on retro programmes.

-

The estimate is net of its per-occurrence reinsurance program and gross of tax.

-

The aim is to capitalise on cat bond market’s robust growth and US peril concentration.

-

New limit of $474mn entered the market across two deals.

-

The Class B segment of the bond has priced below initial guidance.

-

Wildfire is rarely singled out as an exposure that can shift portfolio outcomes.

-

The bond provides coverage for storms, earthquakes and severe weather events.

-

Two ILS funds featured in the top five asset-raisers within the index.

-

The fall marks this the first time in 20 years the index has been negative in January.

-

The firm will match segregated accounts of portfolios to investor mandates.

-

The deal is being issued through Lloyd’s London Bridge 2 PCC.

-

The combined entity ranks third in the Insurance Insider ILS leaderboard.

-

Liquid alternative strategies accounted for around $1.4bn of the total.

-

The LA fires ‘demonstrate the magnitude of tail events not well captured in modelling’.

-

The role at PCS included acting as primary touchpoint for ILS.

-

The carrier’s reinsurance premiums ceded rose by 32% to $3.4bn in 2024.

-

The departures include North American Arcas head Alex Orloff.

-

Neuberger Berman’s AuM stood at $3.2bn as of 1 January 2025.

-

The bond is likely replacing the 2021-1 Class F bond, which matured in December.

-

AuM remains generally flat at UCITS funds over the weeks since LA fires started.

-

The bond will provide coverage for named storms in North Carolina.

-

The executive has also worked for Guy Carpenter during her 20-year career.

-

American Integrity is seeking expanded limit on more favourable terms.

-

FY24 disclosures show shifting fortunes at reinsurer ILS platforms.

-

Over 2024, four hurricanes added 13 points of cat-loss impact to the combined ratio.

-

But cat bonds are experiencing negative secondary market price movement.

-

Tower Hill secured $400mn of Winston Re limit in 2024.

-

Bolding will focus on aligning Gallagher Securities with Gallagher Re.

-

The carrier is likely to exceed its Q1 large-loss budget due to the California wildfires.

-

The reinsurer has cut the cession rate to 33% from 40% last year.

-

The group ceded 55% more premium to Nephila over the year at $1.3bn.

-

The sponsor secured $100mn limit last year, paying a multiple of 8.3x.

-

The value of its investment in RenRe stood at $330.4mn as of 30 June 2024.

-

The restructuring arrangement is designed to protect creditors.

-

Programs did not offer adequate risk-adjusted return.

-

Shreeve’s role will encompass the Aon Captive & Insurance Managers’ ILS business.

-

Capital inflows, notably into UCITS funds, and accumulated returns supported issuance of $17.2bn in 2024.

-

Theokli joined the company in 2021 as a senior underwriter.

-

The deal priced below guidance for the Class A and Class B tranches.

-

The carrier previously raised $125mn via an Ocelot Re cat bond in 2023.

-

The Integrity Re bond is structured into five tranches.

-

The deal has upsized by around 64% compared with the initial target.

-

The offering is a collaboration with Generali and parametric carrier Descartes.

-

Barthelemy Thomas joins from PartnerRe Capital Management in Zurich

-

The reinsurer added two new tranches to its 2025 issuance.

-

Peril- and geography-specific deals are being well received by investors.

-

A negative January return will be unprecedented for ILS industry.

-

The index delivered a total return of 1.29% for the month of December.

-

The carrier has around $2.5bn-$4bn of reinsurance cover specifically for California risk.

-

Axis Capital’s fee income from strategic capital partners grew 39% to $85mn in the year to 31 December 2024, up from $61mn the year prior, the firm’s Q4 earnings release said.

-

The bond went on watch after Mercury said it would exceed its $150mn retention.

-

Models will need to steepen the curve in the tail to reflect severe event frequency.

-

Company touts growing investor demand for Asian cat risks.

-

Non-proportional business accounted for 34% of its total.

-

Both the Class A and Class B notes increased in size.

-

The latest issuance will add extra cat bond limit, with a $100mn note still on risk.

-

-

The figure does not include specie or auto losses.

-

Secondary pricing on the carrier’s Topanga Re bond partly recovered following the guidance.

-

The platform will transform ILS transactions on behalf of Jireh and SRS clients.

-

The firm will advise and support third-party risk capital providers.

-

The carrier also has a $500mn excess $2.4bn aggregate protection.

-

The (re)insurer recorded a reserve charge of nearly $1.3bn within its casualty insurance book.

-

The platform will match partner capital to provide capacity for reinsurance placements.

-

PFZW’s insurance allocation stood at $8.7bn as of year-end.

