Vantage Risk is working to create an investable portfolio of longer-tail business, including excess casualty insurance, for investors looking to move beyond property cat, Chris McKeown, CEO, reinsurance, ILS and innovation, has told Insurance Insider ILS.

The firm has partnered with third-party investors since its launch in 2020 through its Bermuda cell company AdVantage, but the new casualty offering may use the investor’s own Class 3 Bermuda vehicle.

“This is a sophisticated investor with its own framework for investing in insurance and reinsurance. We think of it, all the same, as partnership capital,” McKeown said.

The executive said that the firm had consciously opted not to create a separately branded ILS manager to handle its third-party capital.

“The old model would have been to have a separate brand that did ILS. That can get confusing, with conflicting governance issues adding complexity. It takes on a different flavour of company that you’re running, versus insurance, reinsurance,” McKeown said.

The firm’s AdVantage offering drew “modest numbers of managed capital” in 2021 (AV1) and 2022 (AV2), with 2023 (AV3) being “where we hit the path,” he added. AV3 raised $1bn, of which around $900mn was deployed, with the focus on property cat reinsurance and retro.

[Having a separate ILS brand] takes on a different flavour of company

“On the back of that, the acceptance in the marketplace and outlook for 2024, we raised just over $1.5bn for AV4,” McKeown said.

He explained that the proposition of AV3 was built around a conviction that property cat should be written on a collateralised basis with clarity through the risk transfer chain as to return expectations and levels of capital supply.

Collateralised cat strategy

“AV3 wasn’t a question of taking business out of the balance sheet. We got out of the business on the balance sheet. We said, ‘this is the way to do property cat’, and we have a high level of conviction around that approach,” McKeown said.

“If we can’t sustain that thesis – in 2024, I feel like we can, which is why we raised money – but if we can’t, we’ll sit down with investors and talk about that. There is no question of shifting it back to the balance sheet,” the executive said.

We said, ‘this is the way to do property cat’, and we have a high level of conviction around that approach

The firm writes property cat only through AdVantage which, it says, offers good alignment with investors since there are no selection issues.

Reinsurers generally have argued that the way to demonstrate alignment with investors is to retain a slice of the risk themselves, offering a quota share of their book.

Vantage’s approach looks to align capital and risk by bringing greater visibility to partners in the chain around risk selection, return expectations and capacity flows.

The firm has invested in cloud-based analytics and processes that enhance transparency so that underwriters on the frontline and their clients can know what capital base is being used for their business and what the return expectations are.

McKeown added that this includes “telegraphing” through the chain any shift in capacities and return expectations. “You have to be very, very clear with what your expectations are,” he said.

Alignment through compensation

The executive won’t be drawn on the specifics of how it gets paid and its incentives to turn a profit for investors, but indicates that the cost of its investment in technology is part of the equation.

“I’m pretty agnostic to the structure of fees. We’ve invested a lot in technology, so we feel there are ways to be compensated, if investors see value in that,” McKeown said.

As a partnership capital model, “it’s not as if we have a fund that has subscriptions or redemptions, and you sign up and these are the terms and conditions”, he said.

“We haven’t set in stone a way to think about fees, except to sit down with the investor and talk about what their attitude is toward compensation, fees, and come up with something accordingly,” McKeown explained.

His view on the timeframe for partnership capital is that, typically, it has a one- to three-, to five-year window.

He added that the mechanisms for release of capital back to investors and for capital to exit have to be “very thoughtful on reserves and tail development, depending on line of business”.

“For the last five to 10 years, the investor experience was that we [as an industry] are not disciplined around managing capital, because it didn’t come back to them on day 366 of a contract,” the executive said.

On the casualty-specialty offering, the firm will look to build mechanics to bring back the reserve risk to its own platforms, “having written it to begin with. We already do it with property cat”. (While it largely stopped writing cat risk on its own balance sheet in 2022, the carrier does take tail risk back from its investors).

Demand-driven approach

McKeown emphasises the firm’s focus on demand-side drivers in shaping its strategy. He said that when reinsurance retentions spiked in 2023, the firm saw an opportunity in the mismatch between insurers’ ability to add rate on their inwards business and the new normal level of reinsurance pricing.

“We designed some aggregate covers for insurers, if they didn’t want to maintain that retention in each and every loss. If we can assess the risk and analyse it, we are willing to write those covers,” McKeown said.

Last year, its AV3 portfolio had relatively more hurricane and quake, and in 2024, demand is strong for convective storm coverage.

“If there is demand, and the counterparty wants to come up with a solution that fits to our portfolio, we’ll write it – aggregate covers, top and drop covers, straight occurrence covers,” McKeown said.

“There are still gaps in coverage in the traditional rated market, and still companies in the US suffering losses.”

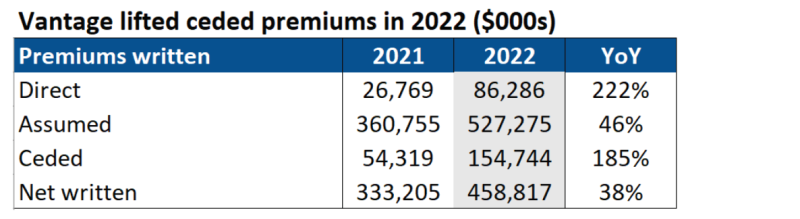

Vantage’s most recent regulatory filings in Bermuda show that its net written premiums grew by 38% to $459mn for full year 2022, compared to $333mn in 2021. The net loss narrowed by 45% to $39mn, from $71mn in the prior year.

The firm launched in 2020 with $1bn from lead investors Carlyle and Hellman & Friedman, with each owning about 48%, and smaller investors including management the rest.

It operates 10 businesses in 20 product areas, with insurance teams writing specialty, healthcare, political risk, construction, excess casualty, management liability, cyber and property. In reinsurance, it has four senior underwriters across property, emerging risk, specialty and credit.

Vantage’s Financial Strength Rating of A- (Excellent) was affirmed by AM Best earlier this month, reflecting the agency’s assessment of the group’s balance sheet as “very strong”.