-

The two bonds offered are both replacing expiring deals.

-

The breadth of strategies targeted by ILS start-ups signals where the industry is heading.

-

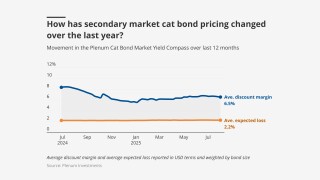

The total yield is down 114bps from 9.94% compared to the final week of 2024.

-

The broker deal has projected cat bond new issuance of $19bn-$21bn for 2026.

-

The carrier first issued Phoenix in 2021 with a size of $42mn.

-

The index returned 10.4% for the 11 months to the end of November.

-

The Aon Cat Bond Total Return Index delivered gains of 11.6% in 2025.

-

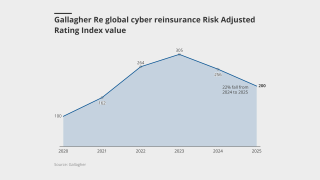

Investor appetite for bonds is exerting pressure on traditional retro providers, according to Gallagher Re.

-

Both lower multiples and potential Fed rate cuts will pressure returns.

-

New issuance will be supported by new sponsors as well as over $13bn in maturities.

-

The ILS AuM in its flagship cat funds rose 13% over the half year to $6bn as of 31 October.

-

The ILW segment shrank in 2025 to around $6bn, the broker estimated.

-

Q2 was the largest quarter for issuance, with $9.6bn of limit placed.

-

The transition reflects ongoing growth at Swiss Re’s ILS platform, the firm said.

-

The placement showed investor preference for slightly riskier aggregate deal.

-

The fund limits positions in aggregate structures exposed to secondary perils.

-

Reinsurers could use retained earnings to target growth and buy more retro.

-

Cat bond market growth has exceeded broker-dealers' 2025 forecasts by some distance.

-

This was the second issuance completed by Farmers via its Bermuda reinsurance vehicle Topanga Re.

-

The Italian asset manager also plans to relaunch its multi-strategy ILS fund.

-

The finance committee discussed shifting market dynamics as tort reform takes effect.

-

CA Fairplan’s Golden Bear Re deal upsized 200% to $750mn.

-

PoleStar Re Ltd 2026-1 includes three sub-layers, which run for a three-year term.

-

The note is paying a spread of 975bps, 11.3% below the midpoint of the initial guidance range.

-

Man AHL Cat Bond Strategy has $1bn in assets, around 2% of Man AHL Partners’ total of $54bn.

-

The TPA approach to investing was adopted by US pension fund Calpers last month.

-

The total yield is down 162bps from 10.31% in the last week of November 2024.

-

Migdal Insurance placed its debut cat bond Turris Re for $100mn of quake limit.

-

The European ETF launch has benefited from the performance of the Brookmont US cat bond ETF.

-

The sponsor is offering two notes but will only place one depending on market interest.

-

Secondary market pricing implies the sponsor could recoup a total of $50mn on the 2022-1 A note.

-

One fund tracked by the index had a negative month.

-

The fund held $10mn in AuM, with $3mn the minimum investment required.

-

North Carolina Farm Bureau raised $500mn with its latest Blue Ridge Re cat bond deal.

-

Demand for top layer coverage may also need to be supported by underlying market growth.

-

The single note is offering an effective coupon of 23.5% at the midpoint of guidance.

-

Assets under management in UCITS cat bond funds stood at $17.8bn as of 7 November, according to data from Plenum Investments.

-

The cat bond market is on course for $56bn of notional outstanding by the end of this year.

-

The two funds feed into the $892.5mn Schroder IF Flexible Cat Bond Fund.

-

The issuance will be the fourth deal offered by the Lloyd’s carrier.

-

The shift in multiples is indicative of price softening in the cat bond the past two years.

-

The deal provides protection in Europe, after Mapfre Re’s debut bond last year covered US perils.

-

The average weighted spread on the deals was 651bps, skewed upward by cyber and wildfire deals.

-

The reinsurer is the second sponsor opting not to renew cyber coverage in the bond market this year.

-

The ratings agency first indicated it would consider a new methodology in March.

-

The single Class A note is offering an initial spread range of 1,050-1,150 to investors.

-

The sponsor has $140mn of cyber cat bond protection maturing in December.

-

One William Street priced its debut cat bond 13% below the midpoint of guidance.

-

The reinsurer-linked manager now offers three ILS funds encompassing private ILS and cat bonds.

-

The sponsor has $200mn of cat bond protection maturing in December this year.

