ILS

-

PoleStar Re Ltd 2026-1 includes three sub-layers, which run for a three-year term.

-

There are various routes for ILS managers wanting to access the diversity of Lloyd’s underwriting.

-

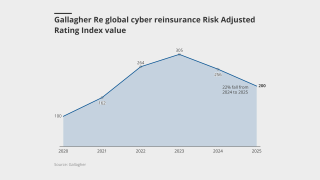

The firm anticipates potential growth in cyber cat ILS similar to property cat ILS post-2005.

-

Fontana 2.0 will encompass a more flexible investment strategy than the 2022 vehicle.

-

The venture will launch in early 2026 and include captives, ART, cyber ILS and specialty (re)insurance elements.

-

Growth included a $240mn increase in partner capital in DaVinci equity plus debt.

-

The firm said this was due to planned returns of capital to ongoing investors.

-

Some experienced investors are pivoting out of cat bonds and into the top layers of private ILS deals.

-

O’Donnell believes RenRe is well positioned to produce longer-tail risk to third-party investors.

-

Investor interest is warming up following a colder spell over the past several years.

-

While rates have “definitely come down,” they were coming off a high base, Rachel Turk said.

-

ILS has been a driver of innovation in reinsurance, Convergence 2025 attendees heard Wednesday.

-

Mory Katz joined the broker earlier this year.

-

The funds will combine credit and ILS holdings.

-

Ryan Saul will work at Ledger’s broker-dealer subsidiary Ledger Capital Markets.

-

The allocation is around 3% of the fund’s total assets.

-

Sources have said $1bn+ of fresh capital from the region is expected to be deployed in 2026.

-

Improved performance and growing investment returns played a role in the upgrade.

-

The figure comprises 5.48% of insurance discount margin and 3.96% of risk-free rate.

-

Bellal Rahman joins from Catalina Life Re, where he was head of finance for two years.

-

The ILS services specialist has worked in the ILS market in Bermuda for 10 years.

-

Charles Mixon joined the firm a year ago in a business development role.

-

The resource was developed by leading ILS managers and investors.

-

The CEA had $19.3bn of claim-paying capacity as of 31 July.

-

The ILS manager has $6.8bn in assets and will be led by MariaGiovanna Guatteri.

-

The sidecar will support five programs providing specialty frequency coverages.

-

Axa IM’s acquisition by BNP Paribas was confirmed in July this year.

-

ILS executives talked pricing, capacity and opportunities in casualty at an ILS roundtable in Monte Carlo.

-

Arch set up Bermuda investment manager Arch Fund Management in February.

-

The syndicate is targeting capital allocation for 1 January, the company confirmed.

-

Hannover Re Capital Partners is in talks with two investors for 1 January launch.

-

The leadership’s commentary spotlighted to value of ILS to the group.

-

The volume of property cat aggregates placed grew 50% in 2025.

-

The target allocation to Munich Re, Elementum and the run-off AlphaCat funds fell in the year to 30 June 2025.

-

Bohm has held senior roles at BMS, Swiss Re and Aon during his career.

-

The investment bank had stopped offering ILS services last September.

-

Funds encompassing private ILS outperformed cat bond strategies in July.

-

Aspen Capital Markets earned $169mn in fee income in 2024 alone.

-

The CUO has added the role of head of private ILS, joining the executive team.

-

Aaron Garcia will hold a senior role at the operation, sources have confirmed.

-

The vehicle will support Platinum Specialty Underwriters, XPT Group’s MGA underwriting unit.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

The firm’s ILS vehicles posted low single-digit growth in assets under management in Q2.

-

The ILS Advisers Fund Index reported a profit of 1.11% in June.

-

The firm attributed a 9% drop in reinsurance NWP partly to higher cession rates.

-

The merged business of Twelve Securis ranked third among ILS managers for AuM, behind Fermat and RenRe.

-

The consultation period around UK ISPVs was opened in November last year.

