Results

-

The venture will launch in early 2026 and include captives, ART, cyber ILS and specialty (re)insurance elements.

-

The outcome of Eaton Fire subrogation is an uncertainty for some vehicles.

-

Carriers are grappling with a rush of investor interest in longer-tail lines.

-

On a nine month basis, fee income was up nearly 30% to $146mn.

-

The shuttering of Munich Re Ventures reflected a focus on the reinsurer’s “core offering”.

-

The carrier attributed the results to a significant fall in major-loss expenditure.

-

The largest net individual loss was January’s California wildfires at EUR615mn.

-

Pre-tax income at the vehicle was $30mn in the first nine months of 2025.

-

The firm said this was due to planned returns of capital to ongoing investors.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

The French reinsurer improved its P&C combined ratio by 7.4 points to 80.9%.

-

Operating revenues were also up on the $29.1mn reported over Q2.

-

O’Donnell believes RenRe is well positioned to produce longer-tail risk to third-party investors.

-

Third-party investors made a net income of $415mn in the quarter.

-

Reinsurers are confident on cat rates and ready to deploy ILS capital.

-

The company plans to launch in New York and New Jersey next year.

-

American Integrity grew GWP by 30% to $287mn and Slide GWP was up 25% to $435mn in Q2.

-

The ILS manager revised down slightly its forecast for the syndicate’s 2023 YOA.

-

The reinsurer plans to repeat its 2025 purchasing for property and specialty protections.

-

The firm booked net losses from the LA wildfires of EUR615.1mn in the first half.

-

The Florida carrier said ceded premiums will rise slightly to $106mn in Q3.

-

The reinsurer’s chair said cat pricing reductions are at a “miniscule level”.

-

Aspen’s gross premium cession ratio grew 7.1 percentage points to 42.2%.

-

The sidecar took $19mn of cat losses relating to the California wildfires.

-

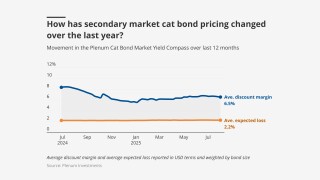

The yield figure comprises 6.53% of insurance discount margin and 4.28% risk-free.

-

Around 95% of the Hiscox Re & ILS portfolio is rated rate “adequate” or better.

-

The carrier posted its H1 results earlier today, beating analyst consensus.

-

The unit said capital in the ILS market remains more than adequate to meet rising demand.

-

The company also purchased $15mn of SCS parametric coverage.

-

In Q2 last year, Everest ceded $26mn in losses to Mt Logan.

-

The reinsurance CoR fell 2.3 points to 79.5% while the primary CoR rose 4.7 points to 98.7%.

-

Scor's CEO said the P&C market had experienced a “competitive” first half.

-

Markel announced the sale of its global reinsurance renewal rights to Nationwide.

-

The firm attributed a 9% drop in reinsurance NWP partly to higher cession rates.

-

This brings the carrier’s total limit on the program to $1.8bn.

-

Reserve releases helped to recapture deferred fees.