Results

-

The venture will launch in early 2026 and include captives, ART, cyber ILS and specialty (re)insurance elements.

-

The outcome of Eaton Fire subrogation is an uncertainty for some vehicles.

-

Carriers are grappling with a rush of investor interest in longer-tail lines.

-

On a nine month basis, fee income was up nearly 30% to $146mn.

-

The shuttering of Munich Re Ventures reflected a focus on the reinsurer’s “core offering”.

-

The carrier attributed the results to a significant fall in major-loss expenditure.

-

The largest net individual loss was January’s California wildfires at EUR615mn.

-

Pre-tax income at the vehicle was $30mn in the first nine months of 2025.

-

The firm said this was due to planned returns of capital to ongoing investors.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

The French reinsurer improved its P&C combined ratio by 7.4 points to 80.9%.

-

Operating revenues were also up on the $29.1mn reported over Q2.

-

O’Donnell believes RenRe is well positioned to produce longer-tail risk to third-party investors.

-

Third-party investors made a net income of $415mn in the quarter.

-

Reinsurers are confident on cat rates and ready to deploy ILS capital.

-

The company plans to launch in New York and New Jersey next year.

-

American Integrity grew GWP by 30% to $287mn and Slide GWP was up 25% to $435mn in Q2.

-

The ILS manager revised down slightly its forecast for the syndicate’s 2023 YOA.

-

The reinsurer plans to repeat its 2025 purchasing for property and specialty protections.

-

The firm booked net losses from the LA wildfires of EUR615.1mn in the first half.

-

The Florida carrier said ceded premiums will rise slightly to $106mn in Q3.

-

The reinsurer’s chair said cat pricing reductions are at a “miniscule level”.

-

Aspen’s gross premium cession ratio grew 7.1 percentage points to 42.2%.

-

The sidecar took $19mn of cat losses relating to the California wildfires.

-

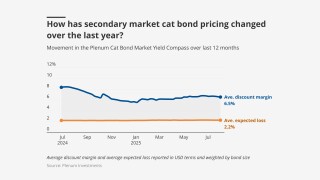

The yield figure comprises 6.53% of insurance discount margin and 4.28% risk-free.

-

Around 95% of the Hiscox Re & ILS portfolio is rated rate “adequate” or better.

-

The carrier posted its H1 results earlier today, beating analyst consensus.

-

The unit said capital in the ILS market remains more than adequate to meet rising demand.

-

The company also purchased $15mn of SCS parametric coverage.

-

In Q2 last year, Everest ceded $26mn in losses to Mt Logan.

-

The reinsurance CoR fell 2.3 points to 79.5% while the primary CoR rose 4.7 points to 98.7%.

-

Scor's CEO said the P&C market had experienced a “competitive” first half.

-

Markel announced the sale of its global reinsurance renewal rights to Nationwide.

-

The firm attributed a 9% drop in reinsurance NWP partly to higher cession rates.

-

This brings the carrier’s total limit on the program to $1.8bn.

-

Reserve releases helped to recapture deferred fees.

-

The carrier reported preliminary profits of EUR2.1bn, driven by “very low” major-loss expenditure in P&C re.

-

The Australian carrier’s nat cat losses are A$200mn lower than its annual allowance.

-

The group reported an 89.7% combined ratio for the quarter.

-

The reinsurer had $2.8bn of natural catastrophe business up for renewal in the year so far.

-

The reinsurer has already dipped into the cat bond market with its Stabilitas Re retro deals.

-

With plenty of reinsurance capacity, CEO Patel said it’s been a “boring year” for treaty negotiations.

-

The (re)insurer used alternative capital in the reinsurance coverage.

-

California homeowners are also expected to move admitted business to E&S.

-

Ark's combined ratio included 25 points of catastrophe losses in Q1.

-

CEO Thierry Léger expects overall P&C pricing to be “stable” through 2025.

-

The unit’s premium reduced by 4% for the first quarter.