-

He replaces Andrew Hughes, who held the role since 2021.

-

The carrier reported preliminary profits of EUR2.1bn, driven by “very low” major-loss expenditure in P&C re.

-

Canio spent over 19 years with PGGM, with nine of those managing ILS.

-

Managers believed end-investors value diversification and non-correlation of cat bonds over liquidity.

-

Cat bonds remain attractive for investors seeking risk-adjusted return and diversification.

-

Matthew Towsey has spent 14 years at Aon.

-

The PRA will also have to report on turnaround time for new approvals against 10-day and six-week targets.

-

We discuss progress in collateral management with our Outstanding Contributor winner.

-

The Diversified Alternative Fund’s allocation to cat bonds was up by 31% from $386mn at 31 January.

-

The Bermudian ILS manager has recently changed its name from Mereo Advisors.

-

The fund’s ILS portfolio is split between 70% property cat and 30% cyber risk.

-

The investment consultancy said yields increased in Q2 by less than could have been expected.

-

The Cayman Islands-domiciled SPI now has four institutional backers.

-

The third-party capital manager is a new entrant to the retro space.

-

The total return for the Swiss Re Global Cat Bond Index stood at 0.61% for the month.

-

-

Twelve Securis is now a challenger for the top spot on the Insurance Insider ILS leaderboard.

-

The pensions scheme’s existing ILS holdings to Aeolus and HSCM are in run-off.

-

M&A and shifts in distribution arrangements bring risks and opportunities.

-

The fund lists Twelve, Swiss Re and Cambridge Associates as managers.

-

Harry White has been with Verisk for 14 years, while Ted Gregory has been with PCS for 12.

-

John Kulik will work within Ledger’s broking team, Ledger Investing.

-

Investors eyeing private ILS include opportunistic allocators keeping watch on storm season.

-

The man is alleged to have conspired with others to falsify LOCs and collateral letters.

-

The latest update brings the agency’s combined estimate for Milton and Helene to $32.4bn.

-

Lyon joins the reinsurance broker from law firm Skadden, Arps, Slate, Meagher & Flom.

-

ILS offers efficient capital for underwriters, but casualty ILS transactions are complex.

-

Property cat XoL rates were off by around 10% on average on a blended risk-adjusted basis.

-

The Swiss pension fund has not disclosed an ILS allocation before.

-

The pension plan has been allocating to ILS since 2005.

-

Some assets in the Medici Fund were transferred to a new UCITS strategy.

-

Berkshire Hathaway lost market share but remained the largest traditional reinsurer, our study shows.

-

Fales will focus on creating investment opportunities for the carrier’s specialty reinsurance portfolios.

-

The platform is based in Bermuda and will focus on strategic capital partnerships.

-

Sources believe the market will grow gradually over years after its initial cluster of dealmaking.

-

Investors want transparency from managers regarding the impacts of climate change.

-

Commutations need to be optimal for the sponsor and the investor to avoid sponsors taking back chunky risks.

-

The CEO said private ILS funds can generate additional returns of 10%-20%.

-

The renewal and upsizing of the Trouvaille E&S sidecar highlighted the market’s potential.

-

Private ILS would benefit from extension spreads to manage investor concerns, the CEO argued.

-

The ILS manager also swung to an operating profit after posting a loss in Q1 2024.

-

The casualty ILS business now has $175mn in capital.

-

This year’s ceremony will include the inaugural Women in ILS Award presentation.

-

The carrier increased its cession by around 13% year over year.

-

He joined what was then Credit Suisse ILS in 2019, moving from Hiscox Re & ILS.

-

Fellow Swedish pension fund AP3 is phasing out its ILS allocation after being active in the sector since 2008.

-

He joined Nephila in 2023 from Lancashire as a senior underwriter.

-

Gokul Sudarsana has been with the company since 2020, having joined from Deloitte.

-

The Swiss rail pension scheme has been cutting its ILS allocation since 2018.

