AuM data

-

The fund will offer additional spread versus other similarly rated corporate debt.

-

The ILS AuM in its flagship cat funds rose 13% over the half year to $6bn as of 31 October.

-

The fund limits positions in aggregate structures exposed to secondary perils.

-

The Italian asset manager also plans to relaunch its multi-strategy ILS fund.

-

Growth included a $240mn increase in partner capital in DaVinci equity plus debt.

-

The reinsurer-linked manager now offers three ILS funds encompassing private ILS and cat bonds.

-

Third-party investors made a net income of $415mn in the quarter.

-

The award of the mandates marks the California public pension plan’s entry into ILS.

-

Returns from cat risk investments stood at 20.1% for the year to 30 June 2025.

-

The allocation is around 3% of the fund’s total assets.

-

The manager’s largest ILS holding is in the cat-bond-heavy High Yield fund.

-

Victory Pioneer Cat Bond Fund also added assets in the past month.

-

Reinsurers are confident on cat rates and ready to deploy ILS capital.

-

The merged business of Twelve Securis ranked third among ILS managers for AuM, behind Fermat and RenRe.

-

The fund was renamed from the Pioneer Cat Bond Fund.

-

The recommended “AIF lite” structure could be suited to cat bond lites.

-

The Diversified Alternative Fund’s allocation to cat bonds was up by 31% from $386mn at 31 January.

-

Twelve Securis is now a challenger for the top spot on the Insurance Insider ILS leaderboard.

-

The pensions scheme’s existing ILS holdings to Aeolus and HSCM are in run-off.

-

The fund lists Twelve, Swiss Re and Cambridge Associates as managers.

-

AuM in GAIA Cat Bond Fund had grown to $3.9bn as of 31 May.

-

The firm said it was the first time a UCITS cat bond fund passed the $4.0bn mark.

-

The fund was set up 18 months ago by cat bond investor Florian Steiger.

-

This followed a $650mn fall in April, after management change of the fund.

-

The Swiss pension fund has not disclosed an ILS allocation before.

-

Some assets in the Medici Fund were transferred to a new UCITS strategy.

-

The ILS manager’s total AuM increased to $2.2bn in 2024 from $1.7bn the year prior.

-

Fermat and GAM announced that the former will take sole control of the GAM FCM Cat Bond Fund.

-

January’s California wildfires meant third-party investors suffered a loss of $195.3mn.

-

The Swiss rail pension scheme has been cutting its ILS allocation since 2018.

-

The Swiss pension fund’s ILS allocation stood at 4.9% of the total fund as of 25 March.

-

Fees on the GAM Star cat bond funds will drop in May in a recognition of fee competition in the market.

-

Most of the ILS investments were made via the cat bond heavy High Yield Fund.

-

Many UK pension funds are over-funded and lack appetite for higher-risk, higher-yield products.

-

ILS as a percentage of the pension fund’s total assets grew to 1.5%.

-

The UK listed investment manager has almost doubled its ILS allocation since April last year.

-

The scope of QRT’s new ILS strategy will include cat bonds and private ILS.

-

There was a slight increase in DaVinci and Fontana from 31 December 2024 to 1 January 2025.

-

The firm will match segregated accounts of portfolios to investor mandates.

-

Liquid alternative strategies accounted for around $1.4bn of the total.

-

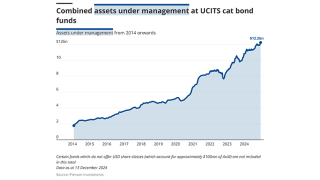

AuM remains generally flat at UCITS funds over the weeks since LA fires started.

-

FY24 disclosures show shifting fortunes at reinsurer ILS platforms.

-

The value of its investment in RenRe stood at $330.4mn as of 30 June 2024.

-

PFZW’s insurance allocation stood at $8.7bn as of year-end.

-

Fermat stayed in the top spot surpassing $10.0bn for the first time.

-

This comes after the firm’s distribution partner GAM has had a challenging few years.

-

The manager’s Interval Fund returned 28.25% over the financial year.

-

The Bermuda based entity is expected to continue on its “responsible growth trajectory”.

-

The UCITS cat bond segment has added 54% in AuM since Hurricane Ian.

-

The reinsurer said investors were interested in expanding after benefiting from good results.

-

Former ILS investors who left the space have looked again and re-allocated.

-

The scheme’s ILS allocation has held steady at 0.7% of the total fund.

-

The ILS manager’s existing Medici cat bond strategy stood at $1.68bn in assets under management (AuM) as of 30 September.

