Risk losses

-

Colorado State University is predicting 17 named storms, nine hurricanes and four major hurricanes.

-

The failure of a Jamaica bond to pay out following Hurricane Beryl damage has brought focus onto the deals.

-

The transaction complements its previous acquisition of RMS in 2021.

-

Urban expansion, climate change and inflation are key drivers of losses.

-

The US tallies $97bn in economic losses from major perils each year.

-

In 2021, SiriusPoint acquired a “significant ownership stake” in the firm, which meant the specialty insurer and reinsurer providing multi-year capacity and paper to the ILS house.

-

The BMA also expects Bermudian insurers to consider double materiality in their reporting, as well as their own external climate-change impact.

-

Reinsurers and brokers alike have warned of a rocky 1 January renewal process ahead as the industry grapples with multiple issues including inflation, climate change and geopolitical uncertainty.

-

Paul Shedden joins from Sompo International, where he was head of portfolio design, pricing and analytics – global insurance.

-

Insured nat cat losses amounted to $35bn globally in H1, while manmade events triggered an additional $3bn, according to Swiss Re Insititute.

-

The reinsurer revealed its Ukraine loss charge excludes aviation.

-

In his new role, the executive will work directly with Steve Tulenko, president of Moody’s Analytics.

-

Continuing a trend of several years, secondary perils caused most insured losses at $81bn, or 73% of the total.

-

The company aims to make its services more recognisable

-

The biggest increases in GWP came from the carrier’s P&C reinsurance and P&C insurance segments.

-

The carrier also cited increasing continental cyber losses as a factor in continued market hardening.

-

The accumulation of cat losses have taken a toll on carrier’s aggregate reinsurance covers, which could set up 1 January renewals for such treaties to be as difficult as last year.

-

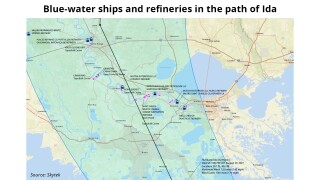

The lower-than-expected losses so far from Ida do not stack up against what is thought to be a $30bn+ cat event.

-

Lloyd’s chief of markets Patrick Tiernan ruled out completely cutting out sources of energy relied on by certain communities.

-

The energy market is being watched closely due to its potential to produce large risk losses.

-

Market sources said there had been no reports of major incidents, but damage assessments would begin in earnest today.

-

The further losses edge into the $20bn range, the more the loss will shift to the retro market, but high uncertainty remains.

-

Overall figure was driven by a deep winter freeze, hailstorms and wildfires and marked the second highest first-half figure behind 2011.

-

Moody’s expects RMS, which had about $320mn in revenue around $55mn in operating income last year, to become accretive to earnings by 2025.

-

The recommendations include establishing side pockets as quickly as possible after an event, prominently disclosing side-pocket performance and being transparent on processes and fees.

-

Investors are seeking to take higher-attaching risks with pure peak peril deals in stronger demand.

-

The nature of the event means that more losses may take time to emerge.

-

Lancashire Capital Management delivered an 80% uplift In the reinsurer’s share of profits from its retro-focused portfolio.

-

The European reinsurance chief says interest rates and loss experience drive the carrier’s hardening stance.

-

Collaboration with HERE would help the business develop predictive analysis and address problems with source data, according to Agile underwriting director Richard Foster.

-

The president and CEO urges wordings precision to avoid cyber-related litigation.

-

Retro structural change will provide a lot of the gains in 2021, with trapping negotiations complicating the mix.

-

The executives also called for government-private sector partnerships to address future pandemics and other protection gaps such as cyber.

-

Loss estimates outstrip early expectations.

-

Possible Covid-19 losses may be slowing capital inflows to the ILS sector, CFO John Dacey has said.

-

The CEO also casts doubt on the future of event cancellation cover.