-

Suzanne Wells is also joining the company from Arch as COO.

-

The asset manager has hired Rom Aviv as head of ILS.

-

LA wildfire-exposed ILS positions experienced further declines.

-

Recent transactions on the platform include cat bonds from Flood Re and Brit.

-

The ILS segment is not ready to gloss over loss-heavy years in renewal discussions.

-

Lara Martiner joined Allianz in 2011 as group legal compliance officer and legal counsel.

-

Industry sources estimate the market to be around $3bn.

-

The firm also promoted Devin Inskeep to an expanded role as SVP, head of ratings and advisory.

-

Guernsey’s TISE listed the world’s first private cat bond issued by Solidum Re in 2011.

-

Indirect exposure to cat risk through long-term investors gives Markel optionality.

-

Premiums ceded to the ILS vehicle increased by 76% to $433mn.

-

The reinsurer had taken the opportunity to buy more limit across event and aggregate covers.

-

ILS as a percentage of the pension fund’s total assets grew to 1.5%.

-

GP Affluent Markets will look to serve high-net-worth individuals.

-

The largest individual net loss at EUR230mn was caused by Hurricane Milton.

-

The UK listed investment manager has almost doubled its ILS allocation since April last year.

-

Tom Fealey has assumed lead portfolio manager responsibilities.

-

There is the potential for cat bond H1 issuance to be a record breaking six months.

-

The scope of QRT’s new ILS strategy will include cat bonds and private ILS.

-

The role oversees the $187bn Canadian pension plan’s ILS allocation.

-

Dispersion of returns was high, with the range 0.87% to -3.71%.

-

The firm has rotated capital in sidecar Voussoir toward direct investor relationships.

-

The firm reported record fee income of $128.2mn in 2024, up 26%.

-

Modest increases to reinsurance costs were partly offset by the Australia cyclone pool.

-

Insurance Insider ILS revealed last week that the executive was leaving Property Claims Services.

-

The loss aggregator has classified the fires as two separate events for reinsurance purposes.

-

Wildfire is rarely singled out as an exposure that can shift portfolio outcomes.

-

Two ILS funds featured in the top five asset-raisers within the index.

-

The firm will match segregated accounts of portfolios to investor mandates.

-

The combined entity ranks third in the Insurance Insider ILS leaderboard.

-

Liquid alternative strategies accounted for around $1.4bn of the total.

-

The role at PCS included acting as primary touchpoint for ILS.

-

The departures include North American Arcas head Alex Orloff.

-

Neuberger Berman’s AuM stood at $3.2bn as of 1 January 2025.

-

FY24 disclosures show shifting fortunes at reinsurer ILS platforms.

-

Bolding will focus on aligning Gallagher Securities with Gallagher Re.

-

The group ceded 55% more premium to Nephila over the year at $1.3bn.

-

The value of its investment in RenRe stood at $330.4mn as of 30 June 2024.

-

Derrick Easton has led Willis’s US ART team since joining the company in 2015.

-

Shreeve’s role will encompass the Aon Captive & Insurance Managers’ ILS business.

-

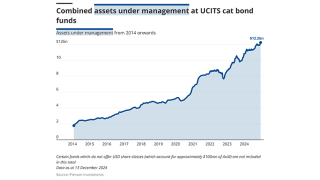

Capital inflows, notably into UCITS funds, and accumulated returns supported issuance of $17.2bn in 2024.

-

The offering is a collaboration with Generali and parametric carrier Descartes.

-

Peril- and geography-specific deals are being well received by investors.

-

A negative January return will be unprecedented for ILS industry.

-

The index delivered a total return of 1.29% for the month of December.

-

Axis Capital’s fee income from strategic capital partners grew 39% to $85mn in the year to 31 December 2024, up from $61mn the year prior, the firm’s Q4 earnings release said.

-

The bond went on watch after Mercury said it would exceed its $150mn retention.

