Emerging risks

-

Fears relating to an economic downturn continue to dominate concerns.

-

The charity said that improved ecosystems could help protect from disasters.

-

Property MGA Arden Insurance Services specialises in multi-family habitations.

-

It is targeting $25mn GWP this year and $50mn GWP in 2025.

-

Praedicat CEO Bob Reville outlined the firm’s approach to "casualty cat" as liability risk modeling continues to mature.

-

The carrier is designing an investable portfolio of long-tail risk.

-

Insurance competition remains vibrant in some of the segments that remain most exposed to persistent risks highlighted by the flagship World Economic Forum report.

-

The broker said the risk from wildfire is also set to increase substantially.

-

The report outlined 17 recurring and emerging risks (re)insurers should be aware of.

-

The insurer can issue policies for mid-market clients in France, while its existing portfolio will still be serviced by the MGA.

-

The firm also hired Aspen’s Crystal Ottaviano as global risk solutions chief risk officer.

-

The property reinsurance market may be fast approaching a true ‘hard’ market, the broker said.

-

In his new role, the executive will work directly with Steve Tulenko, president of Moody’s Analytics.

-

The carrier has introduced a number of ESG-focused roles, which sees Cathal Carr, SVP, underwriting, appointed as global head of climate and sustainability strategy.

-

The incoming SVP joins from BMS Re, where she led the catastrophe analytics team for more than 10 years.

-

The company will use the funding to invest in new software hires and expansion in Hong Kong and Madrid.

-

Maya Bundt referred to cyber security threats as the “dark side” of proliferating digitalisation.

-

Megan Kempe is now based in Bermuda as senior vice president of emerging risks.

-

Lloyd’s report details how the Corporation will support carriers and their clients across the main themes of greener energy, industry and transport.

-

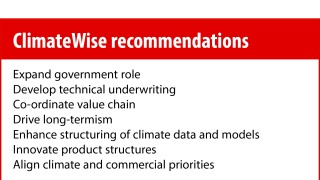

Public-private partnerships such as state-backed reinsurance pools can also enable a more “proactive” approach to climate innovation, the organisation said.

-

The insurers is to sever all ties with the German utility this year due to the size of its coal operation.

-

The broker forecast that this hard market may be more akin to the “discriminate and relatively short-lived" phase following 2005.

-

California blazes including the Glass Fire have driven up the estimate considerably since September.

-

The new guidance is the first update to Bermuda's SPI framework.