Twelve Capital

-

He had spent 10 years at Securis, with seven of them as COO.

-

The fund lists Twelve, Swiss Re and Cambridge Associates as managers.

-

The renewal and upsizing of the Trouvaille E&S sidecar highlighted the market’s potential.

-

The combined entity ranks third in the Insurance Insider ILS leaderboard.

-

The offering is a collaboration with Generali and parametric carrier Descartes.

-

Losses to the NFIP-sponsored cat bonds remains a key area of uncertainty, the investment manager reported.

-

The deal takes year-to-date cat bond lite issuance to $367.6mn

-

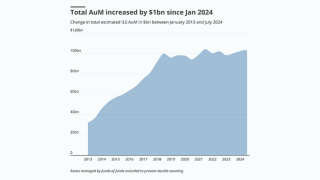

The ILS manager leaderboard demonstrates the ongoing popularity of cat bonds.

-

The combined Twelve-Securis entity would be a top-five ILS firm currently.

-

Urs Ramseier will be CEO and Herbie Lloyd CIO.

-

The firm has observed a “more widespread investor base” in cat bonds.

-

Industry losses of $800mn-$1.2bn are expected from Beryl's impact in Texas.

-

Recent modelling predicts a strong probability of direct landfall in Jamaica.

-

Tanja Wrosch joins Twelve after more than a decade at Credit Suisse ILS.

-

The management’s buyback acquisition brings an end to the two-year relationship.

-

ILS could benefit from focusing on the social aspect of ESG.

-

The fund will follow an existing Twelve strategy and add short-term corporate bonds.

-

Schwartz will set the firm’s investment process on its ILS, equity and debt strategies.

-

Steiger is said to be moving to an “entrepreneurial” role after more than six years with the Zurich-based firm.

-

The Florida hurricane season still has three months to run in a predicted above-average year.

-

Idalia might add further aggregate erosion to several cat bonds covering various perils over an annual risk period, it stated.

-

The ILS manager said returns on casualty ILS were "much higher than on the diversifying nat cat perils such as Italian quake or German flood".

-

An imbalance of capital supply and demand led to strong increases to spreads at issuance for index-linked and indemnity bonds.

-

The Zurich-based ILS manager has entered a partnership with the new life ILS firm set up by former Securis CUO Paul Whiting.

-

The new fund launched earlier this year to invest in companies that are seeking to reduce their emissions.

-

Martina Müller-Kamp will sit on the board of Twelve Capital’s holding company, while Caroline Clemetson and Andreas Knörzer join the board of Twelve Capita’s investment manager.

-

The outcomes were better than the Swiss Re global cat bond index decline after the major hurricane.

-

The Swiss ILS specialist pointed to potential impacts on Floodsmart, Florida indemnity and index-linked bonds.

-

A flurry of selling in the secondary cat bond market is causing “weakness in pricing”, according to a note by Twelve Capital, as sources suggested investors are moving to free up capital for what is expected to be a bumper pre-hurricane season phase.

-

The firm will look to grow its offerings on climate change and natural catastrophe risk.

-

-

The fund will focus on later-stage investment in companies already known to Eos.

-

Twelve Capital has promoted two executives to the new roles of co-managing partners to take on day-to-day management at the firm and head its group management committee.

-

Daniel King-Robinson and Tobias Engeli have joined Twelve Capital from EFG Bank to work on sustainable and climate investing, which the firm said strengthened its ESG focus across portfolios for institutional clients.

-

The company also appointed two senior distribution specialists to focus on expansion in the UK and the Nordic and Benelux regions.

-

The executive was one of the Swiss bank’s most senior ILS executives and established their life fund.