-

Non-proportional business accounted for 34% of its total.

-

-

The platform will transform ILS transactions on behalf of Jireh and SRS clients.

-

The firm will advise and support third-party risk capital providers.

-

The platform will match partner capital to provide capacity for reinsurance placements.

-

PFZW’s insurance allocation stood at $8.7bn as of year-end.

-

He joins from Pillar Capital and will be based in Bermuda and New York.

-

Fermat stayed in the top spot surpassing $10.0bn for the first time.

-

Theo Norris joins from Gallagher Re, which brokered one of the first 144A cyber cat bonds.

-

The former Credit Suisse ILS head Niklaus Hilti said working on life buyout hedges could rejuvenate the life ILS market.

-

The fund returned 15.69% in calendar year 2024.

-

Kusche and Rosenberg will co-lead the firm’s global ILS business.

-

This comes after the firm’s distribution partner GAM has had a challenging few years.

-

Several new awards are up for grabs at this year’s event.

-

The strategy launched on 1 January, winning mandates from several investors

-

The ILS and reinsurance broker was established last October by Raj Jadeja.

-

Amin Touahri spent five years in a variety of roles at Munich Re.

-

The index’s performance in November was stronger than the prior year, although YTD returns are behind 2023.

-

Compressed cat bond spreads could drive some rebalancing, as M&A remains a prospect.

-

The ILS manager analysed 16 UCITS fund portfolios to compare risk levels.

-

The renewal marks the seventh issue of the retro vehicle.

-

Cat bond investors have earned a cumulative 39.6% over 2023 and 2024.

-

Novelty premiums will likely fade once investors are more comfortable with the risk.

-

In the US, pricing fell by 6.2% at the major renewal.

-

The manager’s Interval Fund returned 28.25% over the financial year.

-

Nicole Chase was central to the build-out of Mt Logan while at Everest.

-

Investment in the space comes mainly from the cat bond market, Gallagher Re said.

-

The broker anticipates strengthening investor demand for collateralised re.

-

The firm has commenced writing collateralised retro and reinsurance but its rated launch is still pending.

-

The broker estimated ILS capital has reached $107bn.

-

The UCITS cat bond segment has added 54% in AuM since Hurricane Ian.

-

Casualty ILS made inroads, while hurricane hedging strategies came into focus.

-

The $600mn fund could allocate up to 10% of assets to cat bonds from 2025.

-

Initial spread guidance for the three-year bond is set at 425-500bps.

-

The firm will also act as sub-adviser to the Brookmont ETF cat bond fund.

-

The company no longer has any exposure to reinsurance contracts.

-

Everest is in the process of transforming its ILS offering.

-

Full year 2023 set the record to beat of $15.8bn in new issuance volume.

-

The Swiss-based team of Siglo has transferred to Cambridge Associates.

-

The former co-head of ILS at Schroders left the bank last month.

-

The state insurer is budgeting for an extra 43% of overall coverage in 2025-26.

-

Magnani has served for more than 14 years in ILS broking roles.

-

The ILS manager will “pragmatically accept” a degree of credit risk in deals.

-

Former ILS investors who left the space have looked again and re-allocated.

-

The scheme’s ILS allocation has held steady at 0.7% of the total fund.

-

The ILS manager’s existing Medici cat bond strategy stood at $1.68bn in assets under management (AuM) as of 30 September.

-

The 2025 target would be ~25% larger than the $3.56bn it placed for 2024.

-

Management track record has been a factor in capital raising for 2025.

-

Robert Salzmann has been with the Swiss Re insurer for a decade.

-

The firm is understood to be reviewing contracts to bind coverage for 1 January.

-

Losses from Hurricane Milton are expected to affect only select junior structures.

-

The fund will invest in listed and private transactions.

-

Moderate impacts to ILS returns are anticipated from Hurricane Milton.

-

The headline figure of $7.72bn includes $3.11bn of DaVinci equity plus debt.

