-

Early private deals have provided far more stability in this year’s renewal than last.

-

Shifts in reinsurance appetite across the risk spectrum has squeezed out ILS providers in some cases.

-

Softening cat bond rates are among the bearish signals for cat rates, but latent new demand and still-cautious supply should prolong reinsurer gains.

-

Five counterparties account for almost half of all premiums ceded by a sample of major Floridian carriers, analysis shows.

-

The pace of rate hikes will ease back from the 1 January reset as buyers seek to lock up capacity early after last year’s dislocated renewal.

-

UBS previously explored setting up an ILS offering, but instead opted to offer other firms’ products.

-

The asset class is finding favour particularly with allocators that have been watching returns play out over the long-term horizon.

-

A trend for slightly riskier bonds has brought with it a rise in the absolute margin on offer.

-

The cat bond market is thought likely to receive an outsized portion of any capital inflows.

-

Beazley executives spoke of further growth prospects in the class, after its results revealed a 79% combined ratio for its cyber division in 2022.

-

A canvass of Lloyd’s market executives generated an expected combined ratio of 92%-93% for 2022.

-

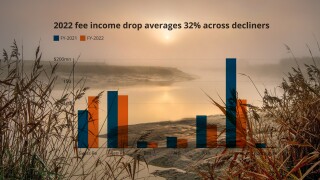

Reinsurer-owned ILS platforms were challenged to grow fee income in a tough year for nat cat losses and as cat market economics shifted.