-

Total yield is down from 11.18% in the last week of October 2024.

-

Covea’s Hexagon IV Re deal priced 13% below the initial target on a weighted average basis.

-

Total gains for the year reached 7.71%.

-

Some experienced investors are pivoting out of cat bonds and into the top layers of private ILS deals.

-

Central pressure of 900mb or below would trigger a full loss of the $150mn deal.

-

Pricing on Friday implied a potential $45mn loss to the bond, before the storm outlook deteriorated.

-

So far this year, there have been 11 first-time sponsors to place a deal.

-

Competition on price from traditional markets is weighing on bond market momentum.

-

The insurer of last resort’s exposure was $696bn as of last September.

-

The bond will provide protection against US wind with a PCS trigger.

-

The cedant’s current deal is due to mature at the end of January 2026.

-

Spreads on USAA’s latest deal priced below comparative issuances in 2023-2024.

-

Investor interest is warming up following a colder spell over the past several years.

-

The funds will combine credit and ILS holdings.

-

The hire is the hedge fund manager’s third ILS appointment in the past year.

-

Key topics include private ILS growth prospects and the longevity of longtail interest.

-

Returns from cat risk investments stood at 20.1% for the year to 30 June 2025.

-

The insurer of last resort currently has $2.15bn of cat bond protection on risk.

-

The alternative asset manager was founded in 2021 with offices in London, New York and Abu Dhabi.

-

Sources have said $1bn+ of fresh capital from the region is expected to be deployed in 2026.

-

The figure comprises 5.48% of insurance discount margin and 3.96% of risk-free rate.

-

Pricing has hit historically soft market lows, based on secondary market pricing.

-

The manager’s largest ILS holding is in the cat-bond-heavy High Yield fund.

-

Cat bonds have outpaced the returns on private strategies in the year to date.

-

The new Verisk SCS model is increasing expected losses on aggregate bonds.

-

Deals would need to be sized at $50mn plus for transfer to capital markets.

-

The CEA had $19.3bn of claim-paying capacity as of 31 July.

-

The ILS manager has $6.8bn in assets and will be led by MariaGiovanna Guatteri.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

ILS executives talked pricing, capacity and opportunities in casualty at an ILS roundtable in Monte Carlo.

-

The market has learned lessons from earlier soft market phases that it will apply now.

-

Victory Pioneer Cat Bond Fund also added assets in the past month.

-

The figure comprises 6.07% of insurance discount margin and 4.15% of risk-free rate.

-

He added that Munich Re does not rely on retro or third-party.

-

The sponsor extended two notes issued in 2022.

-

The investment bank had stopped offering ILS services last September.

-

The agency noted inflows to cat bond funds and investor interest in private ILS.

-

Competition from cat bonds in the top layers of programmes applied downward pressure on reinsurance pricing in 2025.

-

Dedicated reinsurance capital is on track to increase by 8% in 2025, the broker said.

-

Funds encompassing private ILS outperformed cat bond strategies in July.

-

Market participants have until 13 October to provide any comments.

-

A trend towards higher-risk ILW bonds helped keep yields in double-digits despite softer rates.

-

The CUO has added the role of head of private ILS, joining the executive team.

-

ILS accounted for 2.5% of the pension fund’s total AuM.

-

ILS investors have fought shy of multi-peril aggs due to low confidence in SCS modelling.

-

The reinsurer’s chair said cat pricing reductions are at a “miniscule level”.

-

The yield figure comprises 6.53% of insurance discount margin and 4.28% risk-free.

-

The Texas insurer of last resort previously had to have funding for a 1-in-100 year storm.

-

The ILS Advisers Fund Index reported a profit of 1.11% in June.

-

Amid $17bn of new deals, cat bond activity included aggregate and cascading structures.

-

The bond will provide protection on an industry-loss basis, as reported by PCS.

-

The merged business of Twelve Securis ranked third among ILS managers for AuM, behind Fermat and RenRe.

-

Cat bond broking growth contributed to 6% organic growth in reinsurance.

-

The consultation period around UK ISPVs was opened in November last year.

-

Managers believed end-investors value diversification and non-correlation of cat bonds over liquidity.

-

Cat bonds remain attractive for investors seeking risk-adjusted return and diversification.

-

The PRA will also have to report on turnaround time for new approvals against 10-day and six-week targets.

-

The fund was renamed from the Pioneer Cat Bond Fund.

-

The total yield was 11.03% as of 27 June, including 4.3% of risk-free rate.

-

Some $400mn of bonds priced in the past week, after a record-setting H1.