-

Shareholders are voting to approve being wound up on 18 December.

-

Strong growth in fee income builds on the favourable rating environment.

-

The consultation period closes on 14 February 2025.

-

The ILS unit’s AuM was higher by $100mn compared to $1.9bn as of 30 June.

-

The fund will be denominated in US dollars and digital currencies.

-

The capital being returned to shareholders is part of a compulsory partial redemption.

-

The new funds will target the US wealth market through financial professionals.

-

The failure of a Jamaica bond to pay out following Hurricane Beryl damage has brought focus onto the deals.

-

Daniel Ineichen, former co-head of ILS, had been with the company for nearly two decades.

-

The firm sees a "robust" pipeline of potential investors ahead of the renewals.

-

In its first deal, Enstar received $350mn in premium for certain 2019 and 2020 business in AlphaCat’s portfolio.

-

Michael Rich left the portfolio management role in May.

-

The firm will provide an update on 22 November to avoid holiday season.

-

September was the strongest performing month since the index began in 2006.

-

The low PCS number is presenting a challenge for ILW buyers and sellers.

-

Nephila revenues would likely have been higher, but for an ‘elevated climate signal’ this year.

-

The pension scheme has been winding down its ILS portfolio in recent years.

-

Reserve risk specialist Enstar has struck its first deals in the ILS space this year.

-

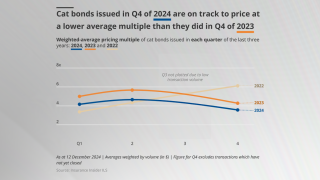

Pricing is expected to “stay neutral of soften” for January renewals.

-

The sovereign wealth fund’s ILS investments grew to $828mn.

-

Cat bonds, private ILS and retro were all kept at “strongly overweight”.

-

The ILS allocation increased in dollar terms and held steady in euros.

-

Many in the ILS sector are bullish on Milton losses falling at the lower end of earnings impacts.

-

Post-Milton investor interest in ILS has yet to translate into dollars allocated.

-

Losses from the hurricane may not significantly impact on many funds’ annual returns.

-

Risk remote strategies, including private ILS, have outperformed higher risk strategies over the last decade.

-

The Dutch scheme is the largest ILS allocator with a long list of mandates within the sector.

-

The manager’s ILS allocation now spans six of its seven investment funds.

-

The ILS industry alumnus is understood to have two ILS investors lined up.

-

Hurricane Milton will show the ILS product behaving as investors expect it to.

-

A client presentation from the broker put total insured losses at $25bn-$40bn, leaving the Citizens and the National Flood Insurance Programs clear of reinsurance impacts.

-

A $40bn Milton loss should barely dent many ILS returns but will trap some capital.

-

Integrity Re 2024-D and Lightning Re 2023-1A are two bonds that were marked down, although no trading has occurred.

-

Collateralised reinsurance and retro are in the firing line.

-

The panelists discussed the ILS reset and the path to maintaining discipline in this sector.

-

The class of 2023-24 cat bond funds will grow existing investors and add new ones.

-

The executive has worked for Hamilton for over a decade.

-

Richard Pennay will become CEO of Aon Securities.

-

The firm’s new name is inspired by 18th Century Swiss mathematician Leonard Euler.

-

The performance marked the best August for ILS since the index incepted in 2006.

-

The biggest limitation to growth is supply, given ILS capital “reticence” after the 2016-22 years.

-

Maya Henry will be tasked with raising capital and managing clients in North America.

-

The facility will provide reinsurance coverage over three underwriting years.

-

The ETF format provides for publication of a daily NAV.

-

The broker replaces Goldman Sachs on the business after the bank ceased offering ILS services.

-

Chris Caponigro will be responsible for expanding Axa XL’s product offering and investor base.

-

Brokers expect strong competition at remote risk layers at the 1 January renewal.

-

A strong forward pipeline will require fast work by ILS investment houses.

