Insurers

-

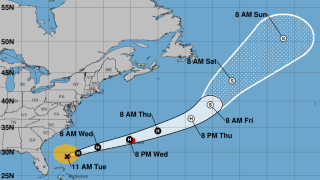

An “extraordinary” proportion of storms reached Category 5 status this year.

-

Demand for top layer coverage may also need to be supported by underlying market growth.

-

The peril has been historically difficult to model compared to others.

-

Insurers with SCS exposure reaped fewer benefits but still improved over Q3 2024.

-

Japanese firm MS&AD acquired 80% of ILS manager Leadenhall Capital Partners in 2019 from another affiliate.

-

The charity said that improved ecosystems could help protect from disasters.

-

Widespread underinsurance and low exposures will limit losses.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

Economic losses from the Cat 5 storm could run 30%-250% of the country’s GDP.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

Competition on price from traditional markets is weighing on bond market momentum.

-

The storm could bring flooding to Jamaica, Cuba and Haiti.

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

Newsom has yet to sign a pending bill to create a public cat model.

-

Winds have strengthened to 80 mph, and the hurricane is expected to intensify further over the next 48 hours.

-

The hire comes as Guy Carpenter fills the void created by the Willis Re raid earlier this year.

-

Deals would need to be sized at $50mn plus for transfer to capital markets.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

Vantage Group Holdings received a BBB- long-term issuer credit rating.

-

The tech firm is building a joint stock company with insurers and investors.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.

-

Syndicate 1440 was approved to assume business incepting January 2026.

-

The data modeling firm said losses previously averaged $132bn annually.

-

The violations included not using propertly appointed adjusters and failing to pay claims.

-

After the LA wildfires in Q1, carriers got some relief in Q2 ahead of wind season.

-

The ILS play will make the business more capital efficient under new owner Sixth Street.

-

The group claims the White House is undermining disaster preparedness.

-

Property MGA Arden Insurance Services specialises in multi-family habitations.

-

The company plans to launch in New York and New Jersey next year.

-

The estimate covers property and vehicle claims.

-

The carrier posted its H1 results earlier today, beating analyst consensus.

-

The company also purchased $15mn of SCS parametric coverage.

-

The reinsurance CoR fell 2.3 points to 79.5% while the primary CoR rose 4.7 points to 98.7%.

-

Scor's CEO said the P&C market had experienced a “competitive” first half.

-

Nationwide will delegate management of the policies to Ryan Specialty.

-

Mercury’s recovery from the guaranteed percentage of losses is $47mn.