-

He joins from Pillar Capital and will be based in Bermuda and New York.

-

Fermat stayed in the top spot surpassing $10.0bn for the first time.

-

Secondary market pricing indicated anticipated California wildfire losses.

-

Graeme Bell (pictured) will continue in his role as group legal officer.

-

The reinsurer has issued updated pricing for the instrument.

-

Theo Norris joins from Gallagher Re, which brokered one of the first 144A cyber cat bonds.

-

The reinsurer has made improvements to its life and health segment, it said.

-

The industry loss number has increased threefold from an initial $5bn pick.

-

The carrier’s Milton loss came in below expectations, but its fire claims will be “material” in Q1.

-

Losses from the larger fire will amount to $20bn-$25bn, the modeller said.

-

Severe convective storms accounted for 41% of last year’s insured loss load.

-

Two 2021 worldwide aggregate ILW notes are also among the markdowns.

-

The carrier can claim separately for the Palisades and Eaton fires if necessary.

-

The bond is split into five tranches, with two notes offered on a zero-coupon basis.

-

Price guidance for the bond is 7.00%-7.75%.

-

The former Credit Suisse ILS head Niklaus Hilti said working on life buyout hedges could rejuvenate the life ILS market.

-

The carrier has received more than 3,600 claims from LA wildfires.

-

The bond is likely replacing the 2021-1 Class F bond, which matured in December.

-

The fund returned 15.69% in calendar year 2024.

-

Kusche and Rosenberg will co-lead the firm’s global ILS business.

-

This comes after the firm’s distribution partner GAM has had a challenging few years.

-

A $30bn industry loss would use one-third of Big Four’s 2025 cat budgets.

-

ILS managers expect the losses to have some impact on future cat bond spreads.

-

The reinsurance attaches at $7bn, unchanged for the past two years.

-

Prominent Name Dhruv Patel is the firm’s founder.

-

The strategy launched on 1 January, winning mandates from several investors

-

As fires still rage, many fear early $10bn-$20bn estimates were too optimistic.

-

The ILS and reinsurance broker was established last October by Raj Jadeja.

-

Amin Touahri spent five years in a variety of roles at Munich Re.

-

The 2024 loss figure exceeded that of the previous record of C$6.2bn in 2016.

-

The Palisades fire is estimated at $9bn-$12bn, while Eaton is $6bn-$8bn.

-

Aetna, Inigo and GeoVera were the three sponsors seeking lower multiples.

-

The index’s performance in November was stronger than the prior year, although YTD returns are behind 2023.

-

Compressed cat bond spreads could drive some rebalancing, as M&A remains a prospect.

-

Investigators are homing in on the likely causes of the incidents.

-

The company’s stock price has plummeted in the wake of the LA wildfires.

-

AM Best said it expects insured losses from the California wildfires to be “significant”.

-

The vehicle is smaller by 8% as White Mountains’ participation grew.

-

The reinsurer is seeking annual aggregate cover against earthquakes and second-event named storms.

-

The sponsor has expanded its target deal size compared with a year ago.

-

The first cat bond deal from the carrier achieved its target size of C$150mn.

-

Hurricane Milton resulted in the largest insured loss of the year at $25bn.

-

The reinsurer is seeking index-based cover for a wide scope of perils and territories.

-

The deal is split into two tranches compared with the single note issued last year.

-

The renewal marks the seventh issue of the retro vehicle.

-

The new agreement provides $40mn of aggregate limit excess of zero.

-

Cat bond investors have earned a cumulative 39.6% over 2023 and 2024.

-

The carrier said reinsurance was a key component of its “low-volatility strategy”.

-

Novelty premiums will likely fade once investors are more comfortable with the risk.

-

The vehicle is yet to recover to 2021 levels of $235mn.

-

Spread guidance anticipates a lower multiple compared to 2024’s Vitality Re issuance.

-

The forecasts anticipate a large volume of maturities and rising sponsor demand.

-

In the US, pricing fell by 6.2% at the major renewal.

-

The manager’s Interval Fund returned 28.25% over the financial year.

-

Nicole Chase was central to the build-out of Mt Logan while at Everest.

-

The largest non-US event in 2024 was the catastrophic flooding in Valencia.

-

Cat bonds were a key supply-side driver at 1 January 2025.

-

Investment in the space comes mainly from the cat bond market, Gallagher Re said.

-

The broker anticipates strengthening investor demand for collateralised re.

-

Over-subscriptions have been evident on well-priced US cat treaties.

-

The Bermuda based entity is expected to continue on its “responsible growth trajectory”.

-

Increased reinsurance capacity was more than sufficient to meet continued growth in global demand.