-

The deal freed up capital held against deals written in 2019 and 2020.

-

The ILS industry offered 11 points of merit that justify cat bonds being eligible for UCITS funds.

-

In an amended complaint, the ILS manager claims A-Cap has exerted control beyond its equity interests.

-

AI’s ability to analyse vast datasets will help in matching risk to capital.

-

Most of the ILS capital was attracted to the cat bond market.

-

ILS brokers are pitching for Sanders Re and ResRe transactions.

-

Cat bond funds continue to draw interest as private ILS more challenged.

-

The Brian Duperreault-led reinsurer start-up has secured a cornerstone investor and aims to have an ILS fund running from day one.

-

Sluggish progress on competitiveness means ILS deals are transacted elsewhere.

-

-

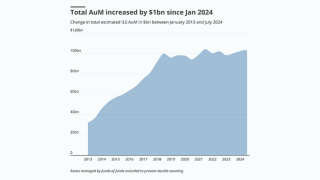

Growth was driven by increased earnings and capital inflows.

-

The broker said it expects strong ILS capital inflows to continue.

-

-

The deal will boost the investment consultancy’s ILS capabilities.

-

The firm’s deals so far have covered cat risk, with space ILS in scope for the future.

-

The subject business of the deal is Ascot’s ~$1bn property portfolio.

-

Growth was driven by strong returns and new investors entering the market.

-

The executive has worked for Scor, RMS, Aon and SiriusPoint, among others.

-

Building better exposure datasets could draw a broader range of investors.

-

-

Quick-moving cat risk trading may become more prevalent in the ILS market.

-

The James River-Long Tail Re deal is the latest example of deal-specific investor capital.

-

The timing is “opportune” to start the strategy according to Bennelong.

-

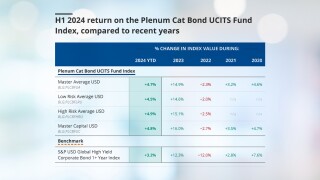

Returns were down on 2023, which benefited from favourable Ian loss development.

-

Winning higher-fee private ILS mandates will strengthen firms’ negotiating positions.

-

The firm predicts 2024 will be a record year for primary issuance.

-

The proportion of total fund assets invested in non-life ILS held steady at 0.6%.

-

The firms’ partnership preceded Japan's first ‘megaquake’ warning.

-

The losses were not passed through to the firm’s ILS business.

-

Sidecar vehicles are being tailored to match investors’ objectives.

-

-

The deal takes year-to-date cat bond lite issuance to $367.6mn

-

The carrier estimates the total industry loss for the Microsoft/CrowdStrike outage at around $1bn-$2bn.

-

The CEO cited ‘no change’ in appetite from a shift in the capital mix.

-

The executive explored ILS options as MD of hedge fund Horton Point post financial crisis.

-

Allocators are waiting for 2024 to pan out, according to Hiscox CEO Aki Hussain.

-

Fee income at the Re & ILS division grew by 58% to $44.3mn in H1.

-

The moves mark a major step in realising “trillion dollar” casualty ILS potential, according to Ledger Investing CEO Samir Shah.

-

-

ILS investors’ stress over Gibson Re is unlikely to inhibit legacy ILS’s future.

-

The deal will include Axa IM’s alternatives funds including ILS.

-

The insurer said once firms give up lower attachments or aggregates they “simply do not get them back”.

-

Insurance Insider ILS reported in June that the company had bought substantial ILW coverage.

-

The broker is yet to participate in a cyber cat bond.

-

The manager is looking to buy positions on the secondary market.

-

Schroders moves into fifth place in the Insurance Insider ILS leaderboard.

-

The deal announced in its Q2 results came as the carrier agreed a take-private deal.

-

Cat bonds, private ILS and retro are "strongly overweight".

-

The ILS manager leaderboard demonstrates the ongoing popularity of cat bonds.

-

The combined Twelve-Securis entity would be a top-five ILS firm currently.

