US Southeast/Gulf

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

Economic losses from the Cat 5 storm could run 30%-250% of the country’s GDP.

-

The insurer of last resort currently has $2.15bn of cat bond protection on risk.

-

The tropical cyclone is expected to be named Imelda.

-

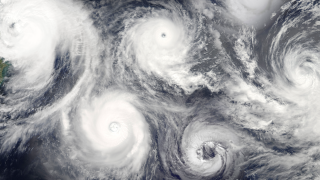

Despite the formation of Gabrielle, there is "a very high probability" of a below-average season.

-

State legislation has led to major strides in rate adequacy.

-

Category 4 and 5 storms could become more common and hit further north.

-

Despite predicting fewer hurricanes, the numbers are still above average.

-

PCS's loss estimate for the March Missouri SCS pushed the bond beyond its exhaustion point.

-

Most of the losses are attributable to a supercell storm in Texas.

-

TSR previously predicted activity slightly below the 1995-2024 average.

-

The agency forecasts up to five major hurricanes and 19 named storms.

-

Proceeds will expand the company’s reinsurance protection in Florida and South Carolina.

-

An allocation to insurance could “feel like a nice, calm port in the storm” amid wider market volatility.

-

The insurer has lined up Piper Sandler and KBW to run the process.

-

The bond upsized by around 20% as pricing settled 2% below initial guidance at 7%.

-

The cat bond manager warned of excess downside risk owing to an accumulation of losses.

-

The multi-day weather outbreak caused widespread damage from Texas to the Carolinas.

-

The 2024 hurricane season stayed within predictions for high activity but lacked market-moving events.

-

Twia’s SCS losses in Q1-Q3 2024 have been more than double the budgeted amount.

-

The NHC is predicting storm surge, exacerbated by the tide, as high as 15 ft for Tampa Bay.

-

A hurricane warning has been issued for the east coast of Florida.

-

Hurricane Milton strengthened from a tropical storm on Sunday to a Category 5 storm yesterday.

-

Milton is expected to move north of the Yucatan Peninsula today and cross the eastern Gulf of Mexico by Wednesday.