-

CEO Jonathan Zaffino said he saw opportunities for expansion in casualty.

-

The UCITS fund was launched in 2021 and invests in cat bonds and the money markets.

-

The headline figure of $7.72bn includes $3.11bn of DaVinci equity plus debt.

-

Strong growth in fee income builds on the favourable rating environment.

-

Daniel Ineichen, former co-head of ILS, had been with the company for nearly two decades.

-

Fee income fell by 42% to $25.1mn in Q3 over the prior-year quarter.

-

The pension scheme has been winding down its ILS portfolio in recent years.

-

The ILS allocation increased in dollar terms and held steady in euros.

-

The class of 2023-24 cat bond funds will grow existing investors and add new ones.

-

The firm’s new name is inspired by 18th Century Swiss mathematician Leonard Euler.

-

The deal freed up capital held against deals written in 2019 and 2020.

-

The ILS industry offered 11 points of merit that justify cat bonds being eligible for UCITS funds.

-

The deal takes year-to-date cat bond lite issuance to $367.6mn

-

Schroders moves into fifth place in the Insurance Insider ILS leaderboard.

-

The combined Twelve-Securis entity would be a top-five ILS firm currently.

-

More than 30% of the fund's AuM is allocated to US windstorm-linked bonds.

-

Sources said that Gallagher Re had ‘first mover’ advantage as the exclusive broker.

-

Sub-1% management fee and performance fee-only structures have evolved in ILS.

-

The Icosa Cat Bond Strategy now stands at $130mn in AuM.

-

Tanja Wrosch joins Twelve after more than a decade at Credit Suisse ILS.

-

The regulation now allows pension funds a more flexible benchmark for measuring alternatives.

-

Rich had spent 13 years at the firm where he began his career and oversaw a cat bond and ILS portfolio.

-

-

The capital will be deployed by Bermuda-based special purpose insurer Arachne.

-

Combined AuM of UCITS funds stood at $11.3bn as of 26 April 2024.

-

Over Q1, the loss ratio improved by 34.6 points year on year to 43.7%.

-

ILS returned 3.2% for the scheme in the first quarter.

-

The platform’s ILS holdings comprise cat bonds and UCITs funds, and were up 8% over January and February.

-

Fee income was up by 30% year-over-year to $136mn in 2023.

-

The fund will follow an existing Twelve strategy and add short-term corporate bonds.

-

Chris Parry said the denominator effect remains a suppressant on ILS inflows after a strong phase of returns.

-

Daniel Ineichen and Flavio Matter have been promoted to co-heads of ILS.

-

It is only the second year in the last eight that the allocation grew.

-

CEO Hussain said third-party capital in 2023 remained flat.

-

The firm’s assets under management dropped to $1.6bn, as a capital return more than offset new inflows.

-

Head of alternatives Gareth Abley believes the asset class remains attractive following a 16% return in 2023.

-

The outlook for M&A activity is brighter after 2023 returns.

-

The parent also expects the ILS platform’s AuM to grow.

-

The acquiring reinsurer will now run off the business.

-

-

The reinsurer’s assets under management rose 14% to $3.3bn.

-

Aside from the one-year view, 2023 remixes the track record.

-

The firm told investors yields in the cat bond market are 'still very attractive'.

-

The sidecars segment has been attracting inflows after returns hit a high note in 2023.

-

In its semi-annual report for the six months to 31 July 2023, the manager said the fund had returned 2.74% over the half-year.

-

The independent manager’s post-Ian growth has helped it more than double from prior estimated assets under management.

-

The Swiss Re Total Return Index climbed month-over-month throughout the year, to more than regain ground lost after Hurricane Ian in September 2022.

-

Nearly 90% of the fund’s allocation is in cat bonds, with a small allocation to other ILS securities and US Treasury Bills.

-

Broker-dealers' year-ahead forecasts have undershot total final issuance in three of the last five years.

-

Schwartz will set the firm’s investment process on its ILS, equity and debt strategies.

-

The asset manager’s flagship ILS funds posted stellar returns for its 2023 fiscal year.

-

The firm’s flagship reinsurance strategy delivered its best performance in its 10-year history.

-

The year brought a degree of closure on the loss-hit years of 2017-2021, while the outlook remains changeable for ILS managers.

-

Swiss Re Alternative Capital Partners assets under management hit $3.3bn as of 30 September.

-

The Australian sovereign wealth fund first allocated to the ILS manager in 2016.