-

InsurTech is not a market that is as ripe for disruption as the catastrophe reinsurance business was, according to Scor’s Adrian Jones.

-

The rating agency also affirmed the company's long-term issuer credit rating of a-.

-

The company is moving away from market-facing collateralised reinsurance funds, head of alternative capital Dan Brookman told this publication.

-

Chief underwriting officer Patrick Gage and head of property Lloyd Tunnicliffe are leaving the insurer as it withdraws from a number of lines.

-

HazeShield covers businesses in Singapore from loss of income and reduced trade caused by haze events.

-

Amundi Pioneer has invested in the new sidecar across several of its funds.

-

Florida Citizens has recovered more than a third of its $350mn “wrap” insurance cover from reinsurers, with payments led by Validus.

-

The city of Osaka sustained most of the losses.

-

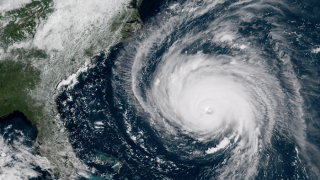

The National Hurricane Center predicted catastrophic freshwater flooding as the eye of the hurricane touched down at Wrightsville Beach.

-

Flood risk concerns could mean more drain on the public purse to pay for damages via the NFIP.

-

Duperreault recognises the quality of the Bermudian reinsurance industry.

-

Human behaviour now has a smaller role in determining pricing, according to the broker's president and global head of casualty.