-

The cyclone pool received $479mn in GWP in the year to 30 June 2024.

-

The deal would represent a diversifying auto risk deal.

-

Redington provides services to UK pension funds, wealth managers and institutional investors.

-

Pricing is expected to “stay neutral of soften” for January renewals.

-

The firm still expects to deliver positive net income for Q3 2024.

-

Assuming Munich Re takes roughly a 3% market share of hurricane losses suggests a ~$20bn industry loss for Helene.

-

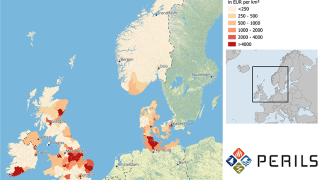

As a result of mostly flooding, £495mn ($644mn) of losses occurred in the UK.

-

The ILS allocation increased in dollar terms and held steady in euros.

-

Many in the ILS sector are bullish on Milton losses falling at the lower end of earnings impacts.

-

The company said $13bn-$22bn will come from wind damage.

-

Risk remote strategies, including private ILS, have outperformed higher risk strategies over the last decade.

-

Florida domestics, aggregate retro and flood deals were all marked down.