-

The recommended “AIF lite” structure could be suited to cat bond lites.

-

This comes in at the lower end of the initial spread guidance of 725-775 bps.

-

The investment consultancy said yields increased in Q2 by less than could have been expected.

-

Property cat-focused sidecar capital was up by approximately 10% in H1.

-

The sidecars will provide capacity for reinsurers and large insurance carriers.

-

Initial responses to ESMA’s report welcomed the long timeframes for any changes.

-

Weighted average multiples were down as sponsors capitalised on demand to push spreads lower.

-

The total return for the Swiss Re Global Cat Bond Index stood at 0.61% for the month.

-

The body said cat bonds are closer to an insurance product than a security.

-

The awards celebration took place at the Hilton Bankside on 25 June.

-

Twelve Securis is now a challenger for the top spot on the Insurance Insider ILS leaderboard.

-

The bond is split across a Series 1 and Series 2 structure, with eight notes in total.

-

Everest Re increased the targeted size of Kilimanjaro Re across all four classes of notes.

-

M&A and shifts in distribution arrangements bring risks and opportunities.

-

Pricing on all classes of notes are being offered at the bottom of the guided range.

-

AuM in GAIA Cat Bond Fund had grown to $3.9bn as of 31 May.

-

PCS's loss estimate for the March Missouri SCS pushed the bond beyond its exhaustion point.

-

The California Earthquake Authority upsized its Ursa Re deal by 60% to $400mn.

-

The Californian insurer had a private deal, Randolph Re, that provided pure wildfire protection.

-

The firm said it was the first time a UCITS cat bond fund passed the $4.0bn mark.

-

Everest Re has structured its deal into two sections targeting aggregate and per occurrence cover.

-

The fund was set up 18 months ago by cat bond investor Florian Steiger.

-

Total yield was 10.93% as of 30 May, including 4.34% of risk-free rate.

-

This followed a $650mn fall in April, after management change of the fund.

-

A total $225mn of fresh limit entered the market across two deals.

-

The bond will provide protection for storms, quakes and fires in seven US states.

-

The bond protects against losses in the US, Canada, Europe and Australia.

-

The company also has $100mn for US hurricane events.

-

The index provider revised up its return for March by 0.39 percentage points to 1.21%.

-

The carrier previously raised a Finca Re cat bond in 2022.

-

The company is a wholly owned subsidiary of AmTrust Financial.

-

The carrier previously redeemed from a Herbie Re cat bond for California wildfire claims.

-

The deals covered Euro wind and Italy quake, Florida hurricane and a retro bond.

-

The ILS market has won market share at the top of programmes as buying expands.

-

The bond will provide protection for Allstate’s Florida subsidiary, Castle Key.

-

The Italian sponsor has $237mn of limit maturing this July.

-

The cat bond limit total is an uplift of around 60% on the carrier’s 2024 bonds.

-

Some assets in the Medici Fund were transferred to a new UCITS strategy.

-

The bond will provide named storm and quake coverage in the US.

-

The bond is offering a spread range of 850-925bps.

-

One dollar-denominated deal has opted to hold collateral in EBRC notes.

-

The bond will cover named storms in five US states.

-

Price guidance for the bond is 4.00%-4.50%.

-

The platform’s aim is to support the ILS industry in ‘getting the marks right’.

-

Debut sponsor SV SparkassenVersicherung also secured its target size of $100mn.

-

Proceeds will expand the company’s reinsurance protection in Florida and South Carolina.

-

Some $200mn of fresh limit entered the ILS market as $3.4bn of deals priced.

-

Sources believe the market will grow gradually over years after its initial cluster of dealmaking.

-

The bond provides coverage on personal-lines property in Florida.

-

The series one notes will provide protection to the benefit of Twia.

-

The total yield, inclusive of the risk-free rate, was down on the same period last year.

-

The bond will provide multi-peril coverage on an industry loss basis.

-

Gallagher Re said rates had softened in 2025 versus the prior two years.

-

The bond will provide storm protection in Florida and South Carolina.

-

Fermat and GAM announced that the former will take sole control of the GAM FCM Cat Bond Fund.

-

The deal will provide named Florida storm protection on an indemnity, per occurrence basis.

-

Florida Citizens upsized its latest Everglades Re deal by 50%.

-

The buzz in the air at ILS Connect told of a market entering its next growth phase.

-

The CEO said private ILS funds can generate additional returns of 10%-20%.

-

The state insurer of last resort is set to purchase $2.89bn of reinsurance this year.

