Risk losses

-

Colorado State University is predicting 17 named storms, nine hurricanes and four major hurricanes.

-

The failure of a Jamaica bond to pay out following Hurricane Beryl damage has brought focus onto the deals.

-

The transaction complements its previous acquisition of RMS in 2021.

-

Urban expansion, climate change and inflation are key drivers of losses.

-

The US tallies $97bn in economic losses from major perils each year.

-

In 2021, SiriusPoint acquired a “significant ownership stake” in the firm, which meant the specialty insurer and reinsurer providing multi-year capacity and paper to the ILS house.

-

The BMA also expects Bermudian insurers to consider double materiality in their reporting, as well as their own external climate-change impact.

-

Reinsurers and brokers alike have warned of a rocky 1 January renewal process ahead as the industry grapples with multiple issues including inflation, climate change and geopolitical uncertainty.

-

Paul Shedden joins from Sompo International, where he was head of portfolio design, pricing and analytics – global insurance.

-

Insured nat cat losses amounted to $35bn globally in H1, while manmade events triggered an additional $3bn, according to Swiss Re Insititute.

-

The reinsurer revealed its Ukraine loss charge excludes aviation.

-

In his new role, the executive will work directly with Steve Tulenko, president of Moody’s Analytics.

-

Continuing a trend of several years, secondary perils caused most insured losses at $81bn, or 73% of the total.

-

The company aims to make its services more recognisable

-

The biggest increases in GWP came from the carrier’s P&C reinsurance and P&C insurance segments.

-

The carrier also cited increasing continental cyber losses as a factor in continued market hardening.

-

The accumulation of cat losses have taken a toll on carrier’s aggregate reinsurance covers, which could set up 1 January renewals for such treaties to be as difficult as last year.

-

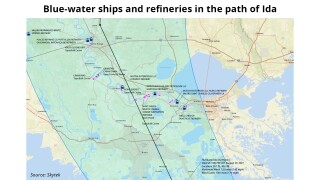

The lower-than-expected losses so far from Ida do not stack up against what is thought to be a $30bn+ cat event.

-

Lloyd’s chief of markets Patrick Tiernan ruled out completely cutting out sources of energy relied on by certain communities.

-

The energy market is being watched closely due to its potential to produce large risk losses.

-

Market sources said there had been no reports of major incidents, but damage assessments would begin in earnest today.

-

The further losses edge into the $20bn range, the more the loss will shift to the retro market, but high uncertainty remains.

-

Overall figure was driven by a deep winter freeze, hailstorms and wildfires and marked the second highest first-half figure behind 2011.

-

Moody’s expects RMS, which had about $320mn in revenue around $55mn in operating income last year, to become accretive to earnings by 2025.

-

The recommendations include establishing side pockets as quickly as possible after an event, prominently disclosing side-pocket performance and being transparent on processes and fees.

-

Investors are seeking to take higher-attaching risks with pure peak peril deals in stronger demand.

-

The nature of the event means that more losses may take time to emerge.

-

Lancashire Capital Management delivered an 80% uplift In the reinsurer’s share of profits from its retro-focused portfolio.

-

The European reinsurance chief says interest rates and loss experience drive the carrier’s hardening stance.

-

Collaboration with HERE would help the business develop predictive analysis and address problems with source data, according to Agile underwriting director Richard Foster.

-

The president and CEO urges wordings precision to avoid cyber-related litigation.

-

Retro structural change will provide a lot of the gains in 2021, with trapping negotiations complicating the mix.

-

The executives also called for government-private sector partnerships to address future pandemics and other protection gaps such as cyber.

-

Loss estimates outstrip early expectations.

-

Possible Covid-19 losses may be slowing capital inflows to the ILS sector, CFO John Dacey has said.

-

The CEO also casts doubt on the future of event cancellation cover.

-

The insurer lifted the attachment on an aggregate portion of its group reinsurance treaty, which was otherwise unchanged after its restructure for 2019.

-

Recent disasters have tested the idea of catastrophe risk as a short-tail risk.

-

The insurer’s overall cat losses were below its budget as higher Australian disaster activity was offset by benign international claims.

-

The reinsurer said its nat-cat exposure is at the highest level since 2015, with support from third-party capital.

-

Rate increases of up to 25 percent on high-risk, loss-affected wind covers have been diluted by flat rates on quake and loss-free layers.

-

The Bermuda-based ILS manager has signed up to use the specialist’s climate risk tools.

-

Cat bond spreads proved to be largely unaffected by last year’s catastrophe activity as sponsors topped up ILS cover in a busy second quarter that nonetheless failed to outstrip 2017’s record volumes.

-

Early signs indicate third-party capital is being deployed aggressively in the Florida market.

-

Convergence reinsurance capital rose by 9 percent throughout 2017, from $75bn to $82bn, Guy Carpenter said in its January renewals report.

-

Smart beta products seem to be the flavour of the month

-

RenaissanceRe said it would take a net $625mn of losses from the three recent hurricanes and Mexican earthquakes.

-

Head of ILS analytics at Twelve Capital Jan Kleinn has left the firm after two years, according to market sources, with another senior analytics executive Markus Stricker also placed on gardening leave.

-

The World Bank has renewed the Pacific Catastrophe Risk Assessment and Financing Initiative (PCRAFI) for a fifth time, providing insurance coverage for Pacific Island countries of up to $38.2mn.

-

Everest Re said it could bear a net fourth quarter loss of between $75mn and $200mn from Hurricane Matthew, based on a modelled industry loss of $3bn-$9bn, which it could absorb within quarterly earnings

-

Australian (re)insurer QBE recouped $131mn of catastrophe and large risk loss claims under its aggregate reinsurance cover in the first half of 2016, down from $213mn in the first half of 2015.

-

A pilot disaster insurance scheme in the Pacific will be continued and rolled into a broader Pacific Resilience Program (PREP), the World Bank said today (22 June).

-

Heritage Insurance Holdings has appointed Steven Martindale as chief financial officer (CFO) to replace Stephen Rohde, who retires next month.

-

Catastrophe data specialist Perils has joined the Singapore-based Natural Catastrophe Data and Analytics Exchange (NatCatDAX) Alliance, the firm announced today (28 April).

-

Credit Suisse is making progress with its plans to issue an operational risk insurance securitisation after a major single investor said it would take at least CHF100mn ($105mn) of the transaction, Trading Risk understands.

-

Global non-marine retro prices experienced year-on-year catastrophe reductions of around 10 percent at 1 April, in line with the January renewals, according to Willis Re

-

Amlin earned £16.5mn ($23.5mn) of fee income from Leadenhall Capital Partners in 2015, up from £2.4mn in the prior year before it had consolidated the asset manager onto its balance sheet

-

Insurance industry thinktank the Geneva Association said that last year's COP21 Paris Climate Conference has opened the doors for innovative insurance solutions covering climate risk in both developed and developing nations.

-

The US government has committed $30mn to support insurance risk pools in the Pacific, Caribbean and Africa at the COP21 Paris Climate Conference this week.

-

Amlin recorded £7.6mn in fee income during the first half of 2015 from funds managed by Leadenhall Capital Partners, which became a subsidiary of the group last October.