-

A new pooling structure allowed the firm to free up historic side pockets and provides a template for future exit options.

-

The pricing is up from an initial spread of 6.75%-7.5% and an updated spread of 7.25%-7.5%.

-

SafePoint and Cajun had initially sought $150mn of coverage for named storm events in Florida and Louisiana

-

The new issuance is offered with pricing guidance at 2.5x the expected loss.

-

All 50 US states and the District of Columbia are covered by the bond.

-

The bond will provide coverage for windstorms and severe thunderstorms on a per-occurrence basis in Belgium and the Netherlands.

-

Steiger is said to be moving to an “entrepreneurial” role after more than six years with the Zurich-based firm.

-

The Nature Coast Re offering is the first in a new series from SafePoint.

-

Analysis by Lane Financial concluded that ILS returns will likely be double-digit-to-high-teens in 2024.

-

The Class A notes priced at the midpoint of guidance and the Class B notes at the top end.

-

The three-year instrument provides cover for US named storms and earthquakes and European windstorms.

-

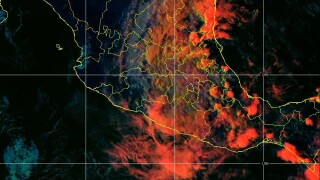

Aon-owned Mexican cat modeler ERN estimated Otis insured wind losses, excluding auto and infrastructure, at $1.2bn-$1.8bn.