-

Richard Pennay also addressed the dip in cyber ILS activity.

-

The renewal and upsizing of the Trouvaille E&S sidecar highlighted the market’s potential.

-

Private ILS would benefit from extension spreads to manage investor concerns, the CEO argued.

-

The bond will offer retrocession coverage for Hannover Re.

-

The catastrophe bond comes after the issuance of a Mayflower Re bond last year.

-

Its 2025 programme exhausts at $9.5bn excess $1bn.

-

All 29 funds tracked by the index returned a positive performance.

-

The bond will provide protection against named storm and thunderstorm.

-

Cat bond sponsors continue to secure higher limits and lower rates versus their targets.

-

Investor interest and capital flows point to potential for ILS proliferation.

-

The bond initially sought $425mn across three tranches.

-

The bond will cover China, India and Japan quake and Japan typhoon.

-

The bond will provide protection against German and Japan quake.

-

Secondary market traders are baking in further loss potential after PCS increased its wildfire and Helene loss estimates.

-

Franklin Templeton’s allocations to ILS are managed by fund of funds manager K2 Advisors.

-

The industry loss data provider also increased its estimate for Hurricane Helene to $15.3bn.

-

This is the first time the Texas Fair Plan has entered the cat bond market.

-

The deal of the size was unchanged at $100mn.

-

Portfolio rebalancing was not triggered last week, but investors are now distracted and nervous.

-

US Coastal Property and Utica Mutual Insurance have brought out their first cat bond deals.

-

The bond will provide protection against China, India and Japan quake, and Japan typhoon.

-

The subject business covers a portfolio of residential insurance.

-

The sponsor is estimating a loss of ~$300mn in relation to one of last month’s US tornado events.

-

Sutton National and Bamboo Ide8 secured $170mn of sidecar and cat bond protection.

-

The bond will provide coverage against named storm or severe thunderstorm over three years.

-

Torrey Pines Re is split among three tranches of notes.

-

The issuance is split across three tranches with varying degrees of risk.

-

The deal is split across four tranches, with the riskiest note Class D targeting $150mn.

-

The cat bond will initially cover named storms in Florida and South Carolina.

-

Market participants expect pricing will be flat to down through Q2.

-

The bond will provide protection against Louisiana named storm.

-

Fees on the GAM Star cat bond funds will drop in May in a recognition of fee competition in the market.

-

The sponsor secured $240mn of limit as the bond upsized by 20% on its initial target.

-

The insurance discount margin is now at a similar level to where it was in the final week of March 2022.

-

Most of the ILS investments were made via the cat bond heavy High Yield Fund.

-

Palm Re will provide Florida named storm cat bond coverage for Florida Peninsula, Edison and Ovation Home Insurance Exchange.

-

Multiples in March were below historic averages from 2001 through 2024.

-

The ETF will invest solely in natural catastrophe-exposed bonds.

-

Scor is targeting limit of $200mn with its latest Atlas DAC retro cat bond.

-

The notes replace a 2021 issuance that matured in January this year.

-

The deal is 45% larger than 2024’s issuance after attracting a “greater number of investors”.

-

The cedant’s Namaka Re bond is offering a spread range of 200-250 bps.

-

The bond provides coverage for North American storms and earthquakes, as well as European windstorms.

-

The pricing is at the top end of the initial guidance range of 550-600bps.

-

The bond is being issued through Lloyd’s London Bridge 2 platform.

-

The bond upsized by around 20% as pricing settled 2% below initial guidance at 7%.

-

The bond will provide coverage for Japan typhoon and flood on an indemnity, per-occurrence basis.

-

Caution about capital markets volatility is leading sponsors to stagger bond renewals.

-

The ILS segment is not ready to gloss over loss-heavy years in renewal discussions.

-

The mega cat bond season in Q2 last year recorded issuance of $8.2bn.

-

The agency said introduction of a new methodology will depend on the feedback it receives from the ILS market.

-

Guernsey’s TISE listed the world’s first private cat bond issued by Solidum Re in 2011.

-

Founding partners DeCaro and Rettino will continue to provide oversight and investment advice.

-

This will be the third cat bond issuance through Baltic Re PCC.

-

The cat bond manager warned of excess downside risk owing to an accumulation of losses.

-

Flood Re’s bond Vision 2039 bucked the trend by pricing up 7% as its secured £140mn ($174mn) of limit.

-

Island appetite remains stable, but early 2025 loss activity has injected fresh uncertainty.

-

The reinsurer had taken the opportunity to buy more limit across event and aggregate covers.