-

The profile of the loss could provide comfort to investors around exposure diversification.

-

Urs Ramseier will be CEO and Herbie Lloyd CIO.

-

The sale is expected to be completed by the end of the year.

-

Aeolus increased its participation on the program more than fourfold.

-

Changes made will make it easier to compare the funds, said Albourne’s Michael Hamer.

-

-

Reinsurer-managers are building out asset management infrastructure as they expand.

-

Two-thirds of Guy Carpenter’s clients bought more coverage in H1.

-

The firm said the move would let it build a multi-vehicle capital management platform.

-

The ILS allocation has posted returns of 5.5% for the year to date.

-

The fund follows an earlier climate change-focused ILS initiative from the firm.

-

He left his role as portfolio manager at Hiscox Re & ILS last year.

-

-

This is lower compared to 8.2% recorded by the index in H1 2023.

-

Availability of ILS has so far fulfilled investor demand.

-

The latest Insider ILS Outstanding Contributor for the year said 2011 was an under-appreciated turning point for the market.

-

-

Benefits of ILS smart contracts include transparency and tradeability.

-

Curtis Dickinson will help to oversee the strategy and vision of Hiscox Re & ILS.

-

The broker is entering the Japanese market with a focus on ILS.

-

The manager’s ILS allocation has grown by 16% since 31 October 2023.

-

-

The broker estimated ILS capacity reached a record $107bn as cat bond interest surged.

-

The broker said high ILS maturities would boost cat bond issuance though the hurricane season would impact capital availability.

-

DeCaro is one of the cohort of pioneering ILS managers.

-

The 2024 winners were celebrated at The HAC in London on 27 June.

-

The broker said the mid-year reinsurance renewals benefitted from “more than ample” capacity.

-

The pension scheme’s holdings in ILS delivered varying returns in run-off.

-

The former Goldman Sachs VP has a background in ILS structuring.

-

ILS capital so far is viewed by sponsors as strategic rather than essential.

-

The Swedish fund AP2 invests in Fermat GAM, Elementum and Credit Suisse.

-

The Canadian pension plan’s investment rose to 1.2% of its total fund.

-

Sources said that Gallagher Re had ‘first mover’ advantage as the exclusive broker.

-

Amy Stern started her career as vice president of group reinsurance at Zurich Re.

-

The firm is the sole provider to offer index services in the US.

-

-

He will continue to play a role as a fund director and firm ambassador.

-

Former Teneo M&A head Alexander Schnieders will lead the unit.

-

Sub-1% management fee and performance fee-only structures have evolved in ILS.

-

The cat bond market was very active in April as spreads began to widen.

-

Tanja Wrosch joins Twelve after more than a decade at Credit Suisse ILS.

-

The Abu Dhabi investor is exploring options for fresh investments in (re)insurance and ILS.

-

The regulation now allows pension funds a more flexible benchmark for measuring alternatives.

-

Additional capacity for upper-layer coverage is driving rate reductions, the broker says.

-

The Canadian pension’s sole remaining ILS allocation is with Fermat.

-

Rich had spent 13 years at the firm where he began his career and oversaw a cat bond and ILS portfolio.

-

The Swiss Re veteran left her former employer last year.

-

Top layer competition is an added pressure on ILS firms, but the impact can be overstated.

-

The Sussex Capital ILS platform managed $440mn at its 2019 peak.

-

Traditional reinsurers such as Berkshire Hathaway and Arch pushed for more share, our annual study of Florida cessions shows.

-

CFO Dacey said ILS investors were not extrapolating too much emphasis from strong returns in 2023.

-

The capital will be allocated to a pure cat bond strategy, sources have confirmed.

-

The management’s buyback acquisition brings an end to the two-year relationship.

-

Spreads could continue widening throughout the rest of the year.

-

The sponsor was targeting between $850mn-$1.1bn of coverage in the latest mega-bond to hit the ILS market.

