-

The investment will be the first allocation to ILS for the public sector pensions investor Funds SA.

-

The fund will offer additional spread versus other similarly rated corporate debt.

-

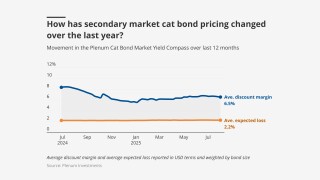

The total yield is down 114bps from 9.94% compared to the final week of 2024.

-

The ILS manager now has 13 individual partners and one corporate partner.

-

There have been few retro exits despite softening amid cat bond competition.

-

Non-loss impacted major property program rates were down by up to 20% at the renewal period.

-

Cedants pursued property renewals “aggressively” amid excess reinsurer capacity.

-

The fund limits positions in aggregate structures exposed to secondary perils.

-

Cat bond market growth has exceeded broker-dealers' 2025 forecasts by some distance.

-

The facility provides solvency support via a fresh equity injection under various scenarios.

-

The Italian asset manager also plans to relaunch its multi-strategy ILS fund.

-

The industry has continued to build and innovate through a third strong year of performance.

-

The TPA approach to investing was adopted by US pension fund Calpers last month.

-

The total yield is down 162bps from 10.31% in the last week of November 2024.

-

There are various routes for ILS managers wanting to access the diversity of Lloyd’s underwriting.

-

The European ETF launch has benefited from the performance of the Brookmont US cat bond ETF.

-

The firm’s external AuM has grown by 175% from 2019 to $3.3bn in 2025.

-

The firm anticipates potential growth in cyber cat ILS similar to property cat ILS post-2005.

-

Assets under management in UCITS cat bond funds stood at $17.8bn as of 7 November, according to data from Plenum Investments.

-

The cat bond market is on course for $56bn of notional outstanding by the end of this year.

-

The outcome of Eaton Fire subrogation is an uncertainty for some vehicles.

-

The two funds feed into the $892.5mn Schroder IF Flexible Cat Bond Fund.

-

Japanese firm MS&AD acquired 80% of ILS manager Leadenhall Capital Partners in 2019 from another affiliate.

-

The deal provides protection in Europe, after Mapfre Re’s debut bond last year covered US perils.

-

The reinsurer is the second sponsor opting not to renew cyber coverage in the bond market this year.

-

The shuttering of Munich Re Ventures reflected a focus on the reinsurer’s “core offering”.

-

The sponsor has $140mn of cyber cat bond protection maturing in December.

-

The carrier attributed the results to a significant fall in major-loss expenditure.

-

The largest net individual loss was January’s California wildfires at EUR615mn.

-

As the P&C market shifts, carriers are looking for growth from acquisitions.

-

The reinsurer-linked manager now offers three ILS funds encompassing private ILS and cat bonds.

-

The firm said this was due to planned returns of capital to ongoing investors.

-

Total yield is down from 11.18% in the last week of October 2024.

-

Some experienced investors are pivoting out of cat bonds and into the top layers of private ILS deals.

-

The French reinsurer improved its P&C combined ratio by 7.4 points to 80.9%.

-

Competition on price from traditional markets is weighing on bond market momentum.

-

Majority shareholder Fosun will continue to hold the remaining 86.7% of shares.

-

EMEA CEO Laurent Rousseau said reinsurance must retain its relevance to investors.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

The reinsurer stressed it “did not shy” from cat business in 2023.

-

The hire is the hedge fund manager’s third ILS appointment in the past year.

-

A cat-focused vehicle is “the missing piece” of Hannover Re’s ILS offerings, said Silke Sehm.

-

The alternative asset manager was founded in 2021 with offices in London, New York and Abu Dhabi.

-

The figure comprises 5.48% of insurance discount margin and 3.96% of risk-free rate.

-

The new Verisk SCS model is increasing expected losses on aggregate bonds.

-

Charles Mixon joined the firm a year ago in a business development role.

-

The resource was developed by leading ILS managers and investors.

-

The economic loss from the event was around EUR7.6bn.

-

The ILS manager has $6.8bn in assets and will be led by MariaGiovanna Guatteri.

-

Axa IM’s acquisition by BNP Paribas was confirmed in July this year.

-

Nick Fallon is the latest in a string of retro-broker moves in the market.

-

Victory Pioneer Cat Bond Fund also added assets in the past month.

-

Arch set up Bermuda investment manager Arch Fund Management in February.

-

The syndicate is targeting capital allocation for 1 January, the company confirmed.

-

Terms are expected to hold, underpinning the stronger recent performance of reinsurers.

-

The figure comprises 6.07% of insurance discount margin and 4.15% of risk-free rate.

-

He added that Munich Re does not rely on retro or third-party.

-

Hannover Re Capital Partners is in talks with two investors for 1 January launch.

-

The target allocation to Munich Re, Elementum and the run-off AlphaCat funds fell in the year to 30 June 2025.

-

The trend for private credit in alternative asset management is “set to continue”.

-

The capital supported sidecar-style syndicates and reinsurance start-ups.

-

The agency noted inflows to cat bond funds and investor interest in private ILS.

-

Dedicated reinsurance capital is on track to increase by 8% in 2025, the broker said.

-

The firm has also updated the loss-calculation engines of existing Jeannie tools.

-

Last year marked the second consecutive year in which carriers made a positive return.

-

Benjamin Baltesar spent more than six years at Euler ILS.

-

The P&C division booked a combined ratio of 81.1% for the first half of 2025.

-

The reinsurer plans to repeat its 2025 purchasing for property and specialty protections.

-

The firm booked net losses from the LA wildfires of EUR615.1mn in the first half.

-

The reinsurer’s chair said cat pricing reductions are at a “miniscule level”.

-

The yield figure comprises 6.53% of insurance discount margin and 4.28% risk-free.

-

Around 95% of the Hiscox Re & ILS portfolio is rated rate “adequate” or better.

-

The unit said capital in the ILS market remains more than adequate to meet rising demand.

-

The new team will be headed by Brown & Brown’s Ed Byrns.

-

Scor's CEO said the P&C market had experienced a “competitive” first half.

-

Insured losses produced the second highest first-half tally since records began in 1980.

-

The merged business of Twelve Securis ranked third among ILS managers for AuM, behind Fermat and RenRe.

-

The figure updates an April estimate of EUR696mn.

-

Cat bond broking growth contributed to 6% organic growth in reinsurance.

-

The consultation period around UK ISPVs was opened in November last year.

-

The proposed reforms are designed to put the UK’s regulatory framework on par with Bermuda and the US.

-

CFO Christoph Jurecka will succeed as management board chair.

-

The broker has nearly 20 years of experience in the reinsurance and retro markets.

-

The carrier reported preliminary profits of EUR2.1bn, driven by “very low” major-loss expenditure in P&C re.