Plenum Investments

-

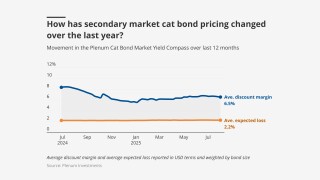

The total yield is down 162bps from 10.31% in the last week of November 2024.

-

Total yield is down from 11.18% in the last week of October 2024.

-

Key topics include private ILS growth prospects and the longevity of longtail interest.

-

The figure comprises 5.48% of insurance discount margin and 3.96% of risk-free rate.

-

The figure comprises 6.07% of insurance discount margin and 4.15% of risk-free rate.

-

The yield figure comprises 6.53% of insurance discount margin and 4.28% risk-free.

-

The total yield was 11.03% as of 27 June, including 4.3% of risk-free rate.

-

Total yield was 10.93% as of 30 May, including 4.34% of risk-free rate.

-

The total yield, inclusive of the risk-free rate, was down on the same period last year.

-

The insurance discount margin is now at a similar level to where it was in the final week of March 2022.

-

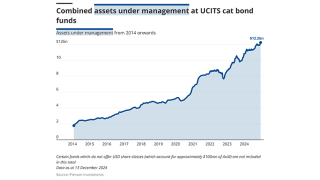

AuM remains generally flat at UCITS funds over the weeks since LA fires started.

-

The UCITS cat bond segment has added 54% in AuM since Hurricane Ian.

-

Hurricane Milton’s overall impact, based on the current pre-landfall scenario, could lead to “moderate losses” for Plenum’s funds.

-

The strategy invests in subordinated bonds issued by European insurers.

-

The ILS manager expects “minimal, if any, losses” to bonds in its funds.

-

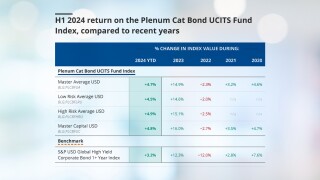

This is lower compared to 8.2% recorded by the index in H1 2023.

-

The parametric structure would have paid out at slightly lower storm pressure.

-

The manager’s conservative strategy posted returns of 7.61%.

-

The firm told investors yields in the cat bond market are 'still very attractive'.

-

The Zurich-based ILS manager has grown the fund by around 167% from $150mn as of mid-2021.

-

The 2020 bond provides $125mn of parametric, per occurrence coverage.

-

The fund is on course for its strongest year of returns since inception in 2014.

-

The Florida hurricane season still has three months to run in a predicted above-average year.

-

Hurricane Idalia will reach Jacksonville but will have weakened by then

-

Tornados in the first six months of the year in the US were slightly above the 27-year average.

-

The ILS fund now comes in at the 26th spot on Trading Risk’s ILS fund manager directory.

-

The low-risk group of funds outperformed the high-risk funds in the month and year.

-

The independent Swiss ILS firm has developed the index to help investors compare fund performance.

-

The company said it expects portfolio positions to reflect the updated figures soon.

-

The outcomes were better than the Swiss Re global cat bond index decline after the major hurricane.

-

The cat bond specialist addressed potential losses on Florida wind-exposed bonds.

-

Following Typhoon Odette in 2021, the Philippines received a $52.5mn payout, leaving $97.5mn for future storms.

-

-

The manager’s analysis concludes some funds manage risk more efficiently than others.

-

The earthquake was 250 times less strong than the 2011 Tohoku disaster.

-

The fund will limit capacity to $400mn or 1.5% market share, and minimise exposure to secondary risks.