-

The capital will be deployed by Bermuda-based special purpose insurer Arachne.

-

The pension fund’s ILS allocation as of the end of 2023 was CHF300.3mn ($356.8mn).

-

The flat growth is a result of multiple forces influencing capital flows in both directions.

-

-

Parent company Markel said the ILS manager’s performance was subject to a reporting lag.

-

Operating revenue at the ILS manager climbed 49% to $19.2mn.

-

The firm’s AuM was down 17% on $1.8bn as of 31 December.

-

Various trends may work together to hold the cat markets up for longer than some had feared.

-

ILS could benefit from focusing on the social aspect of ESG.

-

State interference is likely to be required if an attack is large enough to trigger bonds now on the market, experts say.

-

Diversification in perils and regions can help the market grow.

-

Panellists at the Insurance Insider ILS conference say forecasts can push capital to “the edges” of the market.

-

The World Bank’s Michael Bennett was speaking at the Insurance Insider ILS conference.

-

The awards event will be held on 27 June at The HAC, London.

-

The consortium will offer up to $50mn of per-program capacity.

-

The deal will expand the region and perils covered by Merna Re bonds.

-

The ILS market’s exposure could grow to $1.5bn by the time a major cyber cat event occurs.

-

The fund has a strong focus on cedant quality and transaction structures.

-

The carrier currently has $1.15bn of Merna Re cat bond limit on risk.

-

The coverage will be indemnity, annual aggregate for Florida named storm.

-

Increased ILW purchasing reflects cash-rich funds looking to protect return levels.

-

ILS returned 3.2% for the scheme in the first quarter.

-

The new global bond fund can take a ‘marginal allocation’ to cat bonds.

-

Managers have tightened buffer terms and added extension spreads to enhance illiquid strategies.

-

The reinsurer said it hopes to grow the size of the $13.75mn deal over time.

-

The value of White Mountains’ stake in the ILS manager grew last year despite the firm shrinking its holding.

-

The fund is a continuation vehicle for five of HSCM's life insurance interests.

-

-

The firm, one of three major reinsurance fronts, said it would manage run-off in an orderly way.

-

The platform’s ILS holdings comprise cat bonds and UCITs funds, and were up 8% over January and February.

-

The pension fund handed an ILS mandate to Hiscox in September 2023.

-

Retained earnings resulting from reduced loss activity also helped to boost ILS capital.

-

The former Ledger director was joined by fellow ex-Ledger employees to “hit the ground running”.

-

Market conditions have begun to soften.

-

Modelling has taken a conservative approach over the last quarter of a century.

-

The firm said it was poised to build on ‘significant growth’ in 2023.

-

ILS returns in 2023 sparked a flurry of enquiries from hedge funds.

-

The partnership seeks to serve corporates with captives, Lloyd’s syndicates and ILS funds.

-

-

The broker said 1 April Japanese renewals reinforced positive trends in the US at 1 January.

-

The platform distributed ~$50mn to investors for 2023.

-

The fund will follow an existing Twelve strategy and add short-term corporate bonds.

-

The rise comes as competition has increased for ILS between jurisdictions.

-

Chris Parry said the denominator effect remains a suppressant on ILS inflows after a strong phase of returns.

-

A diverse investor base is among market characteristics seen as important for growth.

-

The firm is focusing on developing specialty offerings.

-

Risk partnerships will now report direct to the board through the CFO.

-

The Guernsey legacy carrier is working with an independent valuer.

-

Managers are hoping strong returns in 2023 will aid capital raising efforts.

-

Pockets of new capital will not shift pricing at mid-year.

-

-

-

The ILS executive will head up structuring for the Americas.

-

Daniel Ineichen and Flavio Matter have been promoted to co-heads of ILS.

-

-

Some $415mn of capacity entered the market last year.

-

The pension fund was one of the first investors to use London Bridge.

-

It is only the second year in the last eight that the allocation grew.