-

The ILS manager also swung to an operating profit after posting a loss in Q1 2024.

-

Renewal rates were favorable compared to what could have happened after several hurricanes.

-

The firm’s assets under management were down $300mn in Q1 as performance fee income was hit.

-

January’s California wildfires meant third-party investors suffered a loss of $195.3mn.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

MAP’s Christopher Smelt said impact on nationwide programmes will cause risk aversion.

-

Premiums ceded to the ILS vehicle increased by 76% to $433mn.

-

ILS as a percentage of the pension fund’s total assets grew to 1.5%.

-

The largest individual net loss at EUR230mn was caused by Hurricane Milton.

-

This came as the market’s underwriting profit dipped 10% for 2024.

-

The reinsurer pegged the market loss at $40bn.

-

The carrier pegged its LA wildfire losses at EUR140mn.

-

The CEO expects to see a larger shift between condos and apartments in 2026 and 2027.

-

HCI will now consist of two operating units – the other being its four underwriting entities.

-

ILS is delivering “a growing contribution” to the group, according to CEO Cloutier.

-

The firm reported record fee income of $128.2mn in 2024, up 26%.

-

Comments came as universal reported a 4.2 CoR jump to 107.9% in Q4.

-

Hurricane Milton accounted for 60% of the firm’s Q4 large loss tally.

-

The carrier expects the market loss to land at $35bn-40bn.

-

Modest increases to reinsurance costs were partly offset by the Australia cyclone pool.

-

Wildfire loss ‘serves as a strong reminder not to unwind hard-fought for rates and terms’, the executive said.

-

The carrier said 72% of those losses occurred in personal property.

-

The estimate is net of its per-occurrence reinsurance program and gross of tax.

-

The company will ‘aggressively pursue subrogation’ for the Eaton Fire.

-

The LA-based firm estimated gross cat losses in the range of $1.6bn-$2bn.

-

FY24 disclosures show shifting fortunes at reinsurer ILS platforms.

-

Over 2024, four hurricanes added 13 points of cat-loss impact to the combined ratio.

-

The carrier disclosed it will book $1.1bn in net losses from the California fires.

-

The group ceded 55% more premium to Nephila over the year at $1.3bn.

-

The Bermudian’s wildfire loss estimate was based on an industry loss range of $35bn-$45bn.

-

Axis Capital’s fee income from strategic capital partners grew 39% to $85mn in the year to 31 December 2024, up from $61mn the year prior, the firm’s Q4 earnings release said.

-

Models will need to steepen the curve in the tail to reflect severe event frequency.

-

The carrier has been reducing its exposure to the area where the wildfires occurred by over 50%.

-

-

CEO Jim Williamson said social inflation was a “growing barrier” to a vibrant economy.

-

The (re)insurer recorded a reserve charge of nearly $1.3bn within its casualty insurance book.

-

The carrier’s Milton loss came in below expectations, but its fire claims will be “material” in Q1.

-

The ILS unit’s AuM was higher by $100mn compared to $1.9bn as of 30 June.

-

The reinsurer took $743mn of nat-cat losses in the quarter.

-

The firm recorded a 13.3% nat cat impact to the P&C combined ratio.

-

Nat cat pricing is expected to be more or less flat, with rises on loss-affected programmes.

-

In other property, Helene and Milton will assure rates remain attractive, he added.

-

The firm’s AuM in four key vehicles rose $526mn in Q3.

-

The firm sees a "robust" pipeline of potential investors ahead of the renewals.

-

The Floridian also announced the completion of its first-ever takeout from Florida Citizens.

-

Ceded losses grew by 69.2% in Q3 from the prior year quarter to $44mn.

-

The combined ratio included 17 points of catastrophe losses in the third quarter.

-

CEO Adrian Cox said Beazley’s recent $290mn ILW purchase was not driven by “capital flexibility in and of itself”.

-

Andrade flagged expected 5% to 10